Shree Renuka Sugars Ltd.- Is it a sweet deal for the future?

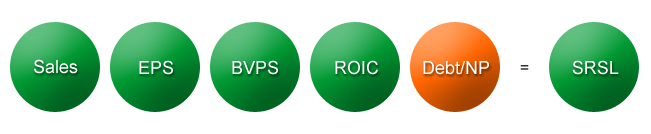

Shree Renuka’s 10 YEAR X-RAY: Green (Very Good)*

*Shree Renuka Sugars has a debt of around Rs. 1300 Cr. on a standalone basis for SY 2008-09 (SY- Sugar Year i.e October to September) . The high debt is on account of capital expansion projects undertaken by the company, specifically for construction of a refinery in Mundra SEZ. The Debt to Net Profit ratio is expected to come down significantly because of bumper profits in the first two quarters of SY 2009-10. However, on a consolidated basis, Shree Renuka’s debt is expected to increase considerably as the company has assumed the debt of two companies it has acquired in Brazil. This could be a cause of concern in the long term

Shree Renuka Sugars, in brief

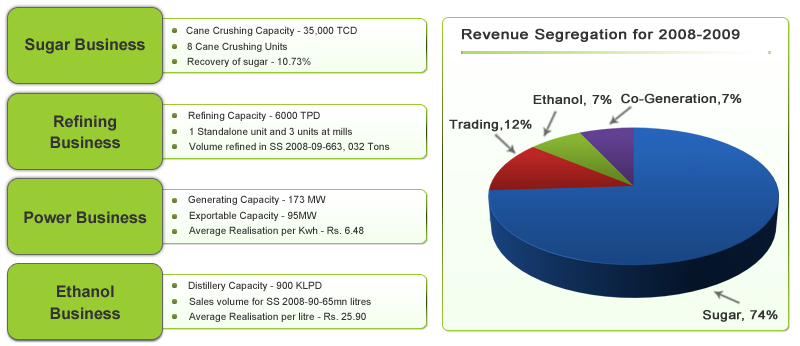

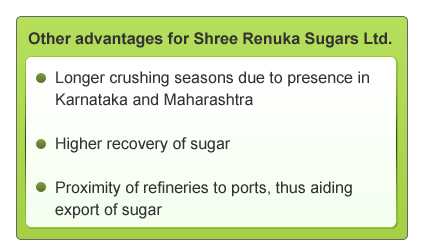

Shree Renuka Sugars Ltd. (SRSL) is the largest private sector sugar manufacturer in Western/Southern India. It is one of the first sugar mills to significantly forward integrate into alcohol (using molasses, a by-product of sugar) and power (based on bagasse). It is the second largest exporter of sugar from India with a presence in the Middle East, South East Asia and East Africa. It exports almost 20% of India’s international sugar trade. The company directly markets sugar to institutional buyers instead of selling to wholesale agents and dealers. SRSL sells premium refined sugar and is a sugar ‘supplier of choice’ amongst companies that produce carbonated soft drinks, fruit juices, chocolates, baby foods and dairy products. Its clients include Coca Cola, Pepsi, ITC, Britannia, Nestle and Cadbury, among others. It has been promoted by the Murkumbi family, The operations of the company are as shown below:

What does Shree Renuka’s past say?

*SY 2009-Sugar Year 2009 i.e. Oct’08 to Sept’09

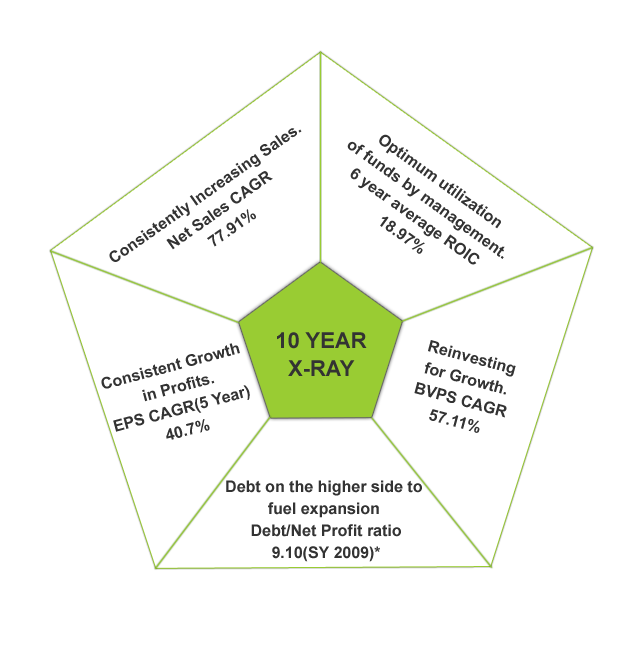

The 10 YEAR X-RAY of SRSL indicates that the financial performance of the company has been very good. Net Sales of the company has grown consistently (9 Year CAGR 77.91%), except in SY 2004 and SY 2007 when there was a drop in the growth. The EPS growth has also been consistent and the company has managed to record impressive figures inspite of the cyclical nature of the industry. The company’s book value per share has also increased considerably over the years at a CAGR of 57%. Return on Invested Capital has also been good indicating the efficiency of management of funds. However, the ROIC figures have decreased a bit in the last few years. The Debt to Net Profit ratio is 9.10 is high due to the debt taken for capital expansion projects. However, this is expected to improve for the next year.

Hence, considering all these factors, the 10 YEAR X-RAY of SRSL is Green (Very Good)

What is Shree Renuka’s Short-term Outlook?

• SRSL is setting up a 3,000 TPD port-based sugar refinery at a cost of Rs.4.5 bn in the Mundra SEZ in Gujarat; it is expected to be commissioned in a few months

• Ethanol capacity expected to go up to 1200 KLPD in 2011 from current 930 KLPD whereas sugar refining expected to increase to 9000 TPD from current 6000 TPD. Co-generation capacity expected to go up to 233 MW with an estimated surplus of 135 MW by 2011

• Sugar prices have corrected considerably over the last few months after record highs seen in January 2010. This correction was due to expectations of high production of sugar for the current sugar season. Going forward, global sugar prices are expected to remain steady at current levels, while ethanol prices are also likely to stay firm. This should prove helpful for Renuka

Hence, we can expect the short-term outlook of Shree Renuka Sugars Ltd. to be Green (Very Good)

What is Shree Renuka’s Long-term Outlook?

Shree Renuka Sugar’s de-risked and unique business model the key:

SRSL was one of the first players in the industry who invested in raw sugar refining capacities and diversified into ethanol production. It is also the first player to acquire sugar units in Brazil thus ensuring adequate supply of raw material. This flexibility in raw material sourcing is the key considering the limitation in sugar cane availability. The company has raw sugar refinery capacity of 6,000 TPD (to be increased to 9000 TPD) which helps to convert raw sugar into white sugar, which the company can sell in domestic or international market depending on the economies. The refining capacity helps the company to benefit from the opportunities arising due to the cyclical nature of the industry. The raw sugar has advantage over white sugar in storage and transportation. The favorable policy in importing the raw sugar through an advance license as compared to 60% duty on importing white sugar also helps the refining business. The company can adopt different strategies to improve the profitability

Deficit in domestic market – Import raw sugar and sell refined white sugar in domestic market

Surplus in domestic market – Buy raw sugar and sell refined white sugar in international markets

The company can also shift production from sugar to alcohol depending on which product offers better profitability especially in Brazil

Foray into Brazil through acquisitions:

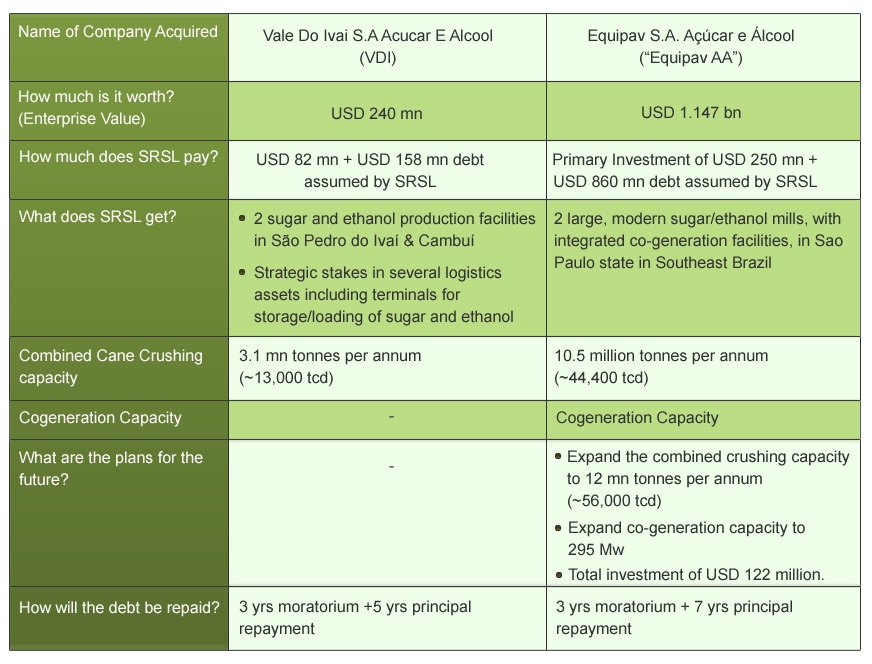

Since, its inception SRSL has been focusing on de-risking itself from the inherent cyclicality of the sugar industry. As a part of this, SRSL has become the first company to foray into Brazil, the world’s largest producer of sugar cane. Sugar/ethanol sector in Brazil has low operating cost, high scalability and highly conducive climatic conditions. The major intention behind foraying into Brazil is to improve access to supply of raw material. SRSL has completed two acquisitions in Brazil over the last year viz. Vale Do Ivai S.A Acucar E Alcool (VDI) and Equipav S.A. Açúcar e Álcool (Equipav) (See table for details). This has given SRSL an important foothold in the world’s largest sugar exporting market. Besides giving a secure source of raw sugar for its India refineries, it has also made SRSL one of the largest players in Brazil. The company has also derived significant logistical advantages from these acquisitions

BOOT model in power:

SRSL is planning to exploit potential for the development and growth of power generation using bagasse. The company is setting up Built Own Operate and Transfer (BOOT) cogeneration power projects in partnership with co-operatives with 2,500 TCD and above cane crushing capacity. All the financial investment will be made by SRSL. The co-operative sugar mills will supply the plant’s entire bagasse needs free of cost to SRSL and SRSL will provide power needed to run the sugar factory free of cost. SRSL will be able to sell the excess electricity generated from the co-generation unit to the grid. The company has recently commissioned first BOOT basis of 30 MWH capacity with 25 MWH of exportable surplus power at Ichalkaranji, Maharashtra for a period of 20 years. It is also implementing another 24 MW capacity project in Satara, Maharashtra which is likely to be commissioned in 2011. The management has estimated the total co-generation potential of ~ 1,000 MW in the co-operative sector. The company is looking for more projects in BOOT format over next three to four years

Talks about the Government deregulating the sugar industry:

After the deregulation of the petroleum industry, the Government is now considering the deregulation of the Sugar industry as well. India’s Food and Agriculture minister, Sharad Pawar, has recently talked about the need of decontrolling the sugar sector. As of now, the Agriculture ministry allocates the monthly quotas to the mills, according to which the mills sell their produce in the open market, as well as through ration shops. The Government also claims a monthly levy quota of 20%, under which sugar is given to the government for public distribution system (PDS). This could be a possible area where decontrol will take place. The government might also do away with decisions on import and export and specifying the distance between two mills. However, it is highly uncertain whether this will actually fructify into some concrete steps being taken. Sugar is a highly politically sensitive commodity. The Government has tried deregulating the sector in the past only to retreat and go back to the controls. If the deregulation does go through, it will act as a major growth driver for the sugar industry and Shree Renuka Sugars, in particular

Increased debt levels on a consolidated basis, a concern

SRSL has assumed around USD 1 bn of debt in the acquisitions of VDI and Equipav in Brazil. Hence, the debt levels of the company are expected to go up on a consolidated basis. It has re-negotiated the debt payment terms with the respective lenders and has got a 3 year moratorium for repayment of debt for both these acquisitions. This gives SRSL sufficient breathing space in the short term. However, over the long term, the high debt levels could pose a problem for the company, if it fails to make the most from these acquisitions.

However, Shree Renuka has a past record of acquiring distressed companies and turning them around.

Thus, considering Shree Renuka’s unique and de-risked business model, increased capacities and strategic acquisitions in Brazil, we can say that the long term future prospects of the company are Green (Very Good)

Conclusion:

Shree Renuka’s unique and de-risked business model has made it one of the most innovative and efficient sugar producers in the country. It is now looking to establish a global footprint through acquisitions in Brazil. Looking at its history of buying troubled companies and turning them around, the company is expected to make the most of these acquisitions and emerge as a global leader in the future.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Sir what ids the MRP of Renuka Sugar?

whereas the co.m/sshree renuka has got abt 1300 crores of debt,hw an investor can expect return on their investment.

the primary concern of the co. might be liquiditing the debt first so as to lower down it's debt liability to ensure profibility in

future.

plz do throw light on this point to dispel the cloud naturally to be found in investors' mind.

kailash thakur,retd.joint commissioner

Please log onto http://www.moneyworks4me.com to know the MRP and Discount Price of Shree Renuka Sugars and other stocks as well.

Sir,

Debt is a bad thing only if the company does not have the capacity to repay it. In Shree Renuka's case, as we have mentioned, it had taken debt to fund expansion of its capacities. However, its profits have increased considerably over the last few quarters and hence the debt to net profit ratio is expected to be more comfortable for the next year. Having said this, Shree Renuka has assumed the debt of the two companies it has acquired in Brazil for which it has got a moratorium of 3 years. Thus, on a consolidated basis, the debt could be a concern in the long term and needs to be watched out for. As investors we need to keep a watch on how the company goes ahead with the repayment of its debt. We will no doubt be keeping a watch on this and inform our investors accordingly.