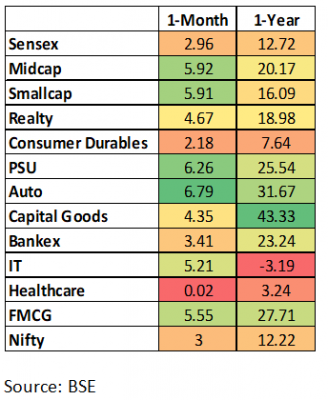

As we write this note in June, Sensex has given 2.96% returns in the month of May 23 and 12.72% over the last one year. The major contributors to this growth in the last month are the Auto, PSU, and FMCG sectors. And the major performing sectors in the last one year are Capital Goods, Auto, and FMCG.

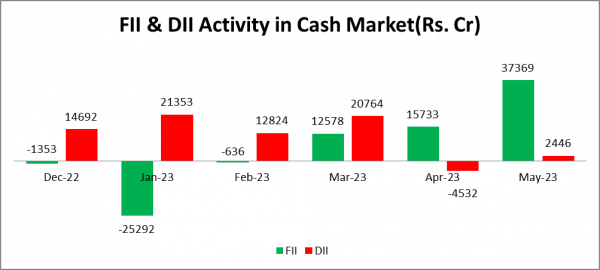

Both FII and DII are buying

FIIs are once again turning back to India and have been net buyers since Mar 23. FIIs have a net purchase worth of Rs. 37,369 Cr in the month of May. DIIs have also been net buyers in the last month. Both of these indicators imply more resilience in our market. Given the current global scenario, it is appearing that India seems to be a steady ship in choppy waters.

Inflation is falling slower than anticipated

The RBI projects FY24 inflation at 5.2% and is optimistic that CPI inflation will moderate this fiscal. Since June 2022, the WPI inflation in India has consistently been declining. In April 2023, it reached a record low of -0.92% since 2020. Simultaneously, the benchmark inflation rate measured by the CPI dropped to 4.7% in April 2023, the lowest it has been in 18 months.

This decline can be attributed to lower food prices and the base effect. As a result, the RBI is effectively managing inflation in the country compared to its peers. This development is expected to stimulate consumer spending and provide a boost to the economy, considering India’s consumption-driven economic model.

Global cues

Average global inflation is projected at 5.2 per cent in 2023, down from a two-decade high of 7.5 per cent in 2022.

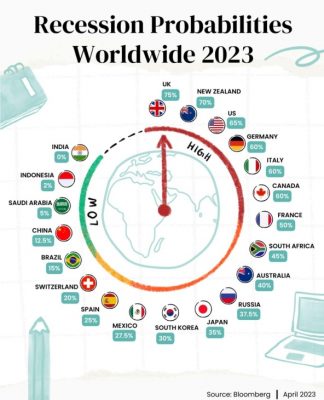

As per Bloomberg, data suggests that the probability of India entering a recession is 0%, in contrast to the 65% probability for the United States.

Developed economies still maintain monetary policies with negative real interest rates, while emerging economies like India have positive real interest rates (Repo rate- Inflation). The global equity risk premium is currently trading below its long-term averages, implying that the equity market is relatively less attractive compared to the debt market.

The increase in oil prices is expected to be limited due to weakening demand. Moreover, the ongoing shift towards renewable energy sources and initiatives to reduce carbon emissions will have long-term consequences for energy markets. These changes may also impact factors such as inflation, trade balances, and overall economic performance.

The global economic outlook should be subdued across most economies for the rest of the year.

Domestic cues

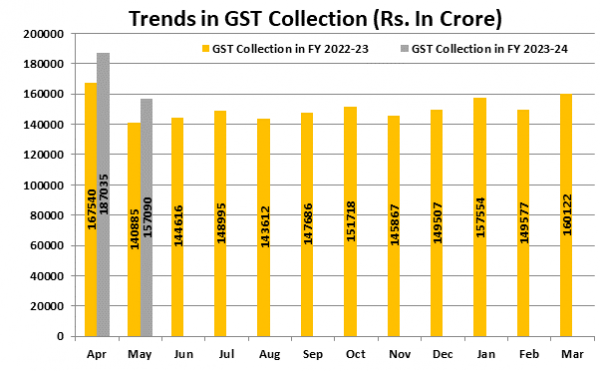

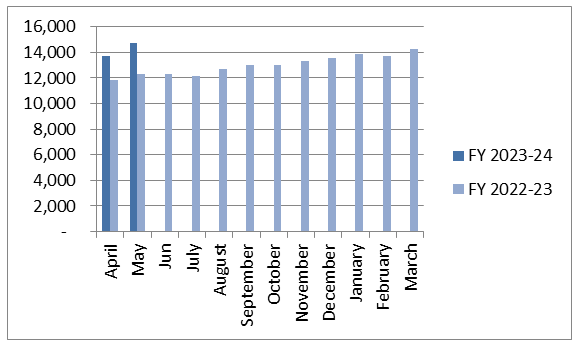

Q4 earnings for most Indian Corporates have been above expectations. In 2023, the corporate profit to GDP ratio for the Nifty500 universe contracted marginally to 4.1 per cent after rebounding in 2022 to reach a decade high of 4.3 per cent. GST Collections and Mutual Fund SIP inflows have been robust. SIP inflows hit an all-time high of Rs. 14,749 crores in May.

Monthly SIP Inflow (Rs. Cr)

The RBI decided to maintain the repo rate at 6.5%. However, the policy statement delivered by Governor Shaktikanta Das indicated that there should be no immediate expectations of a rate cut, as concerns over inflation were highlighted.

The Q4 GDP data of FY 2022-23 shows the Indian economy grew at an annualized rate of 6.1%.

The upcoming monsoon season in India is expected to be either normal or slightly below normal. Although there are increasing risks of El Nino, the impact on GDP is projected to be limited, with minimal effects on CPI inflation and food prices. The rural economy, which is less reliant on agriculture, is benefiting from infrastructure improvements, which help mitigate the impact of adverse agricultural conditions.

As per Jefferies report, suggest that the Indian housing market will experience double-digit growth in the upcoming 4-5 years, which is a positive sign for the overall market. However, soaring input costs have put pressure on margins, resulting in a slowdown in volume growth due to price hikes implemented in the FMCG sector. FMCG players have attempted to sustain margins through price increases and reductions in product sizes, which maintain the value but affect sales volume.

In terms of tax revenue, the GST collections in May 2023 increased by 12% compared to the previous year, amounting to Rs 1.57 lakh crore.

Indian outlook remains strong

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and Purchasing Managers’ Index (PMI), indicate a significant level of economic activity. Projections suggest that India is expected to be among the fastest-growing economies in 2023. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters. However, in the short term, volatility may persist until global uncertainties subside.

Nifty is trading around long-term averages

Historical PE Chart for Nifty 50

How are we looking at this?

The recent development of the shift of manufacturing from China to more domestic production supported by the government as well as the perception of companies to diversify their supply chains bodes well for the Indian Manufacturing sector. Government thrust on capex shall support growth in the infra sector with corollary growth benefits to Financials, construction materials, and allied industries.

With the US on the verge of Recession, Germany already in recession, and Eurozone experiencing high inflation worries, Even though domestic demand is good, there is muted demand in export due to a slowdown in advanced economies. This can be seen by the ramp downs and project delays seen in the Indian IT space. Going ahead with improvement in exports the economy is expected to perform better than before.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlook and growth. While taking a portfolio view to diversify and make the most of the rising economy.

We have given a couple of BUY calls in the past few months. The market has rallied since then. Given the strong dynamics of the economy, we are excited to BUY existing opportunities or new ones in the near future. We are tracking more companies to add in our BUY zone; however, they are still ahead of our MRP.

The deleveraged balance sheets of Indian corporates, sub-par capacity addition in the past decade, and increasing utilisation levels give us confidence on the credit cycle. This combined with the underperformance of the financial sector in the last couple of years gives us confidence on the prospects of lenders (BFSI sector).

We believe that the current economy recovery is led by the credit growth cycle which remains definitive. Also, the Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are looking at sectors that will be early beneficiaries of these two themes.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory

(Source: AMFI, Moneyworks4me)

(Source: AMFI, Moneyworks4me)