What is Nifty@MRP?

As investors, we are used to seeing the Nifty move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is overly depressed or irrationally exuberant. This is exactly what Nifty@MRP is!

Considering that the Nifty stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs. In reality, the stocks are driven by their earnings over the long term. Hence, it is said that the market is a slave of the corporate earnings. Thus, Nifty@MRP gives an indication of whether the Nifty is fairly valued or whether irrationality is driving the markets

Check our earlier reports on Nifty@MRP to learn more about this unique concept.

What is the latest Nifty@MRP value?

Considering the free float market capitalization at the MRP of individual stocks and considering the share price data as of 17th August, the Nifty@MRP comes out to 5938. On 17th August, NSE Nifty index closed at 5360, which is 9.74% or 578 points below the Nifty@MRP of 5938.49. It indicates that the index is undervalued currently.

Considering the free float market capitalization at the MRP of individual stocks and considering the share price data as of 17th August, the Nifty@MRP comes out to 5938. On 17th August, NSE Nifty index closed at 5360, which is 9.74% or 578 points below the Nifty@MRP of 5938.49. It indicates that the index is undervalued currently.

On similar lines, the Sensex@MRP comes out to 19621. On 17th August, the Sensex closed at 17690, which is 9.84% or 1931 points below the Sensex@MRP of 19885.

On similar lines, the Sensex@MRP comes out to 19621. On 17th August, the Sensex closed at 17690, which is 9.84% or 1931 points below the Sensex@MRP of 19885.

So, considering June-12 quarter financial performance, we can say that the broader market indices are currently under-valued by ~10%. And this is despite a short rally seen over the last two months.

Analysis of “June-12 quarter” financial performance of Nifty companies

Net sales & net profit analysis: For the June 2012 quarter, the cumulative net sales of the Nifty companies have grown by ~18.5% as compared to the June 2011 quarter. However, the cumulative operating profits (EBITDA) and net profit (PAT) decreased by 4.65% and 6.44% respectively for the same period.

Net sales & net profit analysis: For the June 2012 quarter, the cumulative net sales of the Nifty companies have grown by ~18.5% as compared to the June 2011 quarter. However, the cumulative operating profits (EBITDA) and net profit (PAT) decreased by 4.65% and 6.44% respectively for the same period.

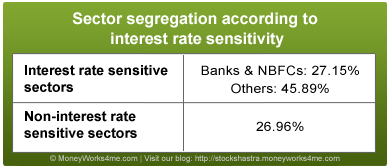

The poor performance of capital intensive and interest rate sensitive sectors weighed heavily over the index; these sectors constitute around 46% of the Nifty index. These sectors are financed by banks and financial institutions (FIs) which constitute around 27.15% of Nifty index. Banks and FIs’ performance has also been affected due to the high interest rates and they have seen rising NPAs on their books. On other side, non-interest rate sensitive sectors, constituting around 27% of the Nifty index have performed well owing to continuing strong demand for products.

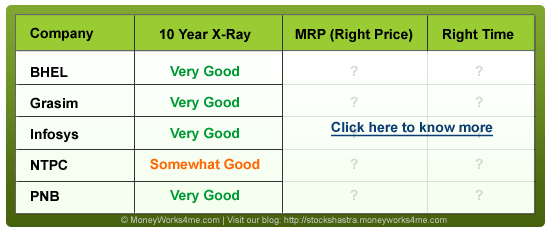

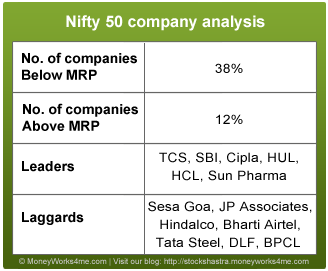

With respect to the financial performance, the list of leaders and laggards from the Nifty 50 companies reflect this trend. Leaders include defensive stocks like Cipla, HUL, Sun Pharma and IT companies like TCS and HCL. On the other hand, laggards include capital intensive companies like Sesa Goa, Hindalco, DLF and telecom player Bharti Airtel.

With respect to the financial performance, the list of leaders and laggards from the Nifty 50 companies reflect this trend. Leaders include defensive stocks like Cipla, HUL, Sun Pharma and IT companies like TCS and HCL. On the other hand, laggards include capital intensive companies like Sesa Goa, Hindalco, DLF and telecom player Bharti Airtel.

The pessimism in the market also seems to have weighed heavily over the valuations. Over all, out of 50 Nifty companies, around 38 companies are trading below their MRP (Under-valued) while only 12 companies are trading above their MRP (Over-valued).

Future Outlook:

On the domestic front, we have seen a few positives in the last quarter such as cooling off of Inflation (6.87% in July, 2013) and increasing FIIs investment which kept the market in the positive territory. However, the economic situation remains weak due to continued inaction of the Indian government on major policy reforms and RBI’s firm stand on interest rates. To add to this, the international rating agency Standard & Poor’s (S&P) warned that India could lose its investment-grade rating considering the weak domestic macro-economic environment and government policy inaction. If this happens, India would be the first BRIC country to lose its investment-grade credit rating. This could lead to slowdown in foreign investment and also increase foreign capital borrowing cost for the Indian corporates.

On the global front, the US economy has seen some improvement in its domestic demand. But, Eurozone’s debt crisis remains a key concern. Europe’s problems have been evident for nearly two years, yet no definitive action has been taken to save the European Union. Recently, European Central Bank President Mr. Mario Draghi indicated that the ECB is prepared to take major policy actions at its September meeting. He has also said that the government would implement the European Stability Mechanism (ESM) or the European Financial Stability Facility (ESFS) to provide financial assistance to the Eurozone members. But looking at past two years, it seems that his comments were meant more to build investor confidence and revive hopes that the European Union would act to save debt-ridden countries such as Greece. Thus, Eurozone would remain a concern for the global markets until or unless some serious steps are implemented to save the European economy.

Prime Minister Manmohan Singh expects India’s GDP to grow more than 6.5% in FY13. He also indicated that to pass major reforms in order to revive the economy, the Government would require the support of all the political parties; however this seems highly unlikely. In fact, over the last few days, the opposition has been pressurizing the PM to resign in response to the CAG report on the coal block allocation.

Going ahead, with softening commodity prices, RBI may cut interest rates to bring back the economy on growth path. But again the thing to watch out for would be the steps taken by the Government on fiscal consolidation. Overall, it seems that the Government’s action on major economic reforms would be a strong push for the market to move upward. But, looking at the chaos in the parliament, it would be very difficult for the government to initiate a dialogue let alone pass major reforms.

Therefore, Global and Indian stock markets would remain volatile till the global economy stabilses and the Indian government passes some major reforms.

Looking at the numbers, Nifty is quoting around 9.74% discount to Nifty@MRP. We expect the Nifty to be volatile in the short term but the long term prospects seem to be good. Over the last couple of months, the Indian market moved northward on back of improved liquidity and huge FIIs investments. Considering ~10% discount to Nifty@MRP and strong long term growth prospects, we believe that the Indian stock market still provides good growth opportunity for long term investors. Currently, there are a few fundamentally sound companies which are available at a hefty discount from their MRP with limited downside risk.

Hence, you, as investors, should remain cautious in in this volatile market while at the same time keep an eye on some bargain buys as indicated by our decision maker.

Considering the situation, investors would be best advised to buy fundamentally strong large companies at the right time and at the right price.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463