KFin Technologies Limited IPO Details:

IPO Date: 19th Dec 2022 – 21st Dec 2022

Total Shares for subscription: ~4.1 Cr

IPO Size: Rs. 1,500 Cr

Lot Size: 40 shares

Price Band: Rs. 347-366/ share

Market Capitalization:~Rs. 6133 Cr

Recommendation: Fairly Valued, No incentive for Retail Investors

Proceeds of the offer:

The company will not receive any proceeds and proceeds will go to the Promoter Shareholder selling.

About KFin Technologies Ltd

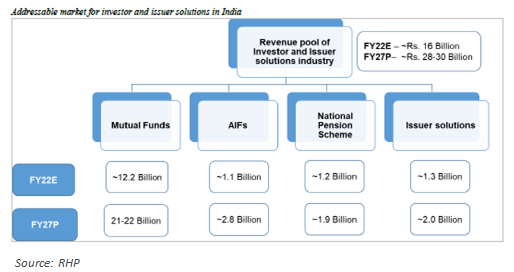

KFin Technologies Ltd is a leading technology-driven financial service platform that provides comprehensive solutions and services to the capital market ecosystems. The Company provides service to asset managers and corporate issuers across asset classes in India and provides several investor solutions, including transaction origination and processing for mutual funds and private retirement schemes in Malaysia, the Philippines, and Hong Kong.

KFin commands the highest share as an investor solutions provider to Indian mutual funds, based on the number of AMCs serviced (24 out of 41AMCs are its customers). It also services 301 funds of 192 asset managers in India as on September 30, 2022, thereby accounting to 30% of the total market share. The Company is also one of three authorised central record-keeping agencies (CRAs) for the National Pension System (NPS) in India.

Business Verticals:

- Investor Solutions to Domestic Mutual Funds. Under MF investor solution KFintech acts as a single window for investors and provides a bouquet of products and services for all industry stakeholders including distributors and AMCs. Their main activities are verifying and maintaining records of unit holder accounts including KYC, helping in buying and selling of MF units, Preparing and mailing account statements, etc. The company earns revenue through a fee-based model, linked to AUM on AMC.

- Investor Solution to Alternatives Investment Funds (AIF) and wealth management firms. KFintech provides various customized services to AIFs, and a vast repository of information on investor behaviour and preferences to wealth management firms in accordance with the market need.

- Central Recordkeeping Agency (CRA) for National Pension Scheme, where KFintech provides data maintenance and record for various NPS subscribers. It commands a 5% market share, while Protean e-Gov Technologies Limited having the rest. Earns revenue based on the number of accounts opened, account maintenance charges, and fees on a number of transactions by the subscriber.

- Issuer solutions – KFintech acts as an independent financial institution, appointed by a company launching an IPO mainly to keep a record of the issue and ownership of shares. KFintech responsibilities involve the processing of IPO applications, allocation of shares to applicants based on SEBI guidelines, refund processing, and transferring allocated shares to the Demat accounts of investors.

Products & Services Offered:

- Providing various Investor services like Account Setup, Transaction Origination, Channel Management, and Customer communication management to Domestic mutual funds, International, Pension services, Alternatives, and wealth management.

- Issuer solutions(Folio Creation and Maintenance, Transaction Processing for IPO, FPO, etc. Corporate Action Processing, Compliance / Regulatory Reporting Recordkeeping MIS, Virtual Voting e-AGM, e-Vault).

- Back-end Global business services like Mortgage Services Legal Services Transfer Agency Finance and Accounting.

Financials:

| Mar-19 | Mar-20 | Mar-21 | Mar-22 | |

| Gross Sales | 162.43 | 449.87 | 481.14 | 639.51 |

| Total Income | 164.76 | 455.27 | 486.20 | 646.28 |

| Total Expenditure | 96.74 | 291.20 | 268.70 | 352.29 |

| EBITDA | 68.01 | 164.06 | 217.50 | 293.99 |

| EBITDA Margin % | 41.28% | 36.04% | 44.73% | 45.49% |

| PAT | 8.96 | 4.52 | -64.51 | 148.55 |

| PAT Margin % | 5.44% | 0.99% | -13.27% | 22.99% |

| ROE | 1.72% | 1.11% | -18.78% | 23.49% |

- The company reported a 40.7% growth in Sales over 4 years period (FY19-22), sales are related to the growth Mutual fund industry and stock issuances in a year.

- The company has reduced its debt-to-equity ratio of 0.91 and 0.71 in FY20 and FY21, to become debt free in FY22.

Management:

- Vishwanathan Mavila Nair is the Chairman and Non-executive Director of the company. He has been associated with the company since November 22, 2018. He has 48 years of experience in financial services and advising fintech start-ups. He has previously served as the non-executive chairman of SWIFT India Domestic Services Pvt Lt, an independent director on the board of directors of Stock Holding Corporation of India Ltd and Encore Asset Reconstruction Co Pvt Lt, as the chairman and managing director of Union Bank of India, and as the chairman and managing director of Dena Bank.

- Venkata Satya Naga Sreekanth Nadella is the Managing Director and CEO of the company. He has been associated with the company since June 28, 2018. He has over 20 years of experience and was previously associated with Accenture Services Pvt Ltd as managing director, IBM Global Services India Pvt Ltd as transformation manager, Capita Offshore Services Pvt Ltd as transition manager, Callhealth Services Pvt Ltd as a chief operating officer, and Indian School of Business as their finance manager.

- Vivek Narayan Mathur is the Chief Financial Officer of the company. He has been associated with the company since January 23, 2020. He has over 26 years of experience and prior to joining the company, he worked with Bharti BT Internet Ltd, American Express Bank Ltd., Bajaj Capital Ltd, Cigna TTK Heatlh Insurance Co Ltd, and Tata AIG Life Insurance Co Ltd.

- Quah Meng Kee is the Country Head – of Malaysia & Philippines of the company. He has been associated with the company since November 17, 2018, i.e., the effective date of the Scheme of Amalgamation pursuant to which the employees of Karvy Computershare (Malaysia) Sdn. Bhd. was transferred to the company. He has over 8 years of experience in system integration, sales and business development, relationship management, business operations, and liaisoning in Malaysia.

Positives & Future prospects:

- KFintech has improved its market share from 28% (FY19) to 31% (FY22) in Mutual Fund AUM segment, with a higher share of Equity AUM (56% VS. 47% for CAMS) in the total AUM mix as of Sept 2022. Equity MF generally has higher fees charged for investor solutions. It also has a higher number of clients as its customers (59% based on AMCs).

- KFintech is the largest issuer solutions provider in India commanding a 46% market share based on Market Capitalisation. With increasing IPOs and the use of public markets to raise funds, provide good visibility for the company.

- KFintech has entered in global markets, providing investor solutions to various AMCs in South East Asia.

- The company has diversified its revenues, deriving 68% of its revenues from the MF industry, while its competitor CAMS around 90%.

- New revenue verticals from CRA for pension, Account Aggregators, and Global business solution providers.

Risks:

- A significant part of the revenue from the MF sector, any negative events in the MF industry will have a negative impact.

- Revenues are dependent on Public markets, any correction, negative sentiment, or lower adoption of financial assets will affect adversely.

- KFintech maintains critical data records on behalf of its clients. A financial liability may arise in case of any data security breach.

- Revenue is dependent on AMCs AUM; failure to increase AUM will lead to lower growth in sales for KFintech.

- Any technological disruption or data security issue. Also, obsolete technology could lead to big spending on technology upgradation.

- 05% of revenue from operations in FY22 is from the top five customers, and the loss of one or more such clients could adversely affect their business and prospects.

Valuation:

At an IPO price of Rs.366 per share, the company trades at a forwards P/E multiple of 33x fy23. At its current valuation, the company is priced at a premium to its competitor CAMS. While future prospects & growth seem to be priced in, giving retail investors no discount.

| IPO Activity | Date |

| IPO Open Date | Dec 19, 2022 |

| IPO Close Date | Dec 21, 2022 |

| Basis of Allotment Date | Dec 26, 2022 |

| Refunds Initiation | Dec 27, 2022 |

| A credit of Shares to Demat Account | Dec 28, 2022 |

| IPO Listing Date | Dec 29, 2022 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 40 | ₹ 14,640 |

| Maximum | 13 | 520 | ₹ 190,320 |

| Date | QIB | NII | Retail | Total |

| Day 1 Dec 19, 2022 |

0.91x | 0.01x | 0.26x | 0.55x |

| Day 2 Dec 20, 2022 |

1.02x | 0.03x | 0.74x | 0.70x |

| Day 3 Dec 21, 2022 |

4.17x | 0.23x | 1.36x | 2.59x |

When will the KFin Technologies Ltd IPO open?

KFin Technologies Ltd IPO will open for subscription on Monday, 19th Dec 2022, and closes on Wednesday 21st Dec, 2022.

What is the price band of KFin Technologies Ltd IPO?

The price band for KFin Technologies Ltd IPO is Rs. 347-366/share.

What is the lot size for KFin Technologies Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 40 shares, up to a maximum of 13 lots i.e. Rs. 1,90,320/-.

What is the issue size of KFin Technologies Ltd IPO?

The total issue size is ~ Rs. 1,500 Cr.

What is the quota reserved for retail investors in KFin Technologies Ltd IPO?

The quota for retail investors in KFin Technologies Ltd IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on Dec 26th and refunds will be initiated by Dec 27th. Shares allotment will be credited in Demat accounts by Dec 28th.

What is the listing date of KFin Technologies Ltd’s IPO?

The tentative listing date of KFin Technologies Ltd IPO is 29th Dec 2022.

Where could we check the KFin Technologies Ltd IPO allotment?

One can check the subscription status on KFintech Pvt Ltd.

What does KFin Technologies Ltd do?

KFin Tech is among the leading technology-driven financial services platform providing comprehensive services and solutions to the capital markets ecosystem including asset managers and corporate issuers across asset classes in India and provide several investor solutions including transaction origination and processing for mutual funds and private retirement schemes in Malaysia, the Philippines, and Hong Kong.

Who are the peers of KFin Technologies Ltd?

Listed company peers for KFin Technologies are CAMS Ltd.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463