“My name is Rajesh and I’m 50 yrs old. I work for one of India’s biggest automobile firm and have invested a major portion of my portfolio in stocks. Apart from that, I also have some part invested in bonds, fixed deposits. I am well-insured for any kind of emergencies. I have heard that one should reduce investments in stock markets as one grows old and instead invest more in bonds and FDs. So, should I restructure my portfolio to reduce equity investments?”

This and many more such questions are frequently seen on various blogs, forums, news channels, etc. and the answer to them is usually one of the below:

a) Follow the thumb rule of investing – 100 minus your age should be invested in equities.

b) Reduce equity investing as you grow older.

c) Stock markets are very risky and the elderly should stay away from it.

Most of us would wonder how the statement given above is a myth. After all, everyone knows that old people are not supposed to take risks. Given their limited earnings capacity they should be conservative in their spending and also in investments!

The common perception is that young people have time on their side; even if they lose all their money they can recover it back.

But consider the following

1. Losing money is not an option at any age

The common argument that one hears is that young people can afford to lose money and hence can invest in stocks. But this is not the mindset you should have when investing in stocks, whether young or old.

Remember Warren Buffet’s Rule #1: Don’t lose money!

Losing your money is not an option at any age. If you have this mindset when investing your money, not only are you more cautious while making your decisions you are also on the lookout to minimize your risk, always. Also, when you are young, you have many needs and aspirations – the latest smart-phone, a new bike or a car, your own house, vacation at an exotic place! In order to fulfill any of these aspirations, you cannot afford to lose money.

2. Stock investing need not be risky

Risk comes from ignorance. It is our style of investing that makes us fearful of the equity markets. But what if we find a method to reduce our risk considerably? The Value Investing approach is one such method which is for all people at all ages! It is the low-risk high-return method to stock investing. It advocates picking fundamentally strong stocks at the right price to gain higher returns. Read our blog: ‘Is taking high risk a necessity for gaining higher returns?’ to know more on this.

3. Higher Growth and More Liquidity

Irrespective of your age, growth is the single-most important factor for your investment portfolio. Investing in fixed income investments like bonds, FDs etc give you a rate of return which barely matches the rate of inflation in the country. So, avoiding stocks altogether as you grow old is definitely not the way to go. If invested in the right stocks at the right price it can serve as one of the best investment avenues for the young and old alike.

Also, in the old age where we usually tend to require more liquidity, we cannot invest in illiquid assets like real estate. Thus stocks can give us maximum growth rate and provide liquidity at the same time.

4. More disposable income in hand

Consider Rajesh’s case. He is aged 50 years and works in an IT firm. Usually, around this age, individuals are in a high-earning phase of their career. Assuming that most of his liabilities must have also been taken care of (e.g. EMIs on a house fully paid off, children’s education almost completed), his expenditures will also be relatively lower. Thus, Rajesh will have surplus money in his hand which he can invest considering his goals and priorities. If he is planning for his retirement or any other goals 5-10 years down the line, he should definitely consider investing in stocks.

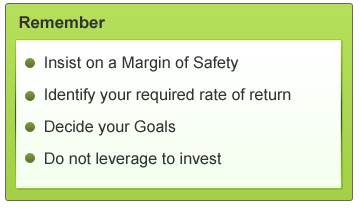

Thus, we do not need to reduce stock investing as we grow older. It is possible to remain invested in stocks and the same time ensure that you reduce your risk. Here are some of the important factors that you need to keep in mind.

Always Remember…

1. Insist on a MOS (Margin of Safety)

One of the best ways to reduce risk is to buy stocks at a discount. It’s like getting a rupee’s worth for just 50 Paisa! The older we get, the more we should be insistent on buying stocks at a 50% discount.

Log on to MoneyWorks4me.com to know the MRP and Discount Price of stocks.

2. Identify your required return

Different individuals have different required rate of returns and different time frames they can stay invested for. For example, Rajesh at the age of 50 would look at a time frame of 5-10 yrs and a RoR of 12-15%, whereas his son at the age of 20 can look at a longer time frame of 20-30 yrs with a higher RoR.

The key to reducing risk in the stock market is overcoming our greed and the temptation of higher returns. Once you have achieved your target return, GET OUT and don’t look back! The discipline to follow this rule could be the deciding factor on what happens to your investment portfolio.

3. Decide your Goals

Define your short, medium and long term goals. For example, if Rajesh wants to go on a vacation to Europe in a few months, it would serve him best to not invest in the stock market to fulfill his goal.Remember what the famous investment guru Benjamin Graham said:

‘In the short term the stock market behaves like a voting machine, but in the long term it acts like a weighing machine’

However, if he has any medium (3-5 years) or long term goals (5-10 years) he should definitely invest a sufficient portion in stocks to capitalize on the high-growth given by stocks.

4. Do not leverage to invest

Invest in stock markets using only the money remaining after you have provided for your liabilities. Do not borrow to invest in the stock market or deploy all your cash in the stock market, so that you have to later borrow to meet your necessary expenditures.

5.Losing money is not an option at any age– The common argument that one hears is that young people can afford to lose money and hence can invest in stocks. But this is not the mindset you should have when investing in stocks, whether young or old.

Remember Warren Buffet’s Rule #1: Don’t lose money!

Losing your money is not an option at any age. If you have this mindset when investing your money, not only are you more cautious while making your decisions you are also on the lookout to minimize your risk, always. Also, when you are young, you have many needs and aspirations – the latest smart-phone, a new bike or a car, your own house, vacation at an exotic place! In order to fulfill any of these aspirations, you cannot afford to lose money.

6.Stock investing need not be risky– Risk comes from ignorance. It is our style of investing that makes us fearful of the equity markets. But what if we find a method to reduce our risk considerably? The Value Investing approach is one such method which is for all people at all ages! It is the low-risk high-return method to stock investing. It advocates picking fundamentally strong stocks at the right price to gain higher returns. Read Stock Shastra 23 to know more on this.

7.Higher Growth and More Liquidity – Irrespective of your age, growth is the single-most important factor for your investment portfolio. Investing in fixed income investments like bonds, FDs etc give you a rate of return which barely matches the rate of inflation in the country. So, avoiding stocks altogether as you grow old is definitely not the way to go. If invested in the right stocks at the right price it can serve as one of the best investment avenues for the young and old alike.

Also, in the old age where we usually tend to require more liquidity, we cannot invest in illiquid assets like real estate. Thus stocks can give us maximum growth rate and provide liquidity at the same time.

More disposable income in hand – Consider Rajesh’s case. He is aged 50 years and works in an IT firm. Usually, around this age, individuals are in a high-earning phase of their career. Assuming that most of his liabilities must have also been taken care of (e.g. EMIs on a house fully paid off, children’s education almost completed), his expenditures will also be relatively lower. Thus, Rajesh will have surplus money in his hand which he can invest considering his goals and priorities. If he is planning for his retirement or any other goals 5-10 years down the line, he should definitely consider investing in stocks.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463