What is Index@MRP?

As investors, we are used to seeing the stock indices move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant; so that you can decide whether you should BUY stocks or SELL them off. This is exactly what Index@MRP is!

Stocks are driven by their earnings over the long term. The MRP at MoneyWorks4me is based on the long-term earnings capacity of the company. Similarly, Index@MRP gives an indication of whether stocks in a particular sector are fairly valued or whether irrationality is driving prices in this sector.

Check our earlier reports on Sensex@MRP & FMCG@MRP to learn more about this unique concept. Click here

BSE Capital Goods @MRP value

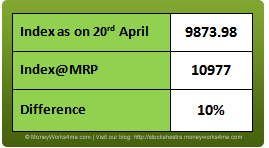

As on 20th April 2012, BSE CG index closed at 9873.98, which is 10% or ~1103 points below the CG@MRP index of 10977. This indicates that the index is undervalued at this point of time. The December quarter has been a mixed bag with a few companies have performed excellently while others have performed poorly.

As on 20th April 2012, BSE CG index closed at 9873.98, which is 10% or ~1103 points below the CG@MRP index of 10977. This indicates that the index is undervalued at this point of time. The December quarter has been a mixed bag with a few companies have performed excellently while others have performed poorly.

The last few quarters were particularly bad for the sector as it bore the brunt of a slowdown in global economies and sluggish domestic industrial growth. During the April-January period, the capital goods index, declined by 26 % due to concerns related to lower public/ private infrastructure spending, input price inflation and rising interest rates.

Also, January’s IIP (index of industrial production) brought no cheer on the capital goods front, as output from the sector contracted by 1.5% when compared to a year ago.

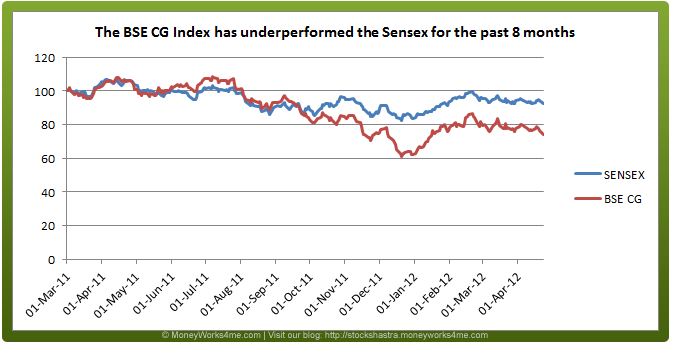

All this has been reflected in the performance of the BSE CG index as compared to Sensex. Since, September 2011, the BSE CG index has underperformed the Sensex while for most part of the remaining three years the BSE CG index outperformed the Sensex.

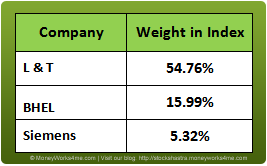

Index concentration level: Larsen & Toubro has the largest weightage in the index of ~55%. Next is BHEL with ~16% weightage. A decent performance by these two companies has helped the index recover its losses to a certain extent. If both these companies are excluded then the index will be undervalued by only 7%. Therefore, the index has high dependency on these two companies.

Index concentration level: Larsen & Toubro has the largest weightage in the index of ~55%. Next is BHEL with ~16% weightage. A decent performance by these two companies has helped the index recover its losses to a certain extent. If both these companies are excluded then the index will be undervalued by only 7%. Therefore, the index has high dependency on these two companies.

Sector Analysis: Overview of 9 months performance:

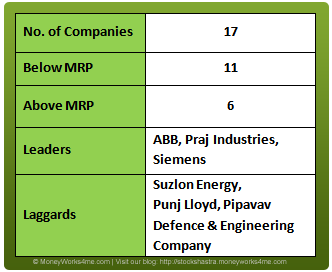

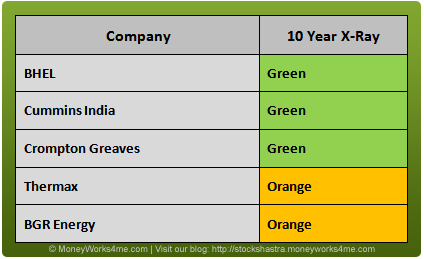

Net sales & net profit analysis: For the 9 month period of FY 12, the cumulative net sales of the BSE CG index companies have gone up by ~23%. Cumulative net profit has also witnessed a growth of ~17% as compared to the same period last year despite severe domestic economic condition. Most companies have posted more than 15% sales growth except 3 of them viz. Crompton Greaves, Bharat Electronics and BEML Ltd. However, performance at the profit level has been more dismal. Only 6 companies have been able to post more than 15% profits. A few have posted lower growth or decrease in profits. Three companies viz. Pipavav Defence and Offshore Engineering Company, Suzlon Energy and Punj Lloyd have posted absolute losses. Siemens shocked investors as it recorded only one-fourth the net profit posted a year before on the back on poor sales and increased input costs.

Net sales & net profit analysis: For the 9 month period of FY 12, the cumulative net sales of the BSE CG index companies have gone up by ~23%. Cumulative net profit has also witnessed a growth of ~17% as compared to the same period last year despite severe domestic economic condition. Most companies have posted more than 15% sales growth except 3 of them viz. Crompton Greaves, Bharat Electronics and BEML Ltd. However, performance at the profit level has been more dismal. Only 6 companies have been able to post more than 15% profits. A few have posted lower growth or decrease in profits. Three companies viz. Pipavav Defence and Offshore Engineering Company, Suzlon Energy and Punj Lloyd have posted absolute losses. Siemens shocked investors as it recorded only one-fourth the net profit posted a year before on the back on poor sales and increased input costs.

Future Outlook:

Growth and business sentiments have weakened in India in the recent months on account of a host of factors. Regulatory issues have dented business confidence and a marked slowdown in announcements of fresh projects and capacity enhancement has taken place. Considerable monetary tightening to fight the sustained high inflation has resulted in a substantial hardening of interest rates. This in turn has dampened consumer demand and affected the viability of infrastructure and other projects. While the execution of ongoing projects and healthy order books may support growth in the current year, investment growth is likely to moderate substantially in FY13, unless policy issues are addressed and there is a substantial pick up in the pace of implementation of big ticket economic reforms. Moreover, the global economic environment remains bleak owing to the deepening sovereign debt crisis in Europe and lack of clarity regarding when a stable solution will emerge.

Industry, in particular: The December quarter results reflect the problems haunting capital goods firms. Material cost as a percentage of sales increased across the board in spite of softening commodity prices, due to either poor pricing, low revenues or the impact of a weak rupee which makes imports expensive. Poor order inflow is still the biggest concern for the sector, because the absence of fresh orders is a challenge for medium to long term earnings growth.

Sluggishness in fresh orders implies low customer advances which along with project delays has led to spiralling interest costs, visible across firms during the December quarter. Also, Indian capital goods space is becoming increasingly competitive, given the new players (domestic and Chinese) and manufacturing capacities being added.

Going forward, demand is not likely to pick-up any time soon until the government takes some speedy and concrete actions, particularly relating to coal blocks and land acquisition. Increased competition will result in aggressive pricing, thereby negatively impacting profit margins of established players. However, most capital goods firms are not highly leveraged when compared to their infrastructure counterparts, hence any recovery in operating profitability will immediately reflect in higher profits

Capital Goods industry, as an investment: The Capital Goods Index continues to register negative growth and also remained very volatile. The index fell by almost 16% over Q3 FY12. However, the pace of decline has now moderated, though it continues to remain highly volatile. Though the valuations may seem cheap at this time, all is not well for the Capital goods sector. The sector is facing the dual risk of sluggish revenues due to depleting orders and margin compression on account of high interest rates and slowing demand. However, easing interest rates may offer some respite to the sector. Also, the much lobbied for increase in customs duty (for foreign, particularly Chinese, equipment vendors), if levied, will be a huge positive for the sector.

The CG@MRP figure indicates that the index is currently undervalued. In such a situation, investors would be well-advised to

Be on the lookout for fundamentally sound companies with attractive buying opportunities in the CG sector to protect your capital as well as get good returns over the long-term.

To find which companies in the Capital Goods sector offer good buying opportunities, log on to MoneyWorks4me.com.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463