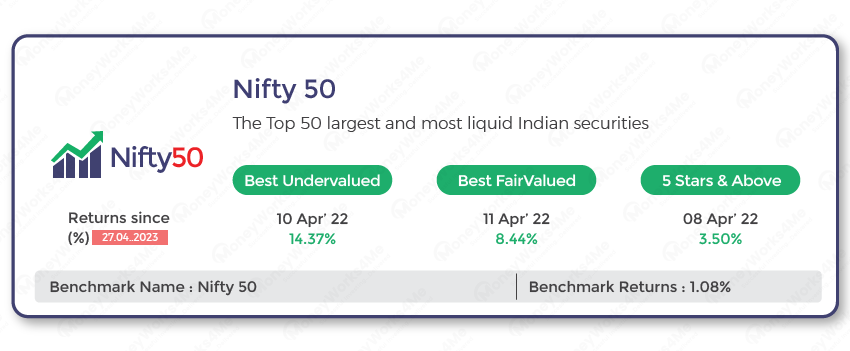

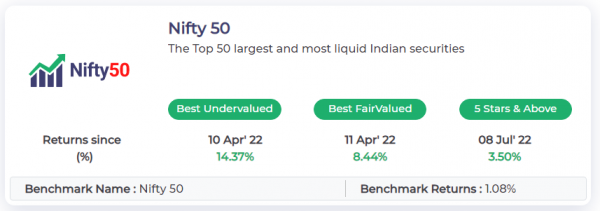

Nifty50 Best Undervalued and Fairvalued AlphaCases were launched a year ago in April 2022. And here’s the Report card for the first year. It’s nothing short of brilliant. The Best UV AlphaCase delivered over 14.37% returns when the Nifty50 Index was up only 1.08% in the same period; an alpha of 13%. The Best FV AlphaCase delivered an alpha of 7.36% over last year.

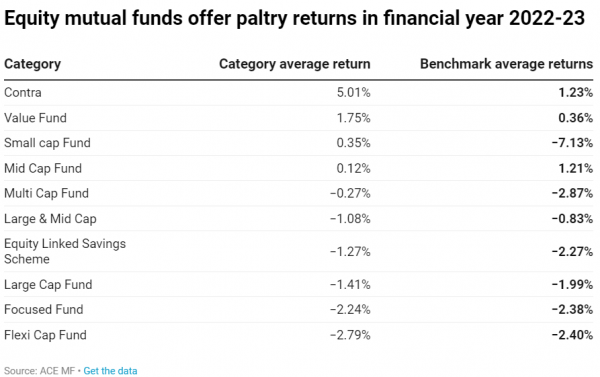

How have the mutual Funds performed last year. The category average returns last year for most Mutual Funds was negative. The large Cap category average is -1.41% (Equity mutual funds offer paltry returns in the financial year 2022-23. ET 3rd April 2023).

The top 3 large Cap funds and their returns last 1 year are Nippon India Large Cap Fund at 12.45%, HDFC Top 100 at 9.77% and SBI Bluechip Fund at 8.05%.

We are very thrilled by the performance of both these AlphaCases in a year when the market was volatile thanks to many shockwaves like the Ukraine war, Adani-Hindenberg, SVB, rising inflation, and interest rates, etc.

Nifty50 is the most important Index, the Benchmark, tracked by all and it has the largest listed Indian company stocks. These are the stocks that are the most invested in stocks by all. Every Direct Investor must have at least half their portfolio devoted to the best large-cap stocks within Nifty50. What the results establish is that using the MoneyWorks4me strategies of investing in the Best Undervalued or the Best FairValued or the 5-Star in the Nifty50 AlphaCase is superior to investing in the Index, ETF, and Active Mutual Funds.

That’s because you are always investing when the stocks are attractively priced- Under or Fairvalued and avoid investing in those which are Overvalued. When investing through ETF/Nifty50 Index you end up buying at least half the stocks when they are overvalued and expensive which tends to reduce returns.

It is also the easiest to manage as you will invest in about 15 stocks over one year. And you can even SIP in AlphaCases because you then are investing in the best stocks at an attractive price always.

If you like what you just read, don’t delay subscribing to Alpha Stocks which has AlphaCases and many other valuable features that you will love. And you will be pleasantly surprised and happy at the low fees.

Here are answers to some frequently asked questions (FAQs) about Alpha Stocks and the All-Weather AlphaCase

Q 1: What is Alpha-Stocks?

A: AlphaStocks is an intelligent System that enables you to make informed stock-investing decisions. Alpha-Stocks help you build your portfolio with the best opportunities and manage it to earn high returns consistently.

Q 2: How does Alpha-Stocks identify the best opportunities?

A: To invest in the best opportunities you need a way to identify for each stock:

- Quality: Is the stock worth investing in, it is safe to invest in, is the company profitable, can it withstand economic and market cycles? Read more

- Valuation: Is the current price a fair and reasonable price to pay for the stock, are you likely to earn high, medium, or low returns at this price? Read more

- Price Trend: Should you consider acting now or are you better off waiting? Is it more likely that the prices will rise in the near term, remain flat or fall? Read more

Alpha-Stocks uses data-driven analysis and intelligence to answer these 3 questions. It color-codes each stock as Green, Orange or Red. So, every stock on MoneyWorks4me comes with the three tags on QVPT to enable you to make an informed decision.

Q 3: How do you invest successfully using the Alpha-Stocks?

A: Follow this Simple Rule: Invest mostly in Green Quality stocks, when the Valuation is Green or Orange. Buy when the Price Trend changes from Red to Orange and even Green if the stock is not overvalued. Sell when Stocks is fully overvalued and Price Trend changes from Green to Orange or Red. At all other times there is no need to take any action. To find the list of stocks that qualify simply use AlphaCases

Q 4: What are AlphaCases?

A: AlphaCases is an intelligent System available in Alpha-Stocks that provides you with a list of stocks that qualify as an opportunity based on its QVPT rating. There are 27 AlphaCases based on different Index, Sector and Themes. In each Alphacase you can select from 3 powerful investing strategies – Best Undervalued, Best Fairvalued and 5-Stars. All of them enable you to build your portfolio with the best opportunities available now and in the future. Read more.

Q 5: How do you build a portfolio with AlphaCases?

A: You need to build a well-diversified portfolio with 25 to 30 stocks. Select an AlphaCases to build a portfolio of large Cap stocks of strong and resilient companies to ensure stable and steady growth and withstand market and economic cycles. The All-Weather Stocks AlphaCase is designed for this purpose. This should be 50% to 70% of your equity portfolio. The rest you invest in AlphaCases that will help enhance your portfolio returns eg mid, small cap stocks or any sector and theme that you think has a bright future.

Q 6: What is special about the All-weather AlphaCase?

A: All the stocks are handpicked from amongst the high-quality stocks, so they are the best of the best. You can invest in them confidently. It tracks the best resilient large cap stocks and you can build a strong and steadily compounding portfolio with stocks in this AlphaCase. It covers the most important sectors so you will be able to build a well-diversified portfolio over time.

Q 7: Can a beginner use AlphaCases?

A: The system is designed to be easy to use and requires no prior investment experience. Start with the All-Weather Stocks AlphaCase. Read the Pocket Guide to Investing Successfully in Stocks and start. You will find many useful easy-to-use tools that help you make informed investing decisions.

Q 8: Can you SIP in AlphaCases?

A: Yes, AlphaCase works extremely well when you SIP. That’s because every time you SIP you are investing in the set of stocks that pass the criteria on that day. This enables you to build your portfolio with the best quality stocks always bought at reasonable prices. This is a big advantage over buying an Index Fund, ETF or a Mutual Fund where you buy the entire portfolio, where some of the stocks are expensive.

Q 9: How do you get more confidence about investing in a stock that passes QVPT criteria?

A: You should refer to the Company’s 10-year X-Ray to see important financial and market-related details. Read more o understand how to interpret the X-Ray.

Q 10: How has AlphaCases performed over the past year?

A: You can see the performance of AlphaCases since its inception for the 3 variant investing Strategies in real-time. You can also see how the relevant Benchmark Index has performed (starting date same as the Best Undervalued Strategy). AlphaCases has outperformed most of the time. For example, Nifty50 has delivered negative 0.7, almost flat, between April 22 to April 23. AlphaCases 3 variants for Nifty50 have delivered 13%, 8 and 4%. The All-weather AlphaCase has been launched a year later and while the performance data is yet to come, we expect it will do even better than the Nifty50 AlphaCase.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory