Investors are always in the search of hot tips, especially when most of them come with a guarantee of becoming the next goldmines. Lets take an example: You’ve just decided to invest in stocks and your well-meaning friend gives you a tip. Having set aside some money you invest in it. Soon its stock price tanks and you lose a chunk of your hard-earned cash.

Many investors have burned their fingers in a similar manner, searching for good stocks to invest in. All this stems from the lack of a strong starting point that can help investors reach a shortlist of sound investment-worthy companies available at an attractive price.

Investors are always in search of companies worth investing in; companies that can give them good returns yet minimize their risk at the same time. But finding such stocks can be cumbersome without any filtering criteria.

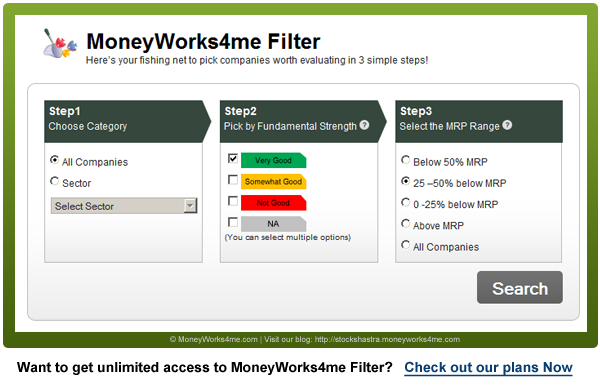

To address this problem, MoneyWorks4me.com has launched a simple and unique Stock Picking Tool – MoneyWorks4me Filter. With this you can identify investment-worthy stocks available at fire-sale prices, at the click of a mouse.

So, how does the MoneyWorks4me Filter help you invest in the best stocks safely?

The MoneyWorks4me Filter helps you arrive at a shortlist of stocks using a filtering criterion that allows you to identify companies/stocks from the whole universe of stocks. It helps you identify the strong and best stocks from this list and weed out the weaker ones in a few seconds.

As investors we are always searching for stocks that will minimize our risk as well assure good returns. For this you should always look for stocks that are fundamentally strong and undervalued at the same time. The MoneyWorks4me Filter helps you do just the same by short-listing safe stocks based on 2 main criterion i.e. their Fundamental Strength (Green, Orange or Red) and on their Price Attractiveness (Current Price vs. MRP).

a) Select a fundamentally strong stock:

While short listing a company it is always important to find a company that has had an excellent financial track record over the last 10 years. Such a company will most likely have a moat/ a competitive advantage that has helped to be a winner in tough times too. While a past performance is not a guarantee of a similar future, it does give us enough clues for the future.

MoneyWorks4me assesses the fundamental strength of a company by analyzing its 10 YEAR X-RAY i.e. financial track record and then assigns a color code to the company’s financial track record –

- Green (Very Good) if it has had an excellent financial track record

- Orange (‘Somewhat Good’) if there have been just a few bad performances over the years

- Red (Not Good)

It is advisable that investors screen on the basis of Green and only if you are willing to take on more risk, then you can go ahead and screen on the basis of Orange. Selecting ‘Red’ companies as a filter is not advisable as these are the companies that have had a dismal performance over the years and hence can be very risky.

b) Next, the stock should be attractively priced:

In order to get returns, you have to make sure that you buy the stock when it is undervalued. After you have filtered companies on the basis of a color code for their fundamental strength, now further screen them on the basis of their valuation i.e. if they are overvalued or undervalued. MoneyWorks4me calculates the right value (MRP) of a company, which helps assess whether the company is overvalued or undervalued.

Thus, this tool helps you identify fundamentally strong stocks that are undervalued, hence worth investing in. At the same time it also helps you screen stocks which are overvalued and that can be considered for selling.

c) Compare after filtering:

Once you have completed the process of narrowing down on stocks – let’s say you have filtered on the basis of Green fundamental strength and undervalued – You may get a shortlist of 10-15 stocks. This list further allows you to compare these companies on the basis of certain criteria like Market Capitalization (large-cap, mid-cap and small-cap), Net Sales, P/E etc. After this you are just one step away from selecting a good company worth investing in and you just need to go ahead and Evaluate the company.

This filter will help you invest safely as you can narrow down upon the best companies to invest in within seconds. By selecting fundamentally strong companies that are undervalued currently, you are minimizing your risk as well as assuring good return for the long-term.

MoneyWorks4me Filter is a special stock picking tool that’s available only to our subscribers. Now you can get unlimited access to MoneyWorks4me Filter along with an array of features essential for Safest stock investing at much affordable price. Check out our plans

It is Great to read MoneyWorks4Me. Iam new to Equity Investing & I find your Analysis very useful , highly scientific, well researched & very easy to understand for novices like me !