Mrs. Bectors Food Specialities Limited IPO Details:

Mrs. Bectors Food Specialities Limited | Market Cap Rs. 1,765 Cr

Bid Price 288 | EV/Sales 2.3x FY20 | P/E ratio 30x (Steady state)

IPO Date: 15th December to 17th December

Total shares: 1.9 Cr

Price band: 286-288 per share

IPO Size: ~ Rs. 540 Cr

Lot Size: 50 shares and multiples thereof (retail individual investor can bid for a maximum of 650 shares)

Purpose of IPO:

• Offer for sale (Rs 500 Cr) for existing shareholders exit

• Funding new projects for Rs. 40 Cr

About Mrs. Bectors Food Specialities:

Mrs. Bectors Food Specialities Limited (Bectors Food) was established in 1995 as a joint venture (JV) with Quaker Oats for supplying condiments such ketchup and sauces to McDonald’s and gradually added buns, batter, and bread. The JV partner withdrew from Bectors Food in 1999 and during 2007, the biscuits and bakery business was transferred to Bectors Food through a slump sale. During 2013-14, the company pursuant to a business reorganization scheme demerged its food supplements (sauces, spreads, and namkeen) division to a separate company named, Cremica Food Industries Limited.

Bectors Food manufactures and sells biscuits under its brand name “Mrs. Bector’s Cremica” whereas bakery products are manufactured under the brand name of “English Oven” and offered in the premium market segments such as Delhi NCR, Mumbai, and Bengaluru. As of June 30, 2020, its bakery segment had a total of 96 products and the Biscuits segment had a total of 384 items.

Bectors Food is one of the leading companies in the premium bakery segment and premium and mid-premium biscuit segment in North India. The company’s product portfolio mainly consists of two categories of products; Biscuits (cookies, creams, crackers, digestive, etc.) and Bakery products (bread, buns, pizza bases, cakes, etc).

Bectors Food also supplies buns to various international QSR chains in India, such as Burger King India Private Limited, Connaught Plaza Restaurants Private Limited, Hardcastle Restaurants Private Limited, and Yum! Restaurants (India) Private Limited.

All of its products are manufactured in-house across 6 strategically located manufacturing units in 5 different cities i.e. Maharashtra, Karnataka, UP, Himachal Pradesh, and Punjab. The company has a distribution network of 154 super-stockists and 644 distributors supplying products through 458,000 retail outlets and 3,594 preferred outlets.

It sells its products to 23 states in India and also exports its products under its own brand name and third-party private labels to 64 countries all over the world.

Financials

Bectors Food has a sales CAGR of 6% in the last six years. Profits are volatile based on the timing of capacity addition. Profit margins get squeezed when new capacity is added due to (i) low utilization wherein fixed costs eat into profits (ii) higher depreciation expense.

Bectors Food has earned reasonable ROE in past. Capacity expansion and under-utilization have led to rising in costs depressing margins. As utilization goes up, ROE may rise to 20%. It has an asset turnover of around ~2.5x and margins of ~7-8%, putting ROE potential of 20%. (ROE=Margin*Asset turnover*leverage factor)

Management

Mr. Anoop Bector is the promoter of the company. Along with his family, he would own more than 50% of the company post IPO. Anoop Bector has more than 25 years’ experience in the biscuits and bakery business. He looks after business development and strategy.

MoneyWorks4me Opinion

How is the business model? Good, Great, or Gruesome?

Good. Bectors Food operates in the food industry with a presence in Biscuits and Bakery. While the industry is growing at a healthy pace ~9% CAGR, it remains quite competitive. The biscuit industry has large strong players with strong brands, while the bakery is very fragmented with many local players.

According to the Technopak Report, there has been a significant increase in the consumption of packaged foods, which indicates an accelerated shift to packaged foods because of increasing quality and safety concerns amongst the customers due to the COVID -19 pandemic.

This development is very positive for organized players in the industry. Brands play a big role, especially in Foods, as these products are bought for personal consumption. If the industry growth rate is 9% CAGR, organized players may grow at 10%+.

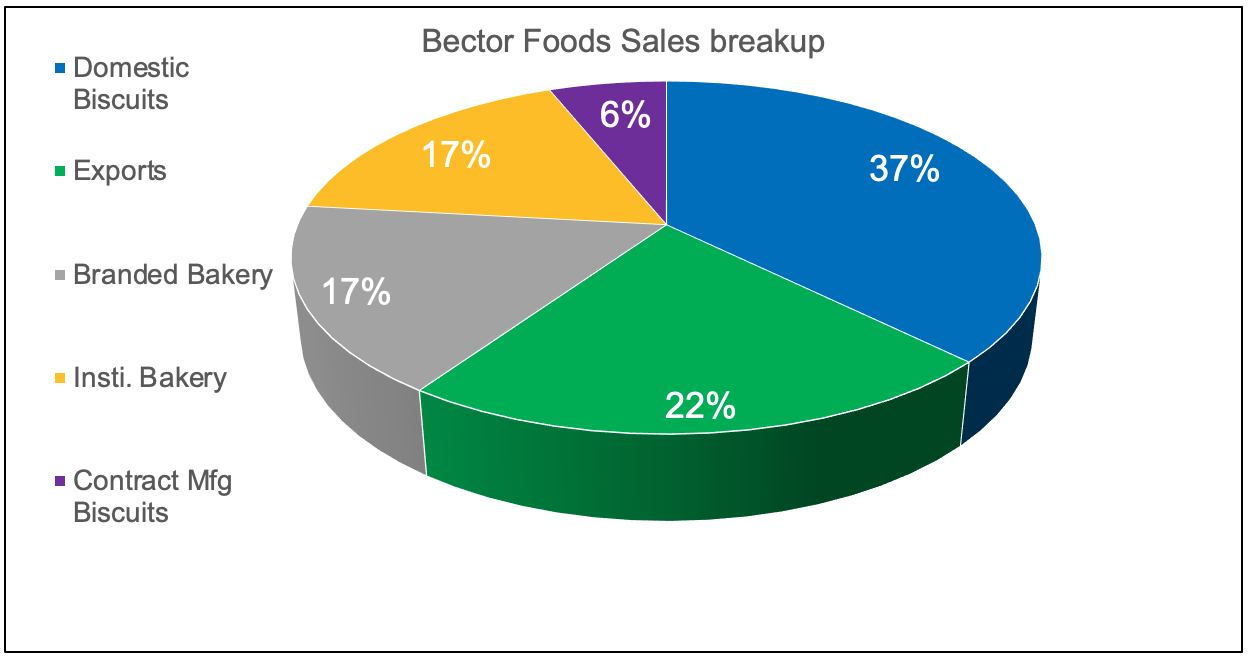

Biscuits (37% of sales): Bectors Food has a 5% market share in biscuits, mostly in the north region. For a company to sustainably earn a high return on capital, it must have economies of scale. Every industry has a minimum market share threshold, upon which a company earns a healthy return on capital and sustains it.

Economies of scale in Biscuits come from (i) bargaining power with distributors and retailers (ii) Advertisement and promotional spending. We find that larger companies like Britannia, Parle, and ITC have strong distribution as well as muscle power to spend heavily to fight competition from Bectors Food. Barring existing regions, we find it tough for Bectors to scale up using advertisements and distribution. Fewer unorganized players in the Biscuits segment is also not helpful. We expect only industry growth for Bectors Food in the Biscuits category. It has been adding capacity, but growth might come at lower ROE as it has to fight strong competition.

Bakery (34% of sales): Bakery is a very fragmented market and operates on thin margins. Local players have better infrastructure to run low-cost operations and replenish stocks. Centralized operations increase logistics and manufacturing costs. Bectors Food is focusing on branded Bakery which is still nascent stage as dependence on local bakeries is still high in India.

QSR is a fast-growing business that requires a regular supply of bakery items. This can further add to sales growth in the future. However, Bectors Food does not have any long-term supply agreements with any of our QSR customers.

Exports, Contract Manufacturing (22%+6%; 28% of sales): During this period, there has been a significant increase in demand for leading Indian packaged food brands in the export markets due to the lower cost of skilled labor and processing packaged foods as compared other jurisdictions (Source: Technopak Report).

This segment can grow fast with rising new entrants who don’t boast enough volumes to set up their own manufacturing. Even multinational companies consider exporting to frontier markets like Africa from India till they don’t achieve enough volumes for local manufacturing operations. Even Nestle makes an entry in new regions in a gradual manner.

Valuation

Bectors Food is present in a competitive industry, earns a reasonable return on capital and smaller scale of operations in Biscuits. IPO doesn’t appear to be aggressively priced to ensure private equity players get an exit.

At the current price of ~Rs. 288/share, 1770 Cr in market cap it is priced at 2.3x Price to FY20 sales. This implies a P/E ratio of 30x assuming margins recovery to 7% and the tax rate of 25%. Assuming sales growth of 15% in next year from new capacity and distribution expansion, it trades at a forward P/E of 25x.

P.S. H1FY21 sales should not be used for measuring valuation as the lockdown was quite favorable for sales of Foods companies and can’t be assumed sustainable.

Another benchmark for valuation is private equity valuation for the company. In 2015, private equity players purchased a stake in Bectors Food at 1.4x Price to Sales. Since then, the margin or ROE profile has not changed for the company. It is definitely priced higher than its acquisition price. We believe the excitement around the FMCG sector has led to rising in price multiples for the company IPO.

Recommendation: We only recommend buying 1 lot for listing gains. Bectors Food is likely to see a good response from the market as FMCG Foods provides a very good long-term opportunity.

We wouldn’t recommend buying additional shares after the stock gets listed. While the company has many growth engines, we would like to see the company’s growth before we invest or valuation becomes very cheap to factor low growth.

Bectors Food IPO is smaller than Burger King but the allotment ratio is better for retail investors. Around 1,33,000 will receive one lot of 50 shares at least.

Log In | Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

Mrs. Bectors Food Specialities Limited IPO Faqs:

What is Mrs. Bectors Food Specialities Limited IPO?

Mrs. Bectors Food Specialities IPO is an IPO of 5.87 Cr equity shares with a face value of ₹10 aggregating up to ₹540.00 Cr. The issue is priced at a price band between ₹286 to ₹288 per share.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

When Mrs. Bectors Food Specialities Limited IPO will open?

The IPO opens on Dec 15, 2020, and closes on Dec 17, 2020, between 10.00 AM to 5.00 PM.

What is the lot size of Mrs. Bectors Food Specialities Limited IPO?

The lot size is in the multiple of 50 with a minimum order quantity of 50 Shares.

How to apply for Mrs. Bectors Food Specialities Limited IPO?

You can apply for Mrs. Bectors Food Specialities Limited IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services like Zerodha.

When is the Mrs. Bectors Food Specialities Limited allotment?

The finalization of Basis of Allotment for Mrs. Bectors Food IPO will be done on 22nd Dec 2020 and the allotted shares will be credited to your Demat account by 24th Dec 2020.

When is Mrs. Bectors Food Specialities’ listing date?

The Mrs. Bectors Food IPO listing date is not yet announced. The tentative date of Mrs. Bectors Food IPO listing is 28th Dec 2020.

Is it worth investing in Mrs. Bectors Food Specialities?

Yes, you may invest 1 lot but we wouldn’t recommend buying additional shares as we want to see the company deliver good growth in sales and profit in a competitive industry.

What are the chances of allotment in Mrs. Bectors Food Specialities?

With 66 Lakhs shares for the retail portion, we find that odds of getting an allotment are low (only 1,33,000 Demat accounts will receive one lot each).

What if I do not get the allotment?

We suggest waiting for other opportunities in the FMCG Foods sector. Tata Consumer Products, ITC, Nestle, Jubilant Foods, Burger King, Westlife Development, Britannia are few stocks in this sector. These stocks can be bought during market volatility.

Recent IPOs:

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463