Details of the issue:

Issue date: 11th – 14th December, 2012

Face value: Rs. 10

Price band: Rs. 210 to Rs. 240 (Rs. 10 discount available to Retail investors)

Issue size: Rs. 3970 Cr. to Rs. 4530 Cr.

Type of issue: Fresh issue and offer for sale.

Fresh shares offered to public: 14.62 Cr. shares.

Offer for sale: 4.27 Cr. shares

Market lot: 50 shares and further in multiples of 50.

So, what is the subscription offer? Here is the review of the Bharti Infratel IPO…

Bharti Infratel, one of the largest tower infrastructure providers in India and a subsidiary of telecom major Bharti Airtel is coming up with an IPO of 18,89,00,000 equity shares of Rs. 10 each. The IPO Price Band has been fixed at Rs. 210 to Rs. 240 per equity share. The offer opens on 11th December and closes on 14th December, 2012. Investors can subscribe to this IPO in market lot of 50 shares and multiples thereof.

Tell me more about Bharti Infratel…

Bharti Infratel Limited, a subsidiary of telecom major Bharti Airtel is one of the largest tower infrastructure providers in India. The company was formed when Bharti Airtel decided to transfer all its towers to a separate entity known as Bharti Infratel through a scheme of arrangement in January 2008. Bharti Infratel’s business model is to acquire, build, own and operate tower and related infrastructure, primarily to wireless telecommunications service providers. This is done on a shared basis, under long term contracts. Under the long term contracts, the telecom service providers are required to pay rent for the tower usage and power charges.

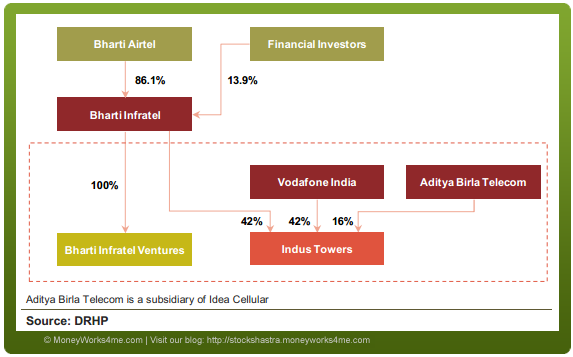

The company has 42% stake in another tower infrastructure company known as Indus Towers. Indus Towers is the result of a Joint Venture in 2007 between Bharti Airtel (42%), Vodafone (42%) and Aditya Birla Telecom (16%) which was formed by the 3 companies to benefit from tower sharing arrangement. Indus Towers’ business is similar to that of Bharti Infratel.

Bharti Infratel solely operates (i.e. it has its own towers) in 11 of the 22 telecom circles in India. However, it has presence in all the 22 circles via Indus Towers which is present in 15 circles. There are 4 circles where the 2 companies co-exist. As a result, Bharti Infratel has economic interest in 80,656 towers as on 30th September, 2011.

Towers owned solely by Bharti Infratel – 34,220.

Economic interest in towers via 42% stake in Indus towers – 46,436.

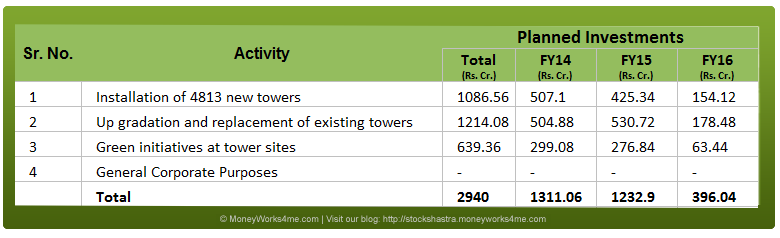

Use of Proceeds…

The IPO contains a fresh issue of 14.62 Cr. shares and an offer for sale of 4.27 Cr. shares by 4 existing shareholders of the company namely, Compassvale, GS Strategic, Anadale and Nomura. The Company will not receive any money from the 4.27 Cr. Offer for Sale shares. These proceeds will be a cash flow to the concerned 4 shareholders. The Company intends to utilize the money from the fresh issue of shares for the following purpose:

What sets the Company apart? Here is the analysis of Bharti Infratel…

Bharti Infratel’s Financial Track Record:-

Considering that its subsidiaries contribute around 55% of the total revenue on a consolidated basis, we have analysed the consolidated financial track record of Bharti Infratel.

The 10 YEAR X-RAY of Bharti Infratel indicates that the financial performance of the company has been below satisfactory over the last 5 years. Though the company has grown its net sales at an impressive rate of ~23% CAGR over the last 3 years, it hasn’t been able to create value as measured by its Return on Investment vis-à-vis its cost of capital. The return on investment has been less than its cost of capital over the last 5 years. The average ROE and ROIC of last 5 years are measly ~2.7% and ~3.0% respectively.

Though still below our benchmark levels, the company has managed to improve its financial performance over the last 5 years. The net and operating profit margins have been bit erratic but managed to post significantly higher than FY09. As a result, it posted good EPS and BVPS growth over the last 3 years. The company has also posted strong and consistent operating cash flow (OCF) and OCF has always been higher than net profit over the last 5 years. It shows that the company has managed its working capital very efficiently. Though the company has comfortable Debt to Equity ratio but its debt to net profit ratio has always been high and current debt to net profit ratio is close to ~7. Therefore, it needs to be monitored regularly.

Advantages of serving to the top telecom companies of India:-

Bharti Infratel primarily serves the top 3 telecom companies in India namely, Bharti Airtel, Vodafone and Idea Cellular. Bharti Airtel is the promoter of Bharti Infratel, which along with Vodafone and Idea Cellular, owns Indus Towers. Airtel, Vodafone and Idea collectively account for 68% of the total wireless telecom revenues in India.

Bharti Airtel is a tenant at almost all of Bharti Infratel’s towers. At least one among Bharti Airtel, Vodafone and Idea Cellular is a tenant at almost all of Indus Towers’ towers. Bharti Infratel (consolidated with 42% stake in Indus Towers) has a right of first refusal by which it has the first right to fulfill tower requirement needs of the 3 telecom companies. Hence, the company benefits from any expansion in the networks of the three telecom companies. On a standalone basis, Bharti Infratel has the right of first refusal for all tower requirements of Bharti Airtel which puts it in a favorable position. Hence, the company serves to a large section of the telecom service providers industry and is assured of catering to their future demands. This augurs well for Bharti Infratel.

High expectations from the untapped rural market:-

As per TRAI data as on 31st March, 2012, urban wireless penetration was 162.8% while rural wireless penetration was 38.3%. Hence, incremental growth is expected to be primarily concentrated in the semi-urban and rural areas. The expansion of services in these relatively under-penetrated markets by wireless telecommunications service providers operators provides a significant opportunity to tower companies.

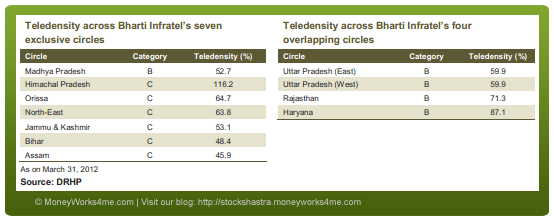

Bharti Infratel is primarily present in areas where the penetration or teledensity is low. Bharti Infratel is exclusively present in 7 circles (i.e. without Indus Towers’ presence) and 6 out of these 7 circles belong to Category C and 1 circle belongs to category B. The 4 circles where both Bharti Infratel and Indus Towers co-exist belong to Category B. The category B and C circles have a much lower teledensity than that of Category A and the metros. These categories are decided on the basis of the revenue generation potential of the circles.

The number of wireless subscriber addition is expected to be muted in the urban areas. Higher wireless subscriber addition is expected from the rural areas. As a result, the demand for towers is also expected to be higher in these areas. Bharti Infratel’s presence in Category B and C circles puts it in an advantageous position.

Expected increase in usage of data services to be the key demand driver:-

Currently, the usage of data services in India is very low. It is estimated that the current usage per active subscriber for 3G is 330 MB for handsets. The fall in 3G data services prices, along with the increasing penetration of smart phones due to better affordability should lead to an increase in the usage of data services. As wireless subscribers’ demand for data services increases, telecom companies in the metros and Category A circles will be required to expand their existing networks to facilitate the roll-out of 3G services as well as the latest 4G services. This will benefit Indus Towers because of its good presence in Metros and Category A circles. Category B and C circles have untapped potential for voice services and should also be demand drivers for data services in the future.

Tenancy of towers expected to be the key revenue driver:-

Tenancy refers to the number of telecom service providers that use a particular tower. It is a very important economic driver for tower infrastructure companies. The capital investment required by a tower company to set up a tower is huge. The operating expenses of a tower like site rentals, security and maintenance are largely fixed in nature. Hence, each increment in tenancy (i.e. the increase in tenants per tower) leads to increased revenue but is accompanied by a minimal increase in costs; this results in higher profits. Bharti Infratel had an average tenancy ratio of 1.85 in FY12 which is better than the industry average of 1.7. The company has managed to clock increase in the tenancy ratio over the past few years. The improvement in Tenancy ratio has led to an improvement in the Operating Profit margins

The tenancy ratio is expected to further increase in the future. In fact, it is expected to be the key revenue driver as growth expected in the number of towers is very less and tower sharing is expected to be the trend going ahead. This is because of the capital intensive nature of the tower business. It is advantageous for the telecom service provider to share towers because then they do not have to invest a high amount of capital to set up their own towers.

But what are the concerns?

Growth in the number of towers expected to be muted in the next three years:-

The number of telecom towers has grown at a good pace in the last few years. As per company’s DRHP, the CAGR in the number of towers has been close to 10% in the FY08-FY12 period with the current number being 3,76,000. There is already an over-capacity situation and hence, the growth expected in the number is of towers is very less. As per CRISIL Research, the total number of towers in India is expected to increase at a CAGR of less than 1% over the next three years. However, the tenancy in India is very low. A tower can handle 3 to 4 tenants whereas the average tenancy ratio in India is 1.7. Hence, although the number of towers is expected to clock a muted growth, the tenancy ratio is expected to improve.

Regulatory concerns:-

Tower infrastructure companies are dependent on telecom service providers for business and the telecom service providers’ business is very sensitive to regulatory decision. India’s telecom sector has always been facing concerns due to regulatory uncertainties. Any regulation which impacts the profitability of telecom service providers will have an adverse impact on the tower infrastructure providers.

Bharti Infratel on a standalone basis and its 42% stake in Indus towers makes it a leading player in the telecom infrastructure. On a consolidated basis, it is present in all the 22 telecom circles of India. The large scale nation-wide presence provides significant cost advantages to Bharti Infratel and creates entry barriers for new players. The tenancy ratios it has managed to get have been higher than the industry average.

There is good growth expected in 3G and 4G services and the huge opportunity available in the low teledensity rural areas of India. Also, Bharti Infratel has a favorable location of towers. However, there is intense competition in the industry leading to poor margins. Also, declining tariffs, growth rate of consumers and demand are further concerns.

Considering all these factors, the long term future prospects of the company appear to be ORANGE (‘Somewhat Good’).

So, should you invest in the IPO?

Bharti Infratel is in to an asset heavy business and hence, requires huge capital investment. Hence, the ideal way to value such a company is by using a P/BV multiple. We believe that the company is fairly valued at a P/BV multiple band of 0.9 – 1 which leads to a fair value of Rs. 226.41 – Rs. 251.57. At the price band of this IPO, it is priced at a P/BV band of 0.83 to 0.95, which provides very low Margin of Safety to retail investors.

Thus, considering the bleak industry prospects and the very low margin of safety, we advise investors not to subscribe to the IPO.

Want to find many other Fundamentally sound stocks and their Right Prices along with incisive Analysis?

Subscribe Now!

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463