This article covers the following:

- What is Earnings per Share, and why is it important?

- But can you decide to invest based on company-reported profits?

- How do you know if a company will grow its profits consistently?

- To increase sales in the long run, a company needs to invest in itself

- Finally, you need to check if the company is using capital efficiently

- But how do you know what ROCE is good enough?

- Debt is cheaper than equity, then why is high debt a problem for an investor?

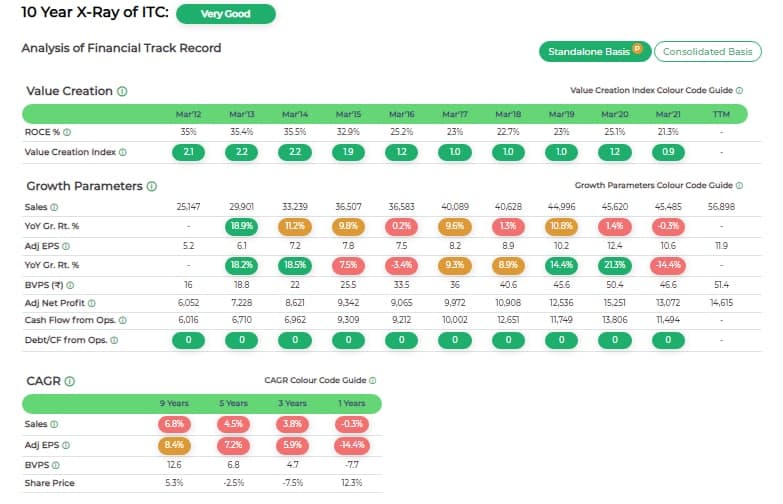

- Companies that meet the following criteria over a 10-year period are certainly the most investment-worthy

Investing in stocks is all about buying a wonderful business, and not just stock. A wonderful business essentially has three important characteristics: a Sustainable Moat, an excellent Financial Track Record, and Trustworthy Management. An Excellent Financial Track record is a Go/No-Go criterion; companies not passing this criterion are best ignored. This will prevent you from investing in the wrong companies. There is also a very good chance that a company with an excellent track record over a long period (10+years) has some kind of sustainable moat, and also trustworthy management, making further assessment worth your while.

But isn’t it very difficult to figure out if a company has an excellent track record? One look at the big, fat, 100+ page Annual Report with reams of data is enough to convince you that this is not your cup of tea. But there is an easy and effective way to separate the investment-worthy companies from the rest. Look at six Financial Parameters to shortlist a wonderful company. These top six parameters when evaluated together over 10 years tell the story of the company in a nutshell:

- Earnings per Share (EPS)

- Net Operating Cash Flow

- Net Sales

- Book Value per Share (BVPS)

- Return on Capital Employed (ROCE)

- Debt-to-Operating Cash Flow.

Let’s see how!

What is Earnings per Share, and why is it important?

What is the first thing that you will look for in a company before investing? Obviously, whether it is making a profit after paying taxes, and consistently! Why? Because Profit After Tax (PAT) is what shareholders get when all is said and done (though you actually get it in hand only when the company pays out dividends). Earnings per Share (EPS) is Profits-After-Tax per Share.

When you put money in a Fixed Deposit, you get an interest @7%; i.e. you get Rs. 7 a year for an Rs. 100 investment in addition to a promise from the bank of getting back your Rs. 100 at the end of the term of the FD. EPS/Price is the equivalent of the interest rate when investing in stocks. It tells us that a company earning an EPS of Rs. 7, if available at a price of Rs. 100, has the same Yield rate as an FD.

So, why would you pay more than Rs.100?

The main reason could be that you expect the company to earn more than Rs. 7 the next year, and so on. EPS/Price is called Earning Yield, and the more popular ratio Price/EPS or P/E ratio or just PE is the inverse of this. How one can make sensible comparisons based on this is the essence of our blog.

But can you decide to invest based on company-reported profits?

No, profits can be misleading for various reasons. So, you need to verify that profits earned by the company are leading to a cash inflow for the company, which means to you as a shareholder. But what if all, or some of it, is required to run the business? Then the profits reported are not really profits. Net Operating Cash Flow highlights this; it is the actual cash generated by a company from its business and excludes cash required for working capital. So, if a company’s Operating Cash Flow is consistently lower than its reported profit, then it does not make it on your shortlist.

How do you know if a company will grow its profits consistently?

A company can increase its profits by selling more and more every year. So, you need to look at a company’s Net Sales and check if it is growing consistently at a healthy rate. Sales can grow with a higher volume or higher price, preferably both. Growth in volume should keep pace with the growth in demand for the category; e.g. if demand for paint is growing at 6%, then that is the minimum growth rate required to maintain market share. Secondly, prices should reflect the effect of inflation. Only when the total cost increase is passed on to consumers will a company maintain its profitability. So, if that paint company encounters an inflation rate of 4%, then its net sales must grow at a minimum rate of (6+4)%, i.e. 10%, to maintain a healthy growth rate. When a company’s sales grow year after year profitably, this indicates that it has a sustainable moat.

To increase sales, in the long run, a company needs to invest in itself

Most companies plough back some or all of the profits back into the company to expand their capacity, increase their working capital, etc. Book Value per Share, BVPS, will tell you how much a company is investing in itself. There are some companies that do not need to reinvest to keep growing at the current growth rate, and they probably do not see the possibility of growing faster at the same level of profitability. These companies, at least the ones with trustworthy management, pay out a substantial portion of their profits as dividends to the shareholders. Alternatively, they buy back the company shares, as was done by TCS and Infosys in 2017. This benefits current shareholders, as it increases the Earnings per share (EPS), and as we saw, the markets reward them with a higher share price.

Finally, you need to check if the company is using capital efficiently

Companies, in the most basic sense, are money-using and money-making machines. How do you rate a machine? Simple, look at what it produces in relation to what it uses, i.e. its efficiency. Companies produce profits using the capital invested (both equity and debt). Hence, to know the efficiency with which a company uses its capital, look at Return on Capital Employed (ROCE). A ROCE of 15% means that the company generates a return of 15% on the total capital it employed.

But how do you know what ROCE is good enough?

Common sense tells us that ROCE should be higher than the cost incurred by the company to get the capital. The two sources of capital, equity, and debt, have different costs; equity is more expensive than debt. Their costs are different for different companies. This is represented by the Weighted Average Cost of Capital, WACC (pronounced wack). Simply put, a large, consistently profitable company has a lower WACC than a small company with an inconsistent track record. The difference, ROCE minus WACC, tells you if the company is indeed generating a positive excess return over its cost of capital. So 15% ROCE is good if WACC is 13%. But it’s bad if WACC is 16%. See our blog post on the Wealth Creation Index to understand why this is something every savvy investor should understand.

Debt is cheaper than equity, then why is high debt a problem for an investor?

When a company borrows money, it should be able to repay it, i.e. the interest and the installment of the principal amount, without serious difficulty over a reasonable period of time. Debt-to-Operating Cash Flow tells you the number of years in which a company will be able to repay its debt out of cash generated from its business operations. When this ratio is high, it means that the company will take a long time to pay off its debts, and hence will pay a large, substantial portion of the company profits towards this. There will be less left for shareholders. And very importantly, in case of any challenges, e.g. an economic slowdown or a worker strike, it will face a crisis of default, the one thing that can send the stock price crashing. A ratio of less than 3 is considered acceptable.

Companies that meet the following criteria over a 10-year period are certainly the most investment-worthy:

- They have grown their EPS, Net Sales, and BVPS by 12%+ year on year.

- They have a ROCE of over 13% every year, and a positive Wealth Creation Index.

- They have the ability to pay off their debt in less than 3 years, i.e. a Debt-to-Operating Cash Flow ratio of 3 or less.

So, where do you find these six Financial Parameters in one place and in an easy-to-understand manner?

Do you have investments in companies that have an Excellent Financial Track Record of over 10 years? Find a few such companies, and add them to your Stock Watchlist.

Read Also: ‘Look for a trustworthy Management, which respects the interests of minority shareholders’

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory

Hi,

You have not told about PE ratio. it is a important parameter without doubt.

good i,hv learned a lot, ur efoort is good, tell some stock name,which small investor can earn.

It is good but please let me know that how a small invester can find these details and where.

One option could be to calculate it on your own, which could be a bit difficult. The other option, as mentioned in the Stock Shastra, is to log on to MoneyWorks4me.com where you will get a 10 YEAR X-RAY with these parameters for more than 1500 companies.

Thanks a lot Sanjoy. The Company Shastra in the newsletter, gives you information about some very good companies. However, you will have to invest in them at the right price.

Why don’t you write an article where you teach us how to calculate

These ratios / numbers.

Yes, Anuj. PE ratio is a important ratio but from a valuation perspective. A company with a low or high PE does not necessarily mean that it is a great company. For more on this read http://bit.ly/98D1Rp.

Sir,

Thank U for U R 5 benchmarks for investment. Sir, kindly explain these 5 things with an relistic company financial figures example.

kindly, mail U R answer to sachin_glowing@rediffmail.com.

how to calculate the BVPS and ROIC of stock from the balance sheet/financials of the company?

BVPS is calculated as Book value/No of shares. Book value is equal to shareholders fund. It can be found in the balance sheet under the heading ‘Shareholders fund’. Number of shares can be found in Schedule 1 under the heading ‘Share Capital’.

ROIC is calculated as Earnings before interest and depreciation/ Total capital. To read more on this click http://bit.ly/cJtpxa .

BVPS OF BHEL IS NW 325….WT IT MEANS……..

from where can we get the net profit debt ratio?

You can get all these 5 parameters alongwith the Debt to Net Profit ratio for your companies on our site http://www.moneyworks4me.com. Do check it out.

your explanation on bookvalue per share and the debt-to-netprofit ratio is simpler and more understandable than the usual things I have read.

Would you be able to provide this data even for a company which got listed in the last 2-3 yrs?

very simple and great.

pl update me on my email id- sudhir_crystal@rediffmail.com

wonderful

your website is fantastic

what does ROIC and BVPS mean? and how to check that?

any site where these all funda. parameter filter & we get stock list?

I am investing in Unitech currently at 20 per share market price. Pls. let me know this is a good bet.

Excellent basic information for the young investors.Worth reading and implementing..

DEAR SIR

I AM NEW IN THIS FIELD I WNAT TO KNOW PER MONTH LUMSUMP HOW MUCH AMOUNT I HAVE TO INVEST FOR GOOD RETURN WITHIN 10 YEARS

Alam, a good return does not depend on how much you invest. It will depend on what and when you invest. No hard feelings, but at this point, the best thing for you to do would be to invest in educating yourself about the stock market. Take courses, read books, go to seminars. That will give you a better return than blind investing.

how cane be Certain about the Financial Data provided by Company? They could release false data to increase hype in the market…i would love to know your thoughts on this…Thank You for this Article!

Sir,

How to know whether Financial Statements are made up to a certain extent.

Thanks,

Virgil Williams

Very good

Thank you so much for providing the useful information regarding theses 6 financial parameters. These parameters really very important, must consider ones while selecting a company to invest.