Nureca Limited IPO Details:

IPO Date: Feb 15th to Feb 17th, 2021

Total Shares for subscription: ~25 lakh

IPO Size: ~Rs. 100 Cr

Lot Size: 35 shares

Price Band: Rs. 396-400/share

Market Cap: ~Rs. 400 Cr

Recommendation: Avoid

Purpose of Nureca Limited IPO

- Meeting the working capital requirements of the business

- Meeting general corporate purposes

About the Nureca Limited

Incorporated in 2016, Nureca Limited is a healthcare and wellness products distributor. Nureca is a B2C company engaged in the business of home healthcare and wellness products, which offers quality, durability, functionality, usability, and innovative designs. The company enables their customer with tools to help them monitor chronic ailments and other diseases, to improve their lifestyle.

The company believes in innovation and catering new products to the ever-growing needs of the home health care sector. Nureca is a digital-first company wherein they sell its products through online channel partners such as e-commerce players, distributors, and retailers. Further, they also sell their products through their own website drtrust.in

The company has most of the product lines supporting the home health market in India, making it a one-stop solution provider. “Dr. Trust” is known for its innovative products in the market and presence in a high growth market.

Nureca classifies its product portfolio under the 5 categories such as Chronic Device Products, Orthopedic Products, Mother and Child Products, Nutrition Supplements, and Lifestyle Products.

Management of Nureca Limited

Saurabh Goyal & Payal Goyal own 93% of the stake in the company. Saurabh Goyal is the Chairman and Managing Director of the company. He has worked with Nectar Life Sciences Limited and has over 10 years of work experience in the marketing division. He has been a Director of the company since February 2017.

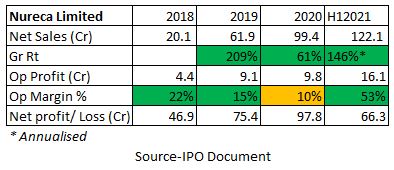

Financials of Nureca Limited

Strengths

- Diversified product portfolio

- Presence in a high growth market

- Online distribution network

MoneyWorks4me Opinion

Ecommerce has enabled many small entrepreneurs to scale up their businesses fast. Earlier selling through brick and mortar stores required setting up distribution channels, advertisement in mainstream media, etc.

Nureca is one such company that has scaled up a business using online websites like Amazon and Flipkart. All it had to do was introduce reasonably priced products and advertise on the same platform through sponsored ads and reviews.

Just like Nureca scaled upto ~100-150Cr in sales in just 4 years, we find that any other player can scale up using similar techniques.

Nureca is nothing but a trading company with no edge in distribution or branding for now. The sheer size of the company doesn’t give us confidence whether the company has the ability to compete with slightly established players in terms of advertising spends or pricing.

We recommend AVOID based on a trading business model and small size.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 15th Feb 2021 |

| IPO Close Date | 17th Feb 2021 |

| Basis of Allotment Finalisation Date | 23rd Feb 2021 |

| Refunds Initiation | 24th Feb 2021 |

| A credit of Shares to Demat Account | 24th Feb 2021 |

| IPO Listing Date | 25th Feb 2021 |

| Date | QIB | NII | Retail | Employee | Total |

| Feb 15, 2021, 05:00 | 0.00x | 0.54x | 31.22x | 0.90x | 5.73x |

| Feb 16, 2021, 05:00 | 0.08x | 1.48x | 80.32x | 2.49x | 14.77x |

| Feb 17, 2021, 05:00 | 3.10x | 31.59x | 166.65x | 4.82x | 39.93x |

What is Nureca Limited IPO?

Nureca Limited IPO is an IPO of 25 lakh equity shares with a face value of ₹10 aggregating up to ~₹100 Cr. The issue is priced at a price band between ₹396 to ₹400 per share. Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

When Nureca Limited IPO will open?

The IPO opens on Feb 15, 2021, and closes on Feb 17, 2021, between 10.00 AM to 5.00 PM.

What is the lot size of Nureca Limited IPO?

The lot size is in the multiple of 35 with a minimum order quantity of 35 Shares.

How to apply for Nureca Limited IPO?

You can apply for Nureca Limited IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services like Zerodha.

When is the Nureca Limited IPO allotment?

The finalization of the Basis of Allotment for Nureca Limited IPO will be done on 23rd Feb 2021 and the allotted shares will be credited to your Demat account by 25th Feb 2021.

When is the Nureca Limited IPO listing date?

The Nureca Limited IPO listing date is not yet announced. The tentative date of the Nureca Limited IPO listing is 26th Feb 2021.

Is it worth investing in Nureca Limited IPO?

Nureca Limited IPO is a trading business model and small size. We would avoid investing in IPO.

Know more: Indian IPO Historic Data 2021

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463