Titan Industries Ltd. – Will its Brand do the trick?

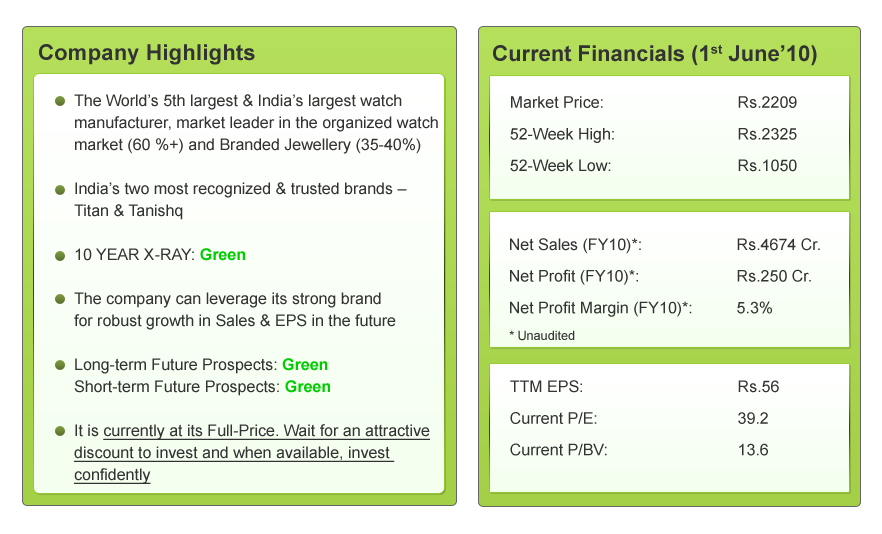

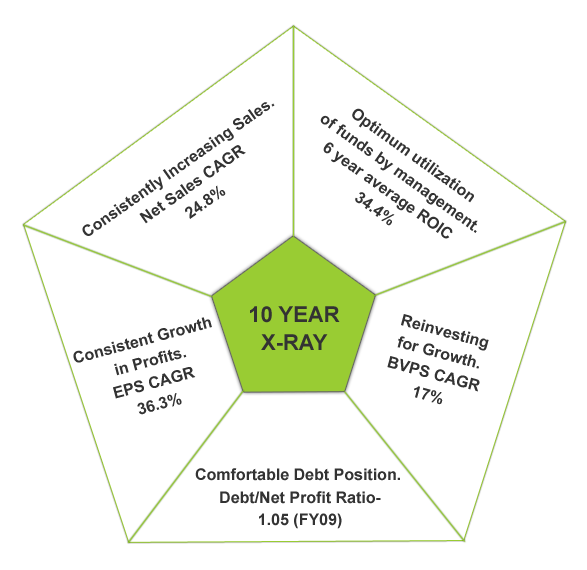

Titan’s 10 YEAR X-RAY*: Green (Very Good)

(* 10 YEAR X-RAY shows the financial performance of a company in the last 10 years.)

Titan, in brief

Titan Industries Ltd, a joint venture between the Tata Group & Tamil Nadu Industrial Development Corporation, is the world’s fifth largest & India’s leading manufacturer of watches (60%+ market share in the organized Indian market). It is also the market leader in branded jewellery with a 40% market share. In both the segments, the unorganized segments dominate the market

It has four main business units, viz. Watches (brands like Titan, Sonata, Fastrack), Jewellery (Tanishq), Eyewear (Titan Eye +) and Precision Engineered Components. Jewellery (70%) and Watches (20%) contribute a major chunk of its revenue.

It operates through 539 stores for its 3 segments through the following retail formats; all designed to give a memorable buying experience to its customers :

The company has five manufacturing plants in Hosur, Dehra Dun, Baddi, Roorkee and Goa. Its products are sold across the world

What does Titan’s past say?

Titan Industries has performed robustly in all its parameters over the last 10 years. Its impressive fundamentals in the past form a strong base for its future. It has increased demand consistently over the years, evident in its impressive Net Sales CAGR of 24.8%, strongly aided by its growth in Tanishq. Besides, it has improved on its margins in the watches segment to also deliver a 36.3% CAGR on EPS. Both its brands have helped Titan grow its Net Sales & EPS in the past. Titan Industries has been able to convert its high brand equity (its moat) in an excellent financial track record. Hence, the 10 YEAR X-RAY of Titan is Green (Very Good)

What is Titan’s Short-term Outlook?

–

- Segment-wise Performance:

- Both, Watches & Jewellery benefited from a longer wedding season, steadily increasing gold prices and an improvement in overall consumer sentiment

- The B2B business of precision engineering was affected due to the slowdown & postponement/cancellation of orders

- It recently shut down 2 of its stores in the US market owing to the slowdown. Titan plans to concentrate on the Indian market for its jewellery segment. Even in the watches segment, it was witnessing stagnancy in the Dubai market, hence it is shifting focus to smaller international markets like Vietnam & Oman

- Titan plans to focus more on its jewellery business (70% revenue), especially on studded jewellery as margins are higher

- To capture the kids segment, Titan recently launched a new brand ‘Zoop’

Despite its exports being a concern, the demand for watches & jewellery in India is expected to further increase with the improvement in consumer spending. Hence, we can expect the short-term outlook of Titan Industries to be Green (Very Good)

What is Titan’s Long-term Outlook?

Till date, Titan has achieved growth & success because of its brand.

Let’s see what will its moat of a strong brand do for Titan’s future in its 3 segments?

Titan – Using the right segmentation & smart branding strategies, Titan has successfully captured the watch market. Over the years it has launched brands to cater to each segment. For example: Titan for the premium segment, Fast-Track for the youth, Sonata an economy brand, Raga to target the women etc.

Once Titan had captured a large market, it moved from its initial strategy of gifting concept, to attaching watches as a fashion accessory; a statement of lifestyle. For this, it initiated the concept of ‘Matching Watches to Clothes’ to remove the earlier perception of watches being a one-time buy. Roping in Aamir Khan added to its brand value. With this, the company also launched its superior range of watches offering people the option of upgrading this part of their wardrobe. This helped the company improve its margins. It is further aiming to improve margins by concentrating more on its premium watch brands like Xylys. Also, the company is setting a new plant at Pantnagar, with an annual production of 3mn watches to cater to the increasing demand

Tanishq – Titan launched its jewellery segment, Tanishq at a time when Indians only followed the traditional way of purchasing jewellery. Local jewelers were the only existing players then. The trust & value that Titan commanded in the market helped it successfully diversify into the jewellery segment starting in 1994. It pioneered the concept of branded jewellery at that time. Till date, 90% of the Indian market purchased jewellery from the unorganized/local jewelers.

Tanishq has built a brand for itself, where now people consider going to a national brand to purchase jewellery. It has grown its sales from Rs. 268 Cr. in 2002 to aprrox Rs. 3505 Cr. in 2010 registering an impressive CAGR of 30%+. It is well-positioned in a market where huge opportunity exists in the form of branded jewellery taking over from local players. It has always promised superior quality jewellery with purity. Aimed at touching the Indian woman’s heart, Tanishq is now focusing on creating jewellery for each scenario/occasion – Valentine’s Day, Wedding etc.

- In fact the branding of jewellery with its new commercial – ‘The Jewellery that makes you want to Marry!!!’ has become a big hit

Right now, Tanishq appears to be aiming at achieving high volumes, even at modest margins. The company is already shifting focus to the high-margin studded jewellery segment.. With the Indian jewellery market expected to grow from Rs 80,000 Cr. to around Rs 1,25, 000 Cr. by 2014-15, Tanishq is well-positioned to achieve a balance of robust growth in sales & margins

Titan Eye+ Recently (2007), Titan has entered into a new market i.e Titan Eye +, which is its prescription eyewear business. This is another market where there is no well-known national brand & people shop at their local opticians. By foraying into this segment, Titan is again aiming re-create its success as it has done in the branded jewellery segment. It currently has around 86 Titan Eye + outlets (FY10) in the country and has plans of increasing the number of stores.

Hence, we can expect Titan’s long-term outlook to be Green (Very Good)

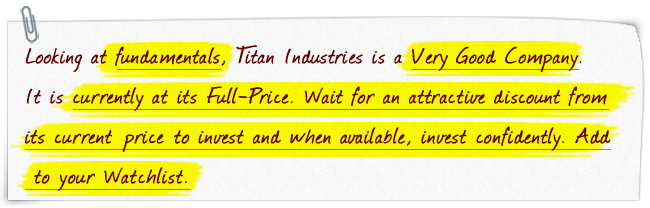

Conclusion:

Titan Industries is a leader in watches & jewellery in India mainly because of the strong brand developed by it over the years. The company can leverage its strong brand to grow its Sales & Profits in the future

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Very good analysis of Titan Industries.

Thanks Supria.

Thanks. How about instead buying 1 unit of ETGF buy 1 share of TITAN? Any comment?

thanks for very nice analysis

Thank you so much for the appreciation.

Have you seen its P/E..Its 40..All the positive things you say have already been factored in the price.

Hi,

The performance of Gold Exchange Traded Funds is solely dependent on the prices of gold. Whereas, in the case of Titan, it is dependent on its business model which not only has Tanishq (branded gold jewellery and now a very famous brand for diamond jewellery too), but also Titan (well established brand in the watches segment) and Titan Eye+(eye-wear). In the long-term, the performance of 1 share of Titan Industries will depend on its performance and success in these 3 segments + any other product extension in future. So, we don't think the 2 are directly comparable. What is your view on this?

Hi Navjot,

You are absolutely right by saying this. It's strengths & growth prospects have already been factored into its price.Titan has been a company with a high historical P/E- average of 6 years is 43. But, you never know when the market can throw open opportunities; for eg: March,2009 – the company's price was around 800, trading at a comparatively lower P/E of 23. At such times you should go ahead & invest confidently.

I have been following your stock shastra and in the recent past, the companaies are trading at their 52 week high price. When you mean “Wait for attractive discount”, what levels do you suggest?

Hi Ujwal,

According to value investing principles, you should ideally be looking for a 50% discount to its Full-Price. This provides you a margin of safety against the volatility in the stock market & minimizes your risk. For more on how to find the Full-Price of a company log onto MoneyWorks4me.com.

Hi, Yes both are not comparable. What is important n deciding factor is whether to buy or sale.

At a price n time it is good buy or sale. My Guru taught me, when u like it – the price n time –

u make a token entry and/or exit and every movement of the stock u further buy or sale, this he

taught me some 40 years back. I follow this n out of say 10 initial purchases, stocks like, L&T,

MRPL, SAIL, Jain Irrigation, Apar Ind., JB Chemicals, Tata Chemicals, Info, Wipro, Apollo Tyres

have given bountiful of returns.

Of course there are always some bad fruits but that is the game. What u have to see the overall

yoy annual returns. I am quite happy, if u keep ur expectations moderate n realistic u will also be

happy. Happy investing and making money. Arthachakra

Great analysis on a great company. I am looking at this site for the first time. Although the company is great. The stock is definitely not….when priced 39x earnings. Not sure how many can track for months or years to get real bargain. I request you to unearth hidden gems in the market especially in mid cap and small cap space in which people can invest immediately. I ahve one more question…why I don't see price/EV or even better EBIDTA/EV parameter to indicate real bargain.

Hi,

Thanks for the appreciation Girish. You are right, at an almost 18000 index you will find great companies, but it is difficult to find great investments, mainly due to the high P/Es companies are trading at. I don't think you really need to track the stock price for days/months/years, you should just enter your target buy/sell price as your trigger & once it reaches that target price, go ahead & take a decision.

For hidden gems, we have given company shastras on Bilcare ( http://bit.ly/bHmAw3 ) & Hind. Zinc ( http://bit.ly/cSA27Q ) which are at a discount. Have a look at the links

To find more hidden gems you can visit our website MoneyWorks4me.com where we provide you with companies below/at discount every month.

Thanks for your suggestion about the ratios like Price/EV, we will surely have a look into it.

Hi…I m new to this financial world…but i tried to do a DCF analysis…I got a fair value price of Rs. 1318….I estimated a cashflow increase of 25% from now on i.e. from 2009 onwards as i didnt get 2010 results which is a v optimistic measure….I dont kno whether i hv performed it correctly or not…can u pls tell me whether i m right….