This article covers the following:

Review

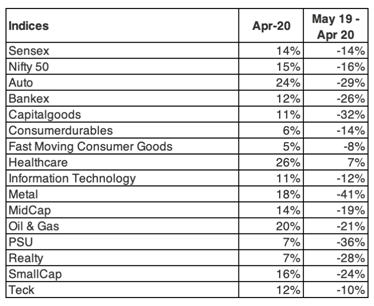

On April 30, Nifty was closed 15% lower than 1 year ago. In the last 3 years, Nifty is down 7% translating into -2% CAGR.

Except for Pharma & Healthcare, no other sector gave positive returns over the last 1 year.

Nifty has bounced back 22% from its lows as aggressively selling abated. The reason for a hold on FII selling may be caused by the announcement of Fiscal stimulus by the US government and quantitative easing from the central bank across the world.

FII sold Rs. 6884 Cr worth of shares in Apr’20 versus Rs. 61973 Cr in Mar’20.

The eight core sector industries contracted 6.5% in March 2020 compared to 7.1 % growth in February 2020. The output of crude oil, natural gas, refinery products, fertilisers, steel, cement and electricity contracted 5.5%, 15.2%, 0.5%, 11.9%, 13%, 24.7% and 7.2%, respectively.

Retail inflation, based on Consumer Price Index (CPI) fell for the second consecutive month to 5.9% in March 2020, from 6.6% in February 2020.

Equity inflows from domestic investors were quite high in the last 3-4 years which means that an average investor’s portfolio hasn’t earned good returns from equity for a long time.

The very risk in equity investing is that returns don’t come in a predictable fashion.

he overall sentiment is low in the consumer market and stock market. The economic impact of lockdown is worrying policymakers and businessmen.

In the previous month, lockdown in the entire country will cause a drop in profits for many businesses in the current year. We expect to see normalized profits next year.

Outlook

As on date, the average upside of our coverage universe is likely to be more than 13% CAGR over the next 3 years.

Just a handful of companies will be delivering earning growth due to existing slowdown and further lockdown to contain Covid-19 spread.

Some pockets of the market like consumer staples and insurance/AMCs are trading at stretched valuation.

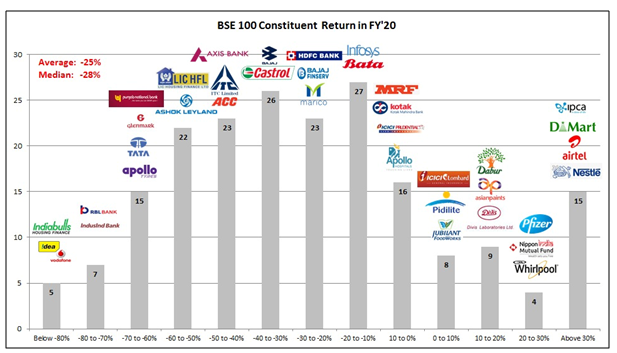

All the gainers of the last financial year are either consumer or pharmaceutical stocks.

We find that Nifty 50 now trades around its fair value while there are pockets of overvaluation and undervaluation.

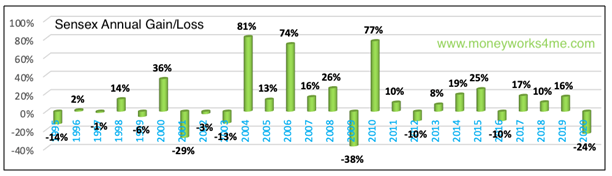

Unlike 2008, we are coming off already somber business performance. Due to current lockdown, anything into the future looks hazy but once we see stability, we can expect a lot of improvement in business and valuation.

We are looking at companies that have good earning triggers over the next 2 years as we are not certain whether broad-based recovery will happen immediately. We are investing in companies i) coming out of sector consolidation, or ii) introducing new products, or iii) commissioning new capacities or iv) executing the order in hand. This gives some certainty as to why there will be growth when things go back to normal post lockdown.

An investor can consider investing in value and high dividend yield stocks like capital goods, high-quality PSUs, private sector corporate banks, pharmaceuticals, and select NBFCs. We are actively tracking agro-chemicals. Not only the domestic growth but also export opportunity looks quite exciting to select agro chemicals stocks. Now as more sectors are correcting, we will recommend it as they reach our desired price.

We are avoiding sectors or stocks that may have become cheap but they have high debt or they operate in highly cyclical sectors.

Our reasonable exposure to pharma stocks, high dividend yield stocks, and liquid funds have helped to restrict drawdown lower than the market. Use our portfolio manager to account for dividends/stock splits and computing portfolio returns.

In every correction, we always kept buying until we were fully invested. This time we find most sectors will be affected, if not business strength wise but from growth prospects over the medium term. Hence we are buying less aggressively. We would advise retaining a small cash position. This will help us to accumulate stocks that have already started showing signs of recovery, they might be existing ones or a new set of stocks.

Sector update

We are writing our view of various sectors as we are receiving queries regarding them:

Banking:

Near term, headwinds are from NPA issues. We believe that these NPAs are unlike those we have seen in 2016. For some top banks, our areas of interest, current NPA are likely to be more granular and secured by an asset. Besides, the current prices are already reflecting quite a lot of pain. The good thing about banking is that future of the top 3-5 players is very bright. They will have a dominant market share, low-cost funds for lending, and huge cost efficiencies. We suggest building positions in these stocks as they trade at attractive levels but we would wait before getting aggressive. Other tactical positions to be taken based on a unique business model and a more resilient balance sheet on liabilities as well as the asset side. (Liabilities – Good reputation to raise funds; Assets – Secured assets with regular cash flows)

Insurance: Life:

In life insurance we see growth coming from new term life insurance due to the recency effect of the Covid-19 virus. But insurance companies already trade at valuations that suggest that there is no margin of safety if expected growth doesn’t materialize. Besides the risks are not yet factored from the falling interest rates in the debt market or exit from ULIPs due to poor equity returns. General: We only favor one listed player who has a large portion of auto insurance which is not seeing any material growth. Its core operations of underwriting are still not profitable. Valuation, however, doesn’t factor any negatives at current prices.

IT services:

IT Services are relatively more resilient business models. Stocks may have corrected but we do not find any material change happening in overall revenue pie. As the industry has matured, the growth rates had come down even before Covid-19. Without growth, the chances of making reasonable returns go down. We will recommend only a selective approach with 1-2 stocks with a better near term future from company-specific advantages.

FMCG:

FMCG sector has now reached exhaustion, the large players also have disappointed with growth numbers. We find that currently, the prospects are not very supportive of sustaining high valuation. We do not expect high growth potential in FMCG names. A few of them have the robust rollout of new products but the rest of them simply had a good run in profit growth from cost-cutting or price increases. Currently, stock prices are quite firm due to the defensive stance taken by market participants but we believe that investing in equity just to avoid downside volatility will lead to lower upside potential.

Consumer discretionary:

We may not see very high growth in consumer discretionary immediately. Towards the festivals, it may happen that they will start reporting growth from pent up demand i.e. pending purchases come bunched together. White goods and autos are some products in the discretionary sector.

Autos:

Autos form part of Cons Discretionary but since it’s a large sector we have covered it separately. Auto stocks have fallen a lot in the last 2 years and their downcycle has been the worst so far. We find that all OEMs are quite resilient in terms of balance sheet strength. But we find challenging for them to grow over the next 2 years. There could be recency effect from Covid-19 for people to buy cars, 2 wheelers but at the same time, individual income and liquidity from banks and NBFCs to fund the purchases may come down. We do find the sector attractive but we await triggers for investing aggressively. We recommend putting a small position at attractive prices, later increase allocation as we start seeing improvement. Prefer two-wheelers over four-wheelers over commercial vehicles.

Pharmaceuticals:

Pharma has been a dark horse that has come back in action due to the defensive stance of the market. We find a few names do have improving ROE, rising sales, etc. But many pharma stocks do not have very high growth for large upside from current levels. We recommend focusing on large to mid-size pharmaceutical companies.

Chemicals & Agri:

Chemical companies with export orders are doing quite well. They have good cash flow growth in the last 3 years as they added capacities in recent years. Growth can’t come without investment in new capacities. Quite a lot of growth from new capacities is also being factored in many stocks. We do not find merit in buying chemical companies at FMCG type valuation ~20-30x EPS.

Agro Chemicals:

Agri sector has done poorly in the last few years due to poor monsoon, poor harvest, low rural income, etc. We see that recent growth has been quite good due to better water levels and better yield this year. We will be watching this sector closely to see if we can participate in sustainable growth.

Telecom:

Telecom is coming out of consolidation. We have found that any industry coming out of consolidation tends to gain back pricing power, starts reducing debt, and experiences rising ROE. We remain positive on this sector.

Power:

The power sector has overcapacity in the last decade. The power offtake was low due to no purchase agreement signed by states. We expect government reforms to get power assets getting resolved. This can lead to improving capacity utilization and improve ROE. It has still not delivered but we remain positive on the sector.

Cement & Construction:

There are short term worries over the release of funds and new orders. The construction work has to start albeit at a slow pace due to lack of labor. Cement and ancillary companies to Infra can perform well in pockets where the demand is good from low penetration. It is very difficult to do pick stocks in this sector, very few exhibit fundamental characteristics for long term compounding.

Metals:

Metals tend to have a lot of variables. On one hand, their demand in the domestic market determines capacity utilization. On the other hand, global prices decide their pricing which could be volatile due to global slowdown. However, if slowdown brings down prices many high-cost metal companies can go bankrupt worldwide. This can bring back pricing to a stable level or at least a moderate level for Indians players to benefit. We are neutral on metals.

Risks

CoronaVirus – Global

As on date, total infected cases have reached 4,181,300 and 283,878 deaths from CoronaVirus. A lot of countries are seeing plateauing of new cases and they are slowly reopening their economies.

China is seeing business activities pick up gradually up to 80% while businesses in the US/Europe/India are still affected due to the extension of lockdown.

With public awareness and government’s precautionary measures in immigration and quarantine of infected patients and the most recent lockdown, we believe the spread will be contained. The timeline of the same remains an uncertain factor.

China and South Korea have already seen a steep fall in new cases due to self-quarantine measures. Now Italy and Spain are seeing plateauing in new cases while the US has seen a significant fall in new cases.

Financial Market contagion

Worldwide the central banks are taking measures to ensure better liquidity in the system and reducing the interest rates to soften the blow from a slowdown in business activities.

It is to be seen whether this will actually result in desired effects or will it further scare the markets. Banks and investors are shying away from making risky investments into corporate bonds, etc.

US markets have become very risk-averse as investors are selling stocks and moving the funds to bonds. 10 Y bond yield less than 0.5% p.a. and 2 Y yield is below 0%.

The US has had 10 years of economic expansion. A recession won’t be a surprise but its implication on the prices of the assets is rather sudden and across the board.

Even if the US does face slowdown most of the exports that happen from India lead to cost-saving for US businesses and citizens (ex. IT and Pharma). So in a way, this trade won’t be cut during a slow-growth period in the US. This makes us confident that India’s future prospects won’t be hit adversely from a recession in the US.

Indian Economy

Indian economy will be impacted by extended lockdown as many labor-intensive sectors are not operational. There is a risk of sustained job losses and salary cuts.

We find that lot of sectors in India were running at lower utilization. The current dip in demand will come back strongly as soon as the economy resumes due to pent up demand.

Post that, the growth will take its course depending on consumer sentiment, government stimulus, and reforms. We expect certain sectors to come back to life immediately while others take longer. Economists and corporate expect/demand fiscal stimulus of ~1-3% of GDP to get back the economy on its feet.

While every sector operates in the same economy, the effects of Covid-19 would affect them differently depending on the change in consumer behavior.

Beyond a point forecasting, macroeconomics is tough. We remain optimistic that the pandemic will affect only near term economic parameters but it won’t dampen demographics of the country nor can it stop the long term momentum in GDP growth and rising consumerism.

What are the consequences of the Covid-19 crisis for equity investors?

Risk of low returns:

Equity gives long term returns in the range of 7%-20% CAGR. We might be in one phase of 7% CAGR. We discard this possibility as we are right now at a very cheap valuation versus its historical average. As markets recover to fair price multiples, the returns would look better.

Risk of volatility:

We have already identified a certain portion of savings to be invested in equity. This was done exactly for such kind of volatility.

We have already taken care of the risk of volatility by committing only a portion of Equity. The rest of the savings are in Gold, Real Estate, and Fixed income.

So getting afraid to add more funds is ‘double accounting’ for the same risk which has been taken care of.

The correct way to look at return is on aggregate including all your assets. This helps not getting carried away in a good market nor worry too much during a market correction.

Risk of delayed recovery:

We always say that only surplus funds, not needed for more than 5 years must be parked into equities. Even if recovery is at a later date, we don’t have to worry about delayed returns in equity.

Equity returns often come in an unpredictable manner and they can be very steep on either side. But they trend upwards as India’s economy keeps growing.

Risk from business:

Whatever the calamity, not all businesses get affected. Even a storm can’t destroy every house in a town. Stronger ones remain steady. The same applies while a building a portfolio in equity.

A stock can lose significant value but a portfolio of stocks doesn’t crumble altogether. Let those loser lose and winners recover.

As far as you keep checking your overall returns rather than individual stock, you will sail through the fears and come out strongly.

This is not the time to panic or putting a hold on fresh investments. You must keep buying, albeit slowly as prices come off.

Where do we go from here?

Overall markets may remain subdued until the time earnings growth kick in. But this doesn’t mean individual stocks won’t rise.

We expect superior returns from stock picking as average stock today is trading cheaper than Nifty itself.

Near term uncertainty in structural growth, story spells an opportunity for long term investors. Stocks are beaten down from fear of short term slowdown and the cuts are much more than actual impact on business.

We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. We leave this field open for speculators, fear mongers, and punters.

We have often seen that after such a sudden fall, the rebound could be equally sharp whenever it happens. We recommend to stay put and not worry about looking at prices.

We are managing only long term money and predicting near term events is futile.

We continue to recommend Gold Fund/Gold (up to 5-10% of the portfolio) as a hedge from contagion risks and some allocation to safe liquid funds/Fixed Deposits (10-20%) within in equity portfolio for capturing new opportunities.

Act on our calls and restrict your allocation to 3-5% in each stock. And not more than 25% in each mutual fund. This will keep you at peace, and not significantly dent your portfolio performance.

Beyond this, tinkering asset allocation will only reduce long term returns thereby missing one’s target corpus. We have diversified our stocks portfolio, we have diversified assets and we have long term horizon. Together this takes care of all potential risks in investing.

Happy Investing!

MoneyWorks4me Outlook:

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463