Why Reasonable Price is critical for you to enjoy success in investing? What is reasonable price and how do you assess that for any stock? Is there a quick and easy method to do this? What more is required if you need to make a large investment in a particular stock? How do you build confidence in the estimates provided by an expert equity analyst?

The stock market is a device for transferring money from the impatient to the patient -Warren Buffett.

However, being patient in the stock market is easier said than done. So, how do you become more patient? By removing triggers that make you impatient and anxious and investing in a way that facilitates you becoming patient.

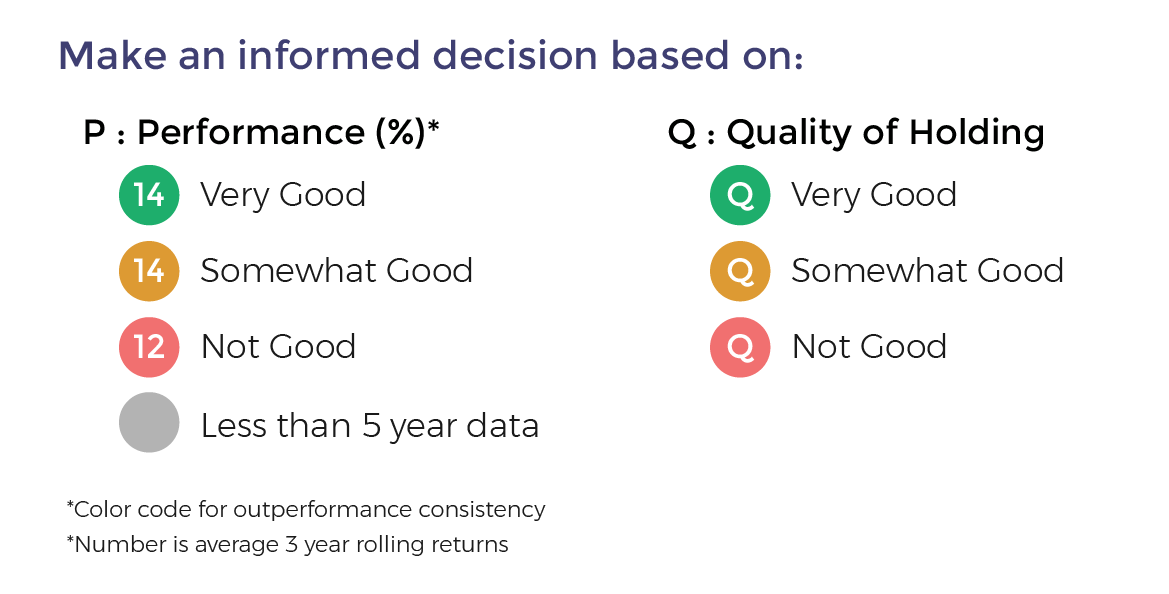

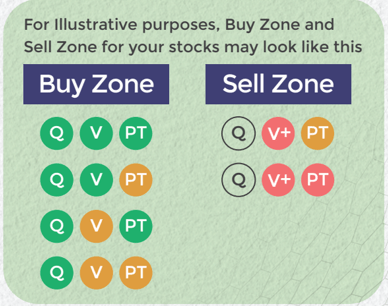

You are more likely to be patient when you are holding a stock you are confident is of high-quality company and if you buy it at a reasonable price. This is the Quality-at-a-Reasonable- Price way of investing.

Buying it at a ‘high’ price creates anxiety and remorse if and when the market and stock corrects. It also reduces investor’s confidence in his decision-making. When prices correct from very high valuations they do not always go up in a hurry. A 25% correction in price requires a 33% increase subsequently to wipe off the loss before it can show a gain. And a 50% drop requires a whopping 100% increase. All this increases your tension and an impulse to act or react and that’s when you make mistakes.

Therefore, “Quality at a Reasonable Price” is the way of investing most suitable for Retail Investors and all DIY investors and the preferred way of investing at MoneyWorks4Me.

What is a Reasonable Price? How do you assess it?

Reasonable price may seem subjective and it does depend on how you make the assessment. However, an investor would consider a stock to be reasonably priced if the chances of earning the expected returns are high. So, if you expect to earn 15% CAGR then you need the price to rise at 15% CAGR. And you need an assessment of whether the stock is likely to do so. This is what valuation is all about.

There are two basic methods used to arrive at a valuation to answer this;

Relative Valuation which as the name suggests is a valuation based on a comparison with others eg similar companies, peers, etc, and even with the stock’s historical prices. Comparing absolute prices does not make sense as the stock’s value changes with the performance of the company. Therefore, valuation ratios such as P/E, P/B, P/Sales, EV/EBITDA, etc are used. For example, if a stock is trading at 50 and if it’s earning per share, EPS is 5 then its P/E is 10. We then compare the P/E of similar companies, industries to assess whether it appears reasonably priced. If in the future its EPS increases to 10, and it is the price is 100 then as its P/E is still 10 (no change) we can conclude that the current price is in line with its historical value based on its P/E. This means that the stock price has risen at the same rate as the company’s earnings. You can see this in the CAGR

...........Read More

Comment Your Thoughts: