What is Nifty@MRP?

As investors, we are used to seeing the Nifty move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant. This is exactly what Nifty@MRP is!

Considering that the Nifty stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs. In reality, the stocks are driven by their earnings over the long terms. Hence, it is said that market is a slave of the corporate earnings. Thus, Nifty@MRP gives an indication of whether the Nifty is fairly valued or whether irrationality is driving the markets

Check our earlier reports on Nifty@MRP to learn more about this unique concept.

What is the latest Nifty@MRP value?

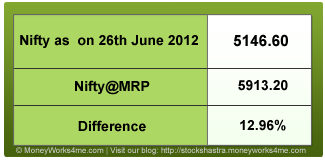

Considering the free float market capitalization at the MRP of individual stocks and considering the share price data as of 26th June, the Nifty@MRP comes out to 5913.20. On 26th June 2012, NSE Nifty index closed at 5146.60, which is 12.96% or 767 points below the Nifty@MRP of 5913.20. It indicates that the index is undervalued and provides investing opportunities for investors.

Considering the free float market capitalization at the MRP of individual stocks and considering the share price data as of 26th June, the Nifty@MRP comes out to 5913.20. On 26th June 2012, NSE Nifty index closed at 5146.60, which is 12.96% or 767 points below the Nifty@MRP of 5913.20. It indicates that the index is undervalued and provides investing opportunities for investors.

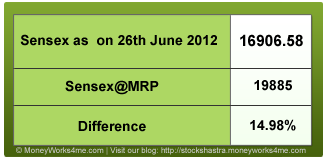

With similar calculation, the Sensex@MRP comes out to 19885. On 26th June 2012, the Sensex closed at 16906.58, which is 14.98% or 2979 points below the Sensex@MRP of 19885.

With similar calculation, the Sensex@MRP comes out to 19885. On 26th June 2012, the Sensex closed at 16906.58, which is 14.98% or 2979 points below the Sensex@MRP of 19885.

Analysis of FY-2012 financial performance of Sensex companies

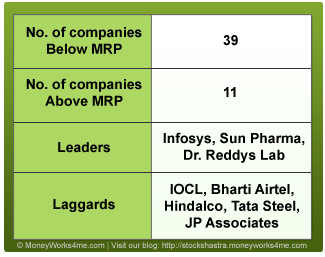

Net sales & net profit analysis: The cumulative net sales of the Nifty index have gone up by ~25% while the cumulative net profits have increased by ~11% for FY-12 as compared to FY-11. Despite economic slowdown, some of the Nifty companies have posted decent results in FY-12. The highly capital intensive sectors such as Telecom, Power, Steel underperformed in the index while low capital intensive and defensive sectors such as IT, FMCG, Pharma outperformed. Infosys, Sun Pharma, Dr. Reddys Lab, SBI and ONGC outperformed with respect to the financial performance while IOCL, BPCL, Jaiprakash Associates Ltd., Siemens Ltd., Bharti Airtel, Hindalco, Tata Power and Tata Steel were the underperformers. As far as valuations are concerned, out of the 50 Nifty companies, around 39 companies are trading below their MRP (Under-valued) while only 11 companies are trading above their MRP (Over-valued).

Net sales & net profit analysis: The cumulative net sales of the Nifty index have gone up by ~25% while the cumulative net profits have increased by ~11% for FY-12 as compared to FY-11. Despite economic slowdown, some of the Nifty companies have posted decent results in FY-12. The highly capital intensive sectors such as Telecom, Power, Steel underperformed in the index while low capital intensive and defensive sectors such as IT, FMCG, Pharma outperformed. Infosys, Sun Pharma, Dr. Reddys Lab, SBI and ONGC outperformed with respect to the financial performance while IOCL, BPCL, Jaiprakash Associates Ltd., Siemens Ltd., Bharti Airtel, Hindalco, Tata Power and Tata Steel were the underperformers. As far as valuations are concerned, out of the 50 Nifty companies, around 39 companies are trading below their MRP (Under-valued) while only 11 companies are trading above their MRP (Over-valued).

Future Outlook:

On the global front, fears of an imminent Greek exit from European Union eased on 18th June, 2012 after the New Democracy party won the elections and pro-bailout parties won enough seats to form a joint government. But, the problem isn’t confined to Greece and is spreading to other parts of Europe. For example Spain requested up to 100 billion euros ($125 billion) of European funds to recapitalise its weakest banks which prompted credit rating agency Moody’s to downgrade credit ratings of many Spanish banks. As long as such problems persist, it would remain a concern for the global market.

On the domestic front, India’s economic growth slumped to its lowest level (March-2012 GDP growth at 5.3%) in nine years and India’s industrial output (IIP) rose only 0.1% in April, far lower than the expectation of 1.7% according to a Reuter’s poll. This extremely weak domestic economic situation has been caused by high inflation & interest rates, lack of much needed reforms and policy paralysis. Further, the RBI has shown no signs of easing interest rates and maintained them at the same level in its monetary policy review on 18th June, 2012 pointing to the inflation which still remains above its comfortable level of ~6-6.5%. With these concerns, India is also at risk of losing its investment grade status from Standard & Poor’s.

Going ahead concerns from the Euro zone are expected to play spoilsport for the global markets. On the back of weak growth in India’s GDP and IIP, we have now seen Prime Minister Manmohan Singh assume the additional responsibility of the finance ministry. Whether, he has the ability and the will to instigate reforms to revive the economy in the near future, remains to be seen.

Going ahead, inflationary pressures are expected to ease owing to softening commodity prices, especially crude oil. Over all, we expect that majority of the Nifty companies will post good financial performance in FY13 backed by the improvement expected on the macro-economic front in India. However, Global and Indian stock markets may remain volatile till the global economy stabilses especially the European markets. Any rate cuts by RBI will also cheer the Indian market. Normal monsoons will also have a bearing on the course of the market going ahead.

Looking at the numbers, Nifty is quoting at ~13% discount to Nifty@MRP. We expect Nifty to be volatile in the short term but the long term prospects seem to be good. A significant fall in stock market provides good investment opportunities for long term investors. Such an opportunity also existed during economic slowdown in 2008. Currently, there are few fundamentally sound companies which are available at a hefty discount from their MRP with limited downside risk. Hence, you, as investors, should remain cautious in in this volatile market while at the same time keeping an eye on such bargain buys. Investors would be best advised to

“Look for bargain buys especially amongst the Nifty 50 stocks”

Our latest offering Nifty 50 Superstars helps you do exactly this i.e. find the best blue-chip stocks and get great returns from safest stocks! To check out Nifty 50 superstars click here.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Amazing Analysis and Timing of the Article