Gland Pharma IPO Details:

Gland Pharma | Market Cap 24,000 Cr

CMP 1500 | P/OCF 37x FY21

IPO Date: 9th November to 11th November

Total shares: 4.32 Cr (For Retail < 2 Lacs – 1.5 Cr)

Price band:1490-1500 per share

IPO Size : ~ Rs. 6,500 Cr (2200 Cr for Retail < 2 Lacs)

Lot Size: 10 shares and multiples thereof

Purpose of IPO:

Offer for sale by existing shareholders (~5000 Cr) and for working capital (1250 Cr).

About the Gland Pharma:

Gland Pharma Limited (GPL) is ~Rs. 3,000 Cr sales company with a focus on injectables-generics in regulated markets i.e. US, EU, and other emerging markets. GPL is a professionally run company with a majority stake held by a China-based global pharmaceutical firm Shanghai Fosun Pharma.

GPL has a long-term presence in complex injectables development, manufacturing and marketing, and related scientific, technical, and regulatory processes.

GPL manufacturing infrastructure includes seven manufacturing facilities in India, comprising four finished formulations facilities with a total of 22 production lines and three API facilities.

As of June 2020, it had 267 ANDA filings including from partners in the United States, of which 215 were approved and 52 were pending approval.

GPL has a long track record of operating a B2B model with leading pharmaceutical companies such as Sagent Pharmaceuticals, Inc. and Apotex Inc. as well as Fresenius Kabi USA, LLC and Athenex Pharmaceutical Division, LLC in the United States and the Rest of the world using long-term development, licensing and manufacturing and supply agreements. Around 50% of sales come from the top 5 customers indicating concentration risk. However, switching costs are relatively higher as investments in plants after contracts from clients and made as per clients’ specifications and processes.

Management

Srinivas Sadu is the MD and CEO of GPL, with effect from April 2019. He previously worked at Natco Pharma. He has over 21 years of experience in business operations and management. He joined GPL as the general manager – exports in 2000, and elevated to the position of senior general manager in 2002, vice president in 2003, director in 2005, and chief operating officer in 2011.

Ravi Shekhar Mitra is the CFO of the company. He has over 20 years of experience in finance. Prior to joining GPL, he had worked at Indian Oil Corporation, Vedanta-Sterlite Industries (India), Ranbaxy Laboratories, and Wockhardt.

MoneyWorks4me Opinion

India enjoys a low cost of manufacturing pharmaceutical drugs due to the low cost of human resources and limited regulations on air/water pollution capping overall capital expenditures.

Global pharmaceuticals either outsource or set up their own manufacturing facilities in India. A few of the companies that supply global pharma companies are Divis Labs, Syngene International (Recent investments), etc.

GPL has set up large manufacturing facilities for complex injectables manufacturing and API manufacturing for internal and global pharmaceuticals players.

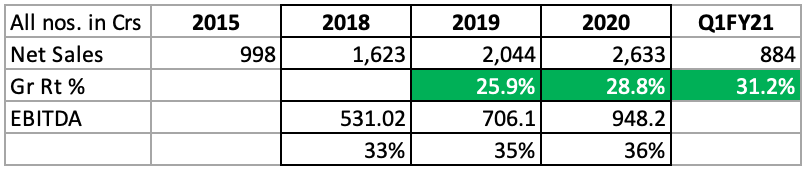

It has been able to grow its sales at 20% CAGR over the last 5 years. Operating profit growth for the last two years is 36% CAGR.

GPL predominantly operates injectables portfolio with several therapy areas from Anti-infectives to pain and central nervous system. Injectables are more complex to manufacture and require higher compliance and R&D costs hence the margins are higher once the company plant gets all approvals. Very few Indian firms have managed to get approvals from USFDA eg. Dr. Reddy’s Labs.

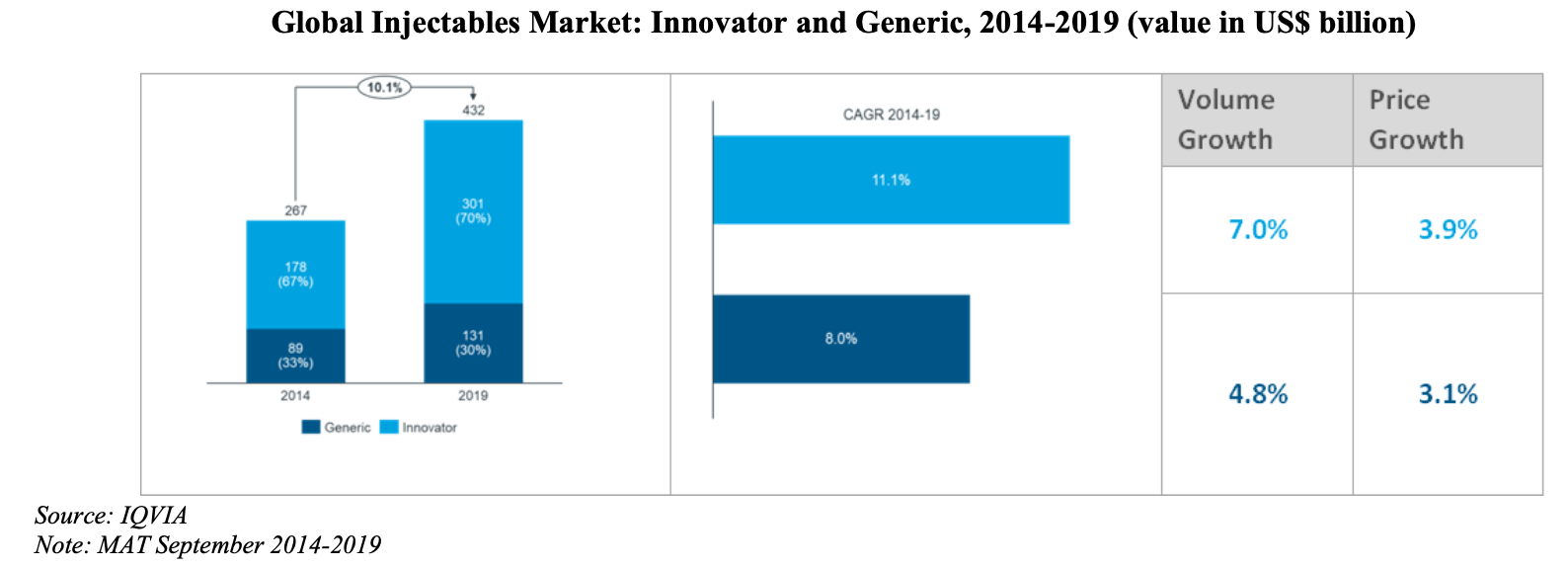

Injectables are growing at a faster rate as Injectables tend to have better efficacy than oral solids. Competition is relatively less due to i) higher upfront costs ii) complexity and iii) uncertainty of timeline for obtaining final approval. This will ensure that the profitability will remain reasonable for successful firms in this space, unlike oral solids where the barrier to entry is low.

GPL’s ownership has changed several hands and currently owned by China’s Shanghai Fosun Pharma. Chinese ownership may invite additional scrutiny by the Indian Government from time to time due to political tensions and the presence of a company in a sensitive sector.

As of today, it is difficult to estimate a company’s future prospects due to limited information on management’s vision and execution. We can say that the industry growth rate is likely to be in the early double-digit based on the guidance of its peers. If the company manages to earn a superior ROCE of more than 15%, it can grow at least at 15% over the next few years.

Fosun Pharma bought a 74% stake in GPL in 2017 for $1.1 billion approx. at valuation Price/Sales of 6.75x FY18. Prior to that, KKR had bought a stake in GPL for Price/Sales of 3.5x in 2014.

With an expected sales growth rate of ~15%, the IPO price is around P/S 7.5x FY21. This implies EV/EBITDA 21x and around Price/Op Cash Flow 37x FY21. In comparison, Divis trades at P/OCF** 50xFY21 and Syngene International at P/OCF 32x FY21.

Risks:

- Risk of USFDA putting a ban on new approval in case of compliance failure

- Timely approval is important so as not to jeopardize high investment that goes into research and filings including R&D and setting up manufacturing plants.

- As majority ownership is with a Chinese firm, it may face scrutiny or delay in approvals for expansion from the Indian Government. Also, Chinese ownership may discourage retail shareholders from holding shares longer than the listing day.

Recommendation: SUBSCRIBE for Booster portion of Portfolio

- Currently, the contract manufacturing and generic pharmaceuticals manufacturing industry has good prospects due to low-cost manufacturing in India and Indian companies’ ability to comply with USFDA rules.

- GPL is expected to do well over the next few years as it wins more clients & orders. Even if the valuation is stretched (already assumes very good execution and growth in the next 2 years), we would recommend aggressive retail investor can Subscribe for 1-2 lots. One may choose to sell on listing day if price gain is more than 15%-20%.

- IPOs in a popular sector often gets oversubscribed and retail investor is fortunate if he receives even 1 odd lot (Rs 15,000) in IPO allotment. Since this investment amount is small for our average investor, we recommend SUBSCRIBE in good companies with favorable prospects over the medium-term (currently IT/Chemicals/Pharma). However, do not consider large investment in IPO stocks post listing as they get listed at even higher valuation; additionally, they may overpromise for IPO success but under-deliver in reality.

- Conservative investors who wish to own a portfolio of Core companies must avoid investing in expensive or mid-small cap IPO.

**Why P/OCF? In companies where working capital is large (40% of sales in this case) or negative (Autos/FMCG has -10-20%), it is better to use Price to operating cash flow (P/OCF) as it will adjust for abnormal working capital of a company.

In this case, we deduct incremental working capital in lines with the growth rate to arrive at a new Operating cash flow. (15% Gr Rt. * 40% WC of sales =6% deducted to arrive at 1 year forward OCF).

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463