Mindspace REIT IPO Details:

Issue Open Date: 27th July 2020

Issue Close Date: 29th July 2020

Equity Shares offered: 6.77 Cr

Price Band: 274-275

Issue Size: 4,500 Cr

Min Lot Size: 200 (Rs. 55,000)

Purpose of the offer

Net Proceeds of the issue are proposed to be utilized in:

- Repayment of certain debt facilities of the Asset SPVs availed from banks/financial institutions

- Purchase of Non-Convertible Redeemable Preference Shares of the company

- Offer for sale to existing investors

About Mindspace REITs

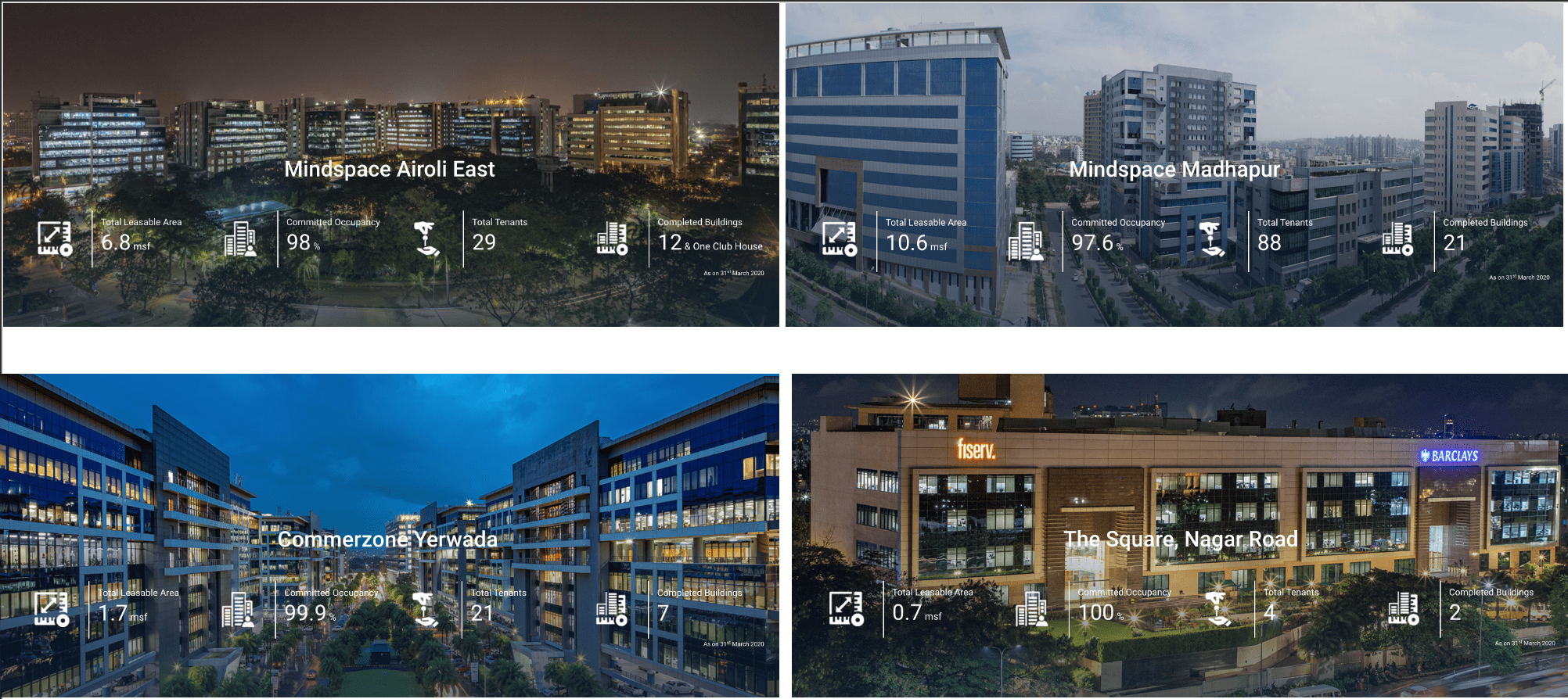

Promoted by Cape Trading LLP and Anbee Constructions LLP (Blackstone & K Raheja Group) Mindspace REIT was registered with SEBI on December, 2019, at Mumbai. Mindspace Business Parks REIT has a quality office portfolio in Mumbai, Hyderabad, Pune and Chennai.

The business parks in Mumbai are Mindspace Airoli East Business Park, Mindspace Airoli West Business Park, Paradigm Mindspace Malad and The Square, BKC(2). The properties in the Pune include Commerzone Yerwada Business Park, Gera Commerzone Kharadi Business Park and The Square, Nagar Road. The Chennai property of the company is Commerzone Porur. And, the office parks in Hydrabad are Commerzone Pocharam and Mindspace Madhapur.

The total leasable area of Mindspace Business Parks is 12.1 msf, 11.6 msf, 5.0 msf and 0.8 msf in Mumbai, Hyderabad, Pune and Chennai, respectively.

With total leasable area of 29.5 msf, it has one of the largest Grades-A office portfolios in India. The under-construction area of the company is 2.8 m sq ft. The future construction of Mindspace Business is spread across Hyderabad, Chennai, and Mumbai in a 3.6 m sq ft area.

MoneyWorks4me Opinion

Mindspace REIT holds premium properties in four different metropolitan cities where demand for commercial properties is high. It has close to 50% property leased to IT and ITes and no particular client contributes more than 8% in gross rentals.

India is experiencing high growth in captive support services of MNCs and existing IT services companies thanks to low cost human resources and English speaking population. This makes commercial REIT attractive as they will have good demand for companies shifting their backend/support to India.

From FY18 to FY20, Mindspace has leased 7.6 msf of office space and grown its portfolio by 4.9 msf primarily through strategic on-campus development. Maintained high occupancy of 92% and saw rental growth of 6.7% CAGR.

Risks

- Due to subdued economic activity, we may see slow employee additions and hence fall in demand for commercial real estate, this may lead to either low occupancy or lower yield due to aggressive negotiations impacting overall distribution (yield) from the REIT.

- Work from Home, currently at nascent stage, can gain traction causing oversupply in commercial real estate market at least in the near term again impacting occupancy and distribution.

Based on stated income distribution (yield) of 7.5%, it may appear reasonably priced but with risk of fall in distribution, limited growth component, this yield is inadequate. We recommend AVOID.

There might be fall in REIT price to reflect better yield as distribution may remain constant while fall in REIT price increases our Return on Investment. We will be tracking the REIT for investment at a later date.

We are very positive on the opportunity available to invest in Real Estate through REIT, but we are cautious to make any decision about making a Real Estate investment today due to i) lower yield, ii) uncertainty on near to medium term trend in real estate iii) limited growth avenues within this REIT to compensate paying up.

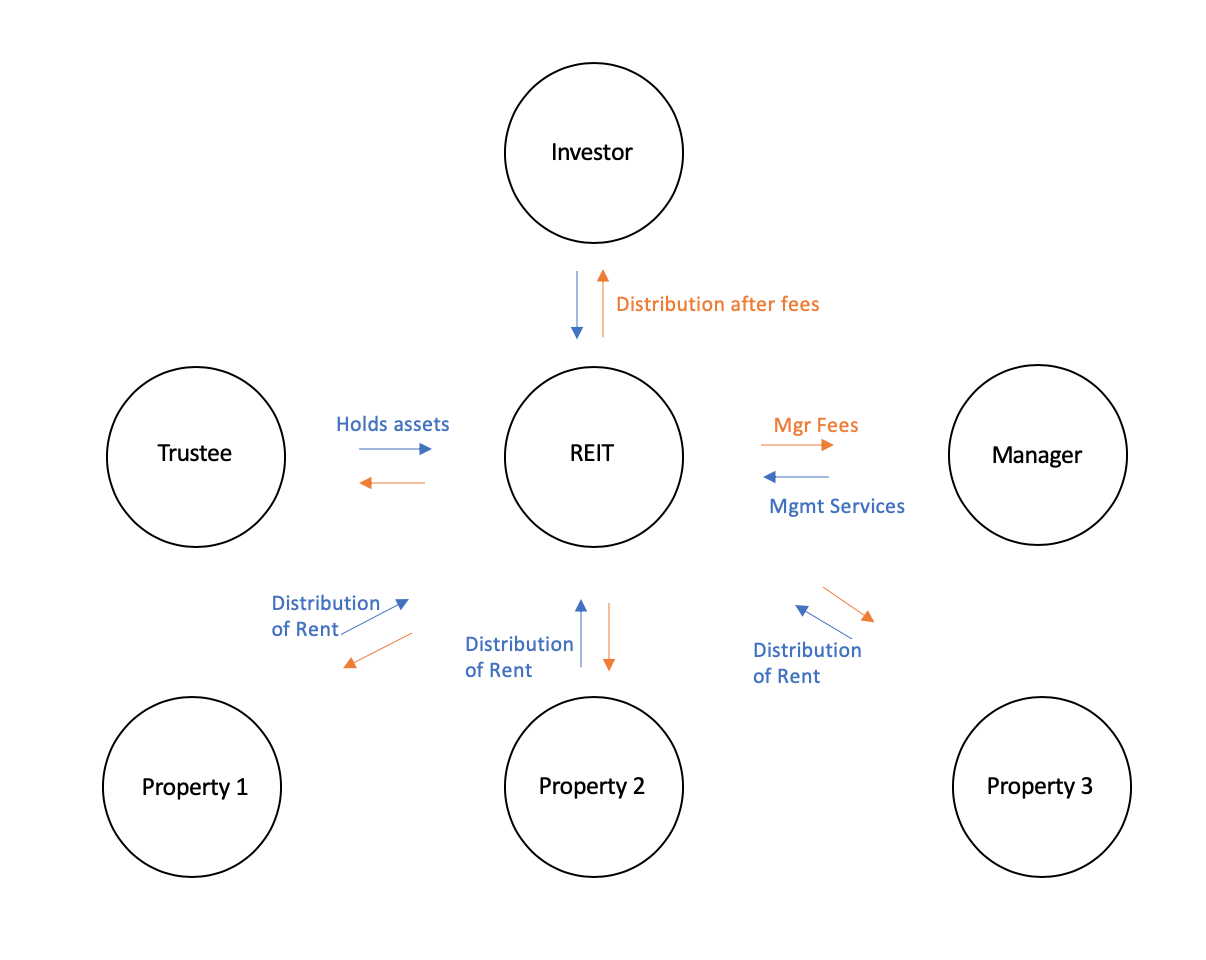

What is REIT?

REIT is a pool of developed assets held and protected by Trustee. It receives rental from lessee and managers handle the collection and maintenance of facilities. This is closet to holding actual real estate in exchange of earning a rent on the same. Usually commercial real estate are best to own as they accrue better rental yield and growth in yield in lines with inflation, assuming no competition or demand issues.

Real Estate as an asset class provides non-correlated returns to equity and gold. It also has regular income similar to Fixed income. Investors with smaller surplus (less than Rs. 3-5 Cr) can diversify their assets into real estate through REIT as smaller portfolio can’t invest in real estate directly due to large ticket size of property. For larger portfolio, investing in 1-2 commercial properties or shops is a good way to diversify their savings.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463