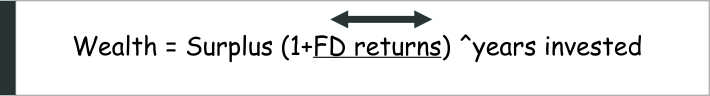

We invest to grow our savings to meet our financial needs and goals of the future. And some invest to create wealth; which is a goal in itself. Whatever the motivation, what we want is for our saving, our surplus money to grow. So how does money grow? Does it follow a formula? Yes, actually it does; perhaps at a personal level it is the most important formula. Let’s call it the Wealth Building Formula, WBF.

Essentially what this says is that wealth (money available to you in the future) is what happens when you put your surplus money to earn returns and let it compound for a number of years.

As you can see there are 3 variables, Surplus (the saving you put to work), Returns (CAGR) and No of years you stay invested and earn the returns. So how does this formula help understand how to invest or how not to invest?

Investing Style 1: The Safe Investor:

You are a Safe Investor if you are putting most of your surplus/saving in safe assets like FD/RD, Debt Funds and Gold.

What does the WBF indicate? Based on your investments, the returns after taxes will hardly beat inflation. So no matter how much surplus you invest and for how long, your money will not create wealth for you. You are you playing it too safe to create wealth? Yes your money will grow, but only enough to fight inflation.

Say you see an expenditure on your child’s higher education 10 years later. Lets assume it costs 10 lacs today. You have some savings today from which you can fund this. How much money will you need to set aside today? If you are a Safe Investor you will need to set aside the entire 10 lacs. That’s because the cost of higher education will also rise at about the same rate as inflation and you will need about 18 lacs after 10 years.

In short your money is not working hard for you.

Learning: Returns earned must be higher than rate of inflation to grow your savings into wealth

Action required: Change your asset allocation to include assets that will give inflation beating returns- Equity. Does it mean you keep nothing in FD? No. You should keep about 20-25% of your total surplus in a very safe asset like FD in the biggest bank e.g. SBI even though it will earn you returns that just about beat inflation. This ensures a reasonable portion of your surplus is very safe and you can take manageable risk and invest the rest to earn inflation-beating returns.

Investing Style 2: The Risk Taker:

You are a Risk Taker if most of your money is invested in equity following a high risk-high returns style of investing (high proportion of mid/small/micro cap stocks or funds, multibagger oriented investment)

What does the WBF indicate? Risk Takers are gunning for very high returns. However, to generate wealth even with high returns, the other two variable i.e. how much is invested and for how long also have to be reasonably large. This is extremely difficult to do and virtually impossible over extended period of time when you follow a high risk-high return strategy.

Risk Takers will see a substantial drop in their portfolio when the market corrects. The quality of their portfolio is unlikely to inspire them to stay invested and hence it is most likely that they will cut losses and exit their equity investments.

Learning: Gunning for high returns will adversely impact the amount invested and the period one stays invested for and hence as per the Wealth Formula it is unlikely to generate wealth

Action required: Be a Sensible Investor

Investing style 3: The Sensible Investor:

You are a sensible investor if you invest your total surplus across multiple assets (debt and Equity) so as to earn returns that are substantially higher than inflation rates without taking risks that makes you want to exit the market.

What does the WBF indicate?

All 3 variables help create wealth. However, all 3 cannot be maximised. Having a sensible returns expectations i.e. reasonably higher than inflation rate but one that ensures you stay invested for long and confidently invest your total surplus is likely to yield the best results.

The main reason investors exit their equity investments is their discomfort in handling a fall in the portfolio when the market corrects. The way to reduce the loss is the allocation to debt and equity. A 50:50 split ensures that the investor’s portfolio drops by roughly half the amount the market corrects. So even if the market corrects by 10%, the investor sees about 5% drop in his portfolio something that does not make you panic. Imagine your portfolio is 1 cr, a 10% drop would mean a paper loss of 10 lacs. If the portfolio has higher exposures to small cap stocks corrections could be even more severe, say 20%.

Learning: Get all the 3 variables working in your favour by having reasonable returns expectations that helps you to maximise the amount you put to work/invest and you stay as long as you are required to depending on your goals.

Here’s a case study of Amit, a Risk Taker and his friend Somu, a Sensible Investor and their experience with Investing

| Amit (Risk taker) | Somu (Sensible Investor) | |

| Initial corpus | 1 Crore | 1 Crore |

| Asset allocation | 100% Equity (Invested across mid,small and micro cap stocks) | 65% equity-35% Debt (invested mainly in large cap and a few quality mid cap stocks) |

| Return after 5 years (CAGR) | 18% | 13% |

| Corpus after 3 years | 1.64 cr | 1.44 cr |

| Additional amount required to bridge the shortfall | 20 lacs (in initial corpus) | |

| Additional Time required to bridge the shortfall | 1 year | |

| Year 4 sharp market correction | ||

| Drop in Nifty | 12% | |

| Drop in Mid/small cap index | 20% | |

| Portfolio loss after markets correct sharply in Year 6 | 25% | 9% (13% on equity portfolio) |

| Change in Asset allocation | 50% equity-50% debt (Equity exposure reduced to 50%) | 75% equity-25% Debt (Equity exposure increased to 75% as suggested by smart asset allocation) |

| Portfolio value after correction | 1.23 Cr (63 lacs in equity and 60 in Debt) | 1.31 Cr (98 lacs in equity and 33 lacs in debt) |

| Returns at end of 4 year (CAGR) | ~5.3% | ~7% |

| What happened later | Having lost 41 lacs from the peak value, Amit decided to play it safe. He invested in safe large and mid cap stock/funds only. Over the next 3 years the markets rose by 15% CAGR Amit portfolio rose to 1.69 cr a 7.8% CAGR over 7 years. | Somu held onto his portfolio having very good companies during the correction. At the end of the next 3 years his portfolio was 1.89 cr. Over 7 years he had earned 9.5% CAGR |

Does this remind you of a story you’ve heard when you were a child? Yes, the hare and the tortoise. Well, that’s what the Wealth Building Formula tells us: Slow and steady wins the race.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: