Raymond Moses

Founder MoneyWorks4Me

Starting and leading a Research and Investment Advisory firm was not part of my career or business plans to begin with.

But when I look back, I can see very clearly how everything I have done in the last 40+ years makes this right. I am

thrilled it has worked out this way.

My focus and expertise have always been to understand what is required for a business to succeed; the templates and

models common to successful businesses and companies. With MoneyWorks4Me, in the last 15+ years, my team and I have

stress-tested potential candidates to identify the investment-worthy stocks that are most likely to deliver

healthy-high, consistent returns.

The first part has been a journey of 40+ years that has spanned graduating with Chemical Engineering from IIT Kanpur,

working in Hindustan Unilever (Management Trainee & Production) and Castrol (Sales & Marketing), The Alchemists Ark

(Business Consulting, Training, e-learning), and finally MoneyWorks4Me.

My five years at IIT Kanpur helped me become a good engineer. It made me extremely good with numbers, most of all at

interpreting them objectively. As a Chemical Engineer I learnt how to handle complex reality through good models that

you continuously improve and make more reliable.

My first job was as Management Trainee and then a Production Manager at Hindustan Lever in Kolkata and Haldia. I learnt

the ropes of how to run a factory efficiently.

My second job was in Sales and Marketing at Castrol. I worked there for 11 years in the Western and Southern Regions in

Sales Management roles in both B2C and B2B, before moving to a National Marketing role. Castrol provided me the

opportunity to learn first-hand how to profitably grow a company multi-fold through the power of Products, Brands,

Distribution, Channel advocacy, and People.

I have worked closely with the automobile companies from two wheelers to heavy earth moving equipment, franchised

dealerships, non-franchised mechanics and garages, transporters, fleet operators and contractors using earth moving

equipment. Thanks to Castrol's strong B2B business, I have worked closely with the best manufacturing companies and

general industries in India.

The third part of my journey was consulting and training market leading companies on Sales and Distribution. The table

below is a list of companies we have worked with, usually with the entire team - MD, Head of Sales & Marketing, Sales

Managers, Front line Sales and Dealership and Distributor teams.

In 2009 we invested in a company that made pellets from bio-mass, agri-residues and stoves that ensured it burn

efficiently without indoor pollution. As these were sold to restaurants and caterers I had the opportunity to understand

this industry closely. We disinvested in 2015.

Running MoneyWorks4Me has helped me developed a better understanding of the Broking, Wealth Management, AMC, and Digital

Businesses.

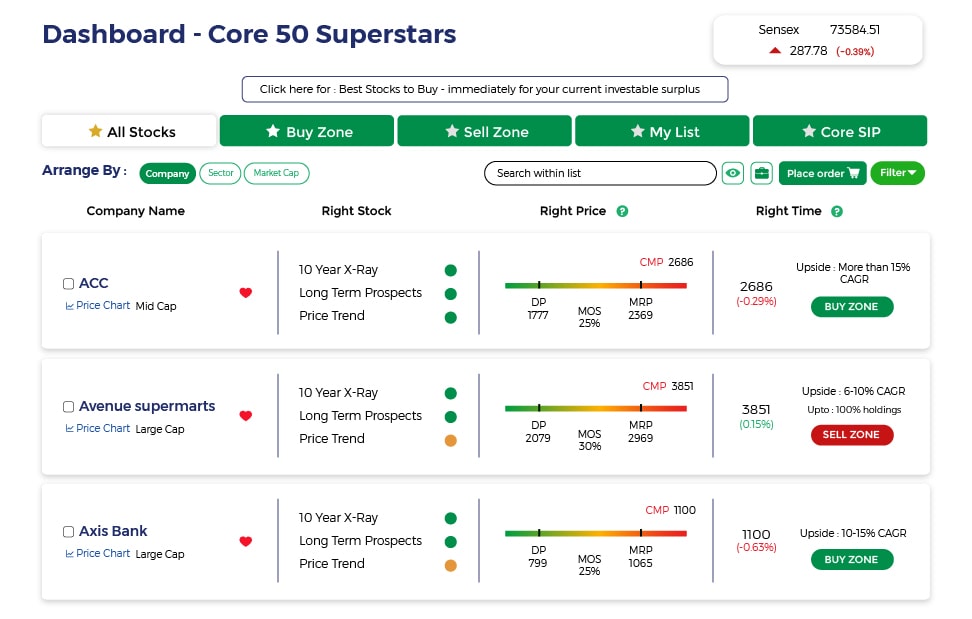

In the last 15 years of building and managing MoneyWorks4Me, our team of equity research and I have analysed, evaluated,

tracked, and re-evaluated a couple of hundred companies. I have been able to put my years of experience to good use to

ensure we select the best companies to invest in and continuously improve on this.

When Direct Plans of Mutual Funds became available, I became comfortable about recommending them. We had to go through

the learning curve of how to invest in mutual funds with and without a Direct Stock Portfolio. We also brought our

insight on stocks to better analyze and recommend funds and create unique and valuable fund pages.

However, we learnt that good research and communication was not sufficient to ensure clients succeed in investing.

Clients needed more - a behavioural edge. My years in consulting, training, my enduring passion for self-development and

actualization helped me work with our clients and discover how investors can develop this behavioural edge.

I have always been aware that not having enough money is a problem (grew up in a middle-class family in the 60s and

70s). However, that can be solved by a job, practice, or a business and by investing successfully. The bigger problem is

what do you do when you have or can see that will have enough money in the future. Answering this is crucial to

achieving Financial Freedom and more. I have captured my experience and thoughts in my book, How the Heck to Invest and

Reach Nirvana; A 5-Step Journey to Financial Freedom.

Download APP

Download APP