In our last blog, we talked about some of the behavioural biases and mental pitfalls investors suffer from. We ended our blog with a promise of more to come! So here it is… a few more behavioural biases and ways to overcome them.

Permanent bulls and permanent bears:

We have this habit of hanging on to our views for too long and are able to adjust very slowly. In the stock market, there are some who are permanently bullish and some who are permanently bearish, about the market. Both generally fail to make money in the market. A general observation about analysts is that they are reluctant to change their stance (from buy to sell or vice-versa) even when the facts demand a change. Primary reason for this is the fact that the analysts have spent time and effort in coming up with those views in the first place. This is known as the sunk cost fallacy. When the facts change, one cannot cling on to his views for long. So, when the situation commands, investors might be required to change their stand completely i.e. from buy to sell or vice-versa.

Fancy stories may not be really fancy:

Investors need to stay away from fancy investment stories. We tend to believe in stories, and our investment decisions are deeply influenced by stories. An investment backed by a story finds more takers than an investment advice backed by plain facts. This is the reason why IPOs are very popular among investors, even though there is sufficient history about the under-performance of IPOs. The admired stocks have great stories and high prices attached to them, whereas the despised stocks have terrible stories and low valuations. Psychologically, we are attracted to the admired stocks. Yet the despised stocks might turn out to be far better investments. Stories usually have emotional content, hence they appeal to the X-system and as a result they find many takers. However, the right thing to do is to only believe in facts and nothing else. Focusing on cold hard facts is likely to be the best defence against the siren song of stories.

Bubbles – This time is different:

Existence of bubbles is a fact of the market, and all bubbles eventually burst. A bubble starts off with a very good idea, followed by fantastic stories; people buy in like mad, they take leverage to buy, taking the valuations to sky high heights. The high valuations do not make fundamental sense, high leverage leads to financial distress and eventually the bubble bursts. Many bubbles have formed and burst, but we fail to learn and keep over-investing in over-valued assets. This is because we suffer from over-optimism, illusion of control, self-serving bias and myopia (short term focus). We need to have control over our urges and not chase investments that everybody is chasing.

Right for the wrong reason, or wrong for the right reason –

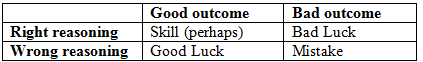

It is assumed that humans learn from history and do not repeat mistakes made in the past. This is not true, more so in the investing world. There is extreme brevity of financial memory, and financial disaster is quickly forgotten. Yet another pitfall of the X-system is an unwillingness to recognize our mistakes and errors. We suffer from self-attribution bias – It is our habit of attributing good outcomes to our skills as investors, while blaming bad outcomes on external things such as economy, circumstances, irrationality of market, etc.

It is advisable to maintain an investment diary in order to overcome our self-attribution bias. If we note down reasons regarding an investment decision while making one, map the outcomes of the decisions and the reasons, we know what we got right or wrong and can learn from it.

A bad outcome because of wrong reasoning is a mistake, which needs to be avoided in future. However, a good outcome in spite of a bad reasoning is a tricky situation. In this case, if an investor tends to avoid the reasoning and focuses only on the outcome, he may fool himself in to thinking that he really knew what he was doing.

The Perils of ADHD investing:

Investors appear to have chronic attention deficit hyperactivity disorder (ADHD) when it comes to their portfolio. We focus on the short term, desire quick results and hence have a bias towards action. The desire for quick results makes us vulnerable to short term price movements and news, and we tend to respond to these movements by buying and selling, even when there is no fundamental reason. This urge to act tends to intensify after a loss – a period of poor performance, in portfolio terms. In certain situations, holding cash and waiting for the best opportunity is the best option to go for, rather than juggling with your investments. As Warren Buffett said “Holding cash is uncomfortable, but not as uncomfortable as doing something stupid.”

Becoming a contrarian investor:

A contrarian investor is the one who attempts to profit by investing in a manner that differs from the conventional wisdom, when the consensus opinion appears to be wrong. He believes that certain crowd behaviour among investors can lead to mispricing in the market which can be exploited. For example, in case of a contrarian bet, when the consensus opinion is to sell, a contrarian would buy when the prices have seen a drastic fall because of the mass sell-out. However, it is not easy to be a contrarian investor, as it is not in human nature to go against the crowd. If we see lot of people doing a particular thing, it is easy to convince ourselves that it must be the right thing to do. The key here is to stick to our investment principles and the pre-committed strategy. Investment decisions need to be made on the basis of information, and not on the basis of what others are doing.

A pre-defined ‘sell’ strategy:

People hate losses somewhere between 2-2.5 times as much as they enjoy equivalent gains, implying that people are generally loss averse. This loss aversion behaviour makes it difficult for investors to get rid of bad investments. One of the most common reasons for holding on to a stock is the belief that it will bounce back subsequently. Ownership seems to massively distort people’s perception of value. So, an investor won’t purchase a fundamentally weak stock, but will find it very difficult to get rid of such a stock when it is beaten down, if he owns one. The solution is again a pre-committed strategy. Stop loss is a good form of pre-commitment in order to get rid of bad investments. In fact, we need to define our ‘sell’ strategy well in advance, so that we react in accordance to our plan and not in accordance to our nerves.

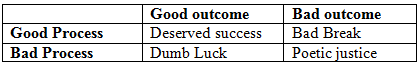

It is better to focus on the process, than on the outcome:

The need to focus on process rather than on outcome is critical in investing. For investors to not fall prey to their behavioural biases and mental pitfalls, it is necessary to follow a process. People often judge a past decision by its ultimate outcome rather than basing it on the quality of the decision at the time it was made, given what was known at that time. This is known as outcome bias. For example, where there is emphasis on short term performance, fund managers may end up buying stocks they find easy to justify to their clients, rather than those that represent considerable opportunity.

The above relationship is similar to the one we saw earlier in this blog. A good process resulting in to a bad outcome is a tough situation to be in, but in the real world, this happens and we need to be patient. The worst is when a bad process leads to a good outcome, as we might continue with the bad process and eventually end up having very bad outcomes. James Montier explains this appropriately, “It is incredibly difficult to look in the mirror after a victory, any victory, and admit that you were lucky. If you fail to make that admission, however, the bad process will continue and the good outcome that occurred once will elude you in the future.”

Better decisions are made when focus is on the process and not on the outcome. Focusing upon process frees us up from worrying about aspects of investment which we really cannot control – such as return. By focusing on the process, we maximize our potential to generate good long-term returns.

To conclude,

We know that we should exercise in order to stay healthy, but not all of us exercise regularly. Same is applicable for investing. We might be aware of our behavioural biases, but are not able to control them. We shouldn’t try to change everything in one go. We need to take small manageable steps, make ourselves aware of our biases, and take efforts to overcome them, and in the process we should become better investors.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

very good article