This article covers the following:

Review

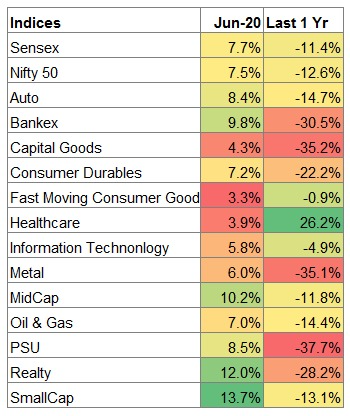

On Jun 30, Nifty closed at 10,300, 12.6% lower than 1 year ago. In the last 3 years, Nifty is up 8% translating into ~2.6% CAGR.

Except for Healthcare and FMCG, every sector gave negative returns in the last 1 year.

Nifty has bounced back 37% from its lows with healthy participation across the board. The announcement of Fiscal stimulus by the US government and quantitative easing from the central bank across the world may have caused a break on selling pressure in equities. Offlate, the increased activity of retail investors in mid and small cap space also led to a recovery in small and mid-cap indices.

FII purchased Rs. 21,800 Cr worth of shares in Jun’20 versus purchases of Rs. 14,500 Cr in May’20. Equity fund schemes saw net inflows of just Rs 240 cr in June, worst in over 4 years.

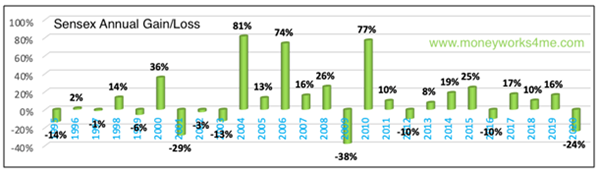

Equity inflows from domestic investors were quite high in the last 3-4 years which means that an average investor’s portfolio hasn’t earned good returns from equity for a long time. The very risk in equity investing is that returns don’t come in a predictable fashion.

The overall sentiment is low in the consumer market and the stock market. The economic impact of lockdown is worrying policymakers and businessmen alike.

Outlook

As on date, the average upside of our coverage universe is likely to be more than 12% CAGR over the next 3 years.

Just a handful of companies will be delivering earning growth due to existing slowdown and further lockdown to contain Covid-19 spread.

Some pockets of the market like consumer staples, chemicals, insurance/AMCs are trading at stretched valuation.

We find that the Nifty 50 index trades above its fair value while there are pockets of extreme overvaluation and undervaluation.

A lot of liquidity has pushed the market higher from low which has led to hope of revival in the economy. Beaten down stocks have rallied however, the economic indicators do not point to V-shaped recovery as of now as many large provinces are still under lockdown mode.

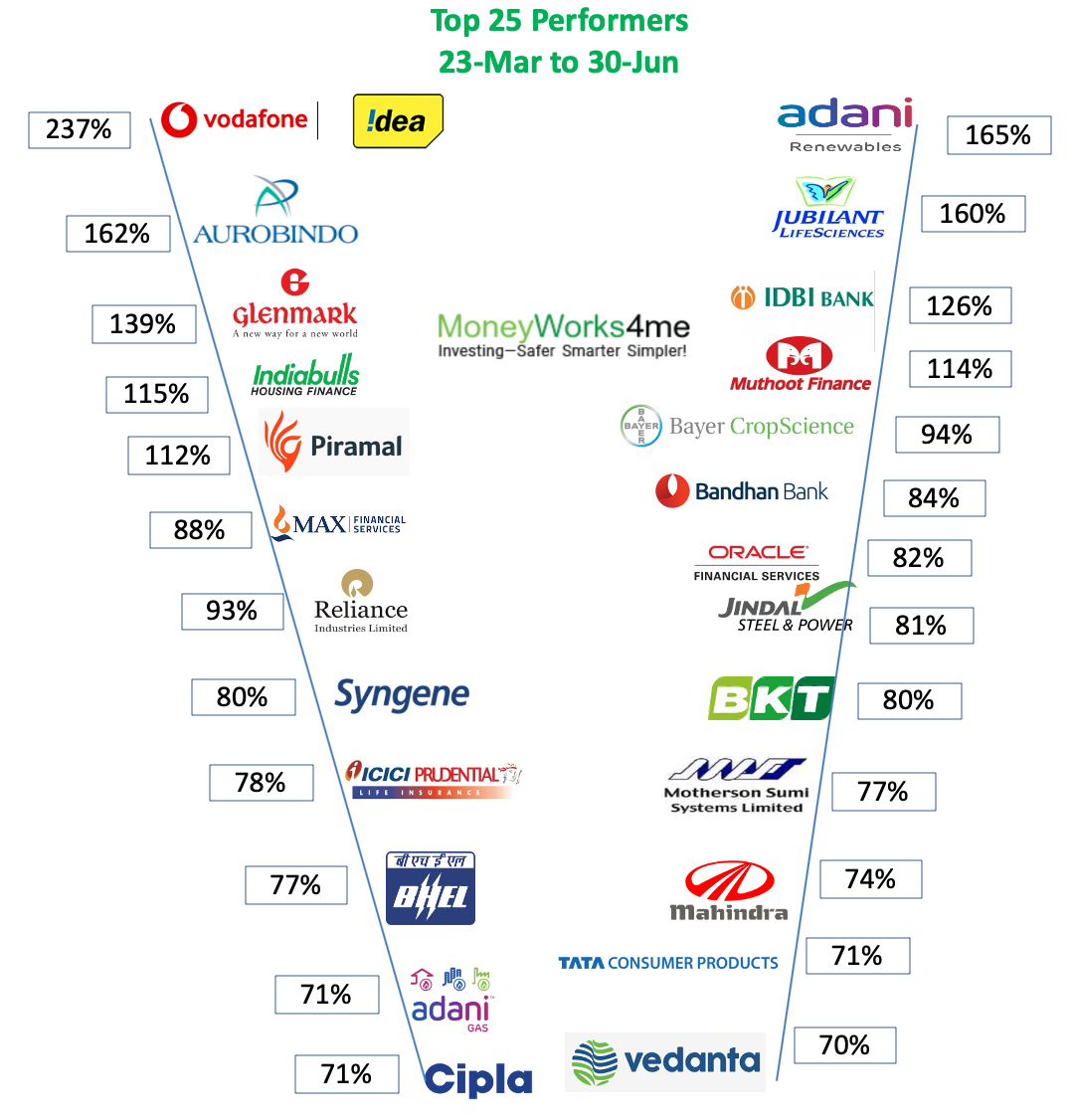

Select individual stocks have earned very good returns (50-80%). Our clients have earned these returns on the incremental amounts invested during this period. While we cannot predict the market movement, but even at this time buying companies in our BUY zone will earn good CAGR returns over 2 year period.

We are looking at companies that have good earning triggers over the next 2 years as we are not certain whether broad-based recovery will happen immediately. We are investing in companies i) coming out of sector consolidation, or ii) introducing new products, or iii) commissioning new capacities or iv) executing the order in hand. This gives some certainty as to why there will be growth when things go back to normal post lockdown.

For now, most of these opportunities lie in Pharma, Telecom, Power, and Chemicals sector. In sectors like cement, autos, banking, etc. stocks are quite cheap but recovery and growth look uncertain in the near term. We are selectively considering only Green Colour code stocks in these sectors to take advantage of low valuations.

We are avoiding sectors or stocks that may have become cheap but they have high debt or they operate in highly cyclical sectors.

Our reasonable exposure to pharma stocks, high dividend yield stocks, and liquid funds have helped to restrict drawdown versus the market.

At the same time, the healthy participation of all the stocks in Nifty/Nifty 200 helped us to outperform Nifty. From its low, our Portfolio is up 41% versus Nifty’s 37%, thanks to a few of the top performers we had in our portfolio.

We have not aggressively added new ideas due to uncertainty about how the businesses shape up in the next few quarters. We are tracking many companies that have good earnings growth coming through or the ones that are trading at a very attractive valuation with high dividend yield.

Risks

US Economy

The focus has now shifted to Economy versus Virus. Economic indicators did show signs of rebound but the recovery is now faltering post the pent up demand. US markets have rallied sharply versus global markets due to proactive stimulus and Fed liquidity infusion.

US market rally has surprised many veterans, especially when the Nasdaq index made new highs amidst economic slowdown. We believe that lot of companies in US markets have now become very expensive. At the same time, the largest companies in US have very good growth prospects masking the risk of overvaluation is not so good for companies.

US is coming out of a very long growth cycle. This makes its a market very fragile as currently, the firms are enjoying steep margins, high realization, etc. The slowdown can have a large impact on its profit if recovery doesn’t happen to pre-COVID levels in a reasonable timeframe.

Indian Economy

Indian economy will be impacted by an extended lockdown as many labor-intensive sectors are not operational. There is a risk of blue-collar job losses and salary cuts.

We find that lot of sectors in India were running at lower utilization. The recent dip in demand is coming back strong as the economy reopens due to pent up demand. But sustainability is hard to predict.

We are tracking i) GST collections per month (starting August) ii) Auto Sales (Retail) iii) Cement offtake. Other indicators may or may not indicate actual recovery as they might be too concentrated on one segment or they might be lagging indicators.

While every sector operates in the same economy, the effects of Covid-19 would affect them differently depending on the change in consumer behaviour.

For example, some people expect people to reduce visiting cinemas as they may have gotten used to OTT content. Auto sales will grow faster as personal transport will be preferred over public transport for a commute. International travel might be lower for the first 2 years due to fear of getting contracted with viruses. Focus on Health & Hygiene may alter eating habits like eating less outside food, lowering the intake of processed food.

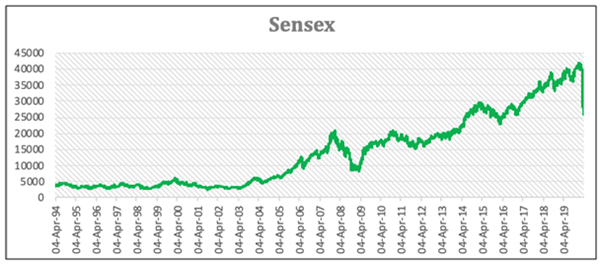

Beyond a point forecasting, macroeconomics is tough. We remain optimistic that the pandemic will affect only near term economic parameters but it won’t dampen demographics of the country nor can it stop the long term momentum in GDP growth and rising consumerism.

Where do we go from here?

Overall the stock market has seen a strong recovery from its lows when everyone thought more correction was on the cards or it might be a very subdued market activity. On the contrary, there has been a broad-based rally with many mid and small caps also recovering 30-60% from their lows. This is proof of how unpredictable markets are!

Markets have rallied 40% from lows that too when economy was under lockdown. If this abnormal market movement can happen, what makes you think that we can predict what happens next?

Markets are always volatile and they will be more volatile this year. Instead of getting whipsawed by market movement, focus on long term growth of stocks. If you are planning to hold stocks for 2 years or longer, you don’t have to get disturbed by price correction in the interim. Just like how the market recovered from its low in the last 3 months, it will recover in the future too.

Going forward, it may appear that stocks have become expensive in comparison to March low, so please do not anchor to March Low prices. Many stocks are still cheap and trade at 12-15x FY22 P/E ratio. We are buying selectively as markets have run up slightly ahead of our estimate of fair value.

Do not wait for bottom prices because there is always a risk of missing out 13-15% CAGR returns right on our platter. Investors who time for lower and lower prices miss out on 13-15% CAGR returns as well. We saw this behaviour among investors who didn’t buy stocks during March-April’20 and in 2008-09.

We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. We leave this field open for speculators, fear mongers, and punters.

We are managing only long term money and predicting near term events is futile.

We continue to recommend Gold Fund/Gold (up to 5-10% of the portfolio) as a hedge from contagion risks and allocation to safe liquid funds/Fixed Deposits (10-20%) within in equity portfolio for capturing new opportunities.

Act on our calls and restrict your allocation to 3-5% in each stock. And not more than 25% in each mutual fund. This will keep you at peace, and not significantly dent your portfolio performance.

Beyond this, tinkering asset allocation will only reduce long term returns thereby missing one’s target corpus. We have diversified our stocks portfolio, we have diversified assets and we have long term horizon. Together this takes care of all potential risks in investing.

Happy Investing!

MoneyWorks4me Outlook:

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463