Motilal Oswal S&P 500 Fund NFO Details:

Name: Motilal Oswal S&P 500 Fund

Benchmark: S&P 500 (US)

Fund Manager: Herin Visaria & Abhiroop Mukherjee

Minimum application: Rs. 500 and multiples of Re. 1

Exit Load: 1% within 3 months; NIL thereafter

Option: Growth Option only

Expense Ratio: Regular Plan 1% ; Direct Plan 0.5%

Currency Hedging: No hedge, INR depreciation adds to return

Indian investors now have one more avenue to invest in U.S. stock markets. Motilal Oswal AMC has launched the S&P 500 Index Fund and its NFO is open for subscription between April 15 and 23. 2020.

About the Motilal Oswal S&P 500 Fund

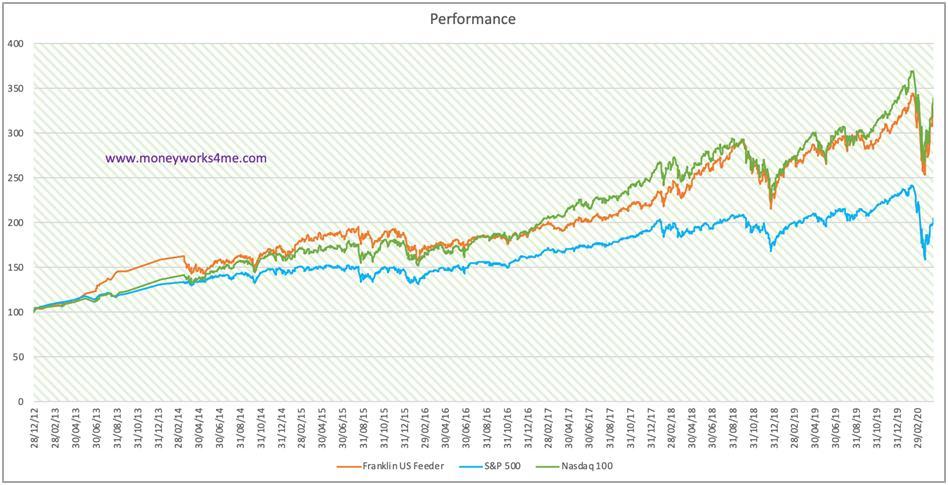

Index funds invest in prominent stocks based on size and liquidity. Although there are mutual funds that invest in US and global markets, Motilal Oswal S&P 500 Index Fund is a plain vanilla diversified index fund versus other feeder funds with active management or its own offering Nasdaq 100 that has a concentration in Technology stocks.

Portfolio characteristics

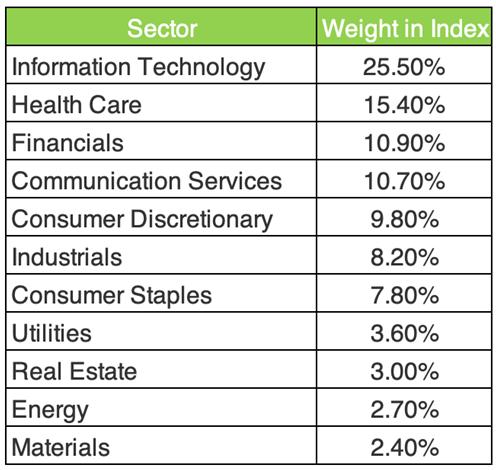

As the name implies, S&P 500 has 500 stocks and it is quite diversified with 25% in Information Technology, 15% in Health Care and ~10% each in Financials, Communication Services & Consumer Discretionary.  Diversification also comes from having low weight to each stock in the index and Top 10 stocks forming just 26.5% unlike Indian indices with 60% in Top 10 stocks.

Diversification also comes from having low weight to each stock in the index and Top 10 stocks forming just 26.5% unlike Indian indices with 60% in Top 10 stocks.

MoneyWorks4me Opinion

We believe in diversification outside the country and especially developed markets. These markets tend to have a better business environment, more innovation, and governance.

We also find that developed nations have more efficient markets, it is an easy call to stick with Index Funds which replicate market return.

Even if the growth rates of that economy is low, the volatility is also relatively low.

Till the time India remains a developing nation, it will have more inflation and also a net importer of capital. This will lead to Indian Rupee depreciating versus the US dollar. This further adds to the overall return.

Valuation

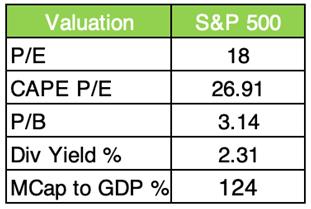

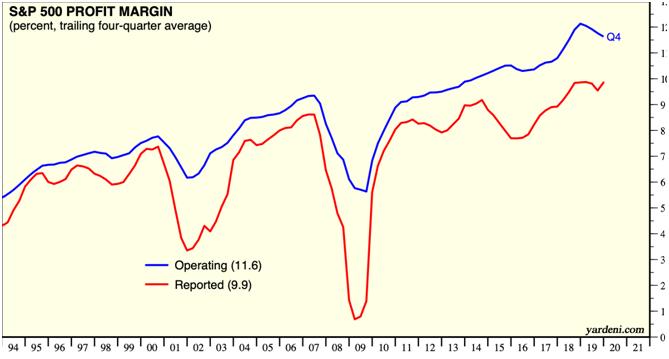

Although the P/E ratio doesn’t look very steep, CAPE P/E ratio looks high as current profit margins are lifetime high. CAPE P/E normalizes the cyclical component of the market. Based on an average profit margin, the S&P 500 appears to be at elevated valuation.

Also, if we consider Market Cap to GDP %, it trades at 124%. In the past, it has traded below 100%.

Also, if we consider Market Cap to GDP %, it trades at 124%. In the past, it has traded below 100%.

Besides, the risk of a sharp correction in earnings from the COVID-19 led slowdown will bring down profits and growth rates of the companies. This turns risk-reward unfavorable at this juncture.

Based above parameters, we do not find merit in investing Lumpsum in US markets, we wait for valuation comfort.

Those who do not have any allocation to the US market may use the SIP route to invest in Motilal Oswal S&P 500 fund – Direct Plan or Nasdaq 100 Fund. Keep the SIP amount lower for now. Later increase it when valuation turns reasonable.

In our opinion, Nasdaq 100 Index offers better diversification versus Indian stocks as it contains a lot of new-age companies with growth characteristics. This is also evident by the performance of the Nasdaq index versus the S&P 500.

The Indian market also offers exposure to other sectors that are part of the S&P 500 but Nasdaq has unique sectors and business models.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463