ICSA (India) Ltd. – Is it likely to carry on the glory of its past?

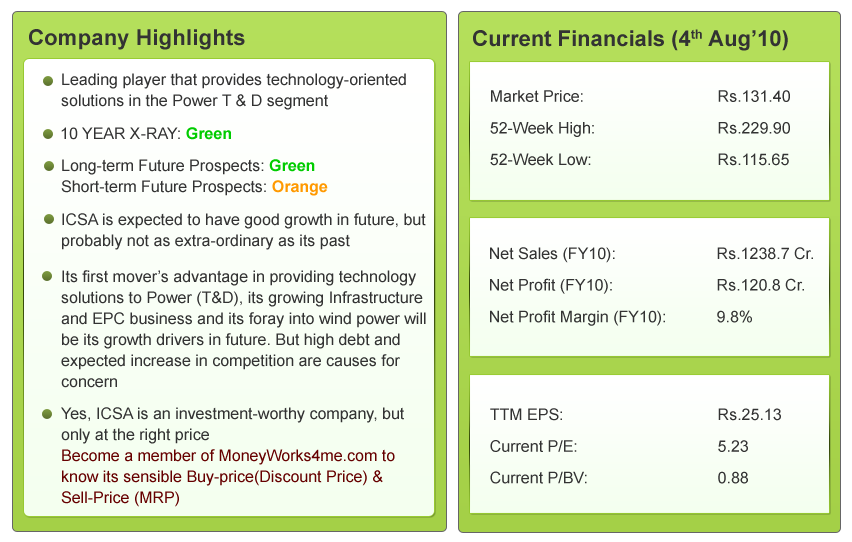

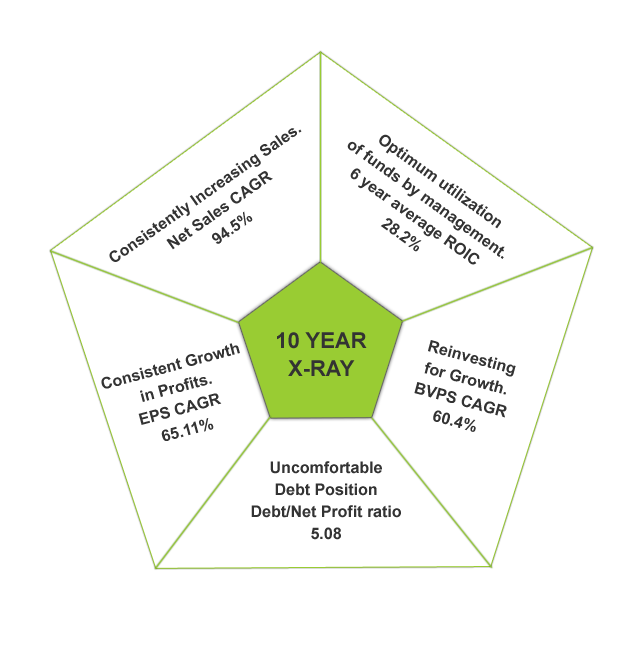

ICSA’s 10 YEAR X-RAY*: Green (Very Good)

*ICSA has a high debt/net profit ratio, due to the high debt on its books; a result of the high working capital requirements

ICSA, in brief

ICSA is a Hyderabad-based technological solutions provider. It has developed technology solutions for the Power Sector to identify Transmission and Distribution (T&D) losses and monitor power consumption using GSM Network. It has 2 revenue segments i.e. Embedded Software Solutions and EPC Services.

- Embedded Solutions: ICSA provides technology solution to identify transmission and distribution losses, discover faults in transmission line, remote access of data from smart energy meter, theft detection devices, remote billing systems etc

- EPC: ICSA is one of the leading Indian companies offering turnkey services for electrical infrastructure projects in power generation, transmission and distribution sectors. It offers turnkey services like design, supply, transport, erection, testing & commissioning of 132 KV to 400 KV Transmission Lines & Sub Stations on EPC (Engineering, procurement and construction) basis.

ICSA has secured many patents for its innovative products like Intelligent Cathodic Protection (ICAP) System, Intelligent Automatic Meter Reading (IAMR) and Distribution Transformer Monitoring System (DTMS). It caters to industries & utilities especially the Energy Sector, which includes power, oil, and natural gas & water distribution segment.

What does ICSA’s past say?

ICSA has registered an impressive 9 year Net Sales CAGR of 94.5. Also, the company has managed to clock a consistent growth in profits, registering a robust 9 year EPS CAGR of 65.11%.

The company’s debt/net profit ratio at 5.08 is a cause for concern. The company has Rs. 613 Cr. debt on its books; mainly due to a high working capital requirement due to the company’s increased operations in the infrastructure and EPC segment.

ICSA has performed robustly in all its parameters over the last 10 years. Its impressive fundamentals in the past form a strong base for its future.

Hence, the 10 YEAR X-RAY of ICSA is Green (Very Good)

To view its past 10-year performance in a simple color-coded 10 Year X-Ray, visit Moneyworks4me.com

What is ICSA’s Short-term Outlook?

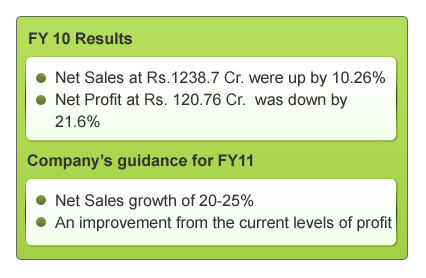

FY 10 results, Increase in Sales, but drop in Profits:

The company posted a rise in sales of 10.26% led by the growth in Infrastructure Projects and Services. Revenue from its high-margin segment i.e. Embedded Solutions fell by 36%. Also high depreciation & interest costs led to a drop of 21.6% in profits

Short-Term Outlook:

The next quarter of the company is expected to remain sluggish due to delay of the projects in the embedded solutions segment. However, the revenue is expected to improve with a ramp up in order visibility in embedded solutions from Sep’10 onwards. One such positive could be the projects from Restructured Accelerated Power Development and Reforms Programme (RAPDRP) which have been delayed due to polls in various parts of the country. The company expects that all the states will award their contracts by September 2010; the implementation will start from H2 FY12.

Smart Energy Meter to drive revenue growth:

ICSA has recently started production of Smart Energy Meter (SEM) from its Hyderabad plant. This manufacturing plant has the capacity to manufacture 1, 50,000 meters per month. The company has invested approximately Rs. 26 crores for setting up this plant. The SEM business is a part of the embedded technology business and is expected to help in accelerating the company’s revenue growth from this financial year onwards.

Strong order book position:

The company’s order book at the end of March 2010 stood at Rs. 1835 Cr. This includes Rs. 352 Cr. from Embedded Technology segment executable in FY2011 and Rs. 1483 Cr. (60% in FY11) from Infrastructure EPC segment to be executed over next 18-24 months. Few of the recent orders are:

- Orders worth 1.3 billion rupees from the Power Grid Corporation of India Ltd received in March 2010

- Order of Rs. 254.21 Cr. from Bihar State Electricity Board for Supply, Installation / Erection of Rural Electricity Infrastructure and Household Electrification in Katihar District of Bihar on Turnkey basis under Rajiv Gandhi Grameen Vidyutikaran Yojna

High Debt a cause for concern:

The company has a relatively high debt of Rs. 613 crore (excluding FCCB) with an overall average cost of debt of more than 11%. This high debt is eating up a major part of company’s profit. The high debt is mainly on account of a substantial amount of cash locked up in sundry debtors. Also, the outstanding FCCBs at the end of the year is US$ 21 million which is due in 2012. The conversion price has been reset to Rs. 189 per share.

Despite the flat results expected in the next 2-3 months, the company is expected to post good results thereafter with a recovery in embedded solutions business and a strong order book.

Considering these factors, we can expect the short-term of ICSA to be Orange (Somewhat Good)

What is ICSA’s Long-term Outlook?

ICSA has a great past, registering robust growth rates in Sales and Profits. Its short-term, though flat for the next few months, is expected to improve by FY11 with an expected increase in embedded revenues.

Going forward, is ICSA likely to carry on the glory of its past?

1) Well-positioned for future growth in India:

T&D losses (around 40%) are much higher in India than any developed country mainly due to lack of adequate investment on transmission and distribution (T&D) works. Out of these losses, the losses in the distribution sector alone are quite large. The situation is further compounded by power thefts and poor state of infrastructure.

Transmission is now receiving more focus than ever before. The Government of India is pursuing an open access policy in the Transmission Sector. It has launched Restructured Accelerated Power Development and Reforms Programme (RAPDRP) to cut down the T&D losses. ICSA enjoys a prime mover’s advantage in the power sector reforms programme as it has specialized products in the Embedded Technology and Software division that cater efficiently to this entire problem. ICSA makes products, which primarily detect ‘where’, ‘how’ and ‘how much’ are the T&D losses and thus help the impacted institutions. With its strong R & D focus in embedded technologies coupled with domain knowledge in power sector, ICSA has deployed its products and infrastructure projects in various distribution companies in India and overseas.

The demand from the above is expected to drive the future growth for ICSA’s revenues.

2) Increasing Government Focus on Power-Losses:

The Government is taking many initiatives to cut down on power-losses – an area which will increase orders for ICSA. A few initiatives are given below:

- Government has re-launched RAPDRP (Restructured Accelerated Power Development and Reforms Programme) with a view to achieve 15% T&D loss level. The RAPDRP has a budget of Rs 50,000 crore to be spent over 3 years of which Rs 10,000 crore is towards Meter data acquisition technology (the segment which the Company caters to). Considering the funds allocated towards control of T&D losses, it offers a huge opportunity to ICSA.

- Increased allocation of Government projects under Rajiv Gandhi Grameen Viduytikaran Yojana (RGGVY) to Rs. 7,000 crores, up by 27%, will see significant orders coming in for ICSA.

3) SCADA Opportunities in India:

ICSA India Ltd. has entered the Supervisory Control and Data Acquisition (SCADA) business in India. It would facilitate proper handling of loads and efficient planning of network for future growth by using proven power system planning tools. The real time monitoring & control of the distribution systems through state-of-the art SCADA encompassing all networks will help in reducing Aggregate Technical and Commercial (AT&C) losses and increase efficiency in the energy management.

It is expected that the SCADA opportunity in India would grow to around Rs. 2,500 crore in next three years. The need for SCADA is also imminent for oil, gas and water sectors in the near future. Huge spending would take place in the next 3-5 years in these sectors as well.

For this, ICSA has partnered with Yantai Dongfang Electronics Information Industry Company Limited based in China. Both Dongfang and ICSA have been empanelled as SCADA implementation agency (SIA) by the Power Finance Corporation. Through this empanelment, ICSA would be eligible to participate in SCADA implementation projects in power sector.

4) Foray into Wind Power:

In order to enhance the revenue and enjoy tax benefits, ICSA has diversified into non-conventional energy and is setting up a 20 MW capacity wind power project in Andhra Pradesh out of which nearly 10MW has already been commissioned. With the commissioning of another 10 MW expected this year, revenue from this project is also expected to increase substantially.

5) Concerns:

a) ICSA’s current (FY2010) debtors’ cycle is 158 days. Though it has come down from 169 days (FY2009), it is still very high. Also, the proportion of debtors more than 6 months to total debtors has gone up to 21% from 18.7% for 2009. This may lead to increase in write-offs and will further affect profitability. This has lead to a high working capital of Rs.1109 Cr. – a figure that is unreasonable considering its turnover of Rs. 1238 Cr. Due to this high working capital requirement, the company has a high debt of more than Rs. 600 Cr. with overall average cost of debt of more than 11%. This high debt is eating up a major part of company’s profit.

b) Entry barrier is low so other technology-oriented companies may develop and offer embedded software solutions and compete with the Company’s concentrated business. Also, in EPC segment, the competition is going up rapidly. In the last one year the Company has seen pricing pressure due to competition.

c) The margins are expected to decrease in the coming years, due to the shift in business revenue mix, leading to an increase in share of infrastructure EPC segment.

Despite these concerns, ICSA is well-positioned to grow in the long-term, but probably not as extraordinary as its past. It is very well placed to take advantage of the Indian growth story; especially the increased focus on T&D losses.

Hence, the long-term future prospects of ICSA can be expected to be Green (Very Good).

CONCLUSION:

ICSA is poised for good growth in future considering that it has the first mover’s advantage in providing technology solutions to the Power sector. The Government’s support is expected to be a major growth driver. Its increasing revenues from the Infrastructure segment and foray into wind power segment will further enhance its growth

Yes, ICSA is an investment-worthy company, but is it at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on ICSA right now, become a member of www.moneyworks4me.com to find its right value.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

As the current price is just above 52Week low, one can start buying in small lot of 15/20 shares and if price drops by another 20 rs. wait for the next quarter result. But if u are not risk averse , if price comes to 1o5/100 buy another lot of 50. Lot of people do not like to averaging the cost. But if u

have a fundamentaly good company then this risk can be worth taking. U can also compare with Areva T&D before taking action. – Borkar