This article summarizes the investment strategy of Siddhartha Bhaiya, the Managing Director and CIO of Aequitas. He is a qualified CA and the driving force behind Aequitas, with more than 20 years of experience in Equity Research and Equity Fund Management. He has been instrumental in taking Aequitas from a start-up to one with a consistently strong performance track record.

He believes in generating outsized returns by investing in small-cap undiscovered companies. He is a specialist in bottom-up stock selection and identifying multibaggers. Multibagger stocks are equity shares of a company which are capable of creating returns several times higher than their associated cost of acquisition. His approach has helped generate a 34% CAGR since inception for Aequitas’ investors. This means that INR 1 million invested with Aequitas in February 2013 was worth INR 25.8 million as on 29th February 2024.

Without envy and in the spirit of learning, we must ask ourselves how someone can achieve and maintain such a stellar record. Such returns are standard deviations above the norm, and while luck may play a role in achieving this success, a different approach based on remarkable skill certainly seems to be the key ingredient. Going through Siddhartha Bhaiya’s videos, presentations, and other relevant material, we have distilled his key lessons for investors. While the words may not exactly be his own, these are our key takeaways.

The article is divided in two parts. Part One focuses on not losing money and the value of patience in the market. Part Two focuses on Siddhartha Bhaiya’s investment philosophy, his opinions on skill and luck, and the importance of healthy habits.

Let’s dive into Part One.

Lesson #1 – Don’t Gamble

Most people don’t make money in the markets over long periods of time even though the Sensex has grown nearly 13 times over the last 24 years, and more than 130 times since its inception in 1986. This is simply because most people in the market want to gamble – to make quick money. People gamble in four ways:

- Derivatives – Investing in leveraged financial instruments

- IPOs – Investing for quick gains

- Leverage – Investing money one does not have

- Impulsive Investing – Investing based on tips

The market is a compounding machine, which means that returns will be generated over a long period of time. Trying to make a quick return is against the nature of the market, and fighting this nature usually leads to defeat. The market rewards patience and punishes haste.

Lesson #2 – Prioritize Survival

As Warren Buffett once said, “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule.” Investors must always increase their probability of going right and minimizing drawdowns. While everyone is focused on maximizing returns, people often forget to protect their downside. Understanding the potential for losses in an investment is important to ensure return of capital.

Lesson #3 – Be Patient: Knowing What to Buy is Only Half the Job

While finding multibaggers is important, the real test of an investor lies in holding these investments for extended periods of time until the gains have been realized. A large number of investors book profits at 50-100% gains because they lack the conviction to own their investments for multiple years. The inability to hold great investments for long periods is a barrier to investment success. The long-term ownership of Titan by the Late Mr. Rakesh Jhunjhunwala, VST Industries by Mr. Radhakishan Damani, and Bannari Amman Sugars by the Enam group for over 25 years each is a testament to the fact that the biggest money lies in waiting, not selling.

According to a story, the Late Mr. Rakesh Jhunjhunwala had told his friends to buy shares of Titan when he was building his original stake. However, none of his friends were willing to hold the stock for extremely long periods and sold them early for gains. Needless to say, their wealth would have grown by multiple times had they been patient.

Lesson #4: Learn to Live through Drawdowns: Returns are Never Linear

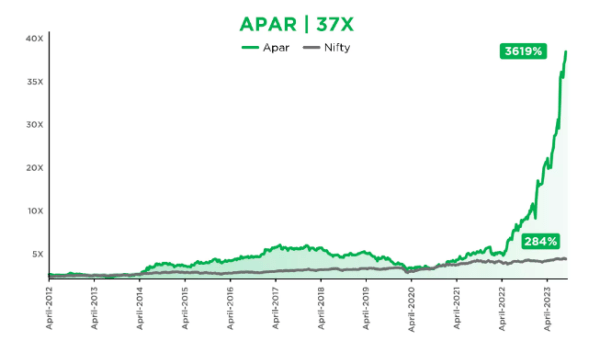

An underlying feature of investing is that returns will never be linear. While most people believe they understand the statement, living through intense volatility is a difficult experience. Let’s look at the example of Apar Industries, one of Aequitas’ oldest and most interesting holdings. As one can see in the image below, between April 2012 and April 2023, a period of 11 years, the company has generated a 37 times return or an annualized return of more than 38%.

However, achieving these returns was far from easy. While the stock gave index-beating returns until 2017, the stock corrected by approximately 60% between July 2017 and July 2020, leading to an overall underperformance when compared to Nifty from April 2012. Generating no alpha, or excess returns, for 8 years can test the patience of even the most patient fund managers. However, it is darkest before dawn.

Since July 2020, the stock has generated extremely high returns. From July 2020 to April 2023, the stock has appreciated by more than 6.5 times, and more than 22 times to date. To quote the late Mr. Rakesh Jhunjhunwala, “In investing, you need conviction. Your patience will be tested, but your conviction will be rewarded.”

Source: Aequitas

Lesson #5: Errors of Commission – Don’t be a Slave to FOMO

There will be times when companies you are researching or recommended by analysts surge by 50% or more before you’ve made your decision. Such instances are not uncommon. It’s essential to invert the thought process here. Suppose you buy a stock before doing your due diligence, and it turns out to be a bad choice, leading to significant wealth erosion. This has real impacts and can hurt your returns. However, if you refrain from buying a stock recommendation, regardless of its performance, it has no impact on your portfolio. Your returns are solely dependent on what you own, and returns on stocks you do not hold are imaginary.

This can be summarized by the famous lines by The Rolling Stones, “You can’t always get what you want, But if you try sometime you’ll find, You get what you need.” It’s important to have a portfolio of great, well-researched investments, achievable through good research and discipline. The fact that some great investment opportunities were left on the table is irrelevant.

Conclusion

The first key lesson is the principle of inversion. To understand how one can make outsized returns in the market, one must first know what can lead to capital erosion. Avoiding gambling and prioritizing survival are important lessons which are often forgotten by investors who view the market as a ‘get-rich-quick’ scheme. The second key lesson is patience – Rome was not built in a day. Making good investments is important, but it’s also important to hold them for extended periods to realise strong gains. Since returns are not linear, good investments can have periods where they give low or negative returns before giving outsized positive returns. The markets are never linear, and one cannot therefore expert the same returns every year. In an additional lesson of patience, he emphasizes that an investor should only be bothered by their own holdings and shouldn’t be swayed by the performance of companies they do not own.

To continue exploring this topic and delve deeper into our insights, don’t miss out on Part 2 of our blog series. Click here to access it now!

Best Stocks From:

Top 10 Stocks for 2024 Best EV Stocks in India Screener Alpha Cases Best Solar Energy Stocks in India Top AI Stocks in India Best Drone Stocks in India Best Sugar Stocks in India Top 10 Infrastructure Stocks in India Best Fintech Stocks in India Top Media Stocks in India Best Data Center Stocks in India

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory

02067258333

02067258333 +91 9860359463

+91 9860359463