Look at your Mutual Fund Portfolio and think how you came about having this particular composition. Did you, like most people pick up a top performing fund every time you decided to invest or did you get a set of funds from a Mutual Fund Distributor or a Robo-advisor? Are you satisfied with the results so far? More importantly, how do you know that your current portfolio will not disappoint you if you held it for the next 3 years? And if you are currently investing through SIP, should you continue in exactly this set of funds or is something not quite right?

Look at your Mutual Fund Portfolio and think how you came about having this particular composition. Did you, like most people pick up a top performing fund every time you decided to invest or did you get a set of funds from a Mutual Fund Distributor or a Robo-advisor? Are you satisfied with the results so far? More importantly, how do you know that your current portfolio will not disappoint you if you held it for the next 3 years? And if you are currently investing through SIP, should you continue in exactly this set of funds or is something not quite right?

It’s healthy to have these doubts and seek answers. Only a naïve investor avoids asking these questions but then he doesn’t remain an investor for too long- most exit when their portfolio corrects.

Fund Portfolio Analysis Tool

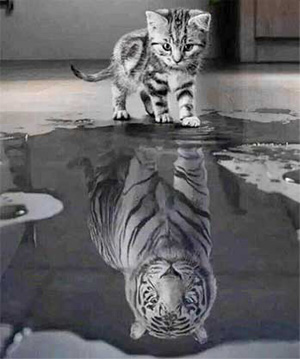

Now, you have a tool to find the answer to your question-will your mutual fund portfolio disappoint you or make you happy? We call this the Sher ya Billi Tool. It’s like going for a walk in the woods and finding a small orange coloured baby of the cat family. It looks feisty, but you can’t quite figure out whether it is a cub or a kitten-Sher hai ya Billi?

Investing is about the likely future performance and hence not certain, nor is it likely to repeat the past. We must therefore look for the tell-tale signs that indicate to us that we indeed have a strong portfolio that can withstand the uncertain times, the tough times that the future will bring? And if not make the necessary changes now rather than wait and be disappointed later. The Sher-ya-Billi Tool helps you know the important risks in your mutual fund portfolio-the ones that could and probably will adversely impact your portfolio’s performance.

Fund Manager Risk:

Investing in one or two mutual funds exposes you to the risk called the Fund Manager Risk. The fund can underperform for one of these 3 reasons 1) His investing style underperforming in the market situation (A single strategy cannot outperform the market all the time) 2) an error of judgement or 3) his moving out of that job/role and his replacement’s investing style or competence is not the same. If this happens you are likely to see a huge loss on your portfolio at the time the fund underperforms. And at such a time even the best of us incorrectly redeem our MF investments.

Over-diversification:

This risk arises from having invested in too many mutual funds. Many investors falsely believe the more the number of funds, more the diversification and hence it’s better. Diversification reduces risk, but beyond a point, adding more funds to a portfolio, does not serve the purpose of reducing risk but rather lowers the returns.

Portfolio Quality:

Most investors incorrectly think that they’re not taking any risks when investing in MFs. The fact is that you are taking on all the risks that the fund manager has taken when building the portfolio. In the rush to be the top performing fund, has your fund manager taken more risk that you can handle? And do you have a large exposure to funds with a risky portfolio? If so, you need make corrections to avoid being disappointed.

False diversification:

You might be at ease thinking that you have sufficiently diversified your MF portfolio by investing in 5-6 funds. However, this might not be the case. You may be holding funds that have similar portfolios and hence you may not be well-diversified. This exposes you to the risk of a sharp correction in your portfolio should some stocks/sectors under-perform.

Low returns:

There are no guarantees of great/good returns by investing in MFs. After all they are subjected to Market Risks. What if you are currently holding funds that have a very large proportion of stocks that are highly over-priced? You are very likely to earn low returns on your MF investments, period. In fact, some funds can give you less than FD/Debt Fund returns. Eventually, the market prices stocks close to the real worth, and when all the irrational exuberance is over markets could hover around this for a long time. You need to ensure you are not overloaded with funds that have a low upside potential.

Check if your mutual fund portfolio is good enough to hold onto or do you need to make changes. Use the Sher-ya-Billi Tool now. Make sure you are investing in mutual funds the Sahi way.

Related articles:

Is SIP in Mutual funds the right way to invest for me?

Do your SIP the right way with the Power of 4

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463