Review

Nifty Total Return Index (Nifty including dividends) earned 0% Year to date 2019 and ~15% CAGR in last 3 years. Although Nifty value is at same level as 16 months ago, less than 15% stocks listed on NSE have made any positive return. Barring banks, IT and select FMCG, most of the stocks gave negative returns and currently trading at fair to undervalued prices. This year has been tough for investors as well as advisor as they couldn’t dodge steep losses in some of the stocks in the portfolio. At an index level, mid and small cap indices have fallen harder than large cap.

Outlook

As on date, average upside of our coverage universe is likely to be ~9% CAGR over next 3 years. Given quality companies are trading at steep price multiples & our coverage mostly has quality companies, expensive valuation is getting reflected in poor upside potential too.

We continue to remain cautious except for select opportunities where we find downside risk is low. There are times in the market when protecting downside becomes more important that earning higher returns. As soon as we see increase in upside potential in coverage universe, we will get more aggressive and try to remain fully invested in opportunities with higher upside.

Based on today’s valuation, we are very good upside in Pharma, select utilities, NBFCs, corporate banks and Autos. As on date, our recommended stocks are likely to earn 13-15% CAGR versus current Nifty upside of around 8-9% CAGR over three years. Our average company earns ROC of 15-18%+ versus average Nifty company with ROC of 12-14%. Since there are not many quality companies providing higher upside potential we suggest parking uninvested amount in liquid funds and wait for our BUY signals. You can also consider “Close to Buy Zone” list to accumulate those stocks.

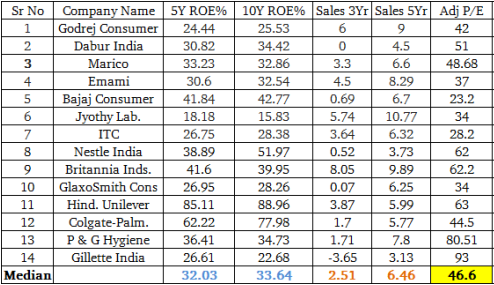

FMCG is getting more than necessary valuation boost due to uncertainty of growth in other sectors. This is due to i) Better Corp Governance sought by FII; ii) Better dividend yield; iii) stable profitability even if growth rates are low. MFs do not own FMCG heavily, it is over-owned by the FIIs. Sales growth is mediocre and profit margin expansion is not a sustainable growth. There are limits on cost savings and fall in working capital. We suggest caution in FMCG and consumer space. Though these are one of “the best companies” to own from long term perspective, acquiring them at overvalued prices would make them “the worst investments”.

Investors are awaiting large jump in earnings of companies. Nifty/Sensex valuation continues to remain at 20-22x earnings. But there is no visibility on growth. IT and Pharma are growing at single digits. FMCG growth rates could come down as kicker from profit margin expansion goes away. Autos are likely to experience single digit to flat growth. We find it difficult to justify high valuation for the overall market. Asset based companies provide reasonable upside albeit with moderate to high risk. Investor must consider investing in Infra & Infra-related companies for medium term.

Risks

In month of February, we saw Pulwama attacks and Indian Government’s response to that. Initially, it appeared that it would lead to war like situation but now things are normalizing. We believe this risk though present, is not very significant for market as of now.

Major risk is now coming from slowdown in GDP growth and auto sales numbers. Even if long term growth trajectory may be intact, near term volatility could be high due to high equity valuation. Few pockets continue to remain expensive and remain vulnerable to steeper correction. Some of the Auto stocks have seen deep cuts and trading at low valuation multiples versus last 5 years.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463