What is Nifty@MRP?

As investors, we are used to seeing the Nifty move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant. This is exactly what Nifty@MRP is!

Considering that the Nifty stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs (fair value). In reality, the stocks are driven by their earnings over the long term. Hence, it is said that the market is a slave of the corporate earnings. Thus Nifty@MRP gives an indication of whether the Nifty is fairly valued or whether irrationality is driving the markets.

What is the latest Nifty@MRP value?

Considering the free float market capitalization at the MRP of individual stocks and the share price data as of 7th March, the Nifty@MRP comes out to be 6385. On 7th March, NSE Nifty index closed at 5863, which is 8.90% or 522 points below the Nifty@MRP of 6385. It indicates that the index is slightly undervalued.

On similar lines, the Sensex@MRP comes out to 21102. On 7th March, the Sensex  closed at 19413, which is 8.70% or 1689 points below the Sensex@MRP of 21102.02.

closed at 19413, which is 8.70% or 1689 points below the Sensex@MRP of 21102.02.

So, considering December-12 quarter financial performance, we can say that the broader market indices are currently under-valued by ~9%.

Analysis of the December 12 quarter financial performance of the Nifty 50 companies

Quarterly performance

For the December 2012 quarter, the cumulative net sales of the Nifty companies have grown by 9.26% as compared to the December 2011 quarter. The cumulative operating profits (EBITDA) and net profit (PAT) increased by 2.28% and 5.11% respectively for the same period.

9 Monthly performance

Analysis of the 9-month performance of the Nifty companies reveals that the cumulative net sales of the Nifty companies has grown by ~14% as compared to the 9 months of FY12. On the other side, the cumulative operating profits (EBITDA) and net profit (PAT) increased by 5% and 9.5% respectively for the same period.

The Nifty companies thus continued dismal run as far as financial performance is concerned in the December quarter as well barring some exceptions. Capital intensive sectors such as construction, capital goods, telecom and metal stocks continued to report weak performance. Order inflow for capital goods companies have been slowing down – BHEL infact reported its first year-on-year decline in quarterly revenue in the past 10 years. Similarly, steel and cement demand has been sluggish while construction activity has been hampered due to execution delays.

Compared to these sectors, defensive sectors like FMCG, Pharma as well as IT outperformed. While FMCG sector has benefitted by consistent rural demand, some companies have expressed that they have witnessed some slowdown in urban regions. Coming to the BFSI sector, public sector banks, have shown poor performance due to increasing non-performing assets (NPA) on their books. However, private sector banks have performed well in the first half of the year on back of effective utilization of funds.

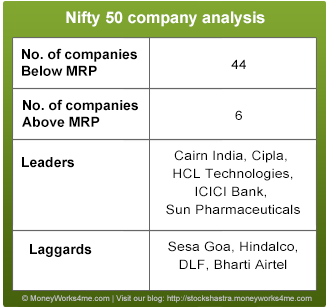

With respect to the financial performance, the list of leaders and laggards from the Nifty 50 companies reflect this trend. Leaders include companies like Cairn India, Cipla, HCL Technologies, ICICI Bank and Sun Pharmaceuticals. On the other hand, laggards include capital intensive companies like Sesa Goa, Siemens, Hindalco, DLF and Tata Steel.

Over all, out of 50 Nifty companies, around 35 companies are trading below their MRP (Under-valued), 9 Companies are trading close to their MRP i.e. are fairly valued while only 6 companies are trading above their MRP (Over-valued).

Future Outlook

On 28th February, Mr. Chidambaram, the finance minister of India, presented the eagerly awaited ‘Union Budget’ for FY-14. However, it turned out to be a let-down and was mostly viewed as neutral and unrealistic. As a result, Sensex was down by more than 300 points on the same day. The FM failed to address key macro problems such as investment growth, inflation, current account deficit, etc. which are affecting the economic growth of the country. However he promised to bring down the fiscal deficit to 4.8% of GDP in 2013-14 from around 5.2% in the current financial year. But it seems unrealistic considering the 30% increase in plan expenditure and no significant actions on the revenue front. Overall, Budget failed to improve investor sentiments as no growth driven announcements were made.

Now, all eyes are on the RBI governor, who will announce the monetary policy on 19th March, 2013. To increase the pace of investment and improve the economic growth, it is expected that Mr. Subbarao would reduce the key interest rates which could improve investor sentiments. If this doesn’t happen, it would further lead to a decline in the Indian stock market.

On the global front, inability of the US president and Senate to reach an agreement on how to control the fiscal deficit has led to a situation wherein automatic cuts in government spending (around $ 85 bn per month) have kicked in. We believe these economic measures are blunt instruments that impacts spending in those areas which affect long term US competitiveness like education. On positive side, they have posted good job and housing starts numbers in the last couple of months, but it is likely they may not be able to maintain these numbers in future considering spending cut by the government. Thus, the US economy, which was recovering from the economic slowdown, might see decline or stall in its GDP growth rate in future. The slowing American growth would severely affect global market sentiments, leading to most investors becoming risk off from risk on.

Europe, which is already going through sovereign debt crisis, faced another big problem. Italy, one of the world’s biggest sovereign debtors, is going through political and debt crisis. Italy’s fiscal deficit went beyond 3 % of GDP, above the European Union’s 3% ceiling. The Italy Government Debt too is at an all-time high of 127% of GDP. To control widening gap of fiscal deficit, the Italy Government has to implement certain austerity measures. But now, investors fear that the strong protest vote against austerity measures in last month’s election could make it impossible for its next government to meet conditions for European Central Bank’s support on debt markets. With these concerns, Italy has been downgraded from A- to BBB+ with a negative outlook by ratings agency Fitch. This has led to increase in government bond yield and declined the investors’ sentiments across the global markets.

Considering the fiscal consolidation measures in the US market and the increased political uncertainty & debt crisis in the Europe, it is expected that it might further affect the global markets as well as the Indian market. Considering non-event budget and Loksabha election in the next year, India, which is already going through economic slowdown, might take couple of years to revive its economic growth prospects. Thus, foreign institutional investors (FIIs)’s investment into the Indian market would be a question mark in future as they might prefer safe avenue for their investments in this volatile environment. With these concerns, the Indian stock market is expected to be remained volatile in future.

Looking at the 9 months financial performance of Nifty 50 companies and future outlook, Nifty is quoting around 9% discount to Nifty@MRP. Considering current 9% discount and future growth potential of the Indian economy, we believe that the Indian stock market still provides good growth opportunity for long term investors. Currently, there are few fundamentally sound companies which are currently available at a hefty discount from their MRP with limited downside risk. Hence, you, as investors, should remain cautious in this volatile market while at the same time keep an eye on some bargain buys as indicated by our decision maker.

Considering the situation, investors would be best advised to buy fundamentally strong large companies at the right time and at the right price.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463