No Commissions. No Hidden Fees. No Conflicts.

Just Your Best Interest.

As a registered investment adviser (RIA), we uphold the highest fiduciary standards—both in letter and spirit—because it reflects our unwavering commitment to our clients.

Every tool we build, every process we follow, and every decision we make is designed to serve your best interest—nothing else. There are no hidden incentives, no fine print, no conflicting agendas.

Our fee structure is simple. Transparent. Aligned with your outcomes. When you do well, we do well. It’s that straightforward.

This is what being a fiduciary truly means. And at Omega, it’s not just a standard—it’s the way we do business, every single day.

We Don’t Just Offer Advice. We Build Alignment That Drives Results.

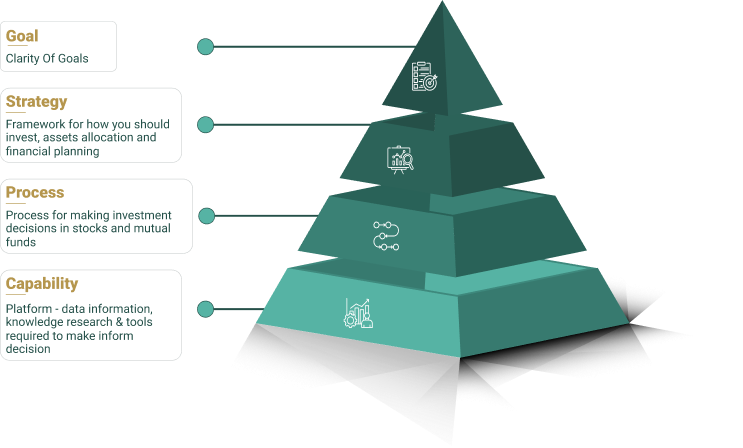

At Omega, our Partner-with-Experts Model is built to ensure that every decision is grounded in shared clarity and purpose. We align with you on four essential levels—your goals, your investment strategy, the process to get there, and the capabilities required to stay on course.

What powers this partnership is our advanced platform. It gives both you and your advisor access to powerful planning tools, in-depth insights, and real-time decision-enabling resources.

This isn't a one-way conversation. It's an ongoing dialogue that leads to sharper thinking, deeper conviction, and higher-quality decisions. You don’t just invest—you grow into a more confident, capable, and informed investor.

Your Goals Deserve More Than Gut Feel. They Deserve Precision.

At Omega, our advisors combine human expertise with the collective intelligence of our organization—backed by a powerful tech stack built for smarter investing. Every portfolio is shaped through a structured process and deep research, not guesswork.

We use real-time financial planning tools, 10-year X-Rays for companies and funds, proprietary analyst insights, performance alerts, and advanced portfolio systems—all working in sync. This ensures every decision is data-driven, every conversation meaningful, and every strategy tailored to your evolving goals.

You’re not relying on one advisor’s instincts. You’re tapping into a well-oiled engine of knowledge, rigor, and strategic clarity—designed to keep your portfolio agile, intelligent, and built for the long term.

15 Years of Research. One Mission: Smarter Equity Investing.

For over 15 years, our in-house team of seasoned analysts has built a deep reservoir of equity expertise. This allows us to identify high-quality stocks with conviction and construct robust, direct equity portfolios tailored to your goals. Our sharp understanding of business fundamentals also extends to evaluating mutual funds and ETFs—ensuring that every equity choice in your portfolio earns its place.

We don’t look at investments in isolation. Using advanced portfolio tools, we take a holistic view of your equity allocation. We eliminate redundancy, enhance diversification, and align each position with your broader strategy.

Superior returns don’t happen by chance. And they don’t come from standing still

At Omega, we believe long-term success demands more than passive investing. It calls for discipline, sharp judgment, and the confidence to act when it matters. Our approach is active—but purposeful. We focus on high-quality opportunities and make timely adjustments to keep your portfolio aligned with your long-term objectives.

We don’t churn for the sake of change. Every move is backed by deep analysis of business fundamentals, market conditions, and shifting valuations. Underperforming or overvalued holdings are replaced with stronger prospects—ensuring your portfolio isn’t just keeping pace, but positioned to outperform.

This isn’t guesswork. It’s a strategic, research-driven process—refined through regular reviews with you. Together, we make sure your portfolio stays resilient, growth-oriented, and one step ahead.