Jindal Steel & Power Ltd.- Will it replicate its earnings growth of the past?

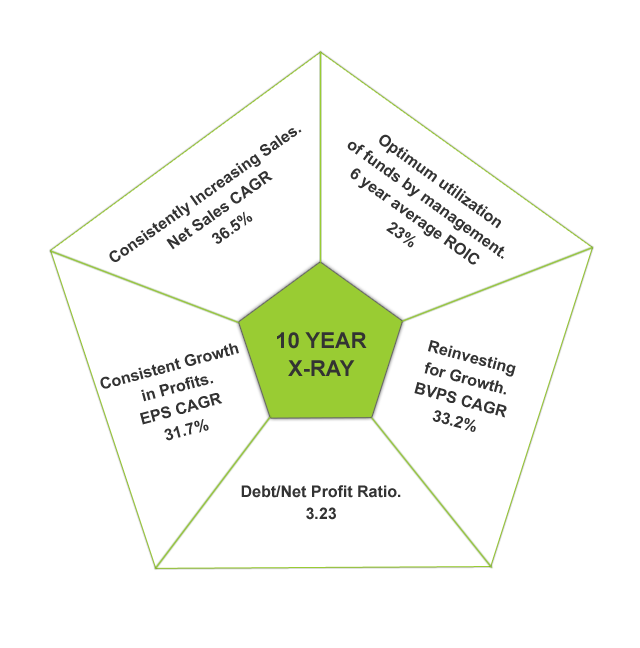

JSPL’s 10 YEAR X-RAY*: Green (Very Good)

(* 10 YEAR X-RAY shows the financial performance of a company in the last 10 years.)

JSPL, in brief

Jindal Steel & Power Limited (JSPL) is a Jindal Group company with an annual turnover of over Rs. 11,000 Cr. JSPL operates in a promising mix of two business segments- Power & Steel. It is a leading player in the Steel Industry. The company produces economical and efficient steel and power through backward integration from its own captive coal and iron-ore mines. JSPL is the one of the lowest cost producer of sponge iron in India. Backward integration has given JSPL the distinction of being the only sponge iron producer with its own captive raw material sources and power. JSPL sells power on merchant basis, which commands higher realizations than other power generation companies that are subject to regulated tariffs. The company serves both domestic as well as international markets. It is also entering into niche value-added segment such as rounds, billets, blooms and slabs

What does JSPL’s past say?

JSPL has performed very well over the last ten years . The company has clocked an impressive CAGR of 36.5% for its Net Sales, showing an increasing demand for its products

The company’s operating margins have improved over the years. This is mainly due to the significant reduction in raw material costs as a % of sales turnover; a result of the captive iron mines and power plants. In fact, Jindal’s margins at an average of 38%, have been much better than its peers like SAIL, JSW etc. This advantage has helped the company register robust EPS growth rates

The company’s Debt-to-Net Profit ratio is slightly more than 3 which is the result of ongoing capacity expansions and is expected to grow sharply in future, due to its capacity additions and global acquisitions.

Looking at its overall financial performance, we can say that the company’s 10 YEAR X-RAY is Green (Very Good)

(To view the company’s 10 year performance in a simple color-coded X-ray, visit MoneyWorks4me.com)

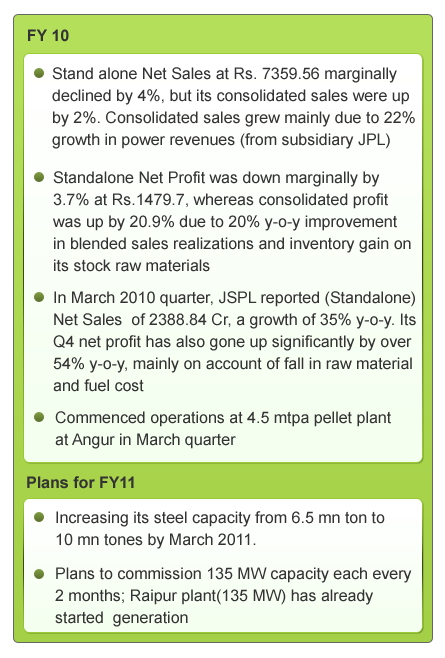

What is JSPL’s Short-Term Outlook?

Rising Steel Imports Disturbing: Rising cheap steel imports is disturbing and puts pressure on the local steel industry. Steel prices have fallen in the past few months mainly on account of oversupply of steel from other countries

JSPL to gain as China scraps Export Rebates: Chinese Ministry of Finance has recently scraped a tax rebate (9-13%) previously available on exports of steel products with effect from 15 July 2010. This move is expected to benefit Indian steel players like JSPL

Debt Woes: Debt on the books of JSPL stands at Rs 5700 Cr. while that of JPL stands at Rs 2500 Cr. As a result, huge debt- service is affecting the profitability of the company. JSPL is planning to raise about Rs 2100 Cr. by issue of warrants to promoters on a preferential basis to help cut debt

The domestic steel demand scenario has been improving since the last two quarters, backed by increased government spending in infrastructure and recovery in the auto industry & capital goods industry. Demand from real estate is also expected to pick up in coming quarters. Globally steel prices are increasing and as the demand for steel increases steel prices are expected to remain firm in coming months. Power demand is also expected to increase substantially. All these factors together, is expected to increase JSPL’s sales and margins in the coming quarters

Considering all these factors, we can expect the short-term future outlook of JSPL to be Green (Very Good)

What is JSPL’s Long-Term Outlook?

JSPL has had an excellent financial track record and has a bright short-term outlook. The company has clocked robust growth rates in its EPS. Moneyworks4me valuations have given it a long-term expected EPS growth rate of 23%

What will help the company maintain this earnings growth rate in the future?

1) Integrated lowest-cost Steel Producer: With more than 20% market share, JSPL is the one of the lowest cost producer of sponge iron in India, due to its own captive resources of raw material and power; helping it reduce costs and increase operating margins. It has the largest coal based sponge iron facility in the world with an installed capacity of 6, 50,000 MTPA. Also, captive coal mines minimize fuel risks and reduce input and transportation costs for its power projects

2) JSPL’ Global Acqusitions to fuel future growth:

- Oman-based Shaheed Iron & Steel for $464 mn – Will give access to a gas-based hot-briquetted iron plant with capacity of 1.5 MTPA. The produce will also be exported to China, which has strong demand for hot briquetted iron. This acquisition will enable JSPL to benefit from rising demand in the Gulf and other West Asian economies

- Bid to buy a 60% stake in Zimbabwe Iron and Steel Company (Zisco) – This will deepen its presence in Africa and secure it significant iron ore reserves. Zisco has iron reserves of 100 million tone, limestone reserves of 60 million tones and also owns a 0.8 mtpa steel plant

- It has acquired development rights for 20 bn tones of Iron Ore in Bolivia and plans to invest US$ 2.1 billion over the coming years in Bolivia by setting up a 10 million ton capacity Iron Ore plant, 6 million ton capacity DRI plant and 1.7 million ton capacity steel plant, besides doing mining activity

3) Capacity Enhancements for Future Growth

- JSPL has an existing capacity of 1.3 million tonnes per annum of sponge iron and 3.6 million tonnes of finished iron. The above acquisitions will see it producing 7.5 million tonnes of steel by FY12

- The company has a total capacity of 475 MW on its books and 1,000 MW in its subsidiary, Jindal Power (JPL). Its power capacity is set to increase substantially from current 1475 MW to 6000 MW by 2014 with additions in various plants

- JSPL is developing a coal-to-liquid project in Orissa, with an investment of Rs.42,000 Cr., which will convert coal to diesel and other useful byproducts. The proposed plant will have a production capacity of 80,000 barrels a day

4) Debt to remain a major concern in future: Funding for its global acquisitions and domestic expansions, will result in substantial addition to its existing huge debt of Rs. 8200 Cr. JSPL’s interest cost has been increasing in the recent past and is expected to rise in future as well; this will put pressure on profitability

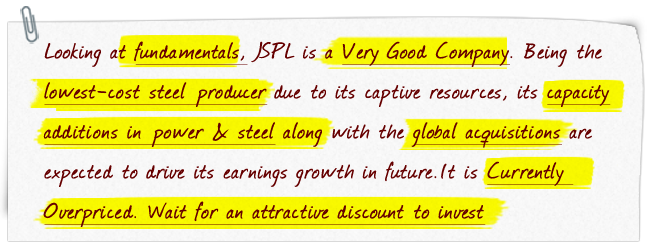

JSPL has achieved robust growth rates in its EPS in the past. It has always increased its EPS with impressive growth rates on a Y-O-Y basis, except for the last year when its EPS fell marginally, due to fall in demand across industries. Despite this, it clocked a 3 year CAGR of 27.4% and 5 yr CAGR of 23.2% in EPS. Going forward, JSPL’s planned capacity additions and acquisitions will help it to continue to grow at a robust pace. Though its rising debt could put pressure on its profitability. Looking at all factors, the company can be expected to maintain a maximum of 23% EPS growth in future. Even taking this growth rate into consideration, the company is currently overpriced

To get more on the company’s valuations, visit Moneyworks4me.com

JSPL is a large player in a market which has huge scope for growth. Existing supply-deficit and expected rise in demand for power, will create great growth opportunities for JSPL in this segment. Also, with the increased government spending in infrastructure, booming auto and capital goods industries and rising domestic demand for real estates, the demand for steel will also increase substantially in coming years

Considering all these points, we can expect the company’s long-term future prospects to be Green (Very Good)

Conclusion:

The company is among the best-positioned steel companies with 100% self-sufficiency in iron ore and growing proportion of value-added products. Along with its global acquisitions and capacity expansions, it is well-poised for growth in future

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

very good article…Nice work

Ideal analysis. Waiting for next dip to enter as longterm investor. GOPINATHAN PULLARA

Thanks a lot for your appreciation. Do keep reading and posting us your feedback.

would have liked if you had mentioned your mrp and the discount as of now and your guid line of 50% discount to have safty moot,then the entry would be well nigh impossible in immediate future.I sure am confused please clear the cobwebs,regards and thanks

Thanks a lot for your appreciation. You are right about waiting for the next dip as a long-term investor; this is a time you will find many fundamentally strong companies at attractive discounts. But, you can find few stocks even now, which are trading at attractive prices. As a part of Company Shastra, we have given a few of them Bharti Airtel ( http://bit.ly/9HmrLs ), Bilcare ( http://bit.ly/bHmAw3 ). You can also log on to http://www.MoneyWorks4me.com , where you can find companies which are trading at a discount. We also provide a feature called 5 Companies Below Discount Price every month which are well-researched stocks, worth buying. If you need any further clarifications on this, feel free to let us know.

what is the right price to invest on this company.?

If I am holding it what should I do bought long back around at very attractive price.

Ahmed