In 2008, Mr. Vivek Sharma liquidated his fixed deposit and decided to invest in the biggest ever Initial Public Offering (IPO) in India by Reliance Power. His friends, brokers and TV experts all were screaming from the top of the roof how it was the “perfect investment opportunity”. It was the Reliance brand and the booming power sector that made Vivek feel confident and he vouched it to others. He even celebrated with champagne when the stocks were allotted to him. That was the mad rush of IPO, but was it worth the risk?

Unfortunately, for Vivek and million others the champagne lost its fizz; the Reliance Power stock did not live up to the expectations. Infact, the stock never reached its issue price barring on the opening day.

The reality is that no one in the investment world remains untouched by the euphoria surrounding an IPO release. The buzz around an IPO actually makes you believe that “Investing in an IPO will yield you great returns; if not long term at least listing gains.”

So, how is this a Myth?

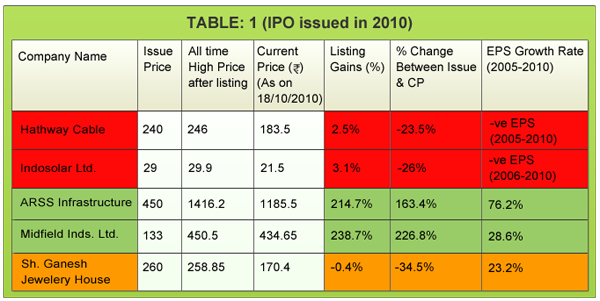

To understand this better let’s have a look at some of the Initial Public Offerings (IPO) that were listed in 2010 and what were the listing gains you would have made by investing in them.

If you had invested your hard earned money in companies like Hathway Cable and Indosolar, you would have to be very lucky to get out with any profits. All these companies rose above their issue price on the opening day. However since then their price has fallen and they have failed to reach even their issue price!!! Contrary to this, companies like Midfield Inds. Ltd., and ARSS Infra, have not only given you handsome listing gains but are also currently trading way above their issue price. So, what is it that sets these companies apart? Why did these companies rise on listing whereas the others did not. The answer to this lies in their fundamentals. Hathway Cable and Indosolar Ltd. have shown poor growth in the past with their EPS growth rate in the last 5 years being negative. Whereas companies like ARSS Infra and Midfield Inds. have been fundamentally strong companies with robust performance.

But is this always the case that strong fundamental performance may lead to listing gains? No. Let’s look at the case of Sh. Ganesh Jewelry House (in orange in Table 1). It’s a fundamentally strong company whose EPS has grown by 23.12% CAGR over the last 5 years. However the returns earned by investing in this IPO would have been negative. Apart from fundamentals, the pricing of the IPO also plays an important role. If the pricing is too high then no matter how good the company is, you might actually end up losing your capital.

In nutshell, you may not always earn listing gains by investing in an IPO. Not all the IPOs will trade at a higher price on listing.

So, should you invest in an IPO from a long term perspective?

While investing in any stock from a long term perspective makes more sense than investing just to make a quick buck, you still have to exercise caution when investing in IPOs.

People are generally excited by anything new whether it is a new car, house, jewelry etc. We always have the tendency to discard the old and embrace the new. IPOs more often than not elicit a similar excitement in us. ?

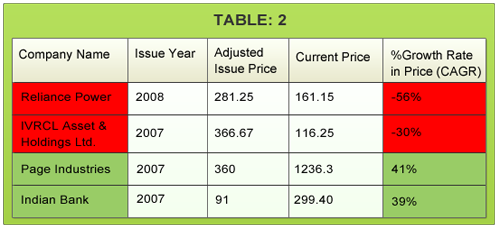

Since 2006 more than 250 IPOs have been issued by companies for needs like capacity expansion, setting up of new plant, acquisitions etc. But how has their performance been? Comparing the current price and the issue price we have found out that only around 40% of IPOs are above their issue price. This means in 60% of case IPOs have failed to add to the investor’s wealth.

All of us know about the Reliance Power IPO and how retail investors lost a lot of money betting on the issue. Another such case was IVRCL Asset & Holdings Ltd. Conversely, Page Industries and Indian Bank proved to be very fruitful IPOs for the long term investors and have given good returns. The common thread here again is the fundamental performance of the company. Page Industries and Indian Bank both have a solid financial track record something which is lacking in Reliance Power and IVR Prime Urban. The key therefore it seems is to make sure that you know whether an IPO is worth investing in.

But before we find such IPOs, let’s know some facts about IPOs:

- Companies try to get maximum price for their IPO issue – Have you ever seen an IPO during a lean period in the market? Most probably not! Companies usually come out with their IPOs when the market is in a bull phase to get the maximum price possible. However, we need to ascertain whether the stock deserves the price that has been asked for.

- IPOs are usually supported with marketing campaigns selling “dreams” – Bollywood may not be the only one selling dreams to the common man. The way experts and advertisers market IPOs, it seems they are selling a once in a life time investment opportunity and there is nothing wrong with the company. Be wary of such campaigns and try to find out the areas of concern for the company.

- Less information – When you decide to evaluate a company you find that there is little information available about the financials and past record of the company. This actually adds to the risk involved while investing in IPO. However every company coming out with an IPO has to submit “The Draft Red Herring Prospectus” with SEBI giving out information about the company, its plans, prospects etc. Before you decide to invest in an IPO check for minimum 3 years financials in “The Draft Red Herring Prospectus”

- Window Dressing – An investor must always be aware that accounting rules allow companies to present their financials in a way which would make the company look better. Consider the case of Cantabil Retail India Ltd., which showed Rs. 60.87 Cr. as stock adjustment in 2010 raising its Total Income. This led to a jump in Net Profits of 136% to Rs. 14.68 Cr.

- Brokers & underwriters may not be your well wishers – Whether the retail investors earn returns through an IPO or not, the brokers & the underwriters surely earn them. A part of the income that they receive as bonus is linked to the subscription of the IPO and hence their primary focus is on selling the IPO.

How do you find an IPO worth investing?

You can put three checks on any IPO that you decide to invest and find out whether it will be a worthwhile investment or not:

Check #1 – Are you investing in a fundamentally sound company

Before investing in an IPO always check the fundamentals of the company. You should also analyze whether the product/service of the company is worth investing in. You should at least have a look at the five key financial parameters and how they have grown to find healthy companies. This will help you in eliminating the weak companies.

Check # 2- Look for the IPO grading?

IPO grading is the credit rating issued by any Credit Agency registered with the SEBI. An IPO can be graded in the range of 1-5 (1 being the worst & 5 being the best). The grading takes into account the prospects of the industry, the strengths & weakness of the company, the risk involved etc. For e.g. Coal India got an IPO grading of 5 which indicate that the company is having “strong fundamentals”. However keep in mind that it does not take into consideration the pricing of the IPO.

Check #3 – Are you paying the Right Price?

A fundamentally sound company with good future prospects does not imply a good investment. Don’t think that because it’s an Initial Public Offering, the shares are being issued at a discount. Most probably they are not. It is a free market and the companies have the right to get the maximum price. We, as retail investors, have to find the fair price or the MRP of the IPO. If it is indeed available at a discount then you can you can expect to earn handsome gains from your investment

Do you have any good/bad experiences of investing in IPOs? Do share with us.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Good Article

Thank you Mregupathy for your appreciation.

I would request Team to add IPO section and give fundamental facts on forthcoming IPO’s.

@ Swalke

Thanks for your feedback. We are definitely considering your suggestion and will look to cover IPO’s in the future. Do check out our analysis of Power Grid Corporation’s FPO here : http://bit.ly/aL6d4k

Two Good !

Thank you Pinaki!!

millions of people burnt their fingers in ” India bull power” IPO, issued at Rs.45/-, barring the first day it never saw that figure again. Now it trades at 28 – 29/-. More over peope got 100% allotment, ie 600 shares costing 27000/- blocked as a dead money. I recently after getting tired, sold off them at a loss of about Rs.11000/-.

we retail investers can only curse them.

I M Rajvanshi

——————————-

Thanks a lot for sharing your experience. Indiabulls Power, similar to Reliance Power, did not have any operational unit when it came up with the IPO. With lack of revenues, the risk is increased substantially. Another point that you have mentioned is how sometimes IPO subscriptions fail to live upto expectations. People tend to think that an IPO will most likely get oversubscribed and thus if they want to buy say only 2 lots, they yet apply for 4 lots. However, if the IPO get subscribed just 100% like it did in your case, you are stuck with more number of shares (and thus higher exposure) than you would want. In this case maybe one could think of selling the incremental number of shares on the listing day itself.

Having said this, the key point still remains that your decision to invest in an IPO should be governed by the company fundamentals and the pricing of the stock. What are your thoughts on this??

Very Good Article

Thanks for your appreciation.

A very good article…. but i think Coal India was overpriced…. more over it being a govt. company my expectations are very lean even if its rightly priced…. So I give a thumbsdown to coalindia…. I was surprised that moneycontrol supported coalindia…. well i guess 1yr from now we will know who was right 🙂

Thanks for your appreciation. We are sure that you would have gone through our take on the Coal India IPO (https://www.moneyworks4me.com/investmentshastra/learn/coal-india-ltd-a-gold-mine-for-retail-investors/). Yes, there are certain areas of concerns for the company. However, we believe that Coal India is well positioned to overcome such hurdles and continue its impressive growth. As you rightly said though only with time will we know how well the stock performs.

I also lost money on the IPO of NHPC…

Thanks for sharing your story. NHPC is another company which is not very fundamentally strong. If you look at the 10 Year X-Ray (10 year financial track record) of the company, you will see that the company has been inconsistent in growing its EPS and BVPS; its average Return on Invested Capital (ROIC) is also low. Even the Debt/Net profit ratio is 6.64 which is quite high. Considering this, the issue price of NHPC (Rs. 36) seems to have been on a higher side.

Thanks for giving a very good information for the small investors. sankaranarayana

Thanks for your appreciation.