Credit Analysis and Research Limited (CARE) Initial Public Offer Highlights:

CARE: Second-largest credit rating agency in India

Issue Date: 7 Dec 2012 – 11 Dec 2012

Face Value: INR 10

Price Band: INR 700 – INR 750 per equity share

Issue Size: 7,199,700 equity shares through an offer for sale by the selling shareholders

Retail Portion: Not less than 2,519,895 equity shares (35%)

Pre and post-offer equity shares: 28,552,812 equity shares

Issue Amount: INR 503.98 Cr. – INR 539.98 Cr.

Market Bid Lot: 20 shares, and in multiples thereof.

IPO Grading: exempted by SEBI

Listing at: BSE, NSE

So, what’s the offer for sale? Here’s the review of the CARE IPO. . .

CARE Ltd., the second largest credit rating agency in India is coming up with a public offer for sale of 7,199,700 equity shares of INR 10 each by the selling shareholders. The issue is being carried out through an offer for sale route, and therefore the company will not be issuing any fresh shares. Rather, the shareholders will be diluting their stake in the offer. The IPO price band has been fixed at INR 700 – INR 750 per equity share. The offer opens on December 7th, 2012 and closes on December 11th, 2012.

According to the offer, 50% of the shares on offer shall be allocated on proportional basis to QIBs, 15% to non-institutional buyers, and 35% to retail investors. The shares will be held in dematerialized form only. The company hopes to raise approximately INR 504 crores – to INR 540 crores from the issue. Since it is a secondary sale, all proceeds from the issue would go to the selling shareholders, and not the company. The primary motive of the company, thus, is to achieve the benefits of listing its shares on the stock exchange. Listing will provide a public market to its securities.

DSP Merrill Lynch Limited and Edelweiss Financial Services Limited are the lead managers and Karvy Computershare Pvt Ltd is the registrar of the issue.

Tell me more about CARE. . .

Incorporated in 1993, Credit Analysis & Research Limited is the second largest rating agency in India and the leading credit rating agency in India for IPO grading. Along with a rating volume of debt of around INR 44.05 lakh crores (as on September 30, 2012), it offers rating and grading services across a diverse range of instruments & industries including IPO grading, equity grading, and grading of various types of enterprises. They also provide general and customized industry research reports.

Who are the selling shareholders?

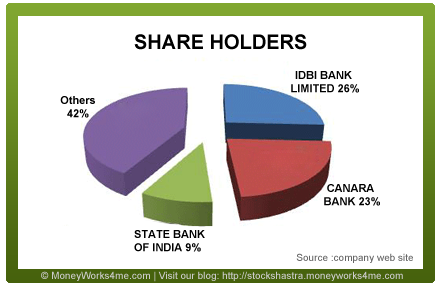

CARE is promoted by some of the leading banks and financial institutions, with the three largest shareholders being IDBI Bank Ltd. with a 26% stake , Canara Bank with a 23% stake, and State Bank of India with a 9% stake. The other prominent shareholders include Federal Bank Ltd., IL&FS Ltd., ING Vysya Bank Ltd. etc.

Exemption from SEBI for obtaining IPO grading

The Securities and Exchange Board of India (SEBI) has exempted CARE from the mandatory grading process for its IPO. The exemption has been granted on the grounds that this would have resulted in a rival rating agency gaining access to its books and insider information. The rationale behind the company asking for an exemption wasn’t hiding information from investors, but to prevent its rivals from knowing their business strategies.

What sets the company apart? Here is the analysis of CARE. . .

1. Financial track record

The company has seen remarkable growth in rating revenue and profits over the last few years. The volume of debt rated by CARE increased from INR 4,32,584 crores as of March 31, 2008 to INR 9,26,861 crores as of March 31, 2012, at a CAGR of 21.0% during that period. The standalone total income and profit after tax increased at a CAGR of 41.0% and 44.3% resp., during the same period. For the preceding 3 years, the EBITDA margins on standalone total revenue stood at 81.3%, 76.4%, and 75.3%, and the ROE was 40.1%, 29.9%, and 30.7%, respectively for FY10, FY11, and FY12. The company has maintained a highly liquid, strong net worth position, with no debt as of September 30, 2012, and has regularly been paying dividends.

2. Domain experience across a range of sectors

The company has rated debt instruments covering a diverse range of sectors, such as manufacturing, services, banks and infrastructure. They also have experience in providing debt and issuer ratings to many types of enterprises, including corporates, banks, financial institutions, public sector undertakings, state government undertakings, sub-sovereign entities, NBFCs, SMEs and micro-finance institutions.

3. Strong origination capabilities and relationship management

With an established rating relationship with 4,644 clients as of September 30, 2012, CARE’s brand name and 19 years of experience in the rating business enables it to obtain repeat business, and source new business. Further the company has undertaken various marketing initiatives from time to time like sponsoring and participating in industry events and seminars, and organizing conferences.

4. Expansion strategy

The company intends to capitalize on its strong brand recognition to expand, organically and by acquisition, into new business segments.

The company will continue to focus on its core debt instruments and bank loan and facility ratings business, and expand through the acquisition of new clients and retention of existing clients, providing high quality service and improving brand visibility and penetration. At the same time, the company will expand its income generating pool of products to include SME rating, Edu-grade, Equi-grade etc., and its research business which provides in-depth research on various sectors.

The company also has expansion plans to geographies such as Maldives, Hong Kong, Latin America, Nigeria, Nepal & Mauritius. The company has already sought authority recognitions and entered into various MoUs in this regard.

But what are the concerns?

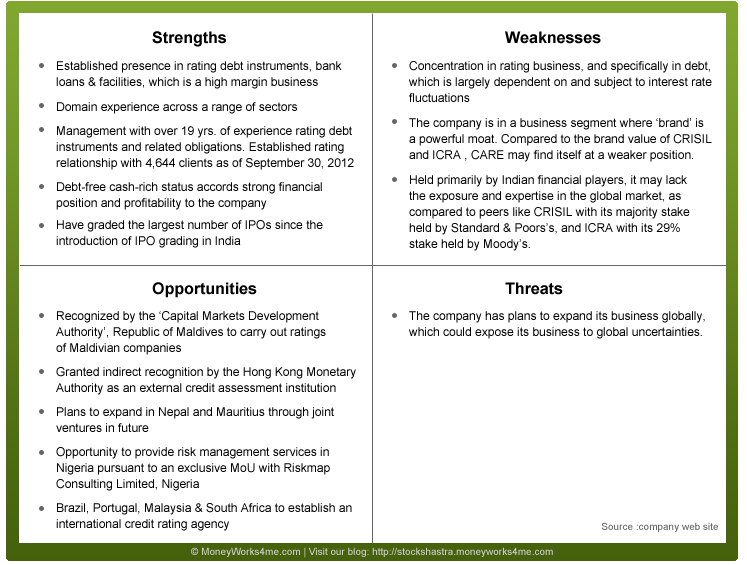

1. Concentration of business in the rating of debt and related instruments

The company is primarily engaged in the business of providing rating services with rating comprising approximately 86.4% of revenues. Within the rating domain, the current business of the company is largely concentrated in the rating of debt instruments, bank loans & facilities. Interest rates are highly sensitive to many factors beyond our control, including the monetary policies of the RBI, inflation, deregulation of the financial sector in India, domestic and international economic and political conditions and other factors. Hence, any increase in interest rates and credit spreads may negatively impact the issuance of debt instruments or demand for bank loans or facilities for which the company provides rating services.

2. Gaining market share from existing peers

The company may face difficulty in gaining market share from existing listed peers such as CRISIL & ICRA. The company is trying to emulate its listed peers by expanding and diversifying its business into research wings. However, such initiatives take time to materialize.

SWOT Analysis of CARE

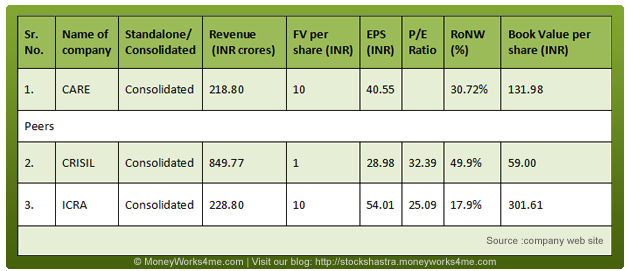

Peer comparison

The Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) margin for the half-year ended September is 69%, comparing very well to listed peers with ICRA at 32.9% and CRISIL at 31.7%. CARE’s Return on Equity (ROE) also was 30.7% in FY12, clearly better than ICRA’s 16%, though lower than CRISIL’s 42%.

The company has a low-cost back office in Ahmedabad, which helps it restrict its employee costs to less than 25% of its sales, compared with nearly 50% as in the case of CRISIL and ICRA.

So, should you invest in the CARE IPO?

According to MoneyWorks4me analysis, at the IPO price band of INR 700 – INR 750, CARE would be trading at a discount as compared to its equity’s intrinsic value.

CARE has EBITDA margins of >60%, and a decent ROE, along with a debt-free balance sheet. Also, it has good growth prospects in a high margin industry. Thus, we expect CARE to trade in the P/E range of 17x to 22x going forward. Considering a conservative growth rate of 12.5%, POST IPO the implied P/E will be in a range of 17.5 to 18.5, which is at a significant discount to listed local players.

The price band for this issue has been fixed at INR 700 to INR 750 per share, which is at a discount to its MRP. We therefore advise retail investors to consider subscribing to the issue from a long term perspective.

Want to find many other Fundamentally sound stocks and their Right Prices along with incisive Analysis?

Subscribe Now!

Disclaimer:This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Excellent analysis.But with the new SEBI guidelines, retail investors will not be able to get more than the minimum irrespective of their application size, isn’t it.SHould they consider applying under NII category?

@disqus_Ss5BcbHPnL:disqus

Thanks!

As per the new SEBI guidelines, the minimum application amount for

Retail category has been fixed at Rs. 15,000. Hence, all retail

applicants will be issued a minimum of Rs. 15,000 worth of

shares, irrespective of whether they have applied for shares

worth Rs. 15,000 or Rs. 2 lakh. The balance shares will be

allotted on a proportionate basis. While under the NII category,

the minimum application amount is Rs. 1 lakh.

Hence, if you intention is to invest an amount >= Rs. 1 lakh,

you could consider applying under the NII category.

Thanks for an insightful analysis, specially for an uninitiated person like myself. Would you recommend investing for full retail amount (ie 2 lacs)?

@disqus_AHOJQfXPFE:disqus We welcome your appreciation, and look forward to more feedback

from you.

No doubt CARE is a safe stock, and worth subscribing to, but

whether you should invest for the full retail amount (i.e. 2 lacs)

largely depends on your portfolio size and risk appetite.

Thanks for the Review. Would like to know whether this one qualify as classical Toll Bridge in one of the buffet term.

@google-07da4adeeae451a33911258a1b24e892:disqus You’re welcome! In our opinion, CARE wouldn’t qualify as a

classical Toll Bridge firm, as there are other companies based on

a similar business model like CRISIL and ICRA. Both these firms

are in fact larger than CARE and have a more diverse business

model. Though CARE itself has certain diversification and

expansion plans, but this is not distinct enough from its peers,

to serve as a Toll or Moat for it.