Every investor dreams of finding the perfect formula — one that promises high returns without too much volatility. But as we all eventually learn, risk and return are two sides of the same coin.

Equities, by nature, are volatile — especially in the short term.

In fact, the difference between a market’s annual high and low is typically more than 20%. This constant up-and-down movement tempts many investors to trade frequently, trying to profit from every swing.

But here’s what’s fascinating — if you zoom out and look at long-term trends, equity markets rise steadily in line with the earnings growth of listed companies. In the short term, prices may lead or lag earnings, but over time, they converge.

This gives rise to two distinct schools of thought in investing:

- Fundamental (Long-Term) Investors – who buy quality companies at reasonable prices and stay invested.

- Market Timers – who focus on short-term price movements, moving in and out of equities to “capture” 10–30% gains or avoid drawdowns.

So, does market timing actually work? Or does long-term investing still come out on top?

Let’s find out.

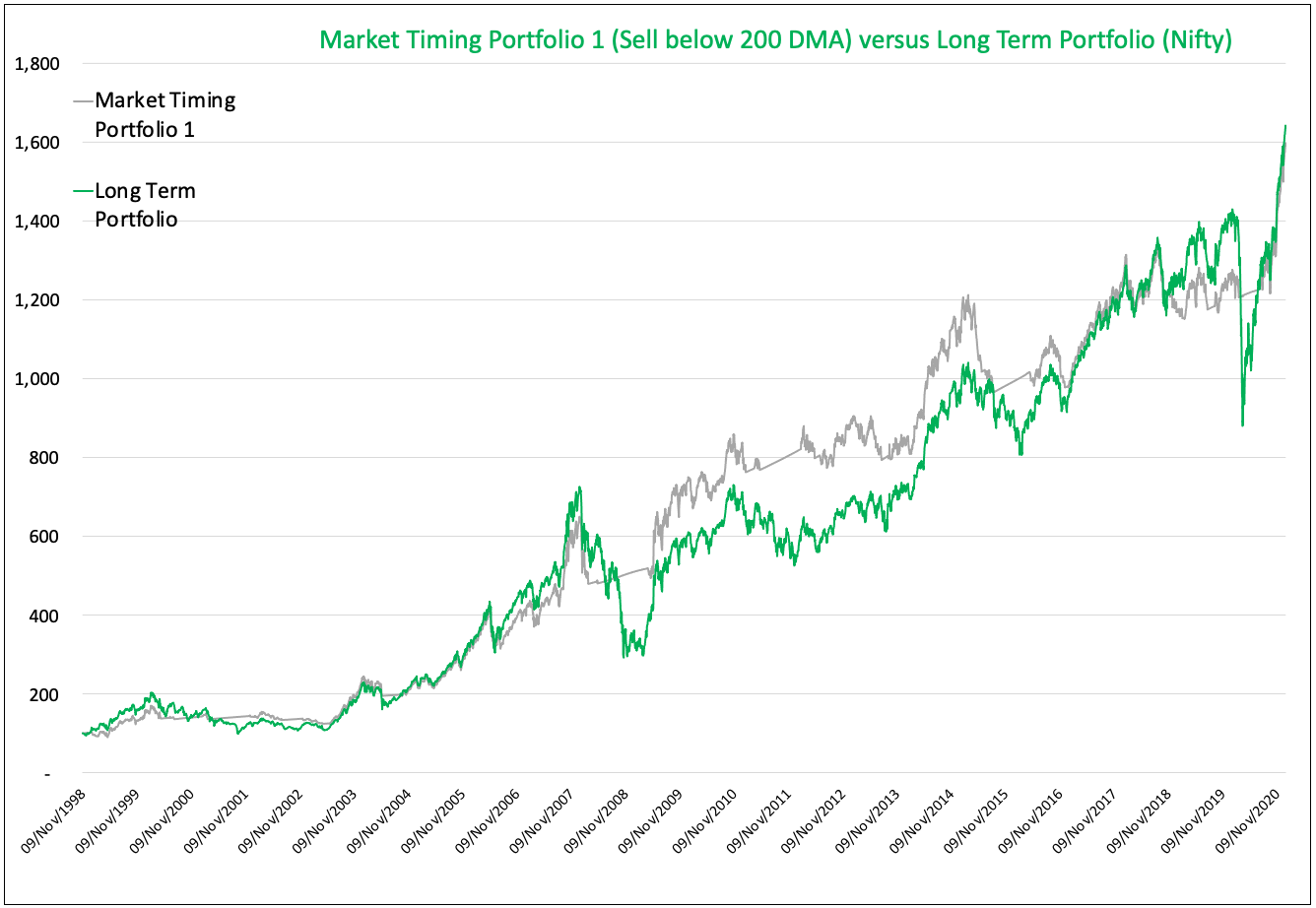

Market Timing Strategy #1: The 200-Day Moving Average (200 DMA)

The 200-day moving average is one of the most widely used market indicators.

It simply averages the last 200 days of a stock or index’s closing prices.

- When the market trades above its 200 DMA → it’s considered bullish.

- When it falls below → it’s viewed as bearish.

In this strategy, the Market Timing Portfolio 1 invests in equities (Nifty 50 Index) when the price is above the 200 DMA, and shifts to a liquid fund (JM Liquid Fund) when below it.

Result:

- Rs. 100 grew to Rs. 1,592 (13.4% CAGR) in 22 years.

- A simple Long-Term Portfolio in Nifty grew to Rs. 1,636 (13.5% CAGR).

At first glance, the timing strategy seems close — but remember, this is before taxes and brokerage. After accounting for those leakages, the Long-Term Portfolio wins.

Takeaway: Market timing using 200 DMA doesn’t improve returns meaningfully, but it adds complexity and costs.

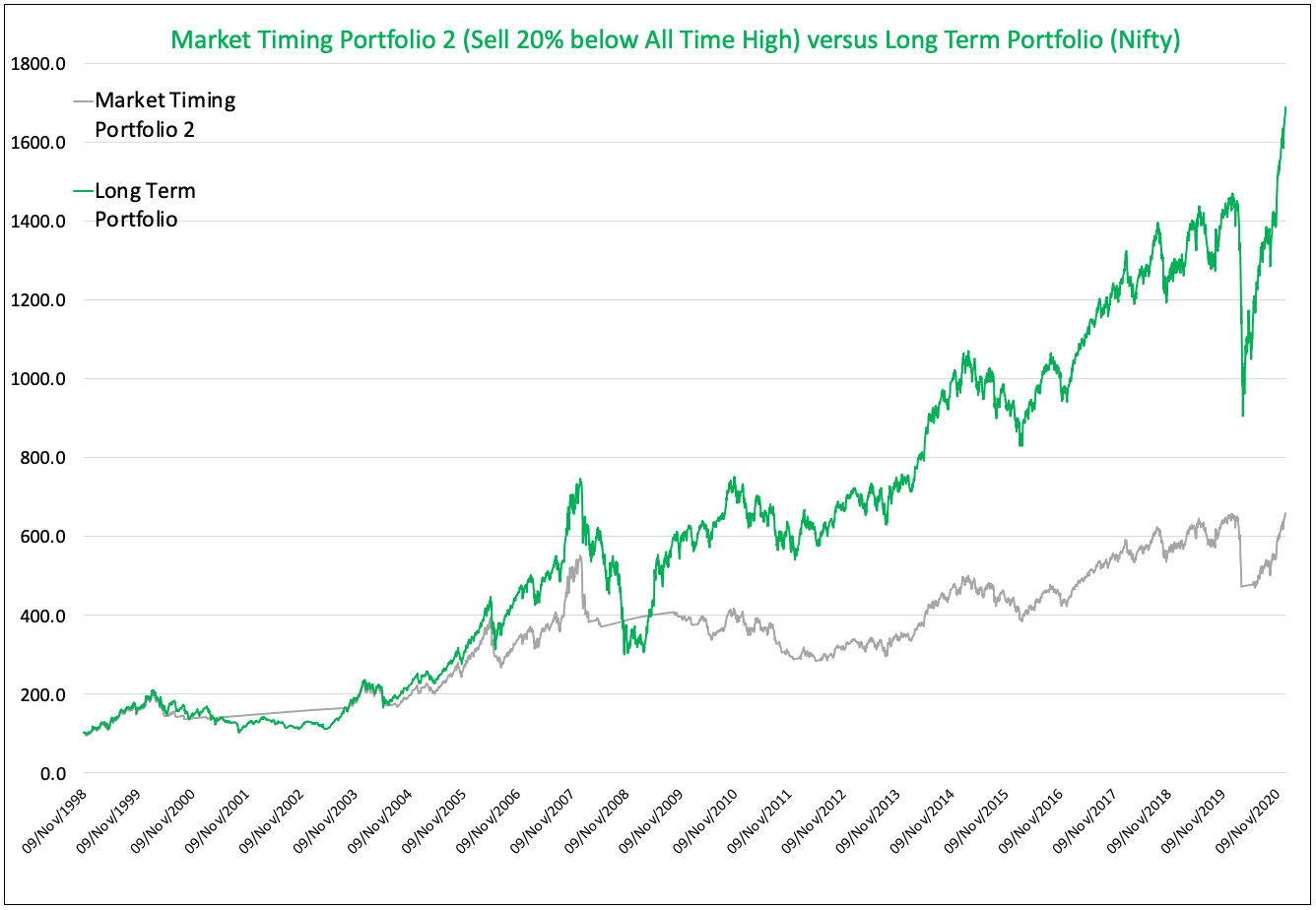

Market Timing Strategy #2: Sell When Market Falls 20% Below All-Time High

In this approach, the Market Timing Portfolio 2 remains invested in equities until prices drop more than 20% from their all-time high. Once that threshold is breached, it moves to a liquid fund.

Result:

- Rs. 100 grew to Rs. 656 (8.9% CAGR) in 22 years.

- The Long-Term Portfolio grew to Rs. 1,688 (13.7% CAGR).

Clearly, avoiding market declines came at the cost of missing recoveries. The portfolio lagged significantly over the long run.

Takeaway: Trying to dodge downturns often means missing the sharpest rebounds that follow.

Market Timing Strategy #3: Sell When Market Falls 20% Below 52-Week High

This variation uses the 52-week high instead of the all-time high.

The Market Timing Portfolio 3 sells when the market is 20% below its 52-week high and re-enters when sentiment improves.

Result:

- Rs. 100 grew to Rs. 695 (9.6% CAGR) over 21 years.

- The Long-Term Portfolio grew to Rs. 1,571 (14% CAGR).

Once again, long-term investing outperformed.

Takeaway: Frequent exits and entries dilute compounding — the true source of long-term wealth creation.

Why Market Timing Fails

1. Operational Complexity

Timing strategies require frequent transactions — often multiple times a year — due to false breakouts and reversals. For retail investors, this is neither practical nor emotionally sustainable without automation.

2. High Costs

Brokerage, bid-ask spreads, and short-term capital gains taxes eat into returns. Even a 0.5–1% annual drag can lower long-term CAGR significantly.

3. Psychological Comfort ≠ Real Returns

Many argue that market timing reduces anxiety by lowering drawdowns during crashes.

While that’s partly true, the comfort is often mental accounting, not actual wealth preservation.

If you look at your total portfolio holistically, small declines in one asset are offset by gains in others.

The solution isn’t timing — it’s diversification.

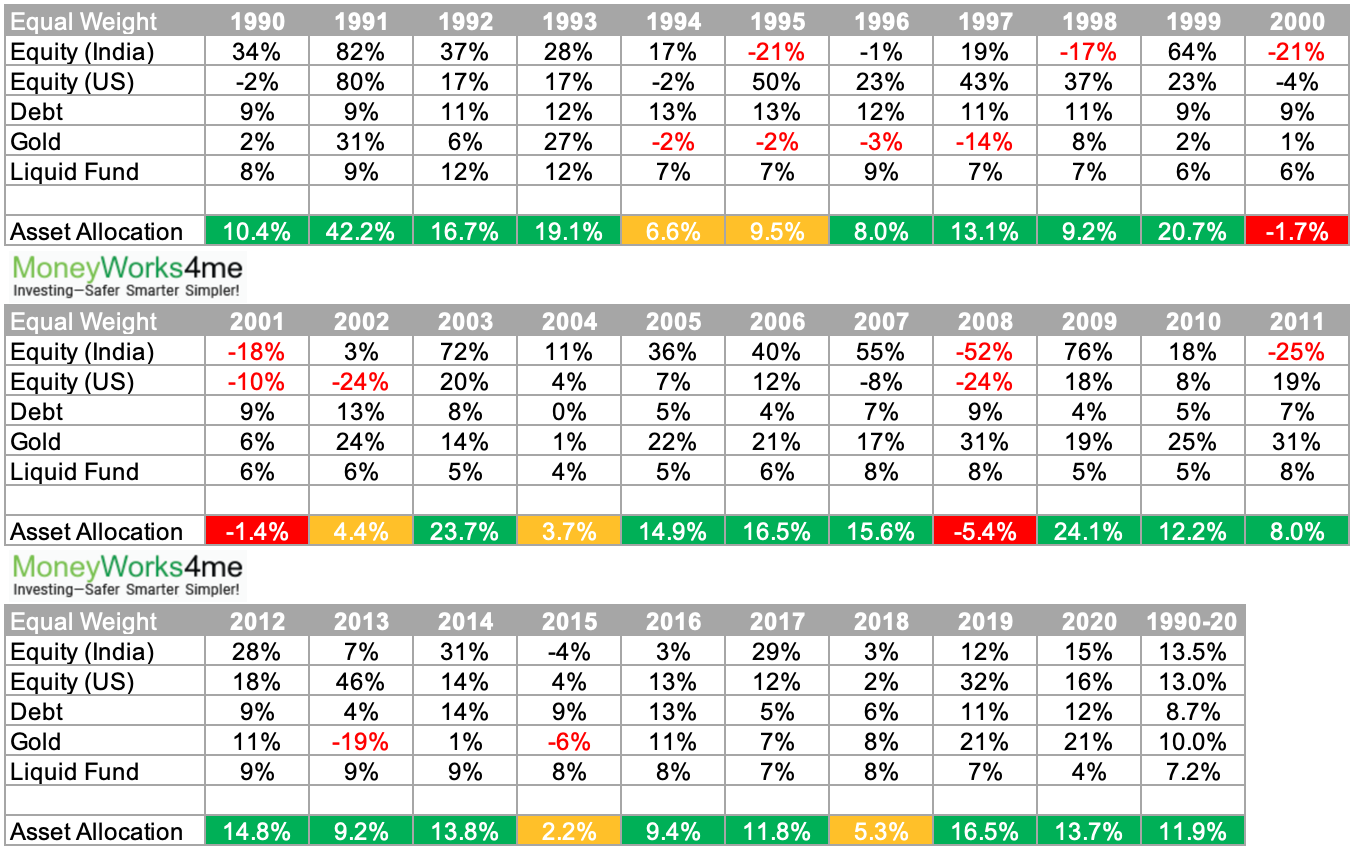

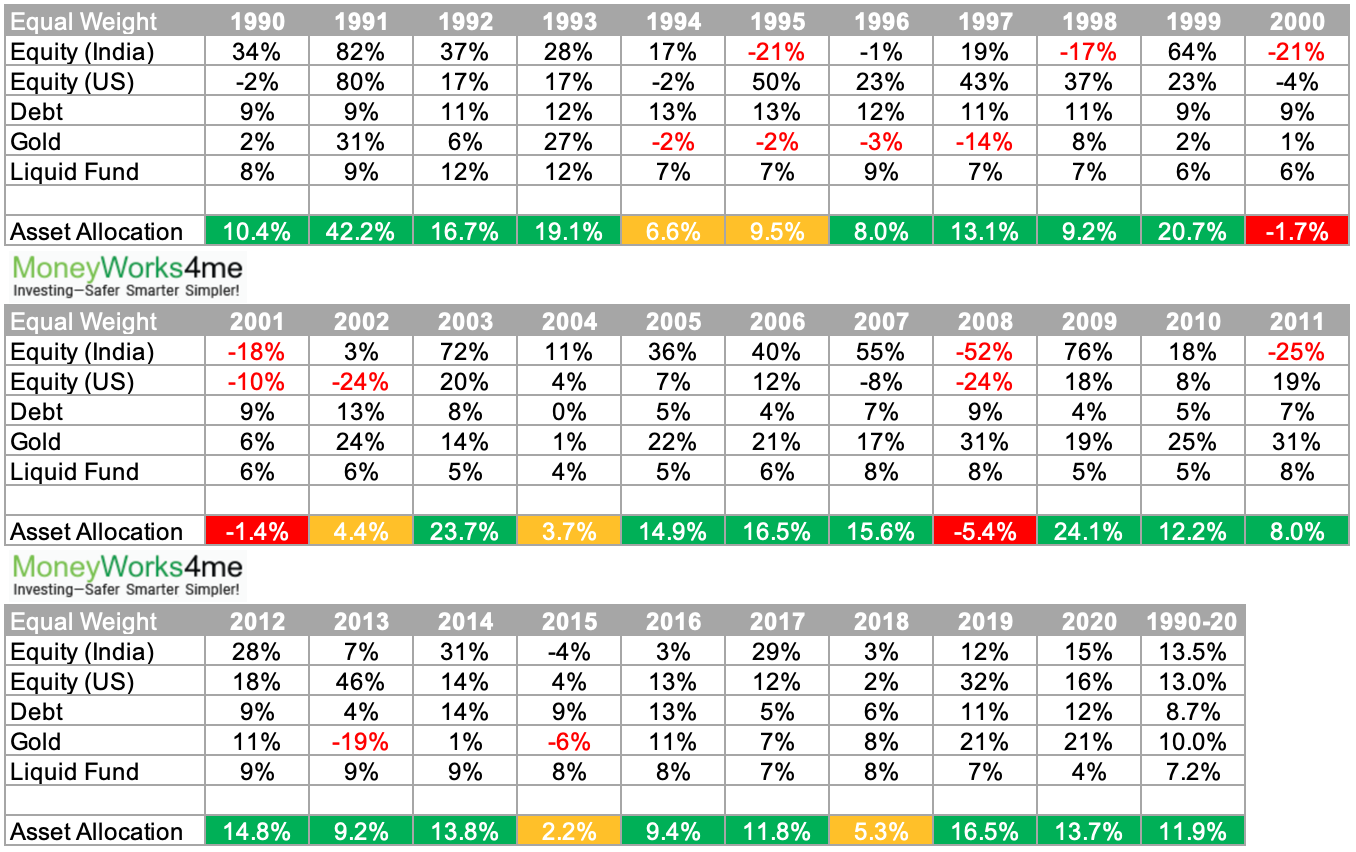

The Real Solution: Think in Terms of Asset Allocation

Instead of managing your anxiety by trading in and out of equities, view your wealth through the Asset Allocation lens.

Mental accounting bias makes investors focus on each stock or asset separately. This creates dissatisfaction when one investment underperforms. But when you view your portfolio as a whole, short-term dips lose their sting.

Let’s see why asset allocation works better:

- A diversified portfolio holding equity, debt, gold, and real estate rarely falls as sharply as any single asset class.

- Even during the 2008 crash, when Indian equities fell 50%, a diversified portfolio was down just ~5%.

- During March 2020, while Nifty fell 30%, an equal-weighted asset allocation portfolio dropped only 8%.

Result: Diversification cushions volatility and helps you stay invested long enough for compounding to work.

How Much Should You Allocate to Each Asset?

Investor Type | Equity | Debt/Fixed Income | Gold/Alternatives |

Aggressive (Young, High Risk Appetite) | 60–70% | 30–40% | Optional |

Moderate (Balanced Risk, 5+ Year Horizon) | 30–40% | 50–60% | Optional |

Rebalance annually — just once a year is enough to stay on track.

At MoneyWorks4Me, our Portfolio Advisory Service helps investors track all their assets in one place and maintain discipline through periodic rebalancing.

The Bottom Line

Market timing feels smart, but the data says otherwise.

- Timing strategies lag behind long-term portfolios.

- They increase costs and complexity.

- And they rarely deliver peace of mind.

Instead, focus on what truly matters:

sound asset allocation, disciplined investing, and long-term patience.

So the next time headlines scream “Market Crash Ahead!”, take a deep breath, log in to your dashboard, and look at your entire portfolio — not just your equity chart.

That’s where true investing maturity begins.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: