When Charlie Munger and I buy stocks – which we think of as small portions of businesses – our analysis is very similar to that which we use in buying entire businesses. – Warren Buffett

When you buy stock you are buying a piece of a business; that seems obvious. But it is not often the way people think about investing. Elections, nuclear attack, tariff wars, etc will keep influencing investors’ decisions.

Every year there will be some or the other reason “for not owning stocks”. We have also seen people forever worrying about stock market all the time while market steadily climbed year after year for decades.

A businessman doesn’t shut down his business because elections are around the corner. Then why should we give up on stocks?

Deep in our mind, we have to accept that when we buy a stock we own a share of a business. We have to trust a good management to use their expertise to steer the business forward. Couple of short term traders do not decide fortunes of a business, its management/staff do. Hence, we insist buying companies with good track record, so that we have no reason to worry about stock price movement.

Even the best of the stocks can experience several +/- 30% movements in a year. Despite knowing Warren Buffett’s investment acumen, Berkshire Hathaway’s stock has got cut into half (-50%) thrice in last 50 years. Just because a stock collapses 50% doesn’t mean the business got cut into half. We write analyst notes to share with you core advantages of a business. This will help you understand why the business would sail through various headwinds in the future. Good businesses are to be bought and held. Unless you hold on to your stocks, you will not be able to make good returns.

Crude Oil affects paints, auto. Trade wars may affect metals. Currency depreciation will affect only importers. Rising interest rates will affect Infra companies/real estate. If you worry about all of the above, there is hardly any business left to invest. But reality is, most of these pains are temporary. Secondly, they may not occur at all or may not occur all at once.

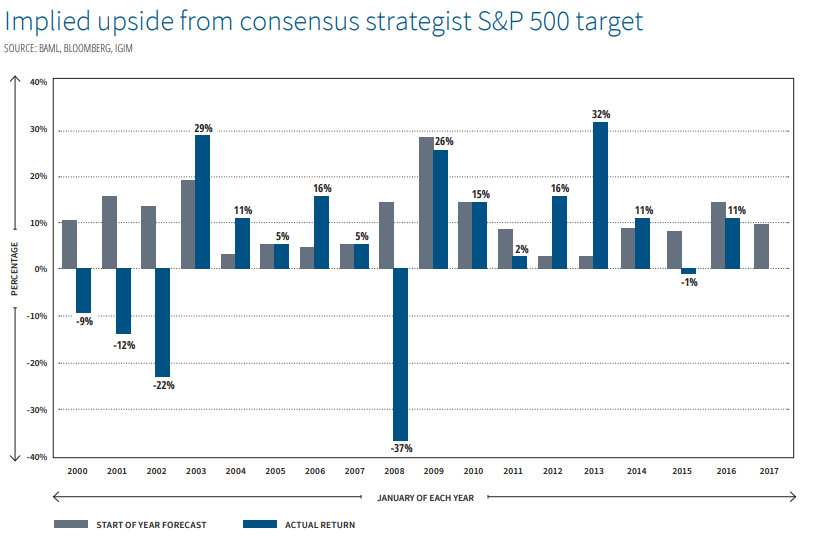

Every expert tends to share his forecast every year but no forecast can be right always. If one had got it right regularly, he would have got very very rich by now. Just 4 out of 17 instances experts have got it right.

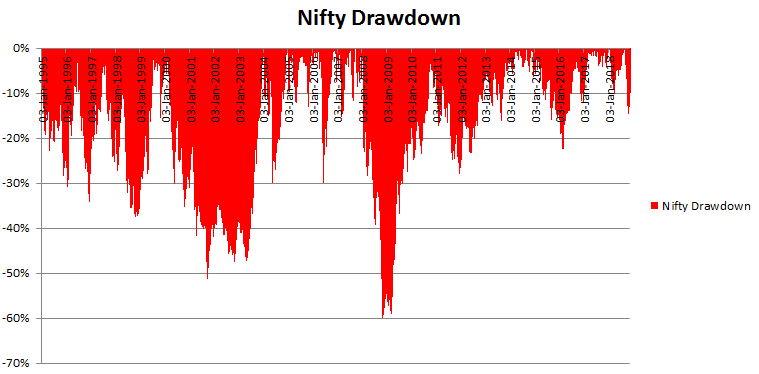

Besides, there will always be correction on the horizon. If you look at Nifty drawdowns, there are several falls of more than 20% in any year. But despite this Nifty Returns have been 13% CAGR over 20 year period. So worrying for market falls would lead missing out an opportunity to make even Nifty return of 13% CAGR which is also good over long term.

We do wait for our favourite stocks to come to our buy price but we won’t wait another day because ‘we could get it cheaper due to news flow’. So even if some expert tells us that markets could correct, there are very low chances to get it right. It may worry a short term trader but as long term investors we have always bought stocks when we found them cheap. And we will continue to do so. It has made us very good money without predicting market movements.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

I liked the title of the blog as we are thinking about it right now. I wanted to raise a query regarding he point mentioned above that if you find the stock cheap, you should buy it irrespective of the experts saying the market correction possibility. Here, the worry is not the value of the share but an investor thinks that if the share falls below their expectation and valuation then why not take an advantage of it. But this creates a conflict of interest and also might create a confusion.

One can definitely take advantage of such an opportunity but we have to decide what portion of the portfolio one keeps on the sidelines. A small portion of portfolio say 10-15% can be kept aside for taking advantage but bulk of it must be invested as soon as we see upside of our desired returns like 12-14% CAGR.

This blog (https://www.moneyworks4me.com/investmentshastra/analyst-corner/is-there-a-right-time-to-invest-in-equity/) will address that buying the bottom is not something that would generate materially higher return.. Definitely we also like stocks super cheap but our goal is not to be perfect but largely right. As far as our portfolio gives good risk adjusted returns, we are happy. Because we can’t keep waiting for correction and losing time value of money.