Indian Bank Ltd. – Can it continue its growth story?

Indian Bank Ltd.: Company Highlights

Market View of Indian Bank Ltd. (as of 27/09/2012)

Latest Stock Price: Rs. 186.30

Latest Market Cap: Rs. 8006.62 Cr.

52 Week High Stock Price: Rs. 265.00

52 Week Low Stock Price: Rs. 152.00

Latest P/E: 0.86

Latest P/BV: 4.53

Tell me more about Indian Bank Ltd.…

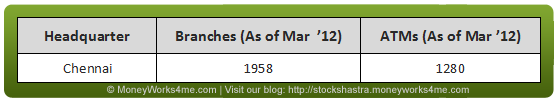

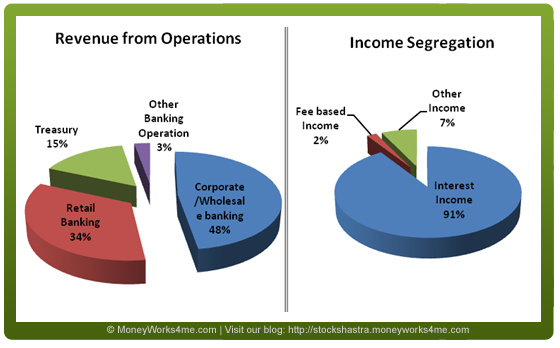

Indian Bank is a mid-sized public sector bank, with a total asset base of Rs.211988 Cr. It has a major presence in South India and is the lead bank for 13 districts in South India – 10 in Tamil Nadu, 2 in Andhra Pradesh, and 1 in Kerala. Corporate Banking, Retail Banking, Treasury, and Other Banking Operations are the four main segments that the bank operates in. Besides these, Indian Bank also offers merchant banking services, credit card services, wealth management services, Mobile & internet banking, etc.

It was established in the year 1907 as a part of the Swadeshi Movement. The Bank has international operations in 2 countries. The Bank has three overseas branches, one each in Singapore, Jaffna, and Colombo. The Colombo branch of the bank was established as early as 1932 and the Singapore Branch operations started in 1941. Jaffna Branch opened recently in 2011, also plays a crucial role in the economic development in Jaffna Region, Sri Lanka. The bank gets 2% of the revenue from its international segment while the rest 98%, comes from the domestic region.

Subsidiaries & Collaborations of the bank:

1. The Bank has three subsidiaries :

i. Ind Bank Housing Ltd

ii. Ind Bank Merchant Banking services Ltd

iii. IndFund Management Ltd.

2. The bank has three associates in the form of Regional Rural Banks: Pallavan Grama Bank, Saptagiri Grameena Bank & Paduvai Bharathiar Grama Bank.

3. HDFC standard life insurance for Life insurance business and United India Insurance Co. For non-life insurance business.

4. UTI MF, Reliance MF and SBI MF agency for distribution of mutual fund products.

How has the financial performance of the Indian Bank been? Here’s the review…

Strong top-line growth in Income & Net Interest Income: In the last 10 years, the total income of the bank has grown by 17% from Rs.3056 Cr to Rs.13463 Cr. During the same time period, there has been a steady growth of 20% in the net interest income of the bank, from Rs.820 Cr to Rs.4428 Cr. This growth has been uniformly spread over this ten-year time frame which shows a high degree of consistency in performance.

Which is reflected in bottom-line growth in EPS & BVPS: The EPS and the BVPS of the bank have shown a good increase of 66%. EPS which was Rs.0.41 in FY03 is now Rs.39.72 in FY12. The growth in BVPS has also been consistent and has reached Rs.214.29 in FY12 from Rs.2.29 in FY03.

Operating metrics & efficiency ratios remain better than industry averages: CASA% of the bank stands at 30%. Moderately High CASA, which is a source of low cost funds for the bank has helped the bank to maintain High NIM. The NIM of the bank in FY12 is at a good 3.22%. Indian Bank is known to have one of the best ROA in the Industry. The Bank has managed to maintain an impressive level of ROA since 2007. FY12 ROA is recorded at 1.33%. Good growth in business has also helped the bank to maintain good ROE. Though ROE is still at a very good level, it is showing a declining trend since FY03. The Bank had a very low level of NPAs from FY07 to FY10. However; the net NPA of the bank has increased drastically in FY12 and reached 1.33% from 0.53% in FY11.

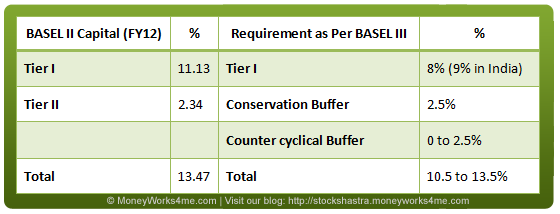

A bank is adequately capitalized: The CAR of the bank is 13.47%, significantly above the RBI requirement of 9%. The government holding is also high at 80% which leaves sufficient room to raise equity capital in the future.

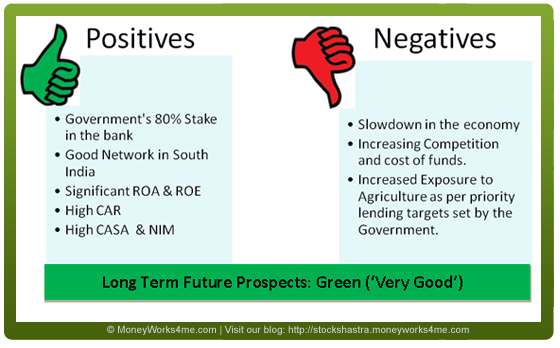

Considering all these points, the company’s 10 Year performance has been rated GREEN (Very Good).

What can we expect in the future? Let’s look at the fundamental analysis of Indian Bank…

Deposits & Advances to continue growing on the back of the calibrated growth strategy:

The total deposits of the bank have grown by 14% to Rs.1,20,804 Cr. This amount includes global deposits as well. The advances, on the other hand, have registered a growth of 20% to reach 91,184 Cr. The personal loan portfolio comes to Rs.13,111 Cr. A home loan is the major proportion of retail loans. Top Industry exposure given below consists of 40% of the total advances.

The net NPA to net advances% of the bank has increased significantly to 1.33. This is mainly due to an increase in the NPA in the advances forming a part of the Services and Agricultural Sector. NPA in the service sector can be attributed to reduced domestic demand owing to slow growth in the Q4 of FY12. Effectively, the provision Coverage Ratio has come down from 84% to 70%. The rise in NPAs is a cyclical phenomenon due to the slow down in the economy. The bank in the past managed to come out stronger in such a situation in 2003-05. It is likely to do so again as and when the economic environment improves. It has put in place prudent risk management processes and constant interaction with lenders. These are likely to help contain any further steep fall in NPAs.

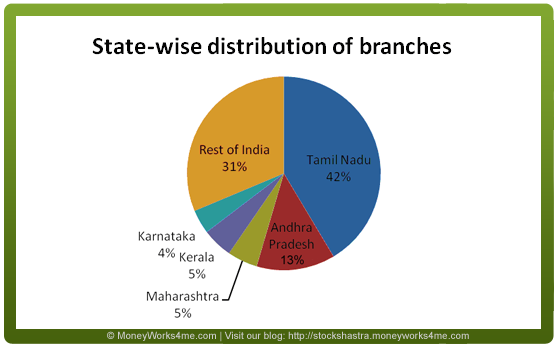

Branch Network skewed towards South India, but well spread across regions:

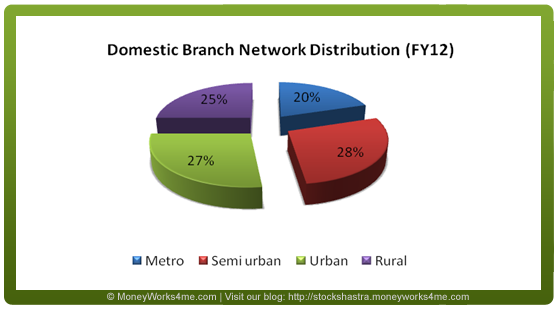

The bank is a strong south India player. Branch network is skewed towards south India which accounts for 65% branches. Out of this Tamil Nadu accounts for 41% of the branches and Andhra Pradesh accounts for 13%. The rest of the branches are well spread across India. In terms of business, 42% is contributed by Tamil Nadu, 14% by Maharashtra, and 10% by Andhra Pradesh.

The branch network is well spread across regions. This protects the bank from the competition in the saturated metropolitan market. Over the last four years, Indian Bank has strategically expanded in emerging urban and semi-urban centers which accounts for 69% of the total expansion. This will ensure savings and retail term deposit generation since there will be lesser competition from aggressive small private sector players. The potential to lend to SME and Retail (Mortgages, Education, and Gold) clients are also higher in these regions.

Superior return ratios to lead to premium valuations, vis-à-vis peers:

The bank has shown consistently high ROA over the past six years. Indian Bank is listed amongst Top 150 Banks by best ROA by the Banker Magazine. The bank has consistently high NIM as compared to other public sector banks. High NIM can be attributed to high yield on advances and lower cost of funds than their peers.

Well capitalized for BASEL III requirements going ahead:

The Bank is well capitalized with CRAR as per BASEL II is 13.47%. Now Banks will have to implement BASEL III norms from 2013 which provides for higher and stricter capital adequacy requirements. It will introduce 2 new buffers – conservation buffer and countercyclical buffer over the minimum capital requirement. In India, BASEL III can be fully implemented by 2019.

Budget 2012 focussed on core sectors for Banks:

Overall, Budget 2012 was positive for the banks with Government ready to infuse funds into the public banks and government abolishing the tax on interest income up to Rs.10, 000 on savings deposit. The downturn was that the public sector banks have to increase their exposure towards the agricultural sector.

Agriculture Credit of Indian Bank is 18% of the adjusted bank’s net bank credit and stood at Rs.2306 Cr in FY12. The Net NPA in the agricultural sector is 2.49% and contributes significantly to the total NPA of the bank. Thus, increasing exposure to agriculture as per Budget 2012 might have an adverse impact on the bank.

Considering all these factors, we expect the long term future prospects of Indian Bank to be Green (‘Very Good’)

So, is it an investment-worthy company?

Considering its fundamentals, Indian Bank is an investment-worthy company. It is considered to be a safer-bet as compared to other similar-sized banks. However, the current sluggish economic environment as a whole does create concerns for the short-term. Thus, investors should invest in the company only at a discount to its MRP.

So, does the current price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purposes and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

Add comment