Tata Steel Ltd. one of India’s largest steel producer, is coming out with an FPO to raise around Rs. 3500 Cr. A global major, Tata Steel is also the 7th largest steel producer in the world.

So, what’s the subscription offer? Here’s the review of Tata Steel FPO

Tata Steel, the seventh largest steel producer in the world, is coming up with a follow-on public offer (FPO) to raise about Rs. 3,500 Cr. The FPO would consist of a fresh issue of 57 million Equity Shares of Rs.10/- each and the price band has been fixed at Rs. 594/- to Rs. 610/- per equity share. At the upper end of the band, the fresh issue would raise around Rs. 3477 Cr., a chunk of which would be used to bring down the $10-billion debt it took to buy European steel producer Corus and to partly fund its ongoing expansion of Jamshedpur plant. The offer opens on January 19th and closes on January 21st, 2010.

Tell me more about Tata Steel Ltd.…

Established in 1907, Tata Steel Ltd., a Tata Group company, is India’s largest integrated steel player in the private sector and the world’s seventh largest steel producer with an annual crude steel capacity of around 30 million tonnes per annum (mtpa). It manufactures hot and cold rolled coils and sheets, galvanized sheets, tubes, wire rods, construction rebars, rings and bearings. After the acquisition of Corus in 2007, it is now the 7th largest steel producer in the world. Apart from India, the company operates through its major subsidiaries on a consolidated basis – Europe (Corus) and South-East Asia (NatSteel & Thailand). In India the company has manufacturing facilities at Jharkhand, Chhattisgarh, Orissa, West Bengal and Tamil Nadu. It has operations in 26 countries and commercial presence in over 50 countries with over 81,000 employees.

Use of Proceeds

The FPO would result in an equity dilution of nearly 5.94% in the expanded capital base of Tata Steel. As a result the promoter’s holding will come down to 30% from 32.48 %. The company has said that out of the total FPO proceeds, Rs. 1,875 Cr. will be used to “part-finance the capital expenditure for expansion of its existing works at Jamshedpur whereas the remaining Rs. 1,090 Cr. will be used to pay the redemption amount of some of the maturing redeemable non-convertible debentures held by the Tata Group company (debt reduction).

How has the performance of Tata Steel been?

Historical Financial Performance:

On Standalone basis: Tata Steel India has performed robustly in all its parameters in the last 10 years. Its Net Sales have grown by 16% CAGR showing consistent demand for its products. Also, a strong re-investment into the business along with an improvement in margins has helped the company grow its Earnings per Share (EPS) by 14.6% over the years. However on the ROE & ROIC front it has shown a weakening performance. The company’s ROE has fallen from 21% in 2009 to 14% in FY10, due to the substantial increase in interest costs and also a slight fall in sales growth rate.

Though the company has maintained an average of 23% ROIC, the figures have shown a decreasing trend in the last 6 years. From a high of 44% in FY05, ROIC was around 12% in the last year. This is because of the continuous increase of debt on books. The company’s debt has increased from Rs. 9600 Cr. in 2007 to Rs. 25000 Cr. currently (mainly due to Corus acquisition). This has led to a rise in Debt-to Net Profit ratio (5.71) and Debt-to-Equity ratio (0.7).

On consolidated basis: Tata Steel has shown a massive jump in net sales since FY 2008 after the acquisition of Corus. This acquisition took Tata Steel’s revenues from Rs. 25117 Cr. (FY07) to Rs. 1,31,498 Cr. (FY08). Its profits too increased from Rs. 4,174 Cr. to Rs. 7,359 Cr. in the same period. Further in FY09 the company registered a good sales growth of 12% and a profit growth of 3.5%. But, in FY10 the company’s sales fell and it registered losses of Rs. 2009 Cr. as a result of the slowdown in the European markets and lower production from Corus. The company’s debt on a consolidated basis is very high at Rs. 53,000 Cr. which includes a major chunk of Corus’ debt burden.

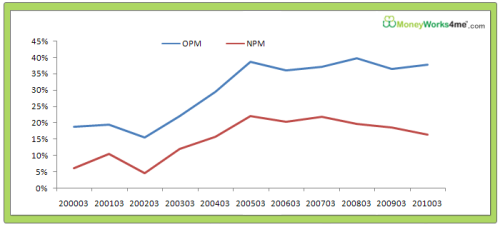

Margins (standalone basis): Over the last 10 years Tata Steel has shown impressive improvements in its profit margin ratios. From FY2005 the company has maintained operating profit margin at 40-45% level. Its Net Margin has also been at a very good level compared to other domestic steel players. But in last two years, it has shown a declining NPM trend mainly due to rising interest cost. Going forward, considering the company’s planned debt restructuring/repayments; we can expect significant improvement in Net as well as operating margins.

Q2FY2011 performance

Sept 2010 was 3rd consecutive good quarter for Tata Steel after a year of bad financial performance. So far the current fiscal has been good for the company on stand alone as well as consolidated basis. Reviving demand from European countries, higher production from Corus, and a growing domestic market have contributed to its turnaround. On standalone basis, the company’s net profit stood at Rs. 2065 Cr. for the quarter ended September 30, 2010 as compared to Rs 903 Cr. for the quarter ended September 30, 2009, up by whopping 128%. Its total income increased by 25% from Rs 5,630 Cr. for the Sept’09 quarter, to Rs 7,038 Cr in Sept ’10 Qtr. On consolidated basis, it reported 11% jump in Net sales and a profit of Rs 2002 Cr. for the September 2010 quarter compared to negative profit reported in Sept 2009 quarter.

What can we expect in the future? Here’s the analysis

Quarters Ahead:

The company’s consolidated results which were in losses till Dec 2009 (due to Tata Steel Europe) have now started registering good profits since last three quarters (March, June and Sept’10). This was a combined result of the gradual improvement in European steel market and the company’s turnaround initiatives of cost saving and customer first program which were implemented for Corus. With the reviving demand, the company’ capacity utilization has risen to 85% in the first half of FY11. Also, selling off Teesside unit is expected to reduce unnecessary expenditures which will further bring down the cost and enhance margins.

Though last three quarters of Tata steel indicate an impressive turn-around, we expect a lukewarm performance in the coming quarters due to rising coal and other raw material prices, stabilizing global steel prices, decreasing imports from China and weak demand. Also ongoing turbulence in European countries and temporary slowdown in China will keep the commodity prices at low label for some more time. According to company, Tata Steel’ global sales volume has declined marginally in the December 2010 quarter, hurt mainly by volume decline at its European operations.

This FPO will help the company to lower its debt position partially and we can expect a slightly lower debt (interest cost) service pressure on the books. However, due to increase in equity base, we will also see a small dip in the EPS going forward.

Massive Expansion Plans:

In its bid to maintain its leadership position, Tata Steel is aggressively expanding its production capacity. Tata Steel is currently implementing a 2.9 mtpa capacity addition to its Jamshedpur plant which will take the total capacity to 9.7 mtpa of crude steel. This is expected to be completed by the end of FY2012. With this expansion, Tata Steel will have the largest blast furnace in India with a much higher efficiency along with an in-house coke making capacity, which will further protect the company from rising coke prices. The Company is also developing a 6.0 mtpa Greenfield steel plant in Orissa and a 5.0 mtpa Greenfield steel plant in Chhattisgarh and is in the initial planning phase for the construction of a 3.0 mtpa Greenfield steel plant in Karnataka. Due to this higher capacity and increased efficiency, Tata Steel will have better footage in domestic steel market.

Integrated Growth:

Tata Steel is one of the lowest cost producers of steel (especially on a standalone basis). It is one of the largest integrated players getting its raw material (iron-ore and coking coal) from captive sources. Tata Steel has full captive sources for iron-ore and relies on external sources only to the extent of 40% for coking coal. Tata Steel’s RM cost constitutes only 23-25% of total cost compared to other domestic players like SAIL and JSW Steel where RM cost form about 50% of total cost. Tata Steel is looking for further acquisitions of strategic raw material mines globally. Besides, the company has also started Industrial Energy Limited, a 24:76 joint venture (JV) with Tata Power that ensures the expanded facilities will have a reliable, low-cost supply of power to its steel plants.

Tata Steel Europe (Corus) to be the future Growth Driver:

With the acquisition of Corus, Tata Steel became one of the largest steel players in the world. After having faced troubles in the last two years, Tata Steel Europe seems to be on a turnaround path. The company is expected to resume close to 90% of capacity utilization in this fiscal. Acquisition of strategically placed Corus has given Tata Steel a low-cost manufacturing set up in India with unrestricted access to the high-end European markets. Looking at its huge contribution and recent recovery, we can expect this subsidiary to be a future revenue driver.

Steel Demand to increase:

Steel is the basic foundation material for many construction activities, equipments, goods etc. The Steel sector has grown by more than 20% CAGR in Sales and Net Profit over the last 6 years. We can expect continued growth in steel demand in India, spurred by the increased need for steel based products (construction and infrastructure, automobiles, appliances, etc.) and estimated gross domestic product. The sector is poised for great growth in the future, especially considering economic recovery and is expected to grow with robust double digits in future. Tata Steel, being one of the largest and most successful players in this industry, is expected to take advantage of all the opportunities available in the industry.

But, what are the concerns?

Exposed to European Market Situation:

Though the company has a much diversified user base across the globe, it gets around 50% (46% in 2010) of its revenue from its Europe operations which mainly focus on European markets. A slowdown in this geography has had an impact on the company in the past and could impact its performance in future as well.

High Debt Level

Tata Steel is sitting on more than Rs 50,000 Cr. of debt which has a very high service (interest) cost. Due to the continuous interest payments, the company is witnessing depressed margins. Though the company is planning to raise around Rs 7,000 Cr. through various options, including this FPO, it will provide only temporary respite to the company.

Cyclicality of Steel Industry

Steel prices are volatile, reflecting the highly cyclical nature of the global steel industry. Steel prices fluctuate based on macroeconomic factors, like consumer confidence, employment rates, interest rates etc, and are also sensitive to the trends in user industries like automotive, construction, machinery, equipment and transportation industries. When downturns occur in these economies or sectors, the Company may experience decreased demand for its products.

So, should I invest in Tata Steel FPO?

With the economy expected to grow at roughly about 7-8% per annum, we expect a rise in economic activities and with that a massive rise in steel demand in coming years. Considering the company’s capacity expansion & integration and rise in demand for steel due to ongoing recovery, this economic growth will have a positive impact on the company’s earnings in coming years.

The price band for this public issue has been fixed at Rs.594-610 per share. But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to the MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy-price and hence take the right action for this FPO.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463