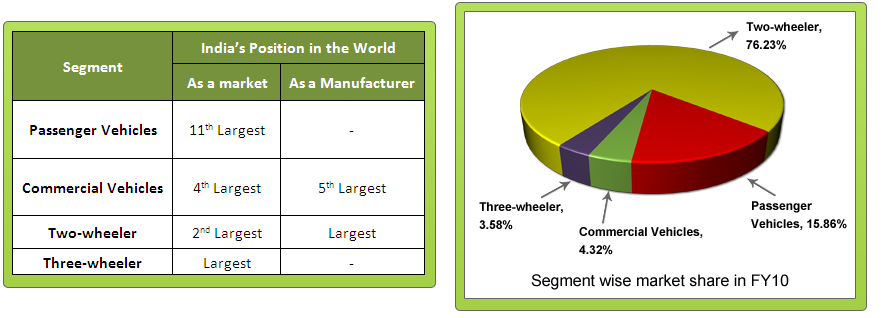

The Indian Automobile sector consists of four segments viz. Passenger Vehicles, Commercial Vehicles, Two-wheeler, and Three-wheeler. It is one of the largest and the fastest-growing sectors in the world. From the 15th position in 2000, India automobile market has emerged as the 7th largest market in the world in 2010. In 2010, India manufactured around 140 lakh vehicles of which around 122 lakh vehicles were sold in the domestic market & 18 lakh were exported.

In India, the two-wheeler segment has around 76% market share and the passenger vehicles segment has 16% (see the pie-chart). However, in the global automobile sector, passenger vehicles alone make up approximately 87% of the total motor vehicle annual production.

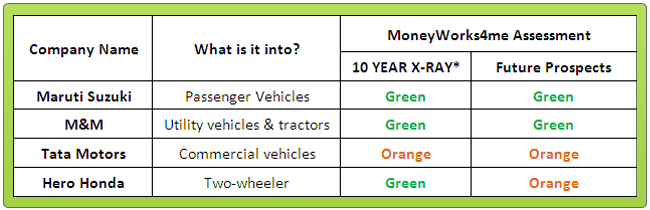

Top Players in the different auto-segments:

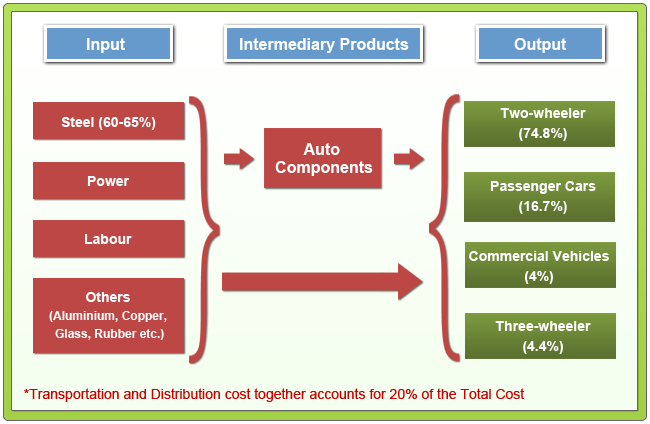

How does Auto Sector work?

What does the past say?

Milestones:

Historical Performance:

The Passenger Vehicles segment has grown the fastest, in production, sales as well as exports during the last five years. Also, due to favourable government policy, exports have jumped by 22% during the same period of time. Let’s now see how the different players in the Auto Sector have performed in the last five years:

Maruti Suzuki has increased its net sales by 25% which is highest. M& M which is India’s largest Utility Vehicles manufacturer increased its net profit by the highest rate of 31%; and Hero Honda earned the highest operating profit margins of 14%. The above table also shows that amongst all the players, Tata Motors has the highest net sales whereas Maruti Suzuki has the highest net profits.

Note: Bajaj Auto’s performance has not been considered in the above analysis because only two years performance is available

What are the growth drivers of the Industry?

Demand-Supply Scenario:

The main driving force of the passenger cars and two-wheeler segments is its increasing demand compared to its suppl; both the segments together account for around 92% market share in the automobile industry. The demand in this industry depends on the per-capita real income growth which also takes care of inflation. In FY11, the demand in the two-wheeler and the passenger vehicles segments increased more than the expected volume, due to which many large players (like, Hero Honda, Maruti Suzuki, etc.) were facing supply constraint problem. To fulfill this high demand, they were operating at their near full capacity. Now, they are setting up additional plants to fulfill the high demand. The sector as a whole shows seasonality in all the segments. Its sales are comparatively higher in the fourth quarter because corporate credits expire in March.

In the three-wheeler and the commercial vehicle segments, there is an excess capacity compared to demand. This makes these segments very competitive and a comparatively low margin business. They are also cyclical in nature because these segments are sensitive to the business cycle. Their revenues are generally higher in periods of economic prosperity and expansion, and lower in periods of economic downturn and contraction.

Interest Rates & Availability of Finance:

The purchase of vehicles in India is heavily dependent on bank loans. Decrease in interest rates make loans cheaper and helps in boosting up the demand for automobiles, whereas increase in interest rates make loans more expensive and act as dampener for the demand. Consumer finance is the lifeline of the industry. Today, consumer finance is easily available in India, which acts as the key driving force for boosting up auto-demand.

Consumer preference:

Consumers purchase vehicles by looking at mileage, after sales service, value for money, brand, etc. So, for the auto industry following are important growth drivers:

- Brand: Brand plays a very important role in the automobile industry. Consumers prefer quality and proven products. This is where a strong brand assumes an even more important role.

- New & better products: India, over the next 10-15 years, is expected to/will have one of the largest young population in the world. So, the frequent launch of new products with new features and improved quality plays a vital role in the growth of this industry.

- Technology: Technology plays a very important role in this industry and is thus required to be patented. There is a need for development of fuel-efficient and alternate fuel technologies to take care of emerging needs of the consumers and environment. Thus, R&D in this sector needs to focus more towards environment friendly technology.

Wide distribution channel & Excellent after sales service:

Having a wide distribution network for sales and an excellent after sales service is an essential to survive and be successful in this industry. The wider the network, the better it is. Transportation & distribution costs constitute around 20% of the total cost.

Exports & Exchange Rates:

The export market presents vast potential for growth. In the last 5 years, the export of auto has increased by 22%, from 8 lakh in 2005-06 to 18 lakh in 2009-10. The export is expected to grow even further in the future. The fluctuating exchange rate brings volatility in the export earnings. Depreciation of rupee reduces foreign earnings whereas weakening increases the export earnings.

So, is there anything to be concerned about?

Shortage of skilled manpower:

Though the labour costs are amongst the lowest in India owing to the large population, the industry as a whole is facing the critical challenge of the shortage of skilled manpower. India still needs to incorporate the latest technologies and to act on a lot of changes in its educational curriculum, like Korea and China has.

Increasing cost:

- Rising steel price: Steel forms the majority of the input (approx. 65%). Thus, an increase in steel prices places a lot of pressure on the margins of the manufacturers. Primary steel producers have a lot of bargaining power because they are few in numbers and are highly concentrated. Thus maintaining good relations with the suppliers is important. In case of spare parts and ancillaries, the suppliers are highly fragmented and thus do not possess significant bargaining power.

- The National Auto Fuel Policy for achieving various vehicular emission norms and fuel quality upgradation requirement has also added to the cost significantly.

- Increase in Excise duty in 2009: In the 2009 budget, the Finance Minister of India increased excise duty for two-wheelers, small cars and buses to 10% (from 8%), for trucks to 12%, for large cars and UVs to 22% plus Rs. 15,000 (for engine capacity of 1500-2000CC) or Rs. 20,000 (for engine capacity above 2000cc). This increased the overall cost of production of the industry. Further, in 2010, no changes were made to the excise duty on automobiles.

Tax Structure:

The tax structure in India varies from state to state. Specific packages are provided by states for large investments. This leads to companies setting up manufacturing plants in specific states so as to take advantage of tax benefits. A lower tax structure also promotes foreign investment. However, the current tax structure in India can be a deterrent to the growth of the industry. India faces competition from other low cost countries like China, Thailand and Brazil. The burden of direct and indirect taxes is higher in India than in other countries.

So, after looking at the growth drivers and the concerns for this industry, what is out future outlook for the industry as a whole?

What is the future outlook for this Industry?

Today, India has become a favorite investment destination as an Auto Hub, and is expected to remain the same in the future also. This has attracted a lot of foreign investment along with higher competition, thus driving the domestic players to become more efficient. This scenario is going to be more intense in India in the coming years. Rapid urbanization is another factor driving the demand for the industry. There is a vast untapped rural market as well as a huge potential for exports. Government supports this industry with favourable policies like the Automotive Mission Plan 2016 in which it has envisaged the Indian auto industry to contribute 10% to GDP by 2016. The government spending on infrastructure in roads & airports and higher GDP growth in the future will benefit the automobile sector. However, the current tax structure seems to be a deterrent. India faces competition from other low-cost countries like China, Brazil and Thailand where the tax structure is more conducive for investment than India. The government is gradually trying to bring about the necessary changes in the tax structure to make it more conducive for investment.

It seems that in the long-run, the automobile industry is all set to grow. But, if we talk about the future prospects of different segments of the automobile industry, studying above mentioned facts, we see the long-term outlook for passenger vehicles and two-wheeler segments seems to be bright, whereas for three-wheeler and the commercial vehicles segments the outlook looks subdued.

Having seen that the auto sector is expected to show good growth in the long term, the next step is to find investment-worthy companies in the sector. For this we look for a company that has an excellent financial track record (i.e. Green 10 YEAR X-RAY) and its long-term future prospects are Green (Very Good).

So, let’s have a look at the MoneyWorks4me assessment for a few automobile companies: At MoneyWorks4me we have assigned color codes to the 10 YEAR X-RAY and Future Prospects of the companies, as Green (Very Good), Orange (‘Somewhat Good’) and Red (Not Good).

*The 10 YEAR X-RAY facilitates analysis of the financial performance of the company considering the five most important parameters. A 10 Year period will normally encompass an entire business cycle. Analysing the performance over this time frame is essential to understand how a company has fared during the good as well as bad times. The five most important parameters that one needs to look at are Net Sales Growth Rate, EPS Growth Rate, Book Value Per Share (BVPS) Growth Rate, Return on Invested Capital (ROIC) and Debt to Net Profit Ratio. To view the 10 YEAR X-RAY of the companies become a member of MoneyWorks4me.com

While investing, one must always invest in a company that operates in an industry with bright long-term prospects. Further, the company’s 10 YEAR X-RAY and future prospects should also be Green. The table given above gives you a list of few companies from the Auto sector that you could consider investing in. But, you need to invest in these companies at the right price (i.e. when the market offers an attractive discount). To find out the right price to invest in these companies, become a member of MoneyWorks4me.com.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

we request you to bring stock shastra in a book form

Only thing i want to say is that, “The team of Stockshastra is ultimate in its research methodology & keep the good work going”

It is a great to read all this and it is interesting as well. Thank you very much.

This is a good analytical statics and well researched …… will like to know x ray report on TVS MOTOR also.thanks

THANKS A LOT…. m a automobile enthusiast n m on same project… thanks a lot for ur contribution

thanks 4 this usefull inf…