What is Nifty@MRP?

As investors, we constantly track the Nifty movements. To make investing more profitable and not a game of mere chance, we need a solution, a solution which could help us identify whether the market is grossly depressed or irrationally exuberant. This is exactly what Nifty @ MRP is for!

What is the latest value of Nifty@MRP?

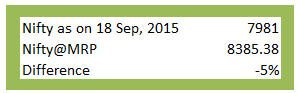

For Dec’15, considering the free float market capitalization at the MRP of individual stocks and the share price data as of 18th Sep, the Nifty@MRP is at 8385. On 18th Sep, NSE Nifty index closed at 7981, which is ~5% or 415 points below the Nifty@MRP. It indicates that the index is undervalued.

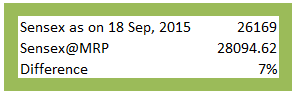

On similar lines, the Sensex@MRP comes out to 28094. On 18th September, the Sensex closed at 26169, which is about 7% or 1925 points below Sensex@MRP.

On similar lines, the Sensex@MRP comes out to 28094. On 18th September, the Sensex closed at 26169, which is about 7% or 1925 points below Sensex@MRP.

Future Outlook

For the past few months markets have been jittery. This was obvious as fears of global economic slowdown and more so an emerging market crisis surfaced as Russia and then Brazil went into recession. China’s slowing economic growth will lead to ripple effects on other emerging economies which were dependent on it.

Starting with China. China has been growing at astounding rates due to significant outsourcing from developed economies. Now since the pace of growth in developed economies is slowing down, China’s export volumes are seeing a downward trend. Additionally, rising labour costs, high leverage & low operating margin of corporates is adding to woes of China’s growth story. Property markets are close to the bubble territory. To stop property bubble from busting, the government incentivized equity investing which led to gambling in equities. (Incentives work negatively as much as they work positively. Suggested Reading: Books by Gregory Mankiw & Robert Cialdini)

Brazil & Australia, along with many other natural resources economies, were dependent on China’s boom. Now since the production numbers of China has slowed down, these countries are facing a fall in demand for their commodities. Brazil has faced a credit rating downgrade due to deterioration of political tension, inflation and business environment. Australia has got a new prime minister and cabinet but we believe it can’t turn around the fortune of Australia as it faces structural issues like over dependence on commodities. Malaysia is facing unrest among civilians who are alleging their leader of corruption charges upto ~$700 million. Indonesia is probably in the same boat as India, which is not being able to make any ground level reforms, that can turnaround the fate of the country. (Suggested Reading: The Economist Magazine articles)

Many middle-east nations are dependent on crude oil for major economic driver. With slowdown in China, the demand for Oil went down. Additionally, US is pumping high amounts of shale oil due to newer technologies and thus increased productivity. This excess oil is flooding the markets with surplus oil. Goldman Sachs with help of its channel checks reports that looking at the inventory levels of Oil, Nymex oil can further crash to $20/barrel. Instead of cutting the supply to halt crude oil price erosion, Saudi and other OPEC nations are still continuing production to retain their market share in crude oil. This will not only result into fiscal deficit of oil producing nations but also civil unrest in the region. None of the oil producing countries are profitable at crude oil price of $45/bbl. (Suggested reading: Bloomberg Crude Oil articles)

Coming to developed economies of the world, Japan is almost into recession phase as Abenomics is not able to boost inflation despite several measures. S&P has downgraded the country to A+ from AA- citing deflation & lower GDP per capita growth. Europe is still not able to come out of woods and is on wait and watch mode. We believe that QE will not yield the expected result. Like they say, money thrown from the helicopter can never prop up the economy. (Suggested reading: The Death of Money, by James Rickards) In EU region, we may see marginal growth in coming year aided by improved liquidity. This can happen only if there is some austerity drive which will shift fiscal budget allocation from unproductive social programmes to productive infrastructure-led growth reforms.

Coming to India…

India’s government has been by far unsuccessful to kick in concrete reforms to turnaround the economy. GST efforts are likely to go sour; other reforms were passed with tweaks which will not result into improvement in current situation. Banks are under stress due to cyclical & power sector exposure. This puts a hold on lending new credit to corporates. Over-leveraged balance sheet of corporates between 2010-2015 as against 2004-2008, will not lead to fast capex growth. In previous decade, rate cuts led to increased borrowing and faster capacity addition. We do not see any such thing happening in 2015-2017. Most of the companies have large amount of underutilized capacity due to excess capacity built during 2004-2008. Even if we see uptick in tenders, many companies will not opt for it either due to leveraged position or margin erosion due to extreme competition.

We firmly agree with Raghuram Rajan that rate cut will not boost economic growth unless structural issues are addressed. We feel that the government is so far not successful in addressing long term goal. (Read speech of RBI Governor here)

On the other hand, corporates will have to consolidate to maintain healthy business environment. The ones who have excess debt should sell their assets partly to repay debt and reduce cost of capital. This can certainly result in above average return on capital in future.

MoneyWorks4me Opinion

Since we are long term bottom-up (Stock specific) investors, we do not assess companies/sectors based on news flow. We conservatively assign values to companies based on their position in the industry, industry’s cycle and competition. However, we are sharing a broader perspective on what is likely to happen across the sectors.

Public sector Banks: No improvement till the government infuses capital.

Telecom: Spectrum bidding proved costly for Idea Cellular, good for Bharti. Reliance Jio is likely to launch its full-fledged telecom services, finally in Dec’2015. (Spectrum was bought in 2010; 5 years in limbo “IRR=0%”)

Private Banks: No credit growth till the rate cut happens. Select banks have stress assets and high exposure to trouble making corporate groups (barriers to exit).

FMCG: Rural income low due to deficit & scanty rainfall three years in a row. One can expect some value driven growth as against volume led in the short term.

Auto: 4W sales are likely to pick up with decline in interest rates; CVs will experience good traction led by replacement market due to start of mining and trade activities; Tractors & two wheelers are likely to experience low to flattish growth due to poor rural income.

Cement: Cement sector growth may experience a slowdown in near term. It saw a bull-run due to the real estate wave. It seems to be subsiding. Real estate has been facing criticism in recent times due to high inventory levels & exorbitant prices.

Steel: Steel is driven by infrastructure, real estate & auto. China is dumping steel at dramatically cheap prices which is likely to hurt many steel players including low cost players like Jindal Steel, JSW, etc. Custom duty on select steel has been imposed but we are not sure how effective it will be in the long term.

Infrastructure: No major projects announced yet. We are hearing noises that business model of infrastructure projects are changing. We should expect companies to benefit from this. However, currently the balance sheet of many companies is very stretched due to time & cost overruns, high interest rate, high inflation, etc.

Airlines/Real Estate/Textile: Not worth covering. High Risk – Avoid!

IT: Very few companies understand the disruption coming in traditional application development services. A few are putting in research effort in latest technologies. Future deal wins and their quantum will tell us what projects are bagged by our favourite companies. Currency depreciation will benefit in the short term.

Pharma: Sales growth was low as the companies had faced many regulatory hurdles. We can expect sales to bounce in near term. However, future earnings are factored in prices of pharma companies. Expect some benefit from currency depreciation in short term.

Capital Goods: No order flows as no capex is happening across sectors.

Oil & Gas: Expecting refineries to add capacities as setup costs go down when crude oil prices correct. Additionally, they will benefit from deregulation of fuel prices.

Power: State electricity boards have very high debt that is why demand has fallen. Power companies including NTPC are also feeling the heat due to low power off-take. Though coal price correction was a breather, low plant load factor is cause of worry now. New capacities are expected to be more in renewable energy rather than traditional coal fired.

Final Verdict

Given the circumstances, we believe that the markets may see further correction. At this point of time, we believe the quality stocks are still in overvalued territory, so they are likely to correct unless earnings catch up. Few commodities companies have corrected significantly due to spill over effects from global market turmoil. We can’t put an exact number to how much downside these companies will see. They are trading at below average multiples now, but they may enter into irrational low price zone. We will re-assess our assumptions when the supply-demand scenario stabilizes with excess capacities going out of the global market.

We advise you to stay on the side-lines till we get sufficient margin of safety while purchasing the stocks. It’s good to hold some part of our portfolio in idle cash. This will help us to buy stocks on Sale when markets correct suddenly.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463