Anyone who follows cricket understands that the most revealing number on the scoreboard is not the target, nor the overs remaining, it is the asking rate. As long as it stays reasonable, the batting side can play with discipline. Shot selection remains thoughtful. Risks are taken selectively. But once the asking rate climbs sharply, technique gives way to urgency. Even the best batters start forcing outcomes.

Long-term investing operates on a remarkably similar scoreboard.

There is a target, financial freedom. There is limited time. And then there is the asking rate: the amount you must invest every year to reach that goal within the time available.

Unlike cricket, however, there is no rain interruption, no revised target, and no last-over miracle. The asking rate in personal finance does not announce itself dramatically. It rises quietly, year after year, often unnoticed until it becomes uncomfortable.

Why Advisors Pay More Attention to Asking Rate Than Market Outlook and So Should You.

From a fiduciary advisor’s perspective, the asking rate explains more real-world outcomes than market predictions ever will.

Markets will fluctuate. Returns will vary. Economic narratives will change. But time moves in only one direction.

When time and compounding work together, the asking rate remains manageable. When time is lost, no amount of optimism, stock selection, or tactical activity can fully compensate for it. The only solution is to either bring the asking rate down to a more manageable level or revise your goals. This is why experienced advisers focus far more on getting investors to make the right allocation to equity - the higher return generating asset, asap without losing any more time, rather than discuss is it the right time to invest in the market.

Rs.10 Crore Goal: Same Destination, Very Different Chases

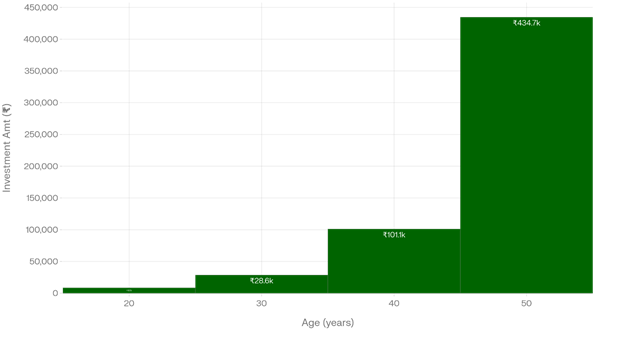

Consider a long-term retirement goal of Rs.10 crore, assuming a reasonable long-term return of 12% per annum.

AGE | Investment per month | Total Investment |

20 | 8,500 | 40,80,000 |

30 | 28,612 | 1,03,00,320 |

40 | 1,01,086 | 2,42,60,640 |

50 | 4,34,709 | 5,21,65,080 |

The goal does not change. Only the asking rate does.

The progression is not linear, it is exponential. Each decade of delay compresses the time available for compounding, forcing the investor to substitute time with capital. What could have been achieved through patience now demands intensity.

This is where many portfolios quietly break not because the investor lacked intent, but because the required behaviour becomes increasingly difficult to sustain.

It's not all over for Late starters - They are just playing a Harder game

It is important to acknowledge reality. Very few people can invest meaningfully in their early twenties. Careers take time to stabilize. Responsibilities grow. Life is uneven.

But the cost of delay is mathematical, not moral.

Losing ten years does not mean investing “a bit more” later. It fundamentally changes the nature of the plan. The asking rate moves from comfortable to demanding, from demanding to fragile. At higher asking rates, portfolios have far less room for error whether from market volatility, career disruptions, or health events.

Like cricket, effort alone does not reduce the asking rate. The scoreboard reflects only what has already happened.

STEP - UP

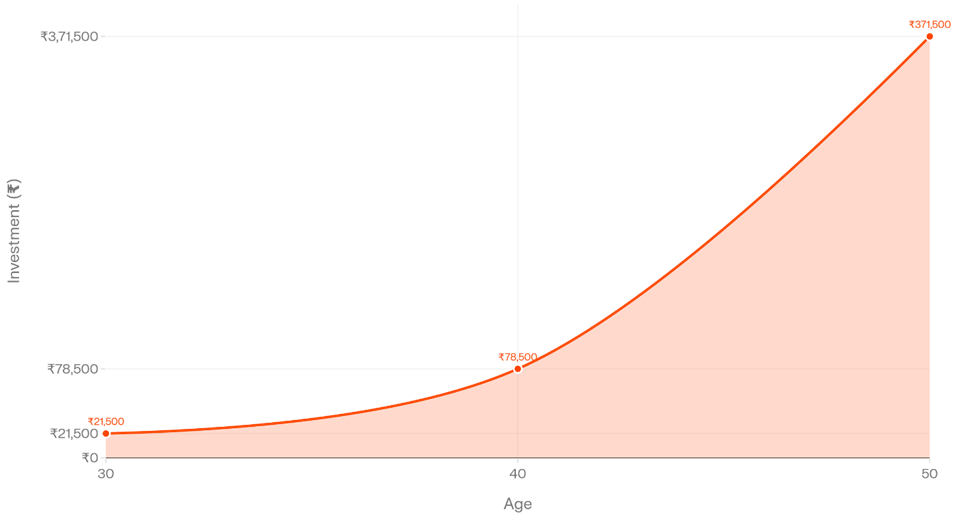

Assuming an expected return of 12%, let’s estimate the starting investment needed with an annual 5% Step-up to reach Rs.10 crore over the long term.

AGE | INVESTMENTS (5% STEP - UP) | SIP Investment for the last year | Total Investments

|

30 | 21,500 | 92,921 | 1,82,56,283 |

40 | 78,500 | 2,08,283 | 3,36,47,535 |

50 | 3,71,500 | 6,05,134 | 6,33,33,857 |

The Step-Up Approach allows investors to start with a manageable investment and gradually increase it over time, typically by 5% each year. This method is particularly valuable because it aligns with real-life earning patterns—salaries and income often rise over the years—so your investments grow as your capacity grows. By gradually stepping up contributions, the asking rate remains sustainable, avoiding the stress and urgency that come with trying to catch up after a late start.

The step-up approach does not eliminate the cost of starting late, but it makes the journey realistic. It replaces desperation with structure, and hope with process. Most importantly, it allows compounding to work alongside income growth, keeping financial freedom achievable without turning the plan into a test of endurance.

The Real Role of an Advisor

Over a long investing journey, there’s a hard truth most people realize only later: one wrong move can undo years of careful investing. The market doesn’t punish you for not being smart; it punishes decisions made under stress. Over the years, there will be plenty of surprises; political changes, policy shifts, global events, and they will keep coming. Each time, it’s easy to react emotionally, and if you make decisions on your own, the chance of a costly mistake quietly rises. One bad decision, one lapse in discipline, or trying to “fix” a short-term problem can set your progress back by years.

This is where perspective begins to matter more than prediction.

At Omega Portfolio Advisors, financial freedom is not framed as a race for extraordinary returns. It is approached as a process of keeping the asking rate realistic through disciplined asset allocation, sensible assumptions, and time-aware planning.

The most valuable input an adviser provides is not a stock idea, it is perspective. Perspective on what can be controlled, what cannot, and how behaviour interacts with mathematics over decades. Markets will test patience. Portfolios will go through uncomfortable phases. Plans will evolve. But one principle remains constant across cycles: time is the only asset that cannot be replenished later.

In both cricket and investing, the calmest chases are the ones where the asking rate never gets out of hand. Because no serious investor wants to reach the final phase of their financial life hoping for a miracle.

Written by

Rutuja Patil & Shaili Lele

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: