Indigo Paints IPO Details:

IPO Date: 20th January to 22nd January

Total shares: 4.71 Cr

Price band: ₹ 1480-1500 per share

IPO Size: ~₹ 1,176 Cr

Lot Size: 10 shares and multiples thereof

Market Cap: ₹ 7,065 Cr

EV/Sales: 11x FY20

Recommendation: Subscribe for listing gains

Purpose of Indigo Paints IPO:

- Capital expenditure requirement for manufacturing facility expansion at Pudukkottai, Tamil Nadu

- Purchase of tinting machines and gyroshakers

- Partial/ Full Repayment of certain borrowings

- Meeting general corporate purposes.

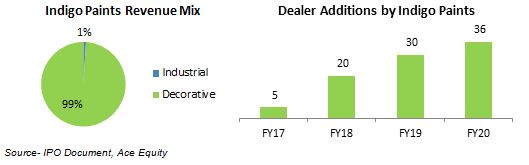

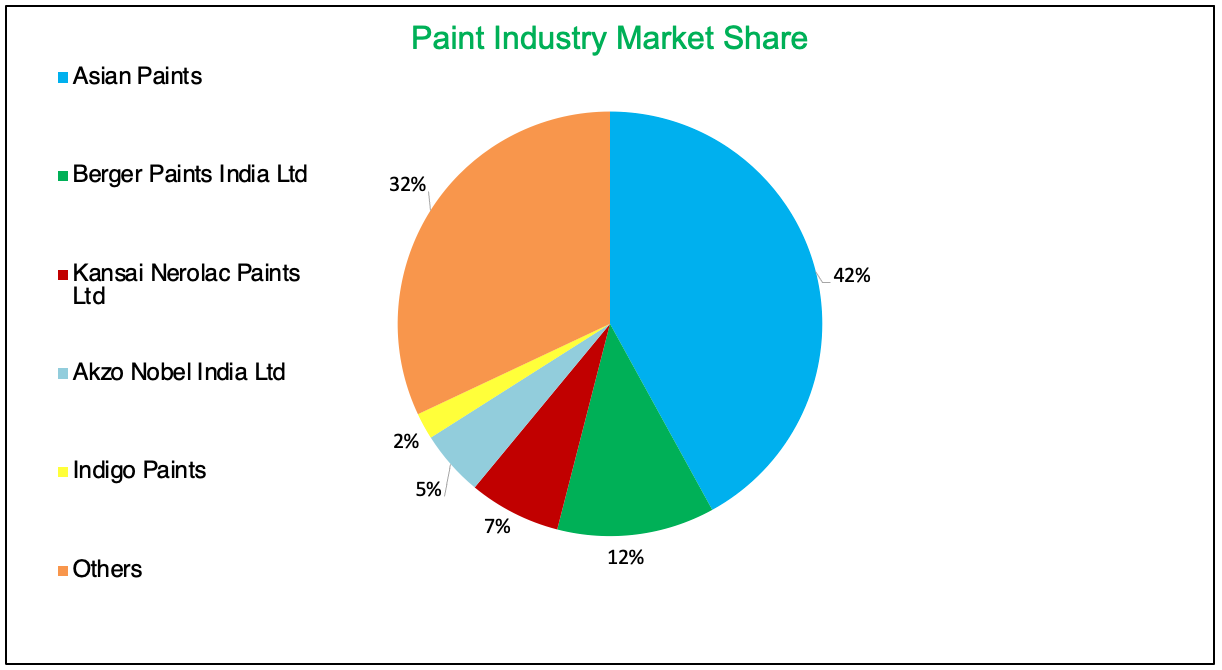

Indigo Paints, one of the fastest-growing paint companies in India (in terms of volume growth), is the 5th largest company in the decorative paint industry. Indigo controls ~2% market share of the Indian paints industry of Rs. 40,000 Cr.

The company is engaged in manufacturing different types of decorative paints like enamels, emulsions, wood coatings, primers, distempers, putties, and cement paints.

Indigo Paints is the first company to have started manufacturing differentiated products like Metallic Emulsions, Bright Ceiling Coat Emulsions, Tile Coat Emulsions, Dirtproof & Waterproof Exterior Laminate, Floor Coat Emulsions, Exterior and Interior Acrylic Laminate, and PU Super Gloss Enamel.

Indigo Paints has 3 manufacturing facilities situated in Jodhpur (Rajasthan), Kochi (Kerala), and Pudukkottai (Tamil Nadu). It is further looking to expand its manufacturing capacities at Pudukkottai to manufacture water-based paints.

Financials

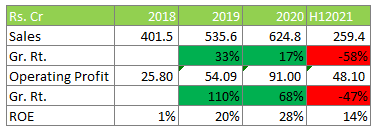

Indigo’s sales growth was around 40% CAGR from 2010 to 2019. With the increase in size and disruption from Covid lockdown, the growth has moderated to 16.5% CAGR in the last 3 years.

Indigo’s EBITDA margins are almost at par with smaller peers like Kansai Nerolac and Akzo Nobel. With higher growth, the margins are likely to improve from operating leverage (Sales growth directly adds to profit as fixed costs stay the same).

Management

Indigo Paints Limited is headquartered in Pune, Maharashtra. Hemant Jalan is the MD of the company and holds a B.Tech degree in chemical engineering from the IIT, Kanpur, and a master’s degree in science from Stanford University, and a master’s degree in business administration from the University of Chicago. He has over 20 years of experience in the paint industry.

How is the business model? Good, Great, or Gruesome?

Good. Paints business is less asset-intensive with reasonable pricing power as it has an oligopolistic market. The top 3 players control 60% of the paint industry which gives the leaders good pricing power, and the rest of the industry piggybacking them.

Indigo Paints has managed to grow at a fast clip on a low base. It stands as the 5th largest player in the paints industry with margins at par with peers of the same size.

Indigo has grown by introducing niche products and Tier-III, Tier-IV towns as its easier to win market share in these regions with a higher number of multi-brand retail shops.

Despite stellar growth of 40% in the better part of the last decade, Indigo forms just 2% market share in the paints industry.

The scale of business allows a company to spend large sums on advertising and promotion (A&P). Selling a higher number of units reducing the per-unit cost of (A&P) which helps it fight competition.

Since Asian Paints and Berger Paints have very high volumes versus their closest competitor, they have the muscle to spend heavily on advertising and influence dealers to sell their products. This will make it difficult for smaller players to grab market share beyond a certain percentage.

Valuation

The paints industry has a growth rate linked to GDP growth, wherein it has grown at a 1.5-1.8x GDP growth rate in the past.

Assuming a similar relationship holds in the future, we expect Indigo to grow at 15-20% over the next 3-5 years. Besides, volume growth will add to its margins from favourable operating leverage. This will lead to > 18-20% CAGR in earnings per share over the next 3 years.

We do not anticipate a very high growth rate versus industry beyond 3-5 years as the cost of grabbing market share will rise exponentially either by shelling out more on dealer margin or higher spend on advertising. (We assume a 4-5% market share for Indigo Paints, ~same as Akzo Nobel)

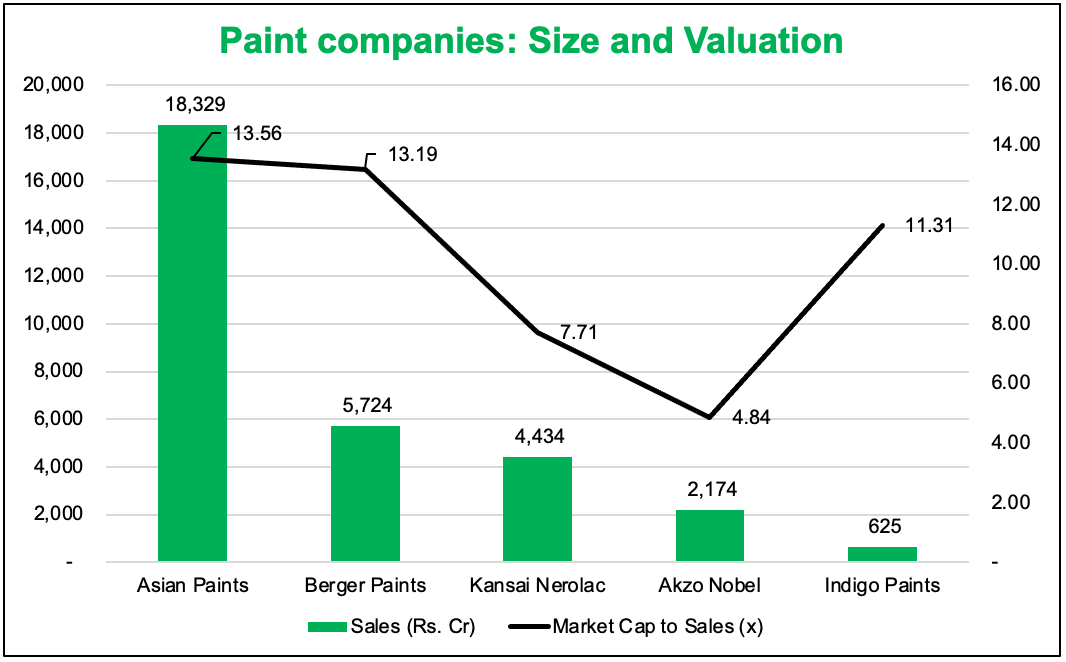

Relative valuation: Since indigos are still in their aggressive investment/growth phase, we can’t evaluate it on an EV/EBITDA or P/E basis versus peers.

We use Price to Sales valuation, we find that Indigo is priced similar to its larger peers.

If we assume Asian Paints and Berger Paints are fairly priced today (They are expensive in our opinion), then Indigo is rightly priced on a relative basis.

It has return metrics similar to peers of the same size but thanks to a faster than industry growth rate and aggressive dealer expansion it can enjoy better valuation.

Back of the envelope optimistic discounted cash flow value suggests 40-50% overvaluation. As the paints sector is one of the market favourites, investors would prefer using relative valuation versus fundamental valuation.

We find it hard to justify long term fundamental value at IPO price, so we wouldn’t recommend buying a post listing.

| IPO Activity | Date |

|---|---|

| IPO Open Date | 20th Jan 2021 |

| IPO Close Date | 22th Jan 2021 |

| Basis of Allotment Finalisation Date | 28th Jan 2021 |

| Refunds Initiation | 29th Jan 2021 |

| A credit of Shares to Demat Account | 1st Feb 2021 |

| IPO Listing Date | 2nd Feb 2021 |

What is Indigo Paints Limited IPO?

Indigo Paints Limited IPO is an IPO of ~80 lakh equity shares with a face value of ₹10 aggregating up to ₹1,176 Cr. The issue is priced at a price band between ₹1480 to ₹1500 per share.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

When Indigo Paints Limited IPO will open?

The IPO opens on Jan 20, 2021, and closes on Jan 22, 2021, between 10.00 AM to 5.00 PM.

What is the lot size of Indigo Paints Limited IPO?

The lot size is in the multiple of 10 with a minimum order quantity of 10 Shares.

How to apply for Indigo Paints Limited IPO?

You can apply for Indigo Paints Limited IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services like Zerodha.

When is the Indigo Paints Limited IPO allotment?

The final allotment for Indigo Paints IPO will be known on 28th Jan 2021, and if you get the allotment, shares will be credited to your Demat account by 1st February 2021.

When is the Indigo Paints IPO listing date?

The Indigo Paints IPO listing date is not yet announced. The tentative date of the Indigo Paints IPO listing is 2nd February 2021.

Is it worth investing in Indigo Paints IPO?

We expect Indigo to grow at 15-20% over the next 3-5 years. Besides, volume growth will add to its margins from favourable operating leverage. This will lead to > 18-20% CAGR in earnings per share over the next 3 years.

We do not anticipate a very high growth rate versus industry beyond 3-5 years as the cost of grabbing market share will rise exponentially either by shelling out more on dealer margin or higher spend on advertising. (We assume a 4-5% market share for Indigo Paints, ~same as Akzo Nobel)

Relative valuation: Since indigo’s is still in its aggressive investment/growth phase, we can’t evaluate it on an EV/EBITDA or P/E basis versus peers.

We use Price to Sales valuation, we find that Indigo is priced similar to its larger peers.

If we assume Asian Paints and Berger Paints are fairly priced today (They are expensive in our opinion), then Indigo is rightly priced on a relative basis.

It has return metrics similar to peers of the same size but thanks to a faster than industry growth rate and aggressive dealer expansion it can enjoy better valuation.

Back of the envelope optimistic discounted cash flow value suggests 40-50% overvaluation. As the paints sector is one of the market favorites, investors would prefer using relative valuation versus fundamental valuation.

Recommendation: We recommend Subscribe for listing gains.

We find it hard to justify long term fundamental value at IPO price, so we wouldn’t recommend buying post listing.

Know more: Indian IPO Historic Data 2021

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463