Joel Greenblatt is an American hedge fund manager and investment officer at Gotham Asset Management. He is the author of books You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of the Stock Market Profits and The Big Secret for the Small Investor: A New Route to Long-Term Investment Success. Joel follows Benjamin Graham’s footsteps of value investing.

Joel starts by highlighting how being successful in investing can be achieved simply by following a disciplined, methodical, long-term investment strategy that makes sense and most money managers focus on yearly returns which rarely beat the market. He outlines comparing investments with risk-free rates (government securities).

He emphasizes the concept of value investing i.e. buying stocks at a discounted price that is way below their true value is introduced. And how the stock market is an opportunity factory, where one can buy a business for less than it’s worth or sell a business for more than it’s worth. Or one could overpay/undersell.

Joel talks about the “Magic Formula”, by calculating Earnings Yield and Return on Capital for stocks.

- Earning Yield, it is earning that you earn on money invested.

EY= EBIT/EV

Ex-Stock A is trading at an Enterprise Value (market cap + debt – cash) of 100 per share and earns Earnings before Interest & Taxes of 5 per share.Earning Yield = EBIT/ EV (5/100), = 5%

EBIT is used as different companies operate at different debt levels & tax rates. While EV takes into account both the price of equity as well as debt financing used by a company to help generate operating earnings.

- Return on Capital (ROC), calculating the ratio of pre-tax operating earnings (EBIT) to tangible capital employed (Net Working Capital + Net Fixed Assets). Ex-Stock A has tangible capital of 20, therefore having a ROC of 25%.

Tangible capital employed is used in place of equity or assets, as it explains how much capital is actually needed to conduct the company’s business. While avoiding equity values because it may be inflated due to acquisition & goodwill. Joel recommends considering stocks with a ROC of 25 or more.

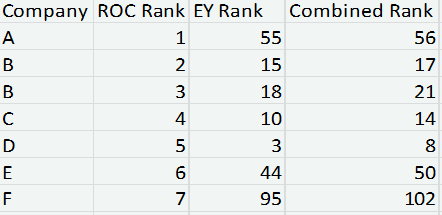

Joel then talks about rankings these from high to low and combining ranks of EY and ROC to determine which stocks rank highest. Joel suggested generally investing in the top 30 of these companies.

We can see here even though Company A ranks highest in ROC, while Company B tops it in combined rank.

- The most important aspect of investing Joel highlights is patience. Lack of patience is why people fail to implement the magic formula. Hence it is important to be patient and remain invested for the long term to reap the most benefits of this formula.

The Magic Formula ranks stocks by quality and cheapness, making sure that there will always be highly ranked stocks to invest in. But these ranks are relative, having its limitations. Magic Formula also doesn’t work all the time; it has periods of underperformance. In 5 out of 12 months it delivered returns poor to the market average. On a yearly period, one of every 4 years it underperformed the market.

This book highlights the use of a consistent investing strategy and being patience to earn healthy returns. The author highlights metrics for quality and low-priced stocks, and how his Magic Formula works. This boring approach is what helps investors earn over the longer run.

Best Stocks From:

Undervalued Nifty 50 Undervalued Nifty 100 Screener Alpha Cases 5 stars rated stocks from Nifty 500

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463