Time seems to fly by when we talk to people we are attracted to, or when we like doing something. And it also seems to slow down when we do something we find boring.

In investing as well, something similar holds true. Days of gain are pleasing and loss making days are painful.

![]()

Source: Yahoo Finance. Returns based on Nifty 50 Closing Price

It was identified by two Israeli psychologists, Daniel Kahneman and Amos Tversky. Studies conducted by above mentioned academicians suggest that psychologically, losses are twice as impactful as gains. This bias is called loss aversion.

So if you are used to watching stock prices daily, every alternate day would be a loss making one. This would bring upon more misery than thrill. On net net basis, you will always be unhappy watching stock prices everyday.

However, if you see annual returns, loss making periods are just 20%. Since they are twice more painful, they are still much lower than 80% of the time your portfolio would have returned profits. Isn’t it more rewarding psychologically?

We know how stress affects our decision making ability. Rational decision making is one of the key to success in investing. But if you are used to watching stock prices daily, there is a very high chance that you will influenced by stress of loss aversion.

You will be definitely better off not watching stock prices regularly. You may want to watch prices of stocks which you wish to buy in future but certainly avoid watching your own stocks.

This will help you make decisions rationally independent of the other or past decisions. Outcome of past decision, a short term quotational loss, won’t affect your new decision of buying another stock. This will not only reduce stress but also help you make right decision.

Rational investing means if a stock is cheap you have to buy. If it gets cheaper you buy more. But short term quotational loss may influence the rightful thinking of buying more. If you are out of money you have to keep holding. But under stress one may bail out of a stock in fear of losing more money. And from there exactly the stock would rally 50% in next few days.

We hope this article will save you from unproductive behaviour.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

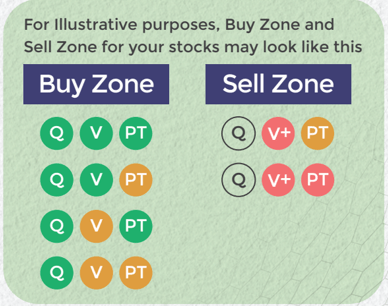

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: