Metro Brands Limited IPO Details:

IPO Date: Dec 10th to Dec 14th 2021

Total Shares for subscription: ~2.7 Cr

Lot Size: 30 shares

Price Band: Rs. 485-500 / share

Issue Size: Rs. 1,368 Cr

Market Capitalization: ~Rs. 13,575 Cr

Recommendation: Avoid

Proceeds of the offer

- New stores opening – Rs. 225 Cr

- Offer for sale (existing shareholders selling their shares) – Rs. 1143 Cr

About the Metro Brands Limited

Metro Brands Limited (“Metro Brands”) was incorporated on January 19, 1977. Metro Brands is one of the premium footwear specialty retailers. From just one store Metro brand in Mumbai in 1955, it has evolved into a one-stop-shop for all footwear needs with 598 stores and 136 cities.

Metro Brands sells footwear under their own brands of Metro, Mochi, Walkway, Da Vinchi, and J. Fontini, as well as certain third-party brands such as Crocs, Skechers, Clarks, Florsheim, and Fitflop. Metro Brands also offers accessories such as belts, bags, socks, masks, and wallets, at their stores.

Own brands:

Third-party brands:

Metro primarily owns Multi Brand Outlets (“MBOs”) and Exclusive Brand Outlets (“EBOs”). They operate Metro, Mochi and Walkway branded MBOs and Crocs™ branded EBOs. It also operates shop-in-shops (“SIS”) in major departmental stores across India.

Metro Brands follows an asset-light model wherein 1) it outsources manufacturing 2) leases outs space on long-term agreements 3) uses advanced inventory management techniques to ensure high asset turnover.

Financials:

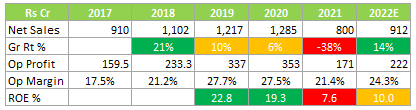

Metro Brands grew from Rs. 900 cr in FY2017 to Rs. 1300 Cr by FY2020. Sales dropped close to 40% due to Covid lockdown and recovered in the first 2 quarters of FY22.

The company clocks healthy margins thanks to private brands. It also earns a high return on equity due to i) asset-light business model ii) higher margins.

Management

Nissan Joseph is the Chief Executive Officer of the company. He has in the past worked with Payless Shoes Pty Ltd and Hickory Brands, Inc. He has also spent over 5 years in key roles in Crocs, where he also worked with the company. Prior to joining the company, he was associated with MAP Active & Planet Sports Inc. in the Philippines, a lifestyle retailer in Southeast Asia, where he was chief executive officer since March 2020. He has been appointed as the Chief Executive Officer on July 1, 2021.

Farah Malik Bhanji is the Managing Director on the Board. She has been associated with the company as a director since December 5, 2000. She has over 20 years of experience in the field of footwear retail. She is the promoter and held a 68% stake pre-IPO.

MoneyWorks4me Opinion

How is the business model? Good, bad, or gruesome?

Good. Retail can be a profitable business model especially if it is managed efficiently and operates in a niche. Asset light, cost consciousness bodes well for sustained profitability for retail business.

Metro Brands is into premium brands for aspirational Indians. It has an average ticket size of Rs 1000+ versus a mass average of 200-500 range. It has its own brands as well as third-party brands like Crocs. Private brands have high margins as the company has pricing power from spends on marketing and promotions.

The asset-light nature of business with outsourced manufacturing and leased-out stores ensures high profitability. However, high fixed costs like lease dent profits if volumes decline but since it is a growing industry, it is unlikely to cause high variability in earnings.

Metro Brands will benefit from an increase in disposable income and improving lifestyle. It can introduce new brands or open more stores of existing brands. The asset-light model can ensure faster scalability and higher return on equity.

Metro Brands reported Rs. 1300 Crore in FY20 and clocked an operating margin of 27%. We estimate that if sales were to go back to pre-covid levels, IPO has priced at ~52x P/E ratio.

We believe that this price assumes around 22% CAGR growth over the next 10 years. While such a growth rate is plausible but paying up for such high growth is fraught with risk.

We would recommend AVOID in IPO but can be added to the watchlist for opportunities in the future. Currently, IPOs even if oversubscribed are seeing selling pressure as liquidity is low. So we recommend avoiding IPOs even for listing gains.

| IPO Activity | Date |

| IPO Open Date | Dec 10, 2021 |

| IPO Close Date | Dec 14, 2021 |

| Basis of Allotment Date | Dec 17, 2021 |

| Refunds Initiation | Dec 20, 2021 |

| A credit of Shares to Demat Account | Dec 21, 2021 |

| IPO Listing Date | Dec 22, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 30 | ₹ 15,000 |

| Maximum | 13 | 390 | ₹ 195,000 |

| Date | QIB | NII | Retail | Total |

| Dec 10, 2021 | 0.00x | 0.02x | 0.52x | 0.27x |

| Dec 13, 2021 | 0.16x | 0.17x | 0.87x | 0.52x |

| Dec 14, 2021 | 8.49x | 3.02x | 1.13x | 3.64x |

When will the Metro Brands Ltd IPO open?

Metro Brands Ltd IPO will open for subscription on Friday, 10th Dec 2021, and closes on Tuesday, 14th Dec 2021.

What is the price band of Metro Brands Ltd IPO?

The price band for Metro Brands Ltd IPO is Rs. 485-500/share.

What is the lot size for Metro Brands Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 30 shares, up to a maximum of 13 lots i.e. Rs. 1,95,000/-.

What is the issue size of Metro Brands Ltd IPO?

The total issue size is ~ Rs. 1,368 Cr.

What is the quota reserved for retail investors in Metro Brands Ltd IPO?

The quota for retail investors in Metro Brands Ltd IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on December 17th and refunds will be initiated by December 20th. Shares allotment will be credited in Demat accounts by December 21st.

What is the listing date of Metro Brands Ltd IPO?

The tentative listing date of Metro Brands Ltd IPO is Wednesday, December 22nd.

Where could we check the Metro Brands Ltd IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

What does Metro Brands Ltd do?

Metro Brands is a footwear specialty retailer, in India. The company caters to the footwear needs of customers through a wide range of branded products for the entire family including men, women, unisex and kids, and different occasions. The company targets the mid and premium segments in the footwear market which have a higher presence of organized players and growth in the overall footwear industry.

Who are the peers of Metro Brands Ltd?

Listed company peers for Metro Brands Ltd are Relaxo, Bata India, and Mirza International. However, Metro Brands operates in higher ticket size footwear.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks and Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. You get all this for a price that can be as low as Rs. 4,999 under a limited period offer. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

How Model Portfolio can help you invest Successfully in Stocks?

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463