This article covers the following:

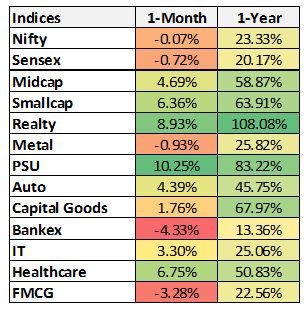

Sensex gave -0.72% returns in the last month and rose 20% on a yearly basis.

Source: NSE, BSE

The Nifty and Sensex indices rose sharply in December, but couldn’t sustain the momentum in January and slowed down towards the end of the month. This rally and the high levels of the indices reduced the returns in the month of January. The sectors that performed the best in the last month were PSU, Realty and Healthcare, and the sectors that performed the best in the year were Realty, PSU, and Capital Goods.

Source: CDSL, NSDL

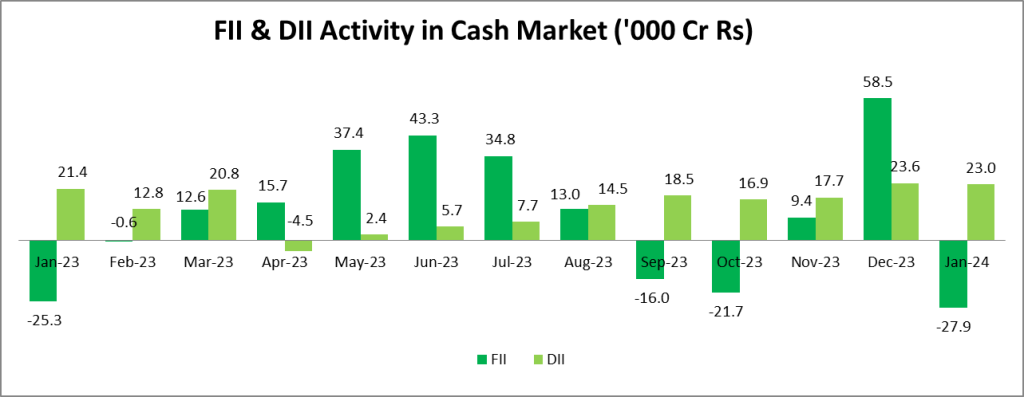

In January, FIIs shifted from being net buyers to net sellers, while DIIs maintained their buying trend. Except for April 2023, DIIs have consistently been net buyers over the past year, and this trend continued in January as well. Specifically, in January 2024, FIIs sold stocks worth ₹27,851 crore, whereas DIIs purchased stocks worth ₹23,010 crore.

Global equities kicked off 2024 with optimism, fuelled by easing inflation expectations. However, valuations are already high, demanding continued earnings growth to sustain the rally.

Source: BEA

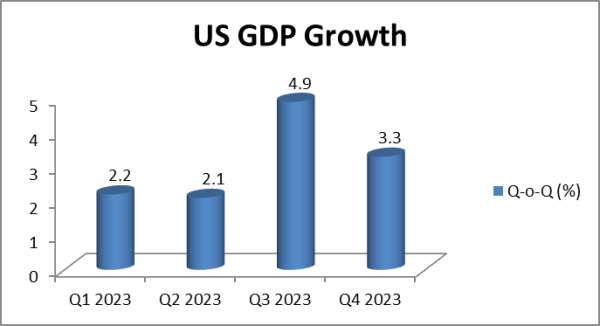

The US economy surprised with robust GDP growth of 3.3% in Q4 2023, defying fears of a slowdown. Consumer spending remains strong, supported by wage growth and a surge in retirement spending. This underpins global market sentiment. Though inflation remains above target in many countries, recent readings show signs of cooling.

Source: FOMC

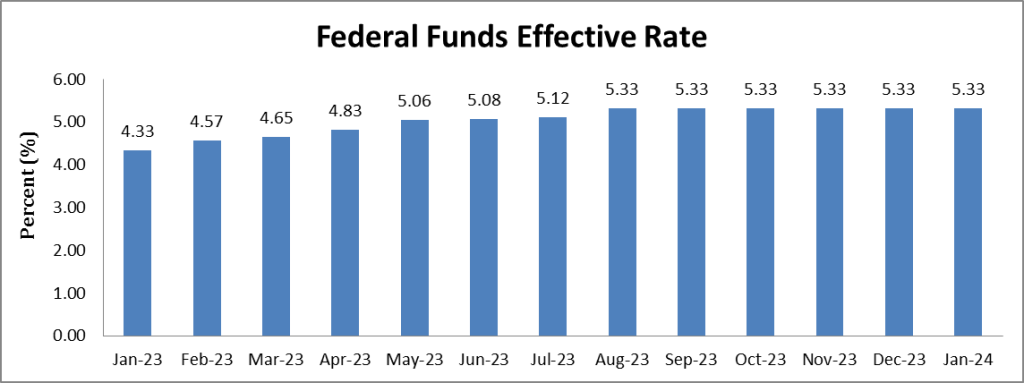

The Federal Reserve has maintained interest rates unchanged at 5.25-5.50% for the fourth consecutive meeting and indicated its willingness to consider reducing them.

Geopolitical risks and supply disruptions continue to keep commodity prices volatile, adding to inflationary pressures and impacting various industries. Conflicts in the Middle East and Ukraine continue to pose risks to energy supplies and broader market stability. Geopolitical uncertainty remains a major headwind.

China’s struggling property sector and lower GDP growth forecast raise concerns about its impact on global trade and demand. The National Bureau of Statistics reported that China’s economy grew by 5.2% in Q4, an increase from 4.9% in the 3rd quarter. However, this recovery was weaker than anticipated due to ongoing issues in the property market, increasing risks of deflation, and weak demand, which are expected to negatively affect the country’s economic outlook for the coming year.

The December quarter earnings season has been positive so far, with many companies reporting healthy profits. This could boost investor confidence and lead to further buying in the market.

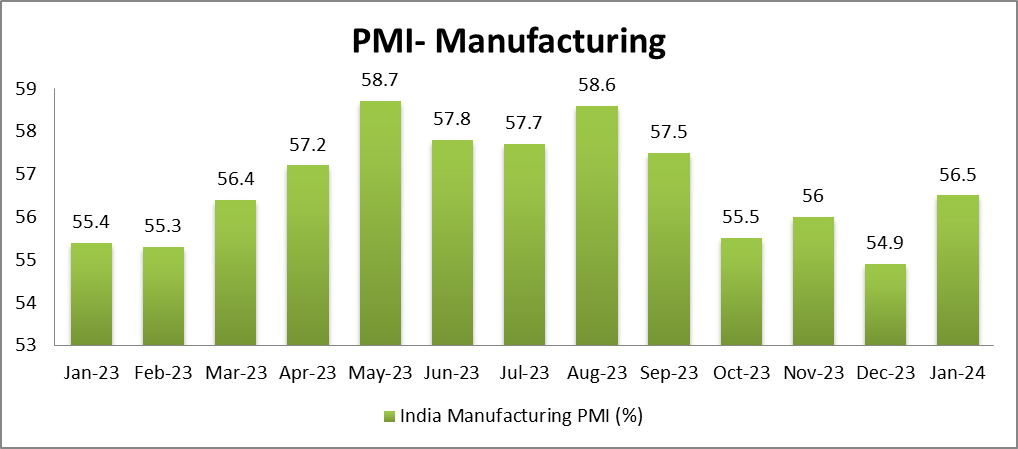

Both manufacturing and services sectors in India witnessed impressive growth in January, indicating strong domestic demand and resilience. This could bode well for the broader Asian region.

Source: S&P Global

The HSBC India Manufacturing PMI, a measure of manufacturing activity, rose to its highest level in four months in January, as orders surged and input costs remained moderate. The Manufacturing PMI rebounded from an 18-month low of 54.9 in December to 56.5 in January. The HSBC India Services PMI, a gauge of services activity, also reached its highest level in six months in January, driven by higher demand, better efficiency, and a rise in the intake of new projects. The index rose from 59 in December to 61.8 in January, indicating the fastest growth in six months, according to private survey data.

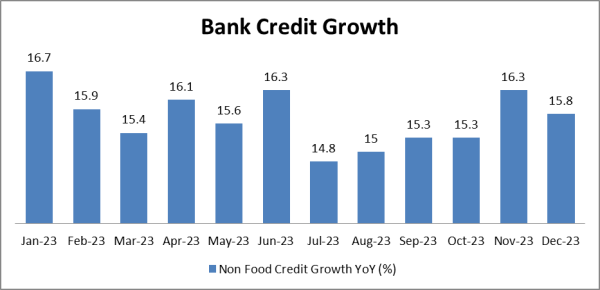

Source: RBI

Non-food bank credit grew by 15.8% in December 2023, slightly higher than 15.3% a year before. Gross bank credit to MSMEs under the priority sector lending increased by 19.1% to ₹23.87 lakh crore in December 2023, as per RBI data. Priority sector lending refers to providing loans to sectors that impact a large section of the population, including weaker sections, and those that are employment-intensive, such as farming and MSMEs. Personal loans growth dropped to 17.7% in December 2023 (from 20.4% last year), due to moderation in credit to housing and vehicles.

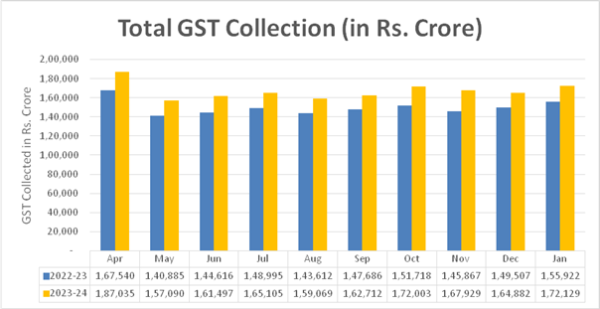

Source: PIB

India’s GST revenue reached ₹1.72 lakh crore in January 2024, a 10.4% increase from a year ago. This was the second-highest monthly collection and the third time in the fiscal year 2023-24, that it crossed ₹1.70 lakh crore. The cumulative gross GST collection from April 2023 to January 2024 grew by 11.6% to ₹16.69 lakh crore. The government reported that the net direct tax collections rose by 160.52% from ₹6,38,596 crore in 2013-14 to ₹16,63,686 crore in 2022-23. Direct taxes include both individual income tax and corporate tax. The direct tax to GDP ratio rose from 5.62% in 2013-14 to 6.11% in 2022-23, which demonstrates increased efficiency.

The recent budget revealed that the government has opted to maintain the status quo which is understandable for an interim budget. However, they have also not been populist in an election year, which is a positive sign. The Interim budget 2024 was focused on empowering youth and women, alongside maintaining fiscal consolidation and sustained capital expenditure.

The government expects that India’s economy will grow by 7.3% in FY24, surpassing the 7% forecast by the central bank, and maintaining its position as the world’s fastest-growing major economy, aided by an increase in manufacturing. The government also expects a similar growth rate of around 7% in FY25, despite potential global uncertainties that could affect trade and increase inflation.

Indian economy continues to be an Oasis in the global desert

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and PMI, indicate a significant level of economic activity.

Projections suggest that India is expected to be among the fastest-growing economies in 2024. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters. However, in the short term, volatility may persist until global uncertainties subside.

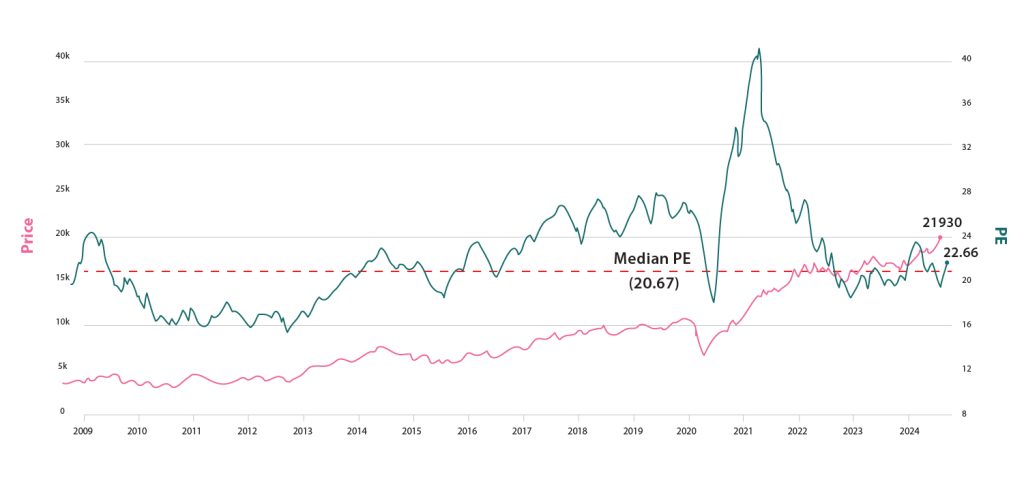

Nifty is trading above long-term averages

Source: Trendlyne

On a PE basis, Nifty is trading at 22.66, above the historical median of 20.67. It shows positive sentiment and bullishness in the market.

The Indian market is trading at a slightly premium valuation compared to other emerging markets. Further earnings growth shall help sustain the momentum. However, large caps still look cheap on a relative level as compared to small and mid caps.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlooks and growth. While taking a portfolio view to diversify and make the most of the rising economy.

Government capital expenditure is growing on an already high base, the fiscal deficit is under control, tax collections are buoyant and overall consumer sentiment is strong. Macros are looking stable for a foreseeable period and our portfolio is well aligned for developments in the Banking, Power, and Healthcare sectors. Investors should stay invested and use every opportunity to deploy additional funds.

Our portfolio companies have performed well in the calendar year 2023, in such bullish markets we advise you to move towards resilient companies. Please check the companies recommended in the BUY zone as per subscribed plans.

Best Stocks From:

Top Fertilizer Stocks in India Best EV Stocks in India Screener Alpha Cases Best 5G Stocks in India Top AI Stocks in India Best Drone Stocks in India Best Defence Stocks in India Top 10 Infrastructure Stocks in India Best Fintech Stocks in India Best Green Hydrogen Stocks in India Best Media Stocks in India

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory