Havells India Ltd – Is it poised for good growth in future, too?

Havells India Ltd’s 10 YEAR X-RAY: Green (Very Good)

Havells India Ltd, in brief

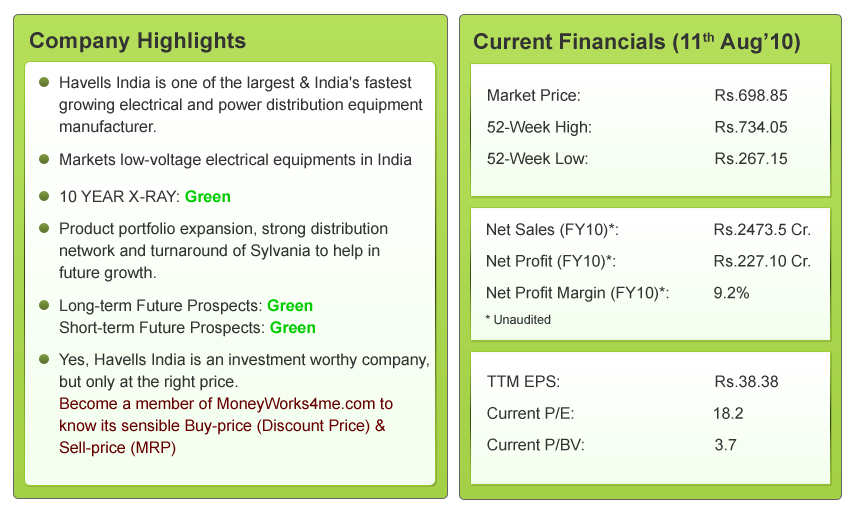

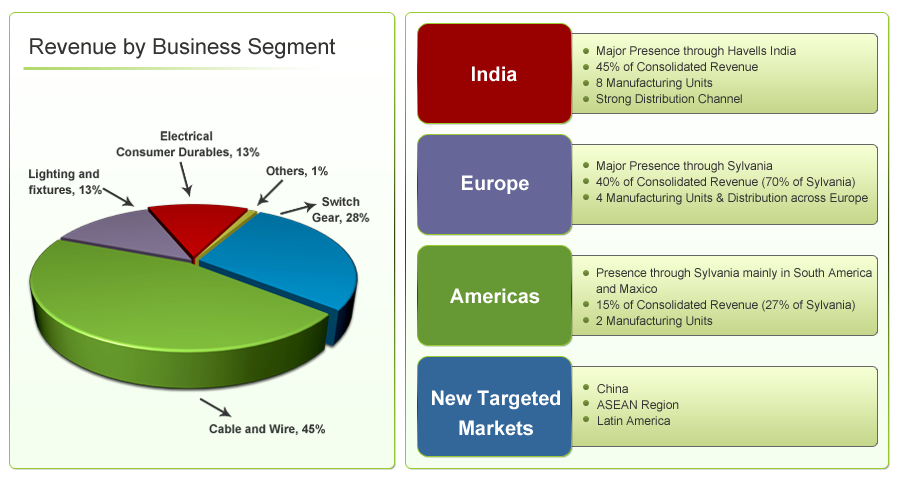

Havells India Ltd is one of India’s fastest growing electrical and power distribution equipment manufacturer. It was incorporated as Havells Pvt. Ltd. in 1983 by Mr. Qimat Rai Gupta. It has a wide range of products and the major revenues come from Cables and Wires segment (45%), followed by Switchgear (28%), Lighting and Fixtures (13%) and Electrical Consumer Durables (13%). Its products cater to domestic, commercial as well as industrial application. Havells owns some of the renowned global brands like Sylvania, Crabtree, Concord, Luminance, Linolite and SLI Lighting.

It has 7 state-of-the-art manufacturing plants in India situated at Haridwar, Faridabad, Baddi, Bhiwadi, Alwar, Neemrana and Noida and 9 plants manufacturing plants located across Europe, Latin America and Africa. It is a leading global player with Sylvania and exports to nearly 51 countries

What does Havells’ past say?

The 10 YEAR X-RAY of Havells India Ltd indicates that the financial performance of the company has been very good. Net Sales and EPS have grown with a 9 Year CAGR 36.7%% and 42.4% respectively. The company’s book value per share has also shown robust growth over the years at a CAGR of 46.6%. Return on Invested Capital has also been excellent throughout the ten year period, with a six year average of 26.9% indicating the efficiency of management of funds. The Debt to Net Profit ratio is 0.30 indicates the companies comfortable financial position. On a consolidated level the debt is high – a level of Rs. 1000 Cr. This is due to the Rs. 920 Cr. loan taken for the acquisition of Sylvania.

Hence, considering all these factors, the 10 YEAR X-RAY of the company is Green (Very Good).

To view its past 10 year performance in a simple color-coded 10 Year X-Ray, visit MoneyWorks4me.com

What is Havells’ Short-term Outlook?

June, 2010 Quarter Performance-

The company registered a robust growth of 22.32% in sales, but managed only a 8.26% growth in profits. The sales growth was led by the growth in all segments.

The Switchgear division margin increased due to better product mix in favor of premium products and better price realization thereon. But Cable and Wire margins were affected due to the increase in raw material costs of copper and aluminum by 50% and 30% resp. This collectively led to an average growth of profits, inspite of impressive growth in sales.

Company Plans for FY11

Sylvania expected to be profitable as a result of restructuring plan:

Havells acquired the loss-making Sylvania in FY 08 to tap the European markets. In order to turnaround the company, Havells implemented a restructuring plan in 2 phases. Restructuring project ‘Phoenix’ aimed at reduction in manpower, working capital and material costs, at a estimated cost of 12 million Euros was implemented between Jan-Sep’09 and second project ‘Prakram’ aimed at reducing fixed costss by shifting of manufacturing facilities to low cost countries, was implemented between Sep’09-Dec’10 at estimated cost of 23 million Euros. The restructuring is going to complete by June 2010. The benefits of the restructuring are gradually reflecting in the business, and hopes to make operational profits in FY11.Also, the company has not planned to incur any significant capex at Sylvania.

Capex expansion:

In FY11, the company plans a capex of Rs 100 crore for increasing capacity in CFL and Fans. Company plans to double the CFL capacity from 4 million units to 8 million units. The company has entered the ceramic metallic halide market and for this, it has planned a production of new generation ceramic metal halide or CMH lighting. The CMH plant is expected to manufacture 1 million units p.a. out of which it plans to export 90% of production. The company has a revenue target of Rs 100 crore from this business, thus adding value to its business.

Good management of debtors:

On standalone and consolidated basis, Havells has managed its debtors efficiently. In fact on standalone basis the company’s debtors days is only 13 days which is impressive

High Debt Levels on consolidated level:

Havells has taken a loan of 920 Cr. (810 Cr- secured + Rs.110 Cr- unsecured debt). The interest cost of this is likely to hamper the company’s profitability level on a consolidated level.

Havells has buoyant end-user segments like Infrastructure, power and construction which are poised for growth in future. Also, with the government’s increased focus on these segments; they are expected to drive the future growth.

Hence, we can expect the short-term outlook of Havells India Ltd. to be Green (Very Good)

What is Havells’ Long-term Outlook?

Havells has had a great past. It also has a bright short-term outlook and has is almost on the verge of turnaround with Sylvania by coming up with a good restructuring plan and by posting good results.

So, is Havells poised for good growth in future? What factors will help it?

Strong distribution network and efficient working capital management:

All of HAVL’s sales are through its distribution channel, which is the strongest and largest trade networks across the country. This strategy, backed by a great product profile, provides Havells with a competitive advantage. Havells retails its products in more than 30,000 outlets across the country and is supported by an extensive dealer network that ensures the brand’s presence everywhere. Besides its dealer base, Havells has also setup Havells Galaxy — an exclusive showroom of the company offering end to end solution to all electrical needs. So far there are 35 galaxies across the country. These initiatives are expected to add to company’s revenues considerably, as Havells as a brand gets more exposure and can reach out to consumers in a big way.

Havells India has managed its working capital efficiently over the years. It’s no. of days of working capital on a consolidated level is 38 days which is impressive.

Brand:

The company has focused on brand building exercises over the years. This has been achieved through extensive media coverage. The brand started its association with cricket through T20 WC 2007, where it associated with most matches. Cricket has been the key focus for the company as they were also sponsors for the IPL T20. The Havells brand today is one of India’s fastest growing brands in terms of product and brand acceptability.

New Product Launches:

New Product Launches:

- The Global Launch of LED Lightings: The company is entering the Light-emitting-Diodes (LED) Market. Havells Sylvania (Global Operations) has set a target of € 50 million turnover from LED segment in next two years while Havells India would target revenue of Rs.100 crores by 2012 in the domestic market. The Company has set-up a lighting R&D centre at its existing plant at Neemrana, Rajasthan for the purpose. The LED product range of company called Endura would include spotlights, downlights, commercial Lights and street Lights.

- Introduces Eco-Friendly HPF CFLs: The company has introduced a new range of energy saving CFLs with “HPF” (High Power Factor >0.85), which are more energy efficient and ecofriendly.

- Entry in CMH lamps: The Company has entered Ceramic Metal Halide (CMH) business. The company has a revenue target of Rs 100 crore from this business. The development of the lamps has been done by Sylvania, which was acquired by Havell’s in 2007. The lamps will be manufactured at Havell’s plant in Neemrana, Rajasthan. Being new product line and high margin low volume business, this would help the company to gain market interest along with benefits of being the first manufactures of CMH.

These products will help Havells to gain market share.

Slyvania to lead growth in Emerging Markets:

Slyvania to lead growth in Emerging Markets:

The company expects business environment in emerging continents like Asia. Latin America (contributing 27 % revenues for Sylvania) to continue to report growth due to renewed demand and euro depreciation. Going forward, company intends to increase its revenue contribution from emerging economies thereby reducing its reliance on crisis hit developed economies. Currently Europe’s revenue contribution stands at 70% which is expected to decline in the future, whereas the share of Asia and Latin America is expected to increase. The company’s strategy of geographical diversification will help Sylvania’s top line to grow

Concerns:

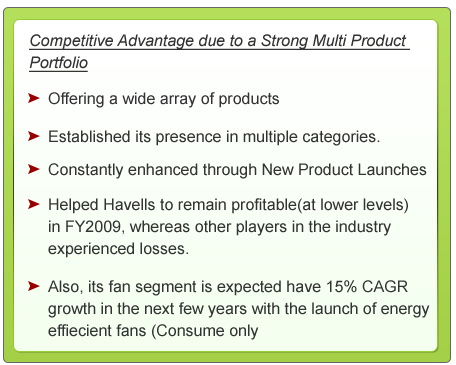

- The company has a change in revenue mix, with an increase in the share of cables and wires and decrease in switch gear business. This change may affect margins as margins for the switchgear business are high while in the C&W business margins are under pressure as raw material prices form about 80 per cent of total costs. The company’s profitability might be affected as a result.

- Increasing competition from low-cost electrical products from China could stunt the growth of Havells and could also affect the product portfolio, especially the new products which are finding their feet in the market. Sylvania has only 5% market share in European markets and competition from larger players and entry of Chinese products can impact the revenue growth and margin expansion at Sylvania.

- Exchange Rate Volatility: With the integration of Sylvania’s operations and increasing global presence Havells foreign currency revenues have increased. This has exposed the company to possible losses due to currency fluctuations. In FY2009 the company suffered a loss of Rs.27.22 crore on foreign exchange transactions.

Buoyant End User Segment

Infrastructure, power and construction are the key user segments for Havells products. The Government plans significant investment with greater focus on infrastructure development, real estate and power sectors. Also, the consumer durables segment which majorly includes fans is expected to grow by over 15% for the next few years. Its CFL segment has a lot of scope in the Indian market. This together with structural changes in the underlying buying patterns will give large opportunities for quality, branded and well distributed product companies like Havells.

Looking at the successful expansion of Havells product portfolio, its strong distribution network we can expect the long term future prospects of the company to be Green (Very Good).

Conclusion:

Havells is well positioned for growth in Domestic Market through a stronger brand, distribution network and vast product range . It has established a global footprint through acquisition of Slyvania in 2007. The planned expenditure on infrastructure and upturn in real estate markets augur well for Havells end user markets.

Yes, Havells India Ltd. is an investment-worthy company, but is it at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on Havells India right now, become a member of www.MoneyWorks4me.com to find its right value.

Havells India Ltd. featured in our ‘5 Stocks below Discount Price’ list quoting@ Rs 330. It has been one of our success stories. Click here to read the Full Story.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Havells India is one of those unsung heroes who have outperformed the market. Sound business model, multi-product portfolio, timely acquisition of loss making Sylvania and its turn around into profit making Co. have all contributed to its uninterrupted rise. The Co. hols an enviable place in the areas of its operations. The analysis by the Team_Moneyworks4me is most useful in identifying a gem. The Co. has also responded equally well to its arrival on the big league by announcing a liberal 1:1 bonus on 27.08.2010. Thanx a bunch Team_Moneyworks4me. Please keep up the good work!!!

Hi! I read your report and I want to said it is good imformation. I like it and I appreciate your effort. Thank you very…much! (^-^)