Jain Irrigation Ltd.: What will make this ‘Green Pioneer’ prosper in the future?

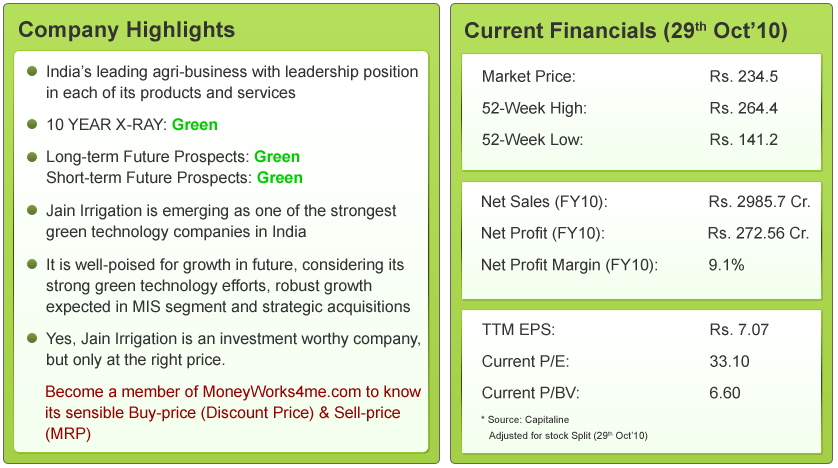

Jain Irrigation’s 10 YEAR X-RAY: Green (Very Good)

Jain Irrigation in Brief:

Jain Irrigation Systems Ltd (JISL) is India’s leading agri-business companies. The Company operates in two segments:

Jain Irrigation Systems Ltd (JISL) is India’s leading agri-business companies. The Company operates in two segments:

a) Hi-tech Agri-Input Products – Micro Irrigation Systems, polyvinyl chloride (PVC) pipes and bio-tech tissue culture.

b) Industrial Products – PVC and Polycarbonate (PC) sheets, (PE) pipes, onion and vegetable dehydration and fruit processing

Jain Irrigation has a leadership position in all its products & services. It is:

a) Globally second and India’s largest (55% market share) micro irrigation company

b) Largest manufacturer of plastic pipes and PVC & PC sheets in India

c) Largest manufacturer of Mango pulp, puree and concentrate

d) Globally second largest manufacturer of dehydrated onion

Jain Irrigation is a global player and gets a good chunk of its revenues from exports. The company has 22 manufacturing plants spread over 5 continents

Share-holding Pattern:

The company’s promoter stake holding is 30.76% and 68.63% is non-promoter stake. Out of the non-promoter stake a major chunk i.e. 54.32% is held by FIIs

What does Jain Irrigation’s past say?

Robust growth rates in Parameters:

Jain Irrigation has performed robustly in all its parameters in the last 6 years. Its Net Sales has grown by 34% CAGR showing consistent demand for its products. Also strong re-investment into the business has helped the company grow its Earnings per Share (EPS) by 45% over the years.

Higher profitability fuelled by comparatively lower growth in total expenditure and higher growth in other income and stocks adjustment:

The Company’s Earnings Per Share (EPS) growth (45 %) is higher as compared to the Sales growth (34%). This is a result of the high growth in Other Income (65.5% CAGR) and Stock Adjustments (44% CAGR) which increased the total income by 35% CAGR. This, along with a comparatively lower growth of 33% in total expenditure has led to a higher profit growth and so EPS growth

Overall increasing trend in ROE while ROIC has been stagnant over the last 6 years:

Though the company has reported a higher growth in EPS (45%) than that of in its BVPS (34%), which has resulted in the overall increasing trend in ROE, its ROIC has been stagnant in the last 6 years. This is mainly due to the high debt of Rs 1783 Cr. on its books. The company has been constantly increasing debt over the years. As a result its Debt-to-Net Profit ratio is 6.54 indicating that it may take over 6 years for the company to pay debt. This debt is on account of the acquisitions and capacity expansions done in the last few years

Thus, except for the concern of high debt, the company has performed robustly in most of its parameters over the years.

Hence, the 10 YEAR X-RAY of the company is Green (Very Good).

To view the company’s 10 YEAR X-RAY on a standalone basis, visit www.MoneyWorks4me.com

What is Jain Irrigation’s Short-term Outlook?

In the June’10 quarter, Jain Irrigation reported a drop in profit of 6% (y-o-y). Let’s see what the reason was for this fall and what lies ahead for the company?

Rise in Sales, but fall in profits:

The company registered a good rise in sales of 27% fuelled by growth in segments, but witnessed a fall in profits of 6%. This drop was due to forex loss and higher depreciation costs

What lies in store, ahead?

Capital expenditure of Rs 400 Cr for FY11 to drive healthy growth in MIS:

For FY11, Jain has planned capital expenditure of Rs 400 Cr. A part of this investment will go into setting up a research facility in Himachal Pradesh and 65-70% is being set aside for MIS expansion. Most of this expense will be funded mainly from internal accruals. Hence, where this expansion is likely to increase costs right now, it is also expected to lead to a good growth in MIS segment in the future

Healthy Order Book gives revenue visibility for future:

As of June 2010, the company has a healthy order book of Rs. 1100 Cr. Out of this, Rs. 600 Cr. is from the MIS segment – high margin business – and Rs. 300 Cr. from the food-processing business. These orders are to be executed over the next few months.

States like Andhra Pradesh and Maharashtra to drive growth:

In the last year, the company’s revenue from Andhra Pradesh witnessed a 20% de-growth due to political uncertainties. But, the company has already witnessed good growth from this state in the June quarter. Going forward, it expects good growth of around 40% from AP.

Also, MIS revenue from Maharashtra in FY10 was Rs. 500 Cr. up by 45% compared to FY09

Hence, the company expects these 2 states to be the major growth drivers for its MIS segment in FY11

High Debt a cause for concern:

Jain Irrigation has high debt on account of constant expansion plans and acquisitions. The interest cost of this is eating up a chunk of its profits.

Irrigation business is seasonal in nature and revenues usually show good growth in the December and March quarters after a good monsoon. Good monsoons lead to bigger harvests which leave farmers with more money to spend on irrigation in the winter months. Hence, the company expects a good growth in profits and sales. Also, the company has given a robust revenue guidance of 40-50% growth in its micro irrigation business as there is strong demand in the domestic market; it also expects the pipe-business to grow by 20%

Hence, looking at the overall factors, we can say the short-term outlook of the company is Green (Very Good)

What is Jain Irrigation’s long-term future outlook?

1) Green technology- the way forward:

Changing climate and growing concern over carbon emissions have led to immense focus on the development of Green/Clean technologies. It is well understood that these clean/green technologies posses the key for the future growth and developments. Clean/Green technology includes any energy, water, transportation, manufacturing or production technologies that keep the environment clean by making emissions less toxic, or by reducing waste. With a population of well over one billion and rising awareness towards the environment, green businesses in India could alter its economy as well as its ecology

So, how does Jain Irrigation fit the bill of a Green Technology company?

Micro Irrigation system and components produced by the company conserve water by almost 40% – a valuable and scarce resource in India. .Micro Irrigation impacts the environment directly by increasing the green cover. In addition, other products manufactured by the company go a long way in saving natural resources like forest, energy, protection & improvement of the environment, namely:

- PVC & PC sheets replace wood used in construction and thus prevents cutting of trees

- Polyethylene and PVC piping system aids the transportation of potable drinking water. This prevents water quality from getting degraded due to corrosive metal pipes. Production of manure from agri-waste

All the above products and services are a result of the company’s strong and innovative research team, Jain Irrigation has constantly endeavored to conserve nature’s precious resources through substitution or value addition. Recently, Global Clean Tech along with Guardian News and Media ranked Jain Irrigation amongst ‘the 100 most promising green technology companies on the planet’. Going forward, these efforts of the company towards green technology will help drive its growth

2) Abundant opportunities in MIS (company’s main growth driver):

Jain Irrigation is the pioneer of Micro Irrigation systems in India and now controls 55% of this business in the country. The high-margin Micro Irrigation segment of the company has shown a robust 61% growth over the last 5 years.

The Indian market presents abundant opportunities for the company as around a large% of the population is dependent on agriculture for its income. The penetration level of MIS in India is very low (below 10%) in comparison to matured countries like America and Europe (approx 40%). Even global buyers are continuously on the lookout for manufacturers, suppliers, exporters and traders of Irrigation Sprinklers and other agricultural equipments. Also, the government’s focus on MIS is increasing; in fact in the last year the Government increased the budgetary allocation for MIS by 100% (y-o-y). Jain Irrigation is a major player in this segment and is constantly increasing capacity to take advantage of these huge opportunities present in segment. Hence, we can expect this segment to be a future revenue driver. Also, being a high-margin segment it is expected to contribute significantly to the profitability as well

3) Strong improvement in margins:

Jain Irrigation has improved its margins over the years. From 14% in 2006, it has improved to a good 22% in FY10. The increasing share of its high-margin MIS business seems to be a contributor to this

4) Strategic acquisitions to fuel growth:

In the last few years to strengthen position in all its segments, the company has completed several overseas acquisitions. For e.g.: It acquired Tera Agro Technologies and the mango-processing division of Parle (for 14 Cr.). This helped Jain became the largest processor of fruits & vegetables in India and the biggest mango pulp processor in the organized sector.

In 2007, Jain acquired 50.001% stake in Israel’s NaanDan, the world’s fifth-largest micro-irrigation company. Earlier, Jain Irrigation had also acquired Chapin Watermatics a well-diversified irrigation company, to enhance Jain’s services and products globally. With these two acquisitions Jain Irrigation became number 2 in world in the field of drip/sprinkler irrigation. Though the company has constantly been raising debt for these acquisitions, they are expected to strengthen Jain’s position and enhance its products and services portfolio

5) Large scope in Agro products (Fruit processing & dehydrated vegetables):

Although the Indian market is not yet ripe for dehydrated vegetables, the overseas market offers huge opportunities for organized players like JISL. The company has been a regular supplier to International giants like Nestle. In this connection the company acquired Terra Agro with 1200 acres of land and a 1600 ton per annum vegetable dehydration plant. The company plans to triple capacity over the next 3 years. Hence, this business division is expected to boost the revenue of the company is coming years

So, after seeing the companies positive points, is there anything you should be concerned about?

a) High working capital intensive business & High debt: MIS segment of company is highly working capital intensive which makes continuous fund infusion necessary. This is clear from the company’s cash locked in outstanding for around 105-110 days and inventory for around 70 days. Also its creditors days are on the higher side, around 120 days. This in turn results in higher working capital requirement. Also, the company’s debt is on the higher side(~1800Cr); the interest cost of which is eating up a chunk of its profits. In FY10, the interest costs were 1/3rd of the company’s operating profits which is a cause for concern

b) Competition from unorganized sector: Company faces competition from unorganized sector, which may put pressure on the performance of the company

c) Highly dependent on monsoon: Company agricultural input business which contributes 50% to the top line of the company is highly dependent on monsoon. Any drought like situation in one or more seasons may adversely affect the demand of agricultural products

Despite these concerns, Jain Irrigation is well-poised for growth in future, considering its efforts in the green technology space, leadership position in each segment, its strong MIS segment and strategic acquisitions.

Hence, the long-term outlook of the company can be expected to be Green (Very Good)

Conclusion:

Jain Irrigation has a leadership position in each of its products and services. It has been emerging as one of the strongest green technology companies in India and the World. It’s robust growth in MIS segment and strategic acquisitions are expected to drive growth in future

Yes, Jain Irrigation is an investment-worthy company, but is its share at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on Jain Irrigation’s stock right now, become a member of www.MoneyWorks4me.com to find its right value.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Is high P/E ratio is concerned?

Hi,

High P/E ratio is not a cause for concern, but should certainly form a part of your decision-making. Companies trading at a high P/E in comparison to their historical average and their peers, may just be overvalued.

High Debt is a definite cause for concern. Like it is for Suzlon.

Hi,

Very true high debt is a cause for concern. But unlike Suzlon, Jain Irrigation has been doing really well on the profit front.

Sometime around 1978 a rep of Jain Irg Sys dropped in my broker’s office n was canvassing to buy the shares n

con debentures. I wanted ro buy but my broker said these iseas won’t work in India. So I didnot buy. But I was

convinced that sooner or later this shud pay. A year or later I bought from the market 200 shares. As my broker said the sahre

price went down n down. I stuck to my decision. Over a period of time gradually in small bits I sold part of it. But again

bought at around 350. The last I sold at around 700 and still hold about 60/ So I will hold them as jewel. My cost is

negative. Shud I buy more.? I will see the anser – Borkar

Thanks for sharing your experience with us.