Review

Nifty Total Return Index (TRI) (including dividends) was flat for Jan’19. IT and energy performed well and Media and Auto went south in last month.

Although Nifty TRI ended flat for the year, there were less than 15 stocks that made any positive return.

This has been a tough time for investors as well as advisors as no one could dodge losses in some of the stock in portfolio.

Outlook

As on date, our coverage universe of 170 stocks is likely to earn just ~8% CAGR over next 3 years. Some pockets of the markets have corrected from the peak, but the companies we like continue to remain expensive. We continue to remain cautious except for select opportunities from time to time.

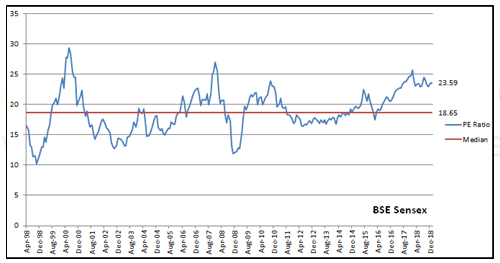

Just to make sure that our opinion on valuation is not drastically different, we checked trailing Price-Earning Ratio of a Large index versus its own history. In above graph, one can see that Nifty is not cheap either.

At MoneyWorks4me, we focus on building a portfolio of stocks with higher upside and lower downside. After broadly classifying good quality companies, we don’t have any favourites. Whether Dr. Reddy’s or HUL, we will buy only those companies where we see more upside and lower downside based on valuation. Valuation doesn’t matter only in hindsight as people tend to see only winners who made good returns despite high starting valuation. Data suggests most companies with high starting valuation earn poor returns in long term.

Our current portfolio has return on equity of 15-18% and median valuation of 15-16x PE. Nifty currently trades at 22x consolidated PE ratio and return on equity of 15%.

Risks

In our previous note, we had highlighted two key risks –Loksabha elections and US Fed interest rate hikes. The latter risk has come down as Fed informed they will go slow on interest rate hikes in the interim.

One new risk that has emerged off late is from money market. IL&FS triggered fear of default in money market in Sept’18. Debt Mutual Funds, one of the largest investors in NBFCs, have seen huge fall in inflows as corporate/HNI investors have turned risk averse. This has put an end to access to new capital and roll over of debt for NBFCs.

One of the housing finance NBFCs has been making headlines lately. We had highlighted in our analyst note in August’17 that we do not prefer this particular NBFC due to risky nature of loans it extends. We are seeing that it is facing issues with debt rollover. It is forced to run down its portfolio. In desperation, it will have to give up on good quality loans and hold on to risky ones. Defaults in risky loans can threaten very existence of the company as it’s a leveraged business. We are not sure about severity of the issue but prima facie we believe it will have hard time coming out of this crisis. In view of these risks, we are advising to stay cautious on NBFC/leveraged businesses. Established business models and long execution track record of the management could be exceptions to this rule.

One of the recent news was with respect to Essel Group. Essel group operates in multiple businesses like broadcasting, entertainment, infrastructure, education, etc. Essel group is facing liquidity crunch to service the loan in their infrastructure business. Promoter’s stake in all of the group businesses is also attached as collateral for these loans. Most of the businesses are listed and in case of default, bankers may liquidate the pledged shares thereby causing sharp drop in group companies’ stock prices. We are not very worried about business fundamentals of Zee Entertainment Enterprises in the face of stock price volatility, but since Zee is a run by promoter’s family only, we need to monitor whether this business is getting adequate attention.

A second order effect of tighter liquidity is fall in asset purchases done against loans. We saw drop in 2W, 4W and CV volumes in previous quarter. We believe these issues are temporary; with some government and central bank intervention, this too shall pass. Despite good return ratios and long term growth potential, these stocks saw a sell off.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463