Tata Consultancy Services Ltd. – Will it be on a high-growth trajectory?

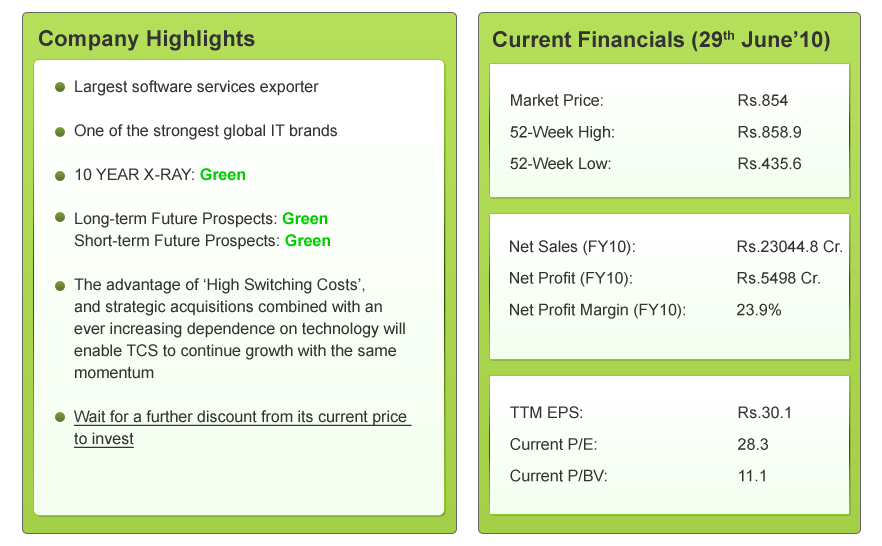

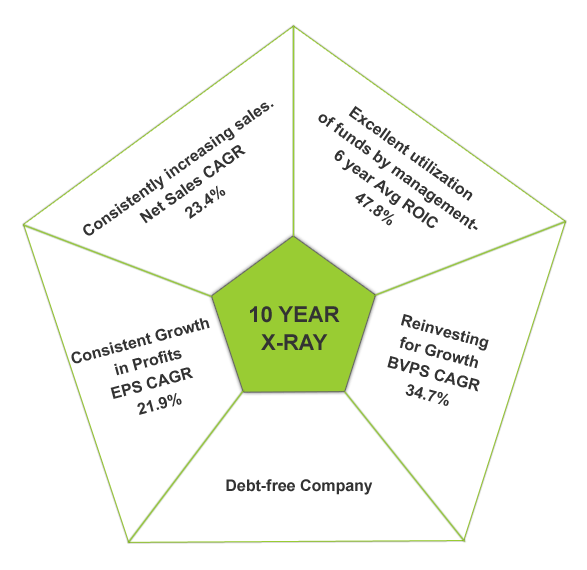

TCS’s 10 YEAR X-RAY: Green (Very Good)

TCS, in brief

TCS, a Tata group company (74% shareholding) is the largest software services exporter from India. It is a global technology services company that provides end-to-end business solutions to its clients. TCS offers a consulting-led, integrated portfolio of IT and IT-enabled services delivered through a Global Network Delivery Model, recognized as the benchmark of excellence in software development. Along with its subsidiaries, TCS operates in 55 countries with over 1,60,000 employees

What does TCS’s past say?

TCS has performed robustly in all its parameters over the last 6 years. Its impressive fundamentals in the past form a strong base for its future

TCS has registered an impressive 5 year Net Sales CAGR of 23.4%; this has been a result of high repeat business (95%+) from existing clientele and at the same time continuously increasing new clientele base. Also, the company has managed to clock a consistent growth in profits, registering a robust 5 year EPS CAGR of 21.9%.

Hence, the 10 YEAR X-RAY of TCS is Green (Very Good)

What is TCS’s Short-term Outlook?

• Revenue Growth in FY 10 was led by:

> Services such as Application Development & mantainence, Business Intelligence & Infrastructure services

> Industry verticals like Telecom, Retail, Energy and Hi-Tech

> Geographies like North America, UK and Asia-Pacific

• TCS is also witnessing a revival in transformational long-term deals, which went on the back burner during FY09 due to the slowdown. The company bagged 15 large deals during the March quarter and 10 big orders in the this quarter. This is expected to increase the company’s revenues

• Despite a wage-hike, higher tax-outgo and appreciation in the rupee, its margins at 27% were affected marginally; mainly due to a higher% of offshore revenues

• TCS’s outstandings (debtors) a slight cause for concern: On a standalone basis, 1/3rd (Rs.951 Cr) of TCS outstandings are due for over 6 months, which is a sizeable amount. Going ahead, if not kept a check on, can be a cause for concern

For FY 11 –

• The company expects the pricing to remain stable right now and on the back of growing demand, is expected to go up in the later part of the year. This will lead to improved realization in the second half of FY11

• TCS has increased its hiring target from 30,000 to 40,000 for FY11; While a part of this increase is to refill the vacancies created by higher attrition rates, a major chunk of it is to cater to higher demand.

• TCS’s ‘bank-in-box’ solution gaining momentum: C-Edge, a 51:49 JV company promoted by TCS and SBI is offering core banking services ‘Bank-in-a-box’ to rural & co-operative banks and seeing good adoption. This initiative which begun 3 years ago, was not so popular then; however, in the past six months C-Edge has added 1,000 branches and expects to further add many more going forward.

• TCS has given guidance of a stagnant margin % (approx 27%) in the coming quarters due to:

> a wage-hike being planned in the short-term

> tax benefits applicable to the company by way of Software Technology Parks are due to expire in March 2011. This indicates a higher tax outgo, hence likely to put pressure on profitability

• Also, with the European crisis becoming bigger and spreading to other countries, TCS does face some risk here.

Despite these few concerns, TCS has posted positive growth in the last few quarters when almost every IT company tumbled. By posting robust results in comparison to its peers, TCS is expected to take advantage of the gradual recovery in the demand for IT services and solutions in the US and Asian markets.

Hence, we can expect the short-term outlook of TCS to be Green (Very Good)

What is TCS’s Long-term Outlook?

TCS has a great past and with its last few quarters performance, it has proved that it has the ability to be a winner, even in tough times.

Now, what factors will help TCS be on a high-growth trajectory in the long-term, too?

1) Products & Software services with ‘High Switching Costs’ : TCS has products & services with high switching costs i.e. clients find it difficult to shift to another partner . TCS generates most of its revenues from repeat business from existing clientele; i.e. more than 95%. This is a proof of its excellent quality of service delivery. A strong focus on a customer centric approach has helped the company migrate its existing clients into higher revenue brands and also increase the number of key customers. A high repeat clientele business also ensures lesser effort/expenditure spent for acquiring new clients This advantage has helped the company increase business from existing & new clients; ensuring consistently growing sales.

2) Clients’ increasing dependence on IT: While moving up the growth path, every client depends more and more on technology for every task. Once a client selects TCS as its partner, for each and every upgrade/new system on technology the client prefers to go back to TCS. Also, once TCS understands a client’s way of working, business model & processes, the client is comfortable with TCS as a partner, making it even more difficult to switch from.

3) Strategic acquisitions have led to strong(profit and sales accretive) subsidiaries: TCS has made many strategic acquisitions in the past few years, which have led to strong subsidiaries and helped it strengthen its leadership position in terms of its industry and service lines.

For eg:

• TCS e-serve ltd. an acquisition of Citigroup’s BPO registered a good growth of 19% in the last year.

• CMC- TCS is expected to gain the most from CMC.; an expert in infrastructure management services, a fast-growing-high-revenue service. The other advantage that CMC brings is strong domestic presence and a sizeable government clientele. TCS may be well-placed to tap this segment as various government utilities are now increasing their IT spends.

Where, in FY09 out of 56 subsidiaries, 21 were loss-making, TCS has brought this figure down to 13 in the current year. Hence, these subsidiaries are expected to strengthen the company’s position in the long-term

4) Re-structuring for Growth: TCS has divided its operations into verticals, each headed by a leader(director) with a certain goal. Each of these directors reports to the CEO of TCS. This way of working is well-aligned for future growth as it brings efficiency and allows each leader to move towards a certain goal and hence, collectively achieve a larger output.

5) Strong focus on non-linear growth & revenues from new services: TCS is planning to focus on non-linear revenue growth i.e. growth based on Intellectual Properties solutions and reusable components; where work is not effort-based/where growth is not linearly dependant on head count. These will result in better margins and reduce pressure from salary hikes in the medium term.

Also, in order to provide clients with integrated services, since the last few years, TCS has started with many new service lines like BPO, Infrastructure, Assurance & Asset Leveraged solutions etc. As of FY10, these services contributed 25% to TCS’ revenues. TCS expects demand for these services to lead growth in future.

6) Efficient Global Network Delivery Model: TCS’ Global Network Delivery Model™ is the engine that has assisted in providing great service to its clients. It has enabled them to achieve client satisfaction ratings of 89% for meeting quality expectations and an average budget variation on projects of just 3% — both figures far better than industry norms. This helps it maintain customer satisfaction, at the same time increase its geographical reach. TCS sees consumers in new emerging markets like Latin America, China as new engines of growth and demand; it is expected that this model will help it reach out to these markets

7) Concerns:

• Geography wise, its revenues are highly dependent on clients located in the U.S. and Europe, an economic slowdown in these countries/industries may affect its business

• Currency fluctuations may bring down profitability

• Intense competition by global firms such as Accenture Limited, Capgemimi, Hewlett-Packard Company, & Indian firms – IBM, Infosys, and Wipro etc; may put pressure on demand for its services.

As India’s largest and most-experienced services firm, TCS is well-positioned to benefit from the growing demand for offshore IT services. Hence, we can expect the long-term future of TCS to be Green (Very Good)

CONCLUSION:

TCS is India’s largest IT company and one of the strongest brands. In the recent past it has outperformed its peers in terms of registering great financial performance. Its ability to generate repeat business from its strong client base and strategic acquisitions have been its major growth driver till today & with our ever-increasing dependence on technology solutions, a company like TCS is poised for good growth in the future

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

yes, tcs , with such dynamic and practical leadership, is on theuptrend as always baljit singh:kuwait

really T.C.S. is a vert marvellous company in I.T. Sector having a very

large spectrum,stability & trustworthiness,loyality towards staffs & sincerity to

it's clients & good returns to the investors.

what should be the ideal ,

level of investment after correction in it's share price.

thanks & regards.

kailash thakur

Of course TCS is a Great Company – to work, to invest. I accompanied my son to Chennai in 1992 when he finished his MTECH in Comp.Science. In due course I bought shares, not in a great number. Today my avg cost of 20 shares is 450/. In case I buy another 20 now say@850/ it will cost me another 17000/ +9000/ earlier will give me avg cost of rs.650/ still discount of rs.200/- . Suppose this discount is not enough and I wait further and if

price corrects by another rs.100/ my avg cost will be 15000+9000=24000 div by 40 will be rs.600/. But if instead of correcting further, if price goes up by another 50/ rs. only, my cost will be 900×20=18000+9000=27000 div by 40 my avg cost will be 675/ will it not be prudent to buy at current price and get a discounted price of rs.650/? Any comments?. NB my son left TCS in 1996- too frequent and too many transfers. He wanted a steady life because I also used to be transferred very freqently. Retired from service in 1992. Present hobby is, spread stock investment culture.

Hi,

You are completely right, TCS is a company that is expected to be poised for great growth in the long-term.

Keep reading and posting your feedback and comments

Thank You.

Hi,

You are completely right. In the long-term, TCS is expected to continue growing with the same stability. To know the ideal price to buy TCS, log on to MoneyWorks4me.com . Here we have provided you the MRP (benchmark for Sell-Price) and Discount Price (Benchmark for Buy-Price) for over a 1000 stocks.

Hi,

You are completely right about TCS being a great company to invest in. It is expected to have great growth prospects in the long-term. To know the ideal discount price of TCS, log on to MoneyWorks4me.com . Here, you will find the Discount Price for over a 1000 stocks.

We are glad to know that your present hobby is to spread the stock investment culture. Our site is very well-aligned with the same objective. MoneyWorks4me.com was initially started with the objective to enable investors to take sensible stock investing decision. Stock Shastra is an educational initiative by MoneyWorks4me.com to educate retail investors, so that they can learn to invest in stocks directly. Read our Stock Shastras (1-13), http://bit.ly/cUlLMf and let us know your feedback..

Thank You

Hi Tcs is greate company to invest and I think RS.700 is Discount Price for TCS which is in forst week of june

Hi Swapnil,

Yes, TCS is a great company indeed. As we have said in the article, you need to wait for a further discount to invest. To know the exact discount price of TCS, become a member of MoneyWorks4me.com where we give you the Discount Price & MRP of over a 1000 stocks. The Discount Price and MRP of a stock are benchmarks for the buy and sell price respectively and hence, help you to take better buying and selling decisions.

For any further clarifications, please feel free to let us know through your comments.

Thank You