Technically speaking, the current situation in Greece is the second act of a tragic play that we are witnessing. In the first act, we witnessed the financial crisis of 2008 caused by the sub-prime mortgage crisis, leading to the climactic fall of Lehman Brothers and Bear Sterns. This act occurred in the realms of Financial Industry and spread to hurt real economy.

Technically speaking, the current situation in Greece is the second act of a tragic play that we are witnessing. In the first act, we witnessed the financial crisis of 2008 caused by the sub-prime mortgage crisis, leading to the climactic fall of Lehman Brothers and Bear Sterns. This act occurred in the realms of Financial Industry and spread to hurt real economy.

However, 2 years down the line and the second act follows – the world is once again staring at the face of another crisis. Unlike the first act however, this is now a crisis of faith in public policy rather than financial systems. The stakes don’t get bigger than this. If handled wrongly, it may impact the current global financial system, force unprecedented changes in the way the global financial systems work, lead to a global slowdown and strengthen the recessionary forces in the developed world.

And it all started at one of the most scenic places on the globe – the Eurozone, specifically in Greece. Soon, it spread rapidly to other countries – Portugal, Italy and Spain (together called PIGS). The story has been same everywhere. Governments funded their fiscal deficits created by spending more than they earn by issuing bonds (purchased by banks of other countries) and borrowing money. However, slowly things have gotten out of control leading to a situation where these countries do not have enough money to repay their debt and could default. This could lead to a cascading effect with gradually the entire global economy being affected.

What has made the situation serious is that people turned a blind eye to this when the going was good, but as the crisis escalated investors became concerned of investing in riskier assets. Bonds issued by these governments were now considered risky investments. It did not help that European leaders first ignored the market reaction, then rallied against it, only to eventually accept the grim reality that the problems are real. These countries may face problems in raising new debt. And some of them may even default leading to problems in some of the major European Banks. The scene is strange, even ironical and humorous in a dark way. These very countries had accused Asian countries of fiscal irresponsibility in mid-1990’s; today they have succumbed to the very same evil.

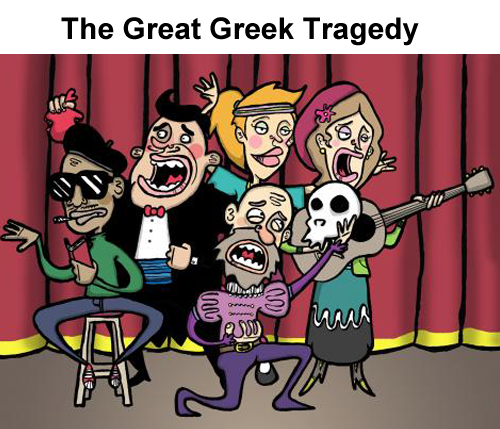

The stage is set; the audience is on the edge of their seats. All eyes are on the ‘actors’ and how they will handle the situation. Let’s then have a look at these ‘actors’ and their predicaments as they struggle to achieve a ‘happily-ever-after’ ending to this story. Here’s the main cast

George Papandreou, Greek PM: Greece continues to be in a very precarious situation. Debt as % of GDP is at stratospheric levels. The Greek Prime Minister’s austerity plan it was hoped would be sufficient to pacify the Investors and bring Greece back from the brink of the crisis. But this does not seem to have worked. The Prime Minister today has an unenviable job – to reduce fiscal deficit, raise taxes and perhaps preside over Greece exit from Euro.

Angela Merkel, Chancellor Germany: The coming days would define Angela Merkel as either a European Leader or a German Chancellor. Germany is the strongest economy in the European Union and any plan to bail out PIGS (Portugal, Italy, Greece and Spain) would involve active participation of Germany. On the 29th September, the German Chancellor won the needed votes in Bundestag to pass a legislation to expand the European Financial Stability Facility to €440 billion ($593 billion) from €250 billion. But the Chancellor has been stung by a series of party losses in local elections this year and faces fierce resistance in Germany for her handling of the euro-zone crisis. Merkel’s continued willingness to back bailouts for other euro-zone governments has cost her dearly in opinion polls. It has also brought bitter losses in recent regional elections as German taxpayers worrying why they have to pay for their neighbours mistakes!

Barack Obama, President of USA: The US President’s presidency has been marked with lots of lost opportunities. His latest call to jump push start the US economy by taxing the rich to put more money in the pocket of the middle class to generate demand looks great on the paper, but as they say the devil is in the details. The President’s speech has focussed less on specifics and more on generalities. While giving an estimation of a $400 billion program, he left out details that put a question on the number itself. Can this program push start the US economy? Only time will tell.

Ben Bernanke Governor US Federal Bank: In early 1990’s some analysts believed, the Governor of US FED, was the most powerful man on earth after US President. It’s increasingly becoming clear that the Goliath has lost its way and his action looks more clueless than ever before. QE 1 and QE2 (monetary policy adopted by the Fed in which it bought financial assets to inject a pre-determined amount of money in the market to fuel growth) helped in allowing money to flow once again. But it has failed seriously in reviving the US economy. US consumer demand has been a driver of growth over last decade. QE1 and QE2 made commodities rise because of excess liquidity but did little to stoke US consumer demand. ‘Operation Twist’ which some believe is just another form of Quantitative Easing and hence are calling it QE3, is the latest arsenal the Governor has put to use. Unlike QE1 and QE2, QE3 won’t raise asset prices much but it will make buying a Home and Vehicle cheaper as long-term interest rates will decrease due to fall in yield of long-term loans.

Nikolas Sarkozy, French President: European Union was predominantly a French idea. Sarkozy though, would be one of those unfortunate leader on whom perhaps fate has forced a political misfortune. He may be forced to make France realise that perhaps EURO club itself may be at risk, that Euro itself was not perhaps that good an idea.

Christine Lagarde, IMF head: IMF has a chequered history in helping countries in the time of distress. Its actions during Asian Currency crisis in middle of 1990’s, makes one wonder if it will be successful this time.

The actions these leaders take over next few week will define how Global Economy behave over next few years.

Most analysts expect the European Financial Stability Facility fund to rise to about €1 trillion to be effective. It remains to be seen if the German Chancellor still has political capital to help expand the fund to such large size without risking her political standing. It would be interesting to see how many votes she can garner from her coalition in the next round.

Apart from the main cast, there is also a supporting cast who have their own role to play and have a chance to rise and write the Economic history of the world.

Chinese Leadership: If China expects that World treat it as a first rate power it will have to rise to assume leadership and support the increasingly disturbing Global Economic scenario. It must realise that, of all the developing countries its export oriented economy is one that would get hurt the most if this crisis escalates.

Indian Leadership: The Indian political leadership has to at least listen to RBI policy statements. In a crisis situation you do not antagonize investors; you make rules and policies that make your country an investment destination. For too long the Indian leadership has parroted “India is a long term growth story”, “India is a domestic demand story”. When the world lives by days and weeks, it’s time for action.

If Greece defaults, fear will grip financial markets; capital markets will see turmoil. Countries like India will find it increasingly difficult to finance large infrastructure plans needed to sustain 9%+ GDP growth rate.

If Barack Obama and Ben Bernanke fails in getting the US economy moving, generating consumer demand and decreasing unemployment, then the US President’s job may be on the line. Not only this, it will risk US economic supremacy and would put brakes on Global Economy for some time to come.

Failure of any one of these leaders will seriously impact trade, capital market flows, commodity prices and global economy. Perhaps, time has come for a second Bretton Woods like conference to sort out the crisis in Global Economy.

There is an old Chinese curse “May you live in interesting times.”

And we live in interesting times.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

Image Credit: Graham Fox, toonpool.com

The first Bretton Woods Conference gave birth to The World Bank, which has proved disastrous for the developing nations

The first Bretton Woods Conference gave birth to The World Bank, which has proved disastrous for the developing nations