Heranba Industries IPO Details:

IPO Date: Feb 23rd to Feb 25th, 2021

Total Shares for subscription: ~90.15 lakh

IPO Size: ~Rs. 625 Cr

Lot Size: 23 shares

Price Band: Rs. 626-627/share

Recommendation: Avoid

Purpose of Heranba Industries IPO

- To meet business working capital requirements.

- To meet general corporate purposes.

- To meet public issue expenses.

About the Heranba Industries

Heranba Industries Ltd (HIL) is a crop protection chemical manufacturer, exporter, and marketing company based out of Vapi, Gujarat. Incorporated in 1992, Heranba Industries Limited is one of the leading domestic producers of synthetic pyrethroids like cypermethrin, deltamethrin, lambda-cyhalothrin, etc. The company manufactures different types of pesticides including insecticides, fungicides, herbicides, and other pest control products.

Heranba Industries operates in different verticals:-

- Domestic sales of Technicals to companies,

- Technicals exports,

- Domestic sales of Branded formulations under its own brand name,

- Export of Formulations in bulk and customer-specified packaging outside India

- Manufacturing and selling of general insect control chemicals by participating in public health tenders issued by governmental authorities and selling to pest management companies.

- Manufacturing and selling of insect control chemicals.

It has a strong network in the domestic as well as the overseas market. In India, it has 8,600 dealers across 16 states and 1 union territory whereas, in the overseas market, it exports its products to more than 60 countries through international distribution partners. The company exported its products in Latin America, CIS, Middle East, Africa, Asia, and South East Asia in FY20.

Management of Heranba Industries

Sadashiv K. Shetty and Raghuram K. Shetty are the company promoters. Both the promoters are first-generation entrepreneurs and have more than three decades of experience in the agrochemicals industry.

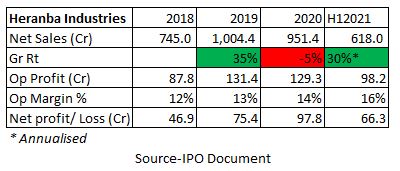

Financials of Heranba Industries

Strengths

- Range of product portfolio including Intermediates, Formulations, and Technical.

- Domestic as well as global reach

- Strong distribution network

- Large customer base

- Experienced promoters and management team

MoneyWorks4me Opinion

The agro-chemical industry has grown at an exponential pace, mainly due to India’s high dependence on Agriculture. India also has the advantage of being a low-cost manufacturing hub with technical competence and manpower availability for producing quality agrochemical products, leading to a substantial increase in exports over the past few years, majorly to the USA, Europe, and Africa.

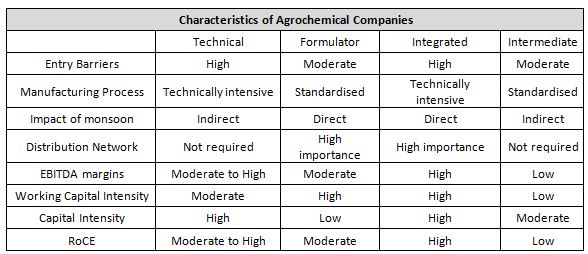

Indian players primarily comprise generic formulations manufacturers, while multinational agrochemicals players are focused on the development of new molecules, which culminate into the development of high-end specialty products. While the formulation business is not capital and technology-intensive, the players’ profitability depends on their ability to develop a strong brand and distribution network, which may entail significant time and costs and act as a key competitive strength. Technical and capital intensity is higher in the case of the production of technicals, which are higher value-added products.

Heranba is an integrated agrochemical player deriving 31% sales from domestic technical sales, 36% from Technicals exports, 13% from formulation exports, and 13% from branded formulations, and 6% from public health products.

Segment diversity will enable the company to better withstand segment-specific risks by shielding them from sharp revenue volatility pertaining to high dependence on the performance of any one segment. However, integrated players are also exposed to risks arising from demand slowdown or price correction in view of their higher fixed cost structure and greater reliance on operating leverage.

The industry is also heavily regulated, given the fact that PAC products can have adverse effects on the environment. Further, for the development of export markets, it may take several years to get requisite approvals from the respective countries’ regulatory authorities and market the products in those countries

Though the future potential is huge, we recommend AVOID due to high risks of execution, competition, and regulation that can lead to lower than expected performance.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 23rd Feb 2021 |

| IPO Close Date | 25th Feb 2021 |

| Basis of Allotment Finalisation Date | 2nd Mar 2021 |

| Refunds Initiation | 3rd Mar 2021 |

| A credit of Shares to Demat Account | 4th Mar 2021 |

| IPO Listing Date | 5th Mar 2021 |

| Date | QIB | NII | Retail | Total |

| Feb 23, 2021 05:00 | 0.00x | 0.09x | 1.65x | 0.84x |

| Feb 24, 2021 05:00 | 1.01x | 0.86x | 4.53x | 2.74x |

| Feb 25, 2021, 05:00 | 67.45x | 271.15x | 11.84x | 83.29x |

When will the Heranba industries IPO open?

Heranba industries IPO will open for subscription on Tuesday, February 23, and will close on Thursday, February 25.

What is the price band of Heranba Industries IPO?

The price band for Heranba industries IPO is Rs 626-627.

What is the lot size for Heranba Industries IPO?

Retail investors can subscribe to the IPO minimum lot size is 23 shares, upto a maximum of 13 lots i.e. Rs. 1, 87,473.

What is the issue size of Heranba Industries IPO?

The total issue size is 90 Lakh shares raising ~Rs. 625 Cr.

What is the quota reserved for retail investors in Heranba Industries IPO?

The quota for retail investors in Heranba industries IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on March 2 and refunds will be credited by March 3. Shares allotment will be credited in Demat accounts by March 4.

What is the listing date of Heranba Industries IPO?

The tentative listing of Heranba industries IPO is March 5.

Where could we check the Heranba industries IPO allotment?

One can check the subscription status on Kfin Technologies.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Batlivala & Karani Securities India Pvt Ltd & Emkay Global Financial Services Ltd.

What does Heranba Industries do?

Heranba Industries Ltd (HIL) is a crop protection chemical manufacturer, exporter, and marketing company based out of Vapi, Gujarat. Incorporated in 1992, Heranba Industries Limited is one of the leading domestic producers of synthetic pyrethroids like cypermethrin, deltamethrin, lambda-cyhalothrin, etc. The company manufactures different types of pesticides including insecticides, fungicides, herbicides, and other pest control products.

Who are the peers of Heranba Industries?

The peer group of companies such as Heranba industries comprises Rallis India Ltd, Sumitomo Chemical India Ltd, Bharat Rasayan Ltd, Punjab Chemicals, and Crop Protection Ltd.

Know more: Indian IPO Historic Data 2021

MoneyWorks4me Solutions:

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463